Online GST Calculator: Easiest Way to Calculate GST Amount

Shivani Jain | Updated: Jul 29, 2020 | Category: GST

A robust mechanism that helps calculate the GST Amount accurately on various goods and services is known as Online GST Calculator. The only aim behind this device is to show the total amount of the goods and services and the value due as GST.

In this blog, we will talk about the concept of GST Calculator Online and the method of calculating the GST Amount.

Table of Contents

Concept of Goods and Service Tax

Goods and Service Tax is an Indirect Tax Structure, which was imposed on 01.07.2017. It is a single taxation system that absorbs all the other Indirect Taxes prevalent in India. The taxes that were abolished or repealed by implementing the GST Act are VAT (Value Added Tax), CST (Central Sales Tax), Service Tax, Octroi Duty, Central Excise Duty, and Entry Tax.

Further, it is an all-inclusive tax regime that is levied on the Manufacture, Sale, and Consumption of Goods and Services. Moreover, every business or individual whose annual turnover exceeds the threshold of Rs 40 Lakhs and Rs 20 Lakhs for special states need to obtain GST Registration.

One can also check the status of his/her GST Registration Application by entering the ARN (Application Reference Number). Further, the applicant will be provided with a 15-digits unique identification number known as the GSTIN (Goods and Service Tax Identification Number) by the authorities.

However, the authorities do not provide a physical copy of the GST Registration Certificate. That means the registered taxpayer needs to download GST Certificate from the official GST Portal[1] .

Different Heads under the GST Regime

The different heads under the GST Regime are as follows:

- CGST: CGST stands for the Central Goods and Service Tax. It is levied in the intra-state transaction, and in this, a part of the GST amount is sent to the Central Government.

- IGST: IGST stands for the Integrated Goods and Service Tax. This becomes applicable in the case of inter-state transactions. Further, in this structure, a part of the amount will be sent to the Central Government, and thereafter the central government will send that portion to the respective state government.

- SGST/ UTGST: SGST stands for the State Goods and Service Tax, and UTGST stands for Union Territory Goods and Service Tax. In this structure, the portion or part of a GST amount will go directly to the respective state government.

Tax Slabs under GST Regime

The different tax slabs under the GST Regime are as follows:

- 0%

- 5%

- 12%

- 18%

- 28%

Concept of GST Online Calculator

The process of GST Return filling involves the calculation of the GST amount, which indeed is a tough and back-breaking task. However, the Online GST Calculator is a device that is ready to use and makes the process of determining the GST amount simple and straightforward.

Further, for calculating the GST amount, the taxpayer must have information and details regarding the HSN/ SAC code or GST Rate applicable to the goods and services.

Furthermore, any person can use the Online GST Calculator for calculating the GST amount. The term “any person” includes Buyer, Seller, Wholesaler, and Manufacturer.

Concept of Reverse GST Calculator

As per Section 9 (4) of the CGST Act, a case where a registered taxpayer purchases goods or services from an unregistered seller or dealer, then, in this case, the registered taxpayer needs to pay GST on Reverse Charge.

Situations Where Reverse Charge Becomes Applicable

The situations in which the Reverse Charge Mechanism becomes applicable are as follows:

- When the Goods are Supplied from the Unregistered Dealer to the Registered Person;

- Services through any E-Commerce Operator;

- Listed Goods and Services by the CBIC.

