Conversion of LLP Into Private Company: Process to Convert

Shivani Jain | Updated: Oct 03, 2020 | Category: Conversion of Company

The term “Conversion of LLP into Private Company” denotes the process under which the Designated Partners of a Limited Liability Partnership wants to expand their business operation by converting into a Private Limited Company.

In this blog, we will discuss the procedure for the Conversion of LLP into Private Company.

Table of Contents

Concept of Limited Liability Partnership

The term “Limited Liability Partnership” or “LLP” denotes a “Hybrid Business Structure” that provides benefits of both a Private Company and Partnership Firm. Further, this Business Format is governed by the provisions of the Limited Liability Act 2008.

Section 3 of the Limited Liability Act 2008 provides the definition for the Limited Liability Partnership. As per this section, an LLP is a corporate body formed under the provisions of the Act and has the feature of Separate Legal Entity.

Further, this business format not only benefits its partners with the feature of Limited Liability but allows them to structure their business environment like a Partnership Firm.

Moreover, an LLP Agreement acts as a Bible for a Limited Liability Partnership. This document not only includes the details of the assets and liabilities but the rights and duties of the partners as well.

However, it shall be relevant to note that an LLP is different from a Limited Liability Company.

Concept of a Private Limited Company

The term “Private Limited Company” denotes a business format that is privately held by a group of people. This business format though does not require minimum share capital after the introduction of the Companies (Amendment) Act 2015, but the same is not eligible for the process of transfer of equity shares.

Further, a minimum of 2 and a maximum of 200 people can become a member of a Private Limited Company. However, it shall be relevant to note that in the case of joint holding or more than 2 people are holding one share, then in this case, all the individuals will be clubbed as 1.

Furthermore, this business format is regulated by the MOA (Memorandum of Association) or AOA (Articles of Association) of the company. The term MOA includes the vision, mission, objectives, and restrictions of a company. In contrast, an AOA denotes a collection of all the rules, regulations, bye-laws, etc.

Lastly, this business structure is chosen by those people or entrepreneurs who have high aspirations and goals to reach.

Reasons to Choose LLP over Private Limited Company

The Reasons to Choose LLP over Private Limited Company are as follows:

- Any small business which is aiming to have business only for a limited time and earns the annual turnover below Rs 40 lakhs, along with that have the capital contribution of less than Rs 25 lakhs must go for the option of LLP;

- Moreover, an LLP which is satisfying the above criteria is not required to get its account audited, but, the same is not the case with a Private Limited Company. As a Private Limited Company needs to get, its accounts audited every year.

- However, it shall be pertinent to note that if in case the Annual Turnover of the Limited Liability Partnership Firm either exceeds the limit of Rs 40 lakhs or the capital contribution crosses Rs 25 lakhs, then, in that case, the amount of annual compliance and requirements will come at Par with the annual compliance of a Private Limited Company;

- Also, a Private Limited Company as a Business Format is chosen by those entrepreneurs who have both high aspirations and goals to reach.

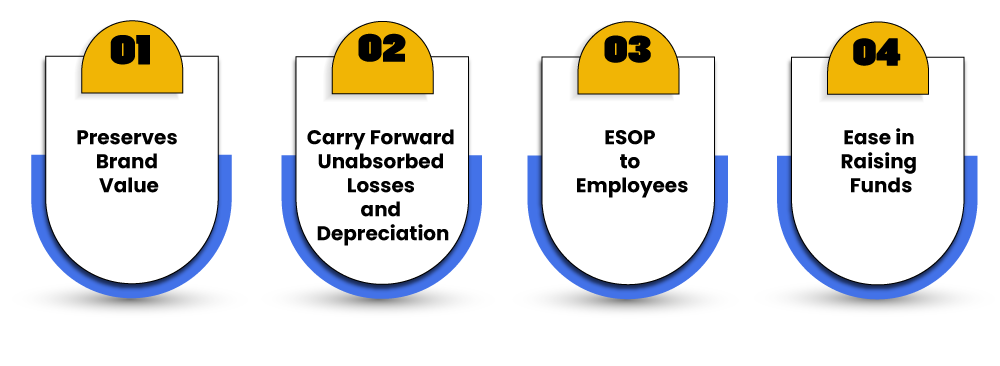

Benefits of the Conversion of LLP into Private Company

The benefits of the Conversion of LLP into Private Company are as follows:

Preserves Brand Value

The process of conversion of LLP into Private Limited Company will continue the existence of the brand name, that too, without bearing any extra cost for Advertisement or Branding.

Carry Forward Unabsorbed Losses and Depreciation

It shall be relevant to note that after the completion of the process of conversion, there is no need for the company to bear any extra expense regarding book keeping, as the depreciation and losses incurred by the LLP will be carried forward on conversion.

ESOP to Employees

The process of Conversion of LLP into Private Company enables companies to offer ESOP (Employee Stock Option Plan) and Stock Ownership. Further, such plans assist companies in attracting efficient employees, as it provides incentive plans and benefits for them to work in the company.

