LLP Agreement: A Guide on its Concept and Sample Format

Shivani Jain | Updated: Jun 27, 2020 | Category: Legal Agreements

The term “LLP Agreement” denotes a written agreement signed by the partners of an LLP. This agreement acts as a binding force for the partners of the firm.

Further, the term “Binding Force” denotes the set of rights and duties mutually decided by the partners of the firm.

In this learning blog, we will discuss in-depth the concept, provisions, and sample format of the LLP Agreement.

Table of Contents

Concept of Limited Liability Partnership

The Limited Liability Partnership or LLP is a combination of a Private Limited Company and Partnership Firm. That means it includes the benefits of both a private company and partnership firm.

A limited liability partnership is a separate legal entity distinct from its partners. That means the Designated Partners enjoys the feature of limited liability. It also means that the liability of a partner is limited to the amount of contribution made by him/her at the time of registration.

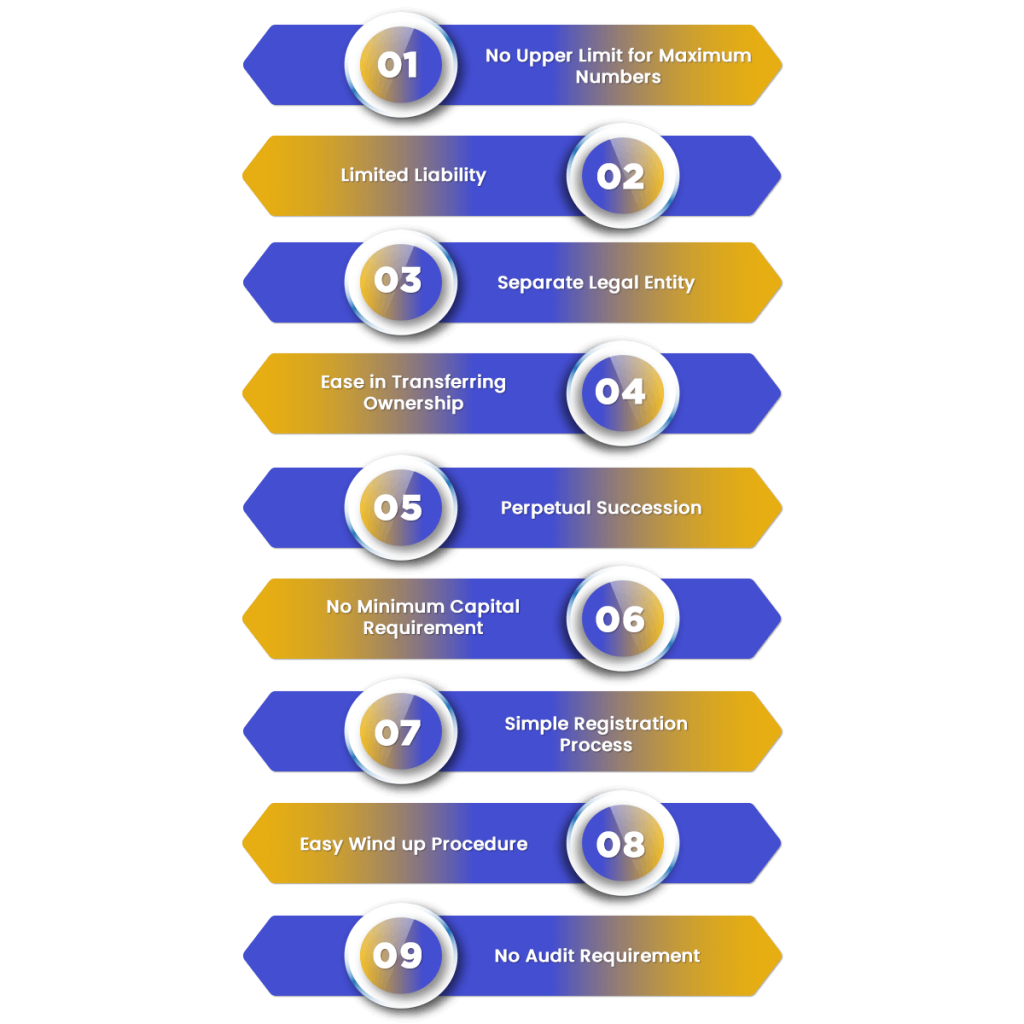

Benefits of a Limited Liability Partnership

The Benefits of a Limited Liability Partnership are as follows:

- No Upper Limit for Maximum Numbers;

- Limited Liability;

- Separate Legal Entity;

- Ease in Transferring Ownership;

- Perpetual Succession;

- No Minimum Capital Requirement;

- Simple Registration Process;

- Easy Wind up Procedure;

- No Audit Requirement;

