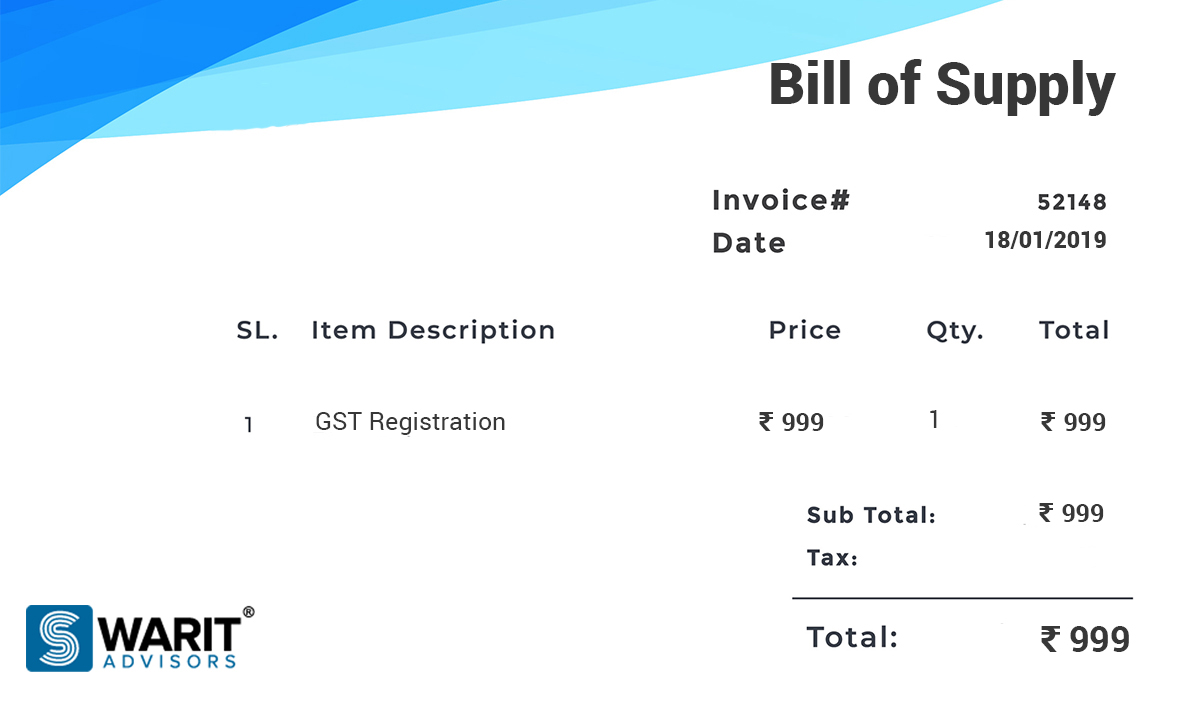

GST Registration Application Procedure

Swarit Advisors | Updated: Jul 17, 2018 | Category: GST

As per the new rule of goods and service tax as a business owner or simply someone being tax payer is required to have a GST registration application procedure.

Table of Contents

Documents Required for GST Registration

Copy of PAN Card of the Business or the Applicant

GSTIN is linked to the PAN of the business. Hence, the PAN card copy is required for obtaining GST certificate.

Identity proof and Address Proof of your business Promoters.

Identity proof and address proof documents like PAN, passport, driving license, aadhar card or voters identity card must be submitted for all the promoters of your business.

Documents related to your Business Registration

Proof of business registration like your company incorporation certificate or partnership deed in case of having limited liability partnership. Your registration certificate has to be submitted for all types of registered entities.

Address Proof for Place of Business

Your documents related to the location of your business and it’s activities. Like the rental agreement or the sales deed depending on the ownership of that property and that to be given along with the copies of your utility bills like water/electricity bills. You could also submit the latest receipt of your latest paid property tax. It could also be a copy of municipal khata. All of these should be submitted for the particular address that was mentioned in the GST registration application.

Bank Account Proof

As a proof for your bank account activity, you could submit a scanned copy of your passbook in which it shows information. The information such as address and a few transactions done.

Digital Signature

A class 2 or a class 3 digital signature is always required for online filing of GST registration application. However, in case of proprietorship, there’s no need for any digital signature.

GST Registration Process

GST Application Filing

Once you are done with the preparation of your GST registration application and have collected all the required listed documents, and finally file your application online. You will soon be provided with an ARN number.

GST Registration Certificate

Once your GST registration application along with the attached supporting documents gets verified by a standard offer, you will get a GSTIN and a GST certificate.

Eligibility For GST Registration

Turnover Criteria

Those individuals or the entities that may be involved with any form of supply of goods and services with an annual aggregate of a turnover that exceeds the amount of ₹ 20 lakhs in most of the Indian states requires GST registration. It is mandatory to have GST registration. However, for certain special states of the eastern side and Jammu Kashmir, this turnover criteria has been reduced to the amount of ₹ 10 lakhs.

Now in addition to this turnover being one of the criteria, there are various other related conditions as well which are useful for GST registration. These are things like the inter-State supply of goods and services, E-commerce sellers, etc.

Read, Also: GST Registration Requirement.