Ease in Raising Funds

Although the process of registering a private limited company in India is a back-breaking and tiring task, but it assists the company in becoming more credible among others. Therefore, the process of conversion leads to ease in raising funds from external sources.

Documents Required for the Conversion of LLP into Private Company

The documents required for the conversion are as follows:

- A copy of the Member’s List;

- A copy of the Limited Liability Partnership Agreement;

- The Statement showing the details regarding the nominal value of the Share Capital;

- The Statement showing the details regarding the total number of shares separated and the total number of shares taken;

- Details about the amount remitted for each share;

- The name of the firm with the word “private limited” to be provided;

- A Certified copy of the Certificate of Registration;

- No Objection Certificate (NOC) from all the creditors;

- A Duly Certified Statement regarding the accounts by the auditor. Further, such a statement must not be less than 6 days, starting from the date of application;

- A copy of the Newspaper Advertisement is required;

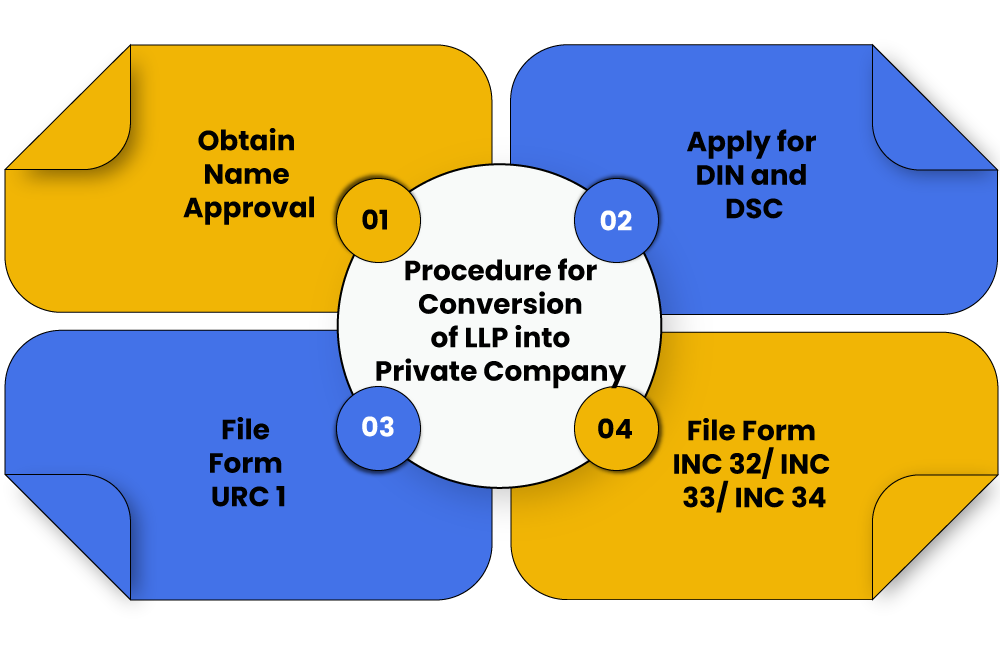

Procedure for Conversion of LLP into Private Company

The steps involved in the procedure for conversion of LLP into Private Company are as follows:

Obtain Name Approval

In the first step, the company requires to obtain “Name Approval” from the ROC (Registrar of Companies) by furnishing Form RUN (Reserve Unique Name) in the e-format.

Apply for DIN and DSC

Now, in the next step, the applicant needs to apply for DIN (Director Identification Number) and DSC (Digital Signature Certificate) for each member of an LLP. Further, after conversion, these members will become the Directors of the Private Limited Company.

Moreover, it shall be taken into consideration that in case of non-availability of DIN, the applicant requires to submit ID proof, Address Proof, and latest photographs with the application form. Thus, an applicant can acquire DIN directly by filing the Incorporation Form.

File Form URC 1

In the third step, the applicant requires to file Form URC 1, together with the documents mentioned above. However, such a form must be filed within a period of 20 days, starting from the date of name approval.

File Form INC 32/ INC 33/ INC 34

Next, the company needs to file E-form INC 32/ INC 33/ INC 34 along with the Form URC 1 as a “Linked Form”, together with the documents, such as follows:

- Newly drafted Memorandum of Association and Articles of Association (usually in form INC 33 and INC 34, but in a physical form if the subscribers are more than 7);

- Form INC 9;

- Form DIR 2;