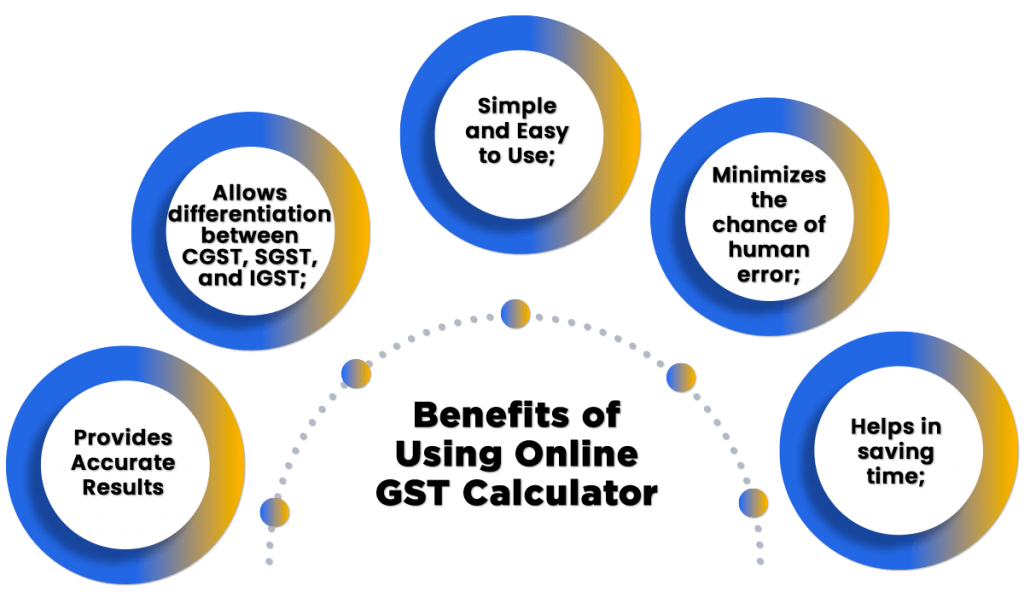

Benefits of Using Online GST Calculator

In India, there are five tax slabs available under the Indirect Tax Regime. That means calculating the GST amount is a tough task. In this situation, the GST Calculator acts as a handy device that makes the process of determining the GST amount simple and easy. Besides this, the other benefits of using Online GST Calculator are as follows:

- Helps in saving time;

- Minimizes the chance of human error while determining the total value of goods and services;

- Simple and Easy to Use;

- Allows differentiation between CGST, SGST, and IGST;

- Provides Accurate Results.

How to Calculate GST Amount?

The registered taxpayer can calculate their GST amount by following the steps given below:

- Enter the details and information as follows:

- Net Value of the Service or Good;

- GST Rates that are applicable are 5%, 12%, 18%, and 28%.

- Now, click on the option “Calculate”;

- After that, the calculator will show the GST amount under each head CGST and SGST/ UTGST or IGST, together with the gross/final amount of the services to be billed.

How to Determine GST on Reverse Basis?

The steps included to determine GST on Reverse Basis are as follows:

- Enter the MRP (Maximum Retail Price) next to Initial Amount;

- Insert the Applicable Rate of Tax;

- Now, Click on the “Subtract Option”;

- The Outcome will be the Basic Value of the Product;

- GST Amount included in the MRP;

- The Result will be the Gross Amount.

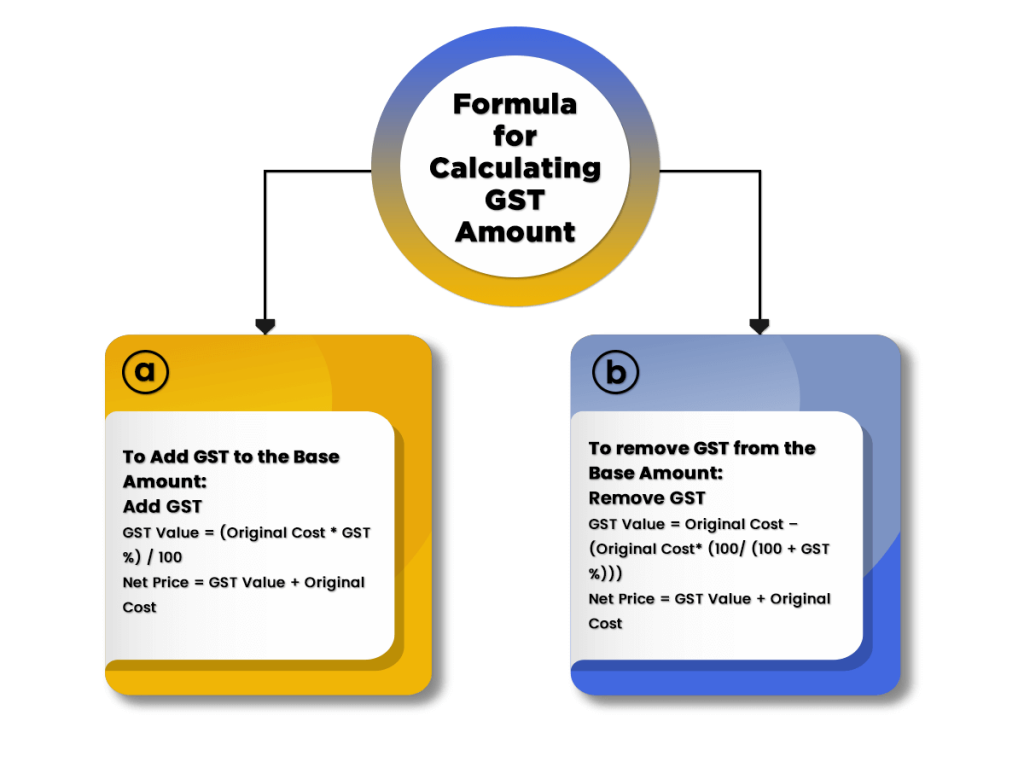

Formula for Calculating GST Amount

The formulas for calculating the GST Amount are as follows:

