Form GSTR 1: A Guide on This Goods and Service Tax Return

Shivani Jain | Updated: Oct 13, 2020 | Category: GST

The term “Form GSTR 1” denotes a Monthly GST Return in which a “Regular Dealer” requires to gather all the “Outward Supplies” made by him/ her in a month or quarter. In other words, Form GSTR 1 is a statement in which all the details of sales and outward supplies are captured. In this blog, we will

The term “Form GSTR 1” denotes a Monthly GST Returnin which a “Regular Dealer” requires to gather all the “Outward Supplies” made by him/ her in a month or quarter. In other words, Form GSTR 1 is a statement in which all the details of sales and outward supplies are captured. In this blog, we will

Table of Contents

Concept of Form GSTR-1

Form GSTR-1 is an online GST Return filed by the Regular Taxpayers who have made Outward Supplies in a month or quarter. Further, this return is applicable to those who have crossed more than Rs 1.5 crores annually.

Also, it shall be relevant to state that the taxpayer needs to file this return on 11th of every next or succeeding month.

Who can File GSTR Form 1?

Every registered person needs to file Form GSTR 1 regardless of whether there are any transactions made during the month or not.

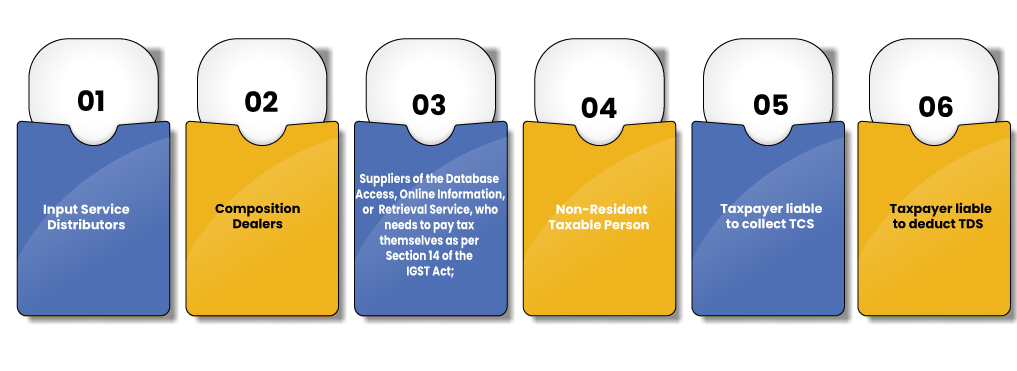

Who are all Exempt from Filing GSTR 1?

The ones who are exempt from filing GSTR 1 are as follows:

- Input Service Distributors (ISD);

- Composition Dealers;

- Suppliers of the Database Access, Online Information, or Retrieval Service, who needs to pay tax themselves as per Section 14 of the Integrated Goods and Service Tax Act;

- Non-Resident Taxable Person;

- Taxpayer liable to collect Tax Collected at Source;

- Taxpayer liable to deduct Tax Deducted at Source;

Latest Updates for Form GSTR 1

The latest updates are as follows:

- With effect from 01.01.2021, the quarterly filing of GSTR Form 1 and GSTR Form 3B for the taxpayers with an aggregate turnover up to Rs. 5 Crores will be allowed. However, it shall be relevant to note that such payment of tax will be made on a monthly basis by way of Challan;

- The Delinking of Credit Note or Debit Note from the Tax Invoice, while reporting them in Form GSTR 1 and GSTR 6 or filing Refund;

- On the foundation of Form GSTR-1 filed by the taxpayers, the administration declared thatForm GSTR 3B is now ready on the official GST portal for monthly Form GSTR 1 filers;

- As per the Notification No 83/ 2020, issued by CBIC, dated 10.11.2020, the due date for filing the details of outward supplies in Form GSTR 1, for each tax period has been extended further to 11th of the coming month;

Features of GSTR Form 1

The salient features are as follows:

- All the Registered Taxpayers who are eligible to fill outward supply details of the business regardless of whether there was any transaction or not, needs to file Form GSTR-1.

- It needs to be filled by the 11th of the succeeding month of which the GST Return has to be filed;

- All the details concerning invoices need to be filled in the specified fields;

- The term “Outward Supplies” include the supplies made to a registered person, unregistered person, exempted person. Further, it applies to exports, received advances, and non-GST supplies as well.