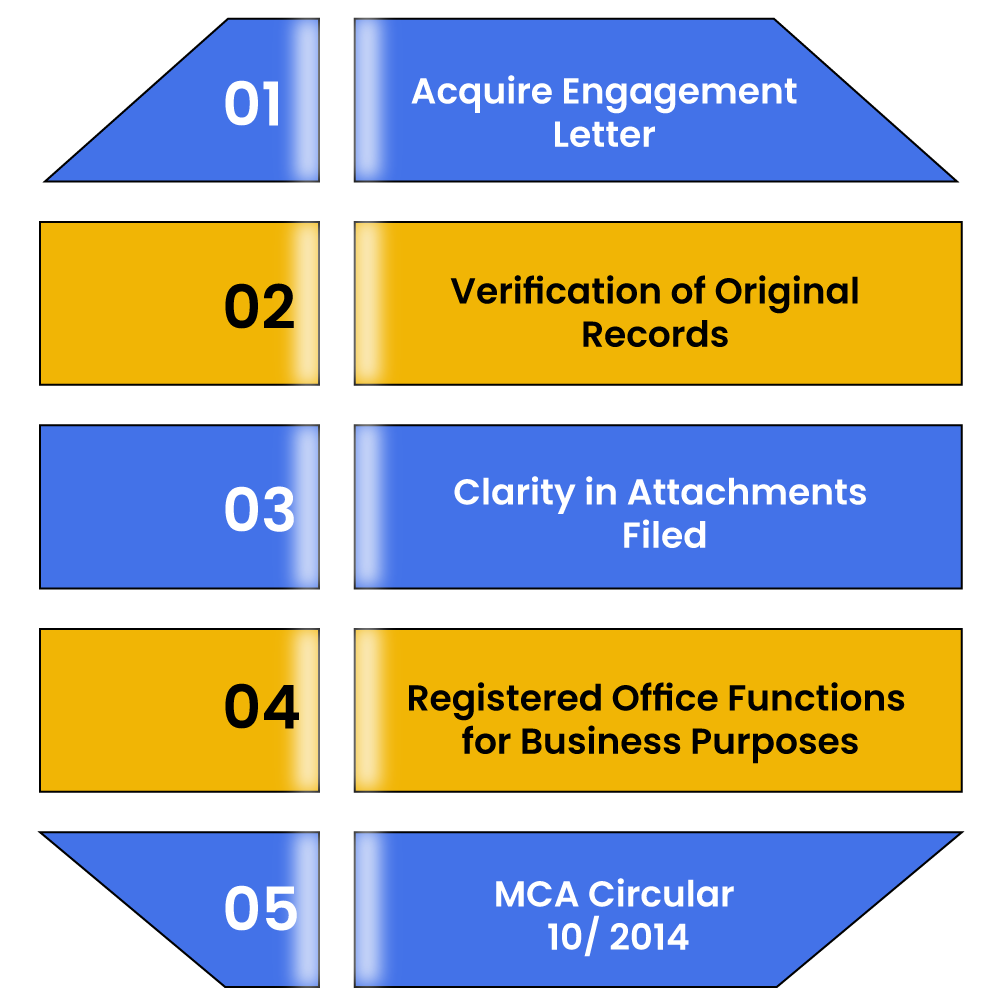

Things To Remember During the Conversion of LLP Into Private Company

The points to remember during the conversion of LLP into Private Company are as follows:

Acquire Engagement Letter

According to the Certification under the SPICE Form, i.e., Form INC 32, a subscriber has to give an Engagement Letter declaring that he/ she is engaged for the “certification purpose”.

Verification of Original Records

According to the Certification under the SPICE Plus Form, i.e., Form INC 32, a subscriber has to give a declaration that all the particulars, together with the attachments have been duly verified from the Original Records.

Clarity in Attachments Filed

According to the Certification under the SPICE Plus Form, i.e., Form INC 32, a subscriber has to give a declaration that all the particulars, together with the attachments filed are both complete and neat to read.

Registered Office Functions for Business Purposes

According to the Certification under the SPICE Form, i.e., Form INC 32, a subscriber has to give a declaration that he/she has personally visited the registered office. Further, he/she needs to declare that all the documents submitted after the process of incorporation are original.

MCA Circular 10/ 2014

According to MCA Circular 10/ 2014, the ROC or RD can initiate further proceedings under section 447 of the Companies Act 2013[1] in the cases as follows:

- If the Material Fact is not submitted;

- Introduction of the Misleading/ Incomplete/ False Information;

However, the ROC (Registrar of Companies) or RD (Regional Director) must give at least one chance to the defaulter to explain the issue to the “Government Division” of the MCA (Ministry of Corporate Affairs).

Conclusion

In a nutshell, the main reason for the conversion of LLP to Private Company is to expand and grow the business multi-dimensionally.

Usually, an LLP as a business format is not suitable for Private Equity or Venture Capitalists. The reason for the same is that an investor feels more secure and safe while investing in a Private Limited Company.

Moreover, due to the flow of FDI (Foreign Direct Investment), a Private Limited Company Registration is again a better option than a Limited Liability Partnership.

Therefore, the conversion of LLP into Private Company is an apt decision as per the current market dynamics.

Read, Also: Procedure of Conversion of Private Company into LLP.