Bill of Supply under GST

Swarit Advisors | Updated: Aug 30, 2017 | Category: GST

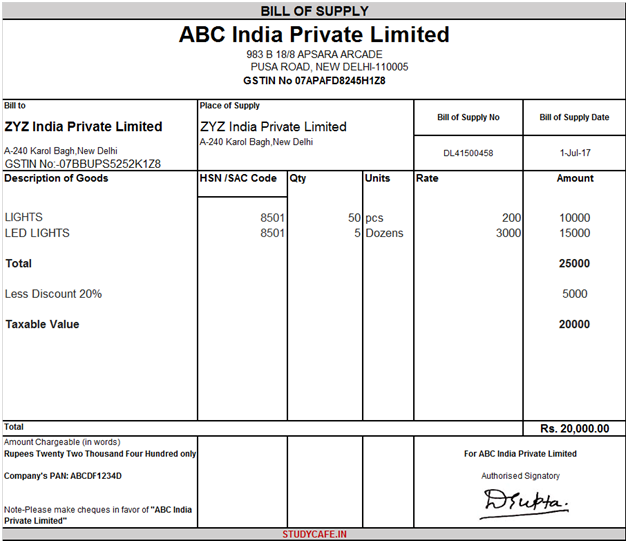

A Bill of supply is a transaction document that is different from the normal tax invoice. It does contain the tax separately in the invoice. In this blog, We will discuss about Bill of Supply under GST.

Table of Contents

A Bill of Supply is issued by the following persons:

- If a registered person is supplying goods or services that are exempted

- If the registered person has opted for composition levy

The bills of supply under GST shall contain the following mandatory fields as below:

- Name and the address of the supplier

- GSTIN No. of the supplier

- Bill of supply should be consecutively numbered.

- If the receiver of the goods is registered the than a name, address and GSTIN no[1]. of the recipient.

- HSN code of goods and SAC code for services

- Description and value of goods or services

- Signature of the supplier

The format of the Bill of Supply:

The Author is an Expert of GST Registration and other tax related services, Visit home page to know more about him.

Also, Read: Audit under GST.