Also, Read: Know About GST Registration process step by step

Due Dates for Filing Form GSTR 1 for the F.Y. 2019-2020

The due dates for filing GSTR will be applicable to the traders falling under the categories as follows:

- Turnover up to Rs 1.5 crore needs to file GSTR 1 on Quarterly basis;

- Turnover more than Rs 1.5 crore needs to file GSTR 1 on Monthly basis;

Turnover up to Rs 1.5 crore

| Period | Last Date of Filing Form GSTR-1 |

| July 2020 to September 2020 | 31.10.2020 |

| April 2020 to June 2020 | 03.08.2020 |

| January 2020 to March 2020 | 17.07.2020 |

| October 2019 to December 2019 | 31.01.2020 |

| July 2019 to September 2019 | 31.10.2019 |

| April 2019 to June 2019 | 31.07.2019 |

Turnover more than Rs 1.5 crore

| Period | Last Date of Filing Form GSTR-1 |

| September 2020 | 11.10.2020 |

| August 2020 | 11.09.2020 |

| July 2020 | 11.08.2020 |

| June 2020 | 05.08.2020 |

| May 2020 | 28.07.2020 |

| April 2020 | 24.07.2020 |

| March 2020 | 10.07.2020 |

| February 2020 | 11.03.2020 |

| January 2020 | 11.02.2020 |

| December 2019 | 11.01.2020 |

| November 2019 | 11.12.2019 |

| October 2019 | 11.11.2019 |

| September 2019 | 11.10.2019 |

| August 2019 | 11.09.2019 |

| July 2019 | 11.08.2019 Note: It shall be relevant to note that the due dates for the notified districts of the states as follow was extended till 20.09.2019: Bihar; Gujarat; Karnataka; Kerala; Maharashtra; Odisha; Uttarakhand; and For registered persons whose principal place of business is in Jammu and Kashmir. |

| June 2019 | 11.07.2019 |

| May 2019 | 11.06.2019 |

| April 2019 | 10.06.2019 for Odisha |

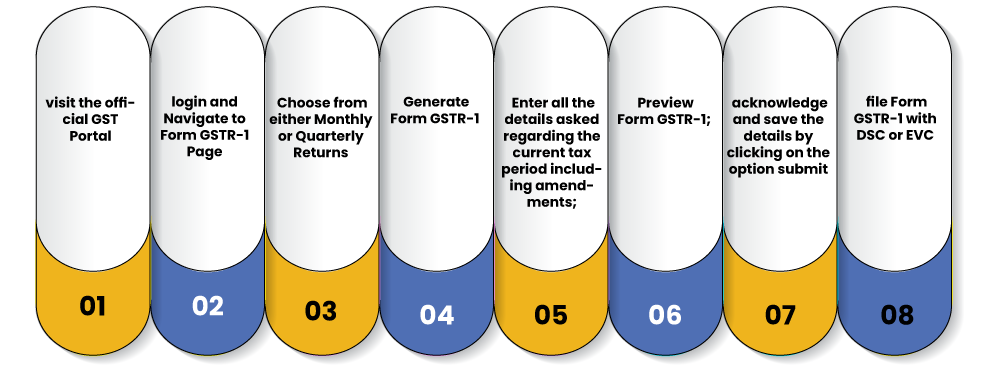

Process to File Form GSTR 1

The steps included in the process to File Form GSTR 1 are as follows:

- In the first step, visit the official GST Portal[1].

- Now, login and Navigate to Form GSTR-1 Page.

- Choose from either Monthly or Quarterly Returns.

- Generate GSTR-1.

- Enter all the details asked regarding the current tax period including amendments.

- Preview GSTR-1.

- Now, acknowledge and save the details by clicking on the option submit.

- Lastly, file GSTR-1 with DSC or EVC.

Process to Check the Status of Form GSTR-1

The steps involved in the process to check the status of GSTR-1 are as follows:

- Visit the Official GST Portal.