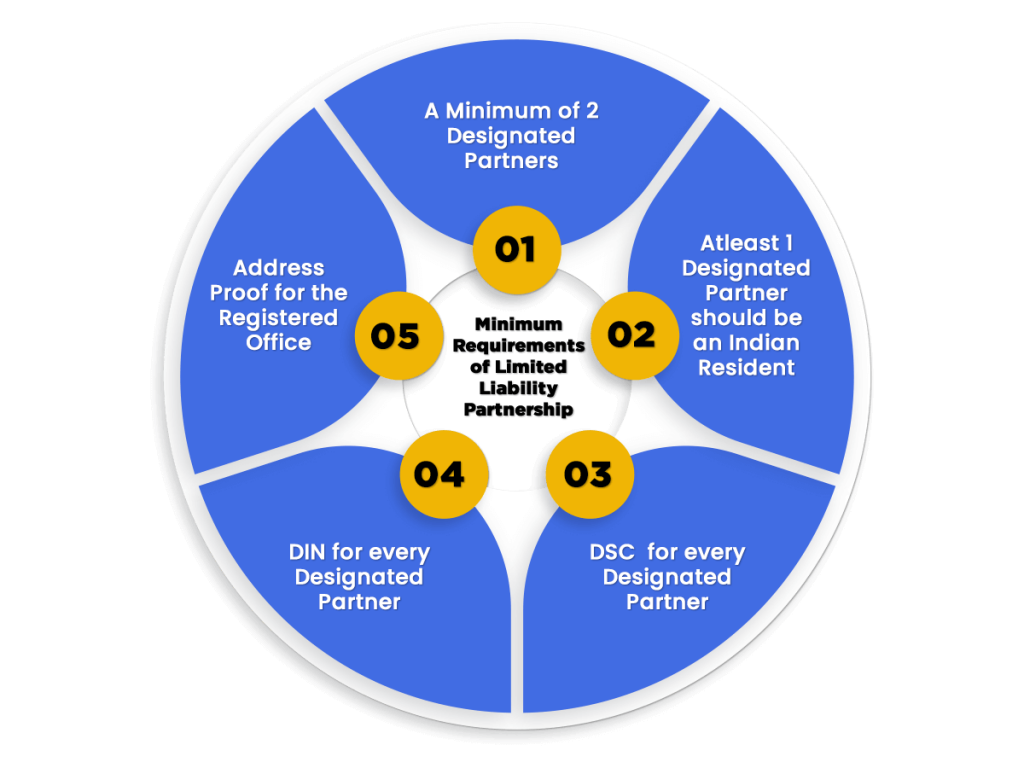

Minimum Requirements for Limited Liability Partnership

The minimum requirements of an LLP are as follows:

- A Minimum of 2 Designated Partners;

- At least 1 Designated Partner should be an Indian Resident;

- DSC (Digital Signature Certificate) for every Designated Partner;

- DIN (Director Identification Number) for every Designated Partner;

- Address Proof for the Registered Office.

Governing Law for LLP

The Limited Liability Partnership Act 2008 acts as the regulatory framework for an LLP. That means the provisions of the Indian Partnership Act, 1932, do not apply to a Limited Liability Partnership Firm.

Who Chooses LLP as a Business Format?

At present, the Limited Liability Partnership or LLP as a business format is chosen by various businesses. The term “businesses” include several Auditing Firm, Real Estate Agencies, and SMEs (Small Medium size enterprises), etc.

Who can become a Designated Partner?

According to section 7 of the LLP Act 2008, every Limited Liability Partnership or LLP needs a minimum of 2 partners. In this format, the individual partners are termed as Designated Partner. However, the term “Partner” can include both individuals and Corporate Bodies.

Further, it shall be relevant to note that there is no upper limit prescribed for the maximum number of partners in an LLP.

Any person, who is of sound mind and has not been adjudicated before for any offense, is eligible to become a Designated Partner or DP in an LLP firm. Further, a DP is known as Agents of the Firm. However, an agent appointed by DP is not the agent of the Firm.

Difference between Designated Partner and Normal Partner

| Basis of Difference | Designated Partner | Normal Partner |

| Term “Individual” | Only Natural Person can become a Designated Partner | Both Natural Person and Corporate Body can become a Normal Partner |

| Responsibility | DP is solely responsible for the execution and management of the firm. | Normal Partners of an LLP are not responsible for the execution and management of the firm. |

Concept of LLP Agreement Format

An LLP Agreement format is known as the Bible for an LLP. It is a written agreement between the Designated Partners of the Limited Liability Partnership (LLP).

This agreement contains a set of mutual rights and duties of the partners working in an LLP. Further, all the day to day business activities will be governed by the Limited Liability Partnership Agreement.

Further, all the details regarding new, terminating, and existing partners, profit sharing ratios, and capital contribution in the LLP are contained in this agreement. The Profit Losses Sharing ratio denotes the way for distributing profit and losses of the LLP.

Concept of Detailed LLP

The term “Detailed LLP” denotes another name for LLP Agreement. It clarifies the working and functioning of a Limited Liability Partnership Firm.

Further, within 30 days of the LLP registration, the Partners need to execute an LLP Agreement. A Limited Liability Partnership Agreement is formed as per Form 2 of the LLP Act.