- To add GST to the Base Amount:

Add GST

GST Value = (Original Cost * GST %) / 100

Net Price = GST Value + Original Cost

- To remove GST from the Base Amount:

Remove GST

GST Value = Original Cost – (Original Cost* (100/ (100 + GST %)))

Net Price = GST Value + Original Cost

Steps to Use Online GST Calculator

The Steps involved to use Online GST Calculator are as follows:

- Select GST Inclusive or GST Exclusive as per requirement;

- Now, Insert the Original Amount;

- Choose the GST tax slab from the drop-down menu list;

- After that, click on “Calculate” to check the result.

- Further, the result displayed on the screen will show both the Pre/ Post GST Amount, along with the total GST Amount.

The term “GST Inclusive Amount” denotes the total worth of the goods and services after adding the GST Amount in the Original Cost of the good. In this, the tax is levied separately from the customer.

Further, the term “GST Exclusive Amount” denotes the price of GST after deducting the GST amount from the “GST Inclusive Amount” of the good.

Example of GST Calculation

Let’s take an assumption that good is sold for a value of Rs 3000, and the GST applicable on this good is 12%.

In this case, the Net Value of the Good becomes Rs 3000 + 12% of Rs 3000.

The Net Value comes out to be Rs 3000 + Rs 360 = Rs 3360.

Comparison between Old Tax Regime and the New Tax Regime

The ITC (Input Tax Credit) can benefit both Dealers and Manufacturers under the GST scheme. Further, the table given below provides a comparison between the calculation of the GST amount under the old tax regime and the GST regime.

| Value to Manufacturer | Old Tax System | Goods and Service Tax (GST) System |

| Cost of Production | Rs 200000 | Rs 200000 |

| Profit Margin of 10 % | Rs 20000 | Rs 20000 |

| Excise Duty of 12 % | Rs 24000 | N/A |

| Total Production Cost | Rs 244000 | Rs 220000 |

| VAT of 12.5 % | Rs 30500 | N/A |

| SGST of 6 % | N/A | Rs 13200 |

| CGST of 6 % | N/A | Rs 13200 |

| Invoice Value for a Manufacturer | Rs 274500 | Rs 246400 |

| Value to Wholesaler | Old Tax System | Goods and Service Tax (GST) System |

| Cost of Goods | Rs 274500 | Rs 246400 |

| Profit Margin of 10 % | Rs 27450 | Rs 24640 |

| Total Value of Goods | Rs 301950 | Rs 271040 |

| VAT of 12.5 % | Rs 37743.75 | N/A |

| SGST of 6 % | N/A | Rs 16262.40 |

| CGST of 6 % | N/A | Rs 16262.40 |

| Invoice Value to a Wholesaler | Rs 339693.75 | Rs 303564.80 |

| Value to Retailer | Old Tax System | Goods and Service Tax (GST) System |

| Cost of Goods | Rs 339693.75 | Rs 303564.80 |

| Profit margin of 10 % | Rs 33969.375 | Rs 30356.48 |

| Total Value of Goods | Rs 373663.125 | Rs 333921.28 |

| VAT of 12.5 % | Rs 46708 | N/A |

| SGST of 6 % | N/A | Rs 20035.28 |

| CGST of 6 % | N/A | Rs 20035.28 |

| Invoice Value to a Retailer | Rs 420371.125 | Rs 373991.84 |

Conclusion

Normally, the process of determining the GST amount for filing GST Return is a bulky and cumbersome task. Moreover, if the registered taxpayer is not aware of the method of calculating the tax amount with IGST, CGST, SGST, and Cess break-up, then it will turn out to be an additional headache for him/her.

However, the Online GST Calculator is a robust mechanism that assists in determining the GST payable in a simple and hassle-free way.

In case of any other dilemma and confusion, reach out to Swarit Advisors, our team of experts will facilitate the process of GST Calculation for you. Moreover, we can also assist you with GST Registration, GST Return Filing, and GST Migration.

Also, Read:Composition Scheme under GST Act