Convert a Section 8 Company into Private Company: An Outline

Shivani Jain | Updated: Oct 05, 2020 | Category: Conversion of Company

The term “Convert a Section 8 Company into Private Company” denotes the process wherein a Section 8 Company decides to change its objective from charitable activities to profit earning activities.

Moreover, the term “Charitable Objective” means promoting Charitable Purpose, Arts, Education, Protection of Environment, Sports, Research, Science, Religion and Social Welfare, etc.

In this blog, we will discuss the process to convert a Section 8 Company into Private Company.

Table of Contents

Concept of Section 8 Company

The term “Section 8 Company” means an NPO (Non Profit Organization) which aims to promote Charitable Purpose, Arts, Education, Protection of Environment, Sports, Research, Science, Religion and Social Welfare, etc.

Further, the income generated by an NPO is not eligible to be utilized for paying out “dividends” to the member or shareholders of the company. Moreover, the same will be used only for the purpose of promoting charitable objectives.

Furthermore, for incorporating a section 8 company, the applicant needs to obtain a Certificate of Registration (COR) from the central government and are responsible for adhering to the rules prescribed by the government as well.

Concept of Private Limited Company

The term “Private Limited Company” means a business structure, which is privately owned by a group of people termed as Shareholders. Further, this structure is chosen by all the start-ups and the ventures with high growth potential.

Moreover, section 2 (68) of the Companies Act 2013 defines the term Private Limited Company.

Also, as per the Companies (Amendment) Act 2015, there is no need to have a minimum paid up capital for obtaining Private Limited Company Registration.

Further, for the registration of a Private Limited Company, a minimum of 2 members are required. However, the maximum limit for the same is 200.

Moreover, the term “member” does not comprise of a former and present employee. Lastly, in this business format, the Articles of Association (AOA) restricts the shareholders or members of the company from transferring their shares.

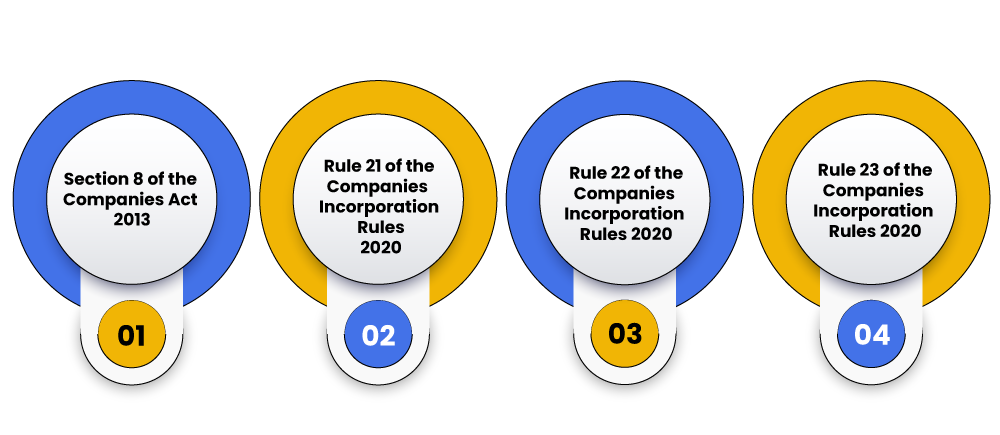

Regulatory Framework for the Process of Conversion

The legal provisions concerning the Process to convert a Section 8 Company into Private Company are as follows:

- Section 8 of the Companies Act 2013;

- Rule 21 of the Companies Incorporation Rules 2020;

- Rule 22 of the Companies Incorporation Rules 2020;

- Rule 23 of the Companies Incorporation Rules 2020;

Conditions for the Process of Conversion

The conditions required to convert a Section 8 Company into Private Company are as follows:

Rule 21 of the Companies (Incorporation) Rules 2020

- The company needs to pass an SR (Special Resolution) in its GM (General Meeting) to convert a Section 8 company into Private Company;

- Directors need to attach the Notice for General Meeting to the Explanatory Statement;

- The Explanatory Statement must include the particulars as follows:

- Date of Incorporation of the Company;

- Objectives of the Company specified in the MOA (Memorandum of Articles);

- Reasons for not achieving the current objectives;

- In case, the directors decide to alter the objectives of the company, then the Altered AOA, together with the Reasons for Alteration;

