The Growth of Alternative Investment Funds in the Indian Scenario

Swarit Advisors | Updated: Feb 13, 2019 | Category: AIF

Alternative Investment funds in India’s economy has got a boost ever since came into existence in India in 2012. There has been a steady hike in the number of investors in this sector lately. Recently, SEBI chairman Ajay Tyagi shared that the year 2018 witnessed a peak growth as there are commitments of Rs 2 lakh crores while raising Rs 1 lakh crores corporate funds already.

Table of Contents

The growth of Alternative Investment Funds in the past several years

Such huge numbers elucidate the growing inclination of investors into Alternative Investment areas in India which is an uplift to the Indian economy. Not only this, as per the Global Limited Partner Survey, 2017 of Emerging Markets Private Equity Association, India was placed at a 1st position as the ‘most preferred destination’ by global investors in 2017. This has encouraged the development of new capital as well as widened the scope of consumer protection in this area.

Where the stock market has seen a tremendous decrease in investments with the fall of benchmark Sensex, Alternative Investment Funds are making a huge hype in India. In addition to this, the AIF structure proffers incorporation of hedging strategies whereas there is no such allowance from the mutual funds. Such reasons promise a strong position to the Alternative Investment funds market in the coming years.

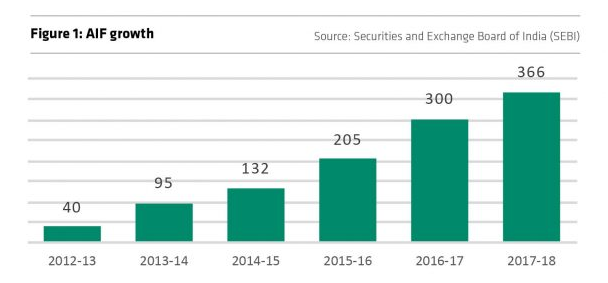

According to SEBI, The funds registered are continuously growing for AIFs to year after year and has reached to a 366 in 2018. Till September 2018, 476 AIFs have raised funds that have resulted in improving the efficiency of this volatile secondary market. This marks a significant rise in the Indian economy at a rapid rate.

What are Alternate Investments Funds and its various categories?

Alternative Investment funds, unlike conventional investment methods, are outside the SEBI regulatory framework meant for investment institutions. They are different from the main investment techniques such as stocks, bonds etc. They are considered to be private investment opportunities. These funds are mainly classified into different types:

Category I AIF: It includes all the funds that are invested in economically or socially desirable ventures such as Venture Capital Funds, Social Venture Funds, Infrastructure Funds, and SME funds etc.

Category II AIF: It includes all the funds that are not included in Category I or Category III AIF. In this, the investment is done on the basis of their Investment Mandate, like Private Equity Funds and Debt Funds.

Category III AIF: It includes all those funds that have complex and varied investment strategies so that one can earn a decent return, either by investment in different investment products, such Hedge Funds or by the use of leverage.

How to Invest in Alternative Investments Funds in India?

The reason why AIFs are gaining sudden popularity is their ease of investment. Given below are some of the ways through which one can make a hassle-free investment in no time.

Given below are the essential eligibility criteria to invest in Alternative Investment Funds in India:

- The Investor may be an Indian, NRI or a foreigner. In the case of angel funds, Investors ought to be angel investors only.

- The Minimum corpus amount must be Rs. 20 Crores for every scheme and Rs. 10 Crores to invest in angel funds.

- Also, each investor must make a minimum investment of Rs. 1 Crore, and Rs. 25 Lakhs if the investor is an employee/ fund manager/director of AIF or angel investors. However, there is no minimum investment requirement on AIF units for the employees or the manager so that they can share good profit.

- For each scheme, the maximum number of investors can be 1000 and for angel funds, only 49 are there. However, the industry need is to upscale the number for angel funds to 200, in parity with the private placement provisions as per the Companies Act, 2013.

- Also, AIFs under Category I and II can be close-ended only that too for a time period of three years. However, AIFs under Category III can be both open as well as close-ended.

- Along with this, the manager or the sponsor must have a continuing interest in the respective AIF:

- for Category I or II: Not less than 2.5% of the corpus

- for Category III: 5% of the corpus

- for each scheme: Rs. 5 Crores

- Angel Funds: Rs. 50 Lakhs

All this has to be brought in the form of investment in the respective AIF and this interest will not be considered as the waiver for the management fees. The Management fees are kept fixed as a percentage of the corpus, on an annual basis, and/or carried interest, which serves as an added incentive for the manager.

- Close-ended AIF units can be put on the stock exchange for a minimum tradable lot of Rs. 1 Crore. This type of Alternative Investment Fund listing is allowed only after the final closure of the fund or scheme.