- Now, login with your Credentials;

- After that, click on the option “Services”;

- Choose “Returns”;

- Then click on “Track Returns Status”;

- After that, the taxpayer can see the status of the previously filed returns by providing Acknowledgement Reference Number (ARN), or the period of GST Return filing;

- On the other hand, one can track the status of GSTR by choosing the type of status from the drop-down menu. Further, there are 4 different types of GST Return status that one might see:

- To be Filed

- Submitted but Not Filed

- Filed Valid

- Filed Invalid

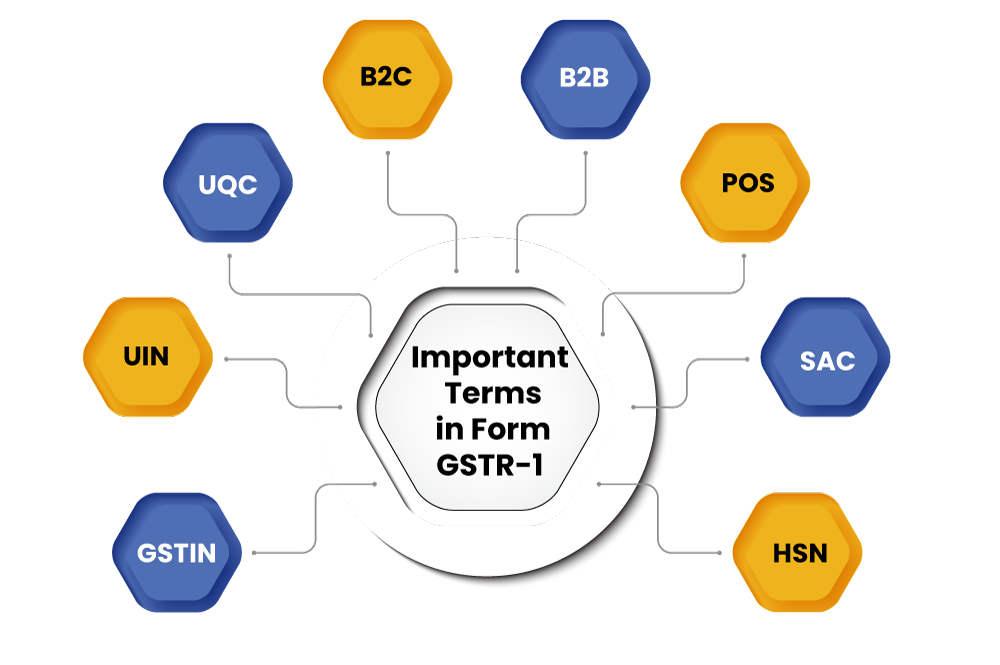

Important Terms in GSTR-1

The important terms of are as follows:

- GSTIN: Goods and Service Tax Identification Number;

- UIN: Unique Identification Number;

- UQC: Unit Quantity Code;

- B2C: One Registered Taxpayer to other Unregistered Person;

- B2B: One Registered Taxpayer to other Registered Taxpayer;

- POS: Place of Supply of Goods and Services;

- SAC: Service Accounting Code;

- HSN: Harmonized System of Nomenclature;

Process to Revise GSTR-1

It shall be relevant to state that a GST Return once duly filed is not eligible to be revised. That means in case of any error or omission, the taxpayer can rectify the same in the return of next quarter only.

For example, an error or omission made in the GSTR 1 of September can only be rectified in the GSTR 1 of October.

Interest on the Late Payment of GST

According to the Rules and Regulation passed by the GST Council, a taxpayer on every continuous late payment of taxes will be liable to pay 18% per annum interest on the GST applicable after the commencement of the due date till the time taxes are to be payable to the government.

Late Fees for Not Filing GSTR-1

The late fee for not filing GSTR 1 is Rs 200 per day of the delay caused. Further, the bifurcation of Rs 200 is Rs 100 as per the CGST Act, 2017[2] and Rs 100 as per the SGST Act.

Also, it shall be relevant to note that the late fees will be charged after the due date of filing.

Further, according to a Latest Update, the late fees for filing GSTR 1 have been reduced to Rs 50 per day and Rs 20 per day for nil return.

Conclusion

In a nutshell, the details needed to be gathered in the GSTR 1 format are either rate-wise, invoice-wise, or state-wise details of the outward supplies made during a month.

Further, if in case the GSTR 1 return is not filed in time, then it will have an effect on the business creditability of a taxpayer.

Subsequently, it will impact the customer base of the taxpayer as well, since ITC (Income Tax Credit) depends on supplier compliance.

For any other doubt and query, reach out to Swarit Advisors, our experts will assist you with the process of GST Registration and GST Return Filing.

Performa of Form GSTR 1

Form-GSTR-1notfctn-83-central-tax-english-2020

Also, Read: Types of GST Return in India