- Impact of Conversion on the Shareholders;

- Details of the benefits that will accrue to the members after conversion;

- A complete list of the concessions and privileges enjoyed by the Section 8 Company;

- All the details regarding the Market Price of the property acquired;

- All the details regarding the Concessional Rates offered by the company for such property;

- Details concerning the bequests and donations received by the company;

- The certified copy of the SR (Special Resolution) passed must be filed with the ROC (Registrar of Companies);

- The certified copy of the Notice for the General Meetings must be filed with the ROC;

- An application must be filed with the RD (Regional Director), together with the attachments as follows:

- A Certified Copy of the SR passed by the company in its General Meeting;

- A Certified copy of the Notice for the General Meetings;

- The proof of serving notice must be sent to the authorities as follows:

- Charity Commissioner;

- Income Tax Officer who is having jurisdiction over the company;

- Chief Commissioner of Income Tax who is having jurisdiction over the company;

- Central or State Department in whose jurisdiction the said company was operating;

- The copy of the application must be filed to both the Regional Director and Registrar of Companies.

Rule 22 of the Companies (Incorporation) Rules 2020

- The directors of the company must publish the notice to convert a section 8 company into Private Company in at least 2 newspapers. Out of which one should be in Vernacular Newspaper, and the other one should be in English Newspaper;

- The directors of the company need to file the financial statements with the Regional Director before making the application for conversion;

- The company needs to submit a declaration before the process of conversion, stating that the profits of section 8 company are neither used nor distributed among the members of the company;

- The directors of the company need to file a certificate with the ROC, certifying that provisions of conversion are duly complied with. Further, such a certificate will only be given by either of the following:

- Practising Chartered Accountant;

- Practising Company Secretary; or

- Certified Cost and Management Accountant;

- The company needs to file the representations received from any authority with the Regional Director within a period of 60 days, starting from the date of receiving the notice;

- The directors need to attach the proof of service with the application made to the RD (Regional Director);

- The RD can ask the applicant to obtain approval from the particular authority for the process of conversion;

- The applicant needs to acquire a report from the ROC (Registrar of Companies);

- After obtaining approval from the Regional Director (RD), the company must hold a GM (General Meeting) for allowing the alteration of MOA and AOA of the company;

- After holding the general meeting, the directors of the company need to file the particulars as follows with the ROC:

- A true and certified copy of the approval received from the RD within a period of 30 days. Further, such approval will be filed in form INC 20, together with the prescribed fees;

- Altered MOA (Memorandum of Association);

- Altered AOA (Articles of Association);

- A Declaration stating that the conditioned imposed by the RD are duly complied with;