Also, there are a number of conditions for investing in all the categories of Alternative Investment Funds and SEBI has laid down proper guidelines for each. Also, if any contravention of the AIF provisions and regulations, there are penalties defined for the violation such as suspension, debarment, and cancellation of Registration Certificate etc.

Once you fulfill all these criteria, you can easily do investment and earn a decent profit without many efforts.

Also, Read our Article: Process of Alternative Investment Fund Registration in India

What are the reasons for this huge growth of Alternative Investment Funds in India?

There are a plethora of factors that affect the growth of Alternative Investment Funds in India, some of them are given below:

- The growing Real Estate Sector has led to a tremendous hike in the AIFs in India. Also, in 2017, the Indian real estate sector was considered the second most active sector. The development of National Infrastructure Investment Fund (“NIIF”) of INR 20000 Crores by the Indian Government is one of the crucial factors owing to the boost of AIFs.

- Investors are investing more in Category III AIF as they are permitted to invest in Commodity derivatives until 10% of the investible funds. Not only this, but they are also allowed for leverage up to two times.

- Since November 2015, RBI has also issued a notification for the Alternative Investment Funds Foreign Investments under the Automatic Route. There are 2 things: There will be FDI restrictions applicable for Alternative Investment Funds if the sponsor or the Manager who controls these funds is an Indian and the AIFs that have a Majority Foreign Capital shall be regarded as Local Funds.

- Implementation of the Tax Pass-through Structure for both Category I and II Funds. This way, all the investors investing under these categories is taxed and also, helps in avoiding the Double Taxation system.

However, still, there are many areas that have loopholes and need serious reforms for long term growth stability.

What are the steps for exceptional growth in Alternative Investment Funds in India?

Growth in AIFs reflects a steady growth in the Indian Economy. Thus, it is mandatory to eliminate the loopholes by opting for suitable reforms so that there can be a positive change in the present Alternative Investment Funds structure of India.

Given below are some essential points that must be considered to maintain a steady cash investment:

- Rise in the Domestic Institutional Investors to invest in Alternative Investment Funds: Right now, India is more dependent on the foreign market for funds. If there was a hike in Domestic Institutional Investors, you will see positive results in the growth of the Alternative Investment Market in India.

- Required Amendments to the GST Framework: There must be 2 important changes brought to the current GST Registration framework i.e. CGST Act so as to boost up the growth:

- For all investor who invests in VC and PE Funds, 5% of tax should be levied on services provided to these funds.

- GST should not be charged on foreign investments that exceed 50% in an AIF as all the services that the AIF receives must be considered as an export of services.

- Effective and Desired taxation Reforms: There is a stringent need for some reviewing on the existing tax reforms for the AIF industry. We have a list of some of them given below:

- For Category III AIFs, there is a need for making Pass-through structure.

- Whenever any transfer of unlisted securities is done and profits are generated, they should not be treated as business gains but capital gains. Not only this, the AIF management expenses should be taken as a “cost of the improvement.”

- If the AIF incurs a loss, it must be set-off against the investor’s income rather than the AIF’s future business profits.

- Implementation of a Unit-based Taxation Approach should be done for all AIFs coming under the Stock Exchange Platform, such as mutual funds. The tax shall not be levied to the investors of the registered AIFs:

- Distribution tax should be put on income distributions i.e. On dividend as well as Interest

- There should be Capital gains tax and unit transfers levied for Short-term as well as Long-term Capital Gain

- Any offshore investor must get tax exemption on the income he earns when he invests through an AIF in an IFSC.

- Option for leverage on Category III Funds of Funds (FOF): The Funds of Funds market is at a root stage in India while at a global scale it has reached its peak growth. Therefore, it is essential to provide an option for taking leverage at the FOF level or individual portfolio level.

- Mandatory Disclosure of Fund-related Information: Essential Information related to the Fund Performance must be disclosed to the investor. Also, there should be a formation of an Investment Advisory Committee that will play a crucial role in handling all the fund related conflicts in a well-managed way.

Following these essential reforms will surely help in the long term growth of the Alternative Investment Funds in India. Although the AIFs are still at the root stage, with such effective reforms coming at hand, they will surely reach a good position in the upcoming time.

Conclusion

The growth in Alternative Investment Funds will surely have a strong future in the upcoming times. You will see that the number of domestic investors will increase which will, in turn, lead to a hike in the Indian economy. A great metamorphosis is on its way to depicting a clear cut development in the AIF sector soon.

Swarit Advisors is a renowned company that helps in providing Alternative Funds Investment related service. For any doubts, you can freely contact us.