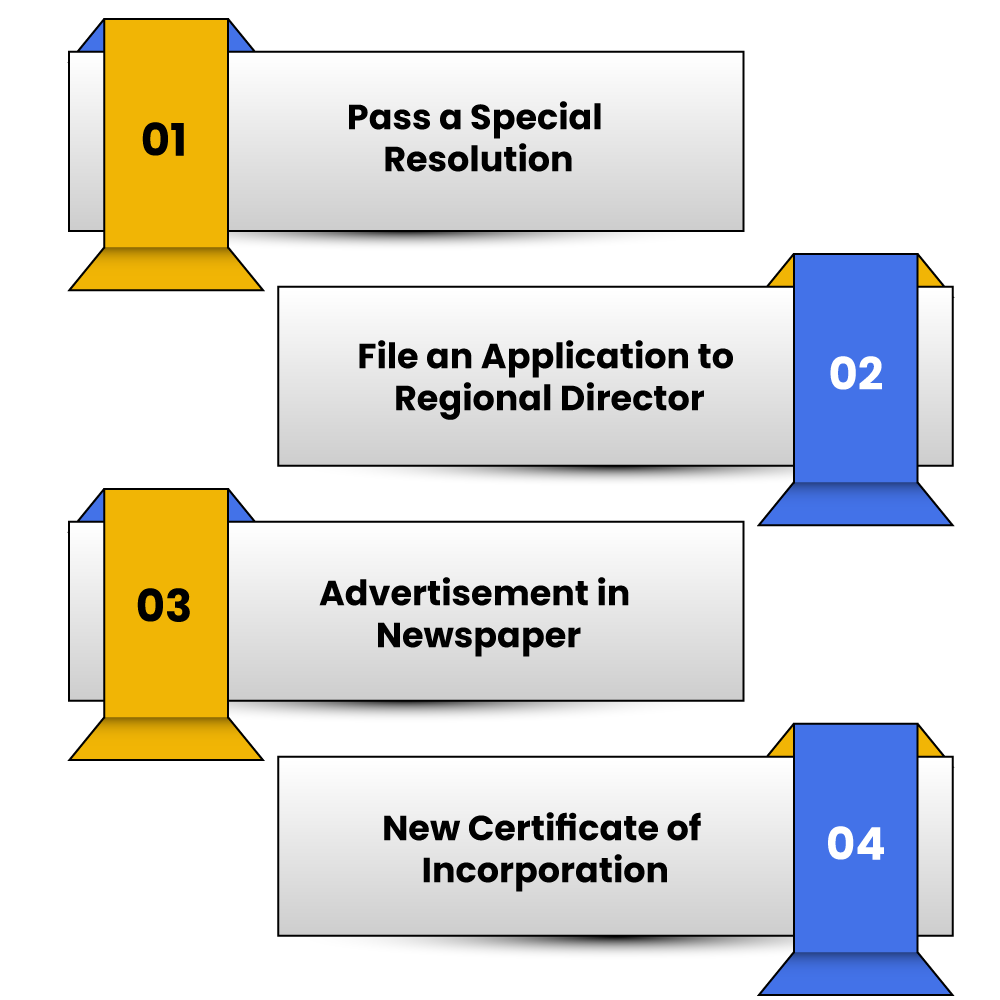

Procedure to Convert a Section 8 Company into Private Company

The steps involved in the procedure to convert a Section 8 Company into Private Company are as follows:

Pass a Special Resolution

According to Rule 21 of the Companies (Incorporation) Rules 2020, a Company must pass a Special Resolution (SR) in the General Meeting of its shareholders for the approval of the process of Conversion.

Further, a true and certified copy of the SR, together with the Explanatory Statement needs to be filed with the Registrar of Companies (RoC).

Also, a copy of the Special Resolution and the Notice to hold General Meeting must be filed in MCA Form MGT 14 within a period of 30 days, starting from the day of the passing of the Special Resolution.

File an Application to Regional Director

According to Rule 21 of the Companies (Incorporation) Rules 2020, a Company needs to file an application with the RD (Regional Director) inForm INC 18, together with the fee prescribed.

Advertisement in Newspaper

After furnishing an application to the Regional Director, the directors of the Company needs to publish a notice for the conversion of section 8 company into a private limited company in the newspaper.

Further, the said publication must be made within a period of one week, starting from the date of furnishing the application to the Regional Director.

Also, a copy of the Notice published must be sent to the Regional Director in MCA Form INC 19.

New Certificate of Incorporation

On the receipt of the documents required, the Registrar of Companies (ROC) will grant a new Certificate of Incorporation to the applicant company.

Further, after the revocation of the license of Section 8 Company, the said entity can apply for the Conversion of its name and status with the Registrar of Companies in MCA Form INC 20.

Effects of the Process of Conversion

The effects of the process of conversion are as follows:

- After the process of conversion, the entity cannot claim exemptions and privileges which were available to section 8 company under the companies act 2013;

- In case, before the process of conversion, the section 8 company has bought an Immovable Property at a price lower than the prevailing market rates, then the newly incorporated company will need to pay the difference to the government;

- If in case the company is left with some accumulated profits and unutilized income, the same will be used for setting off the outstanding dues to the creditors and suppliers;

- After the settlement of each due, the amount left will be transferred to the IEPF (Investor Education and Protection Fund) within a period of 30 days, starting from the date of conversion.

Conclusion

In a nutshell, the Companies Act 2013 provides for the process to convert a Section 8 Company into a Private Company.

Further, the main reason for conversion is that the companies are not able to achieve the desired object within the prevailing structure of the Company. If you want to know more about the Online Private Limited Company Registration process, then you can call us directly on the given numbers.

Also, the process to convert a Section 8 Company into a Private Company is a time-taking and intricate task, which indeed requires professional assistance.

We at Swarit Advisors have a team of experienced and skillful professionals who will assist you with the process to convert a section 8 Company into a Private Company, together with the on-time completion of the work.

Read, Also: Procedure for Section 8 Company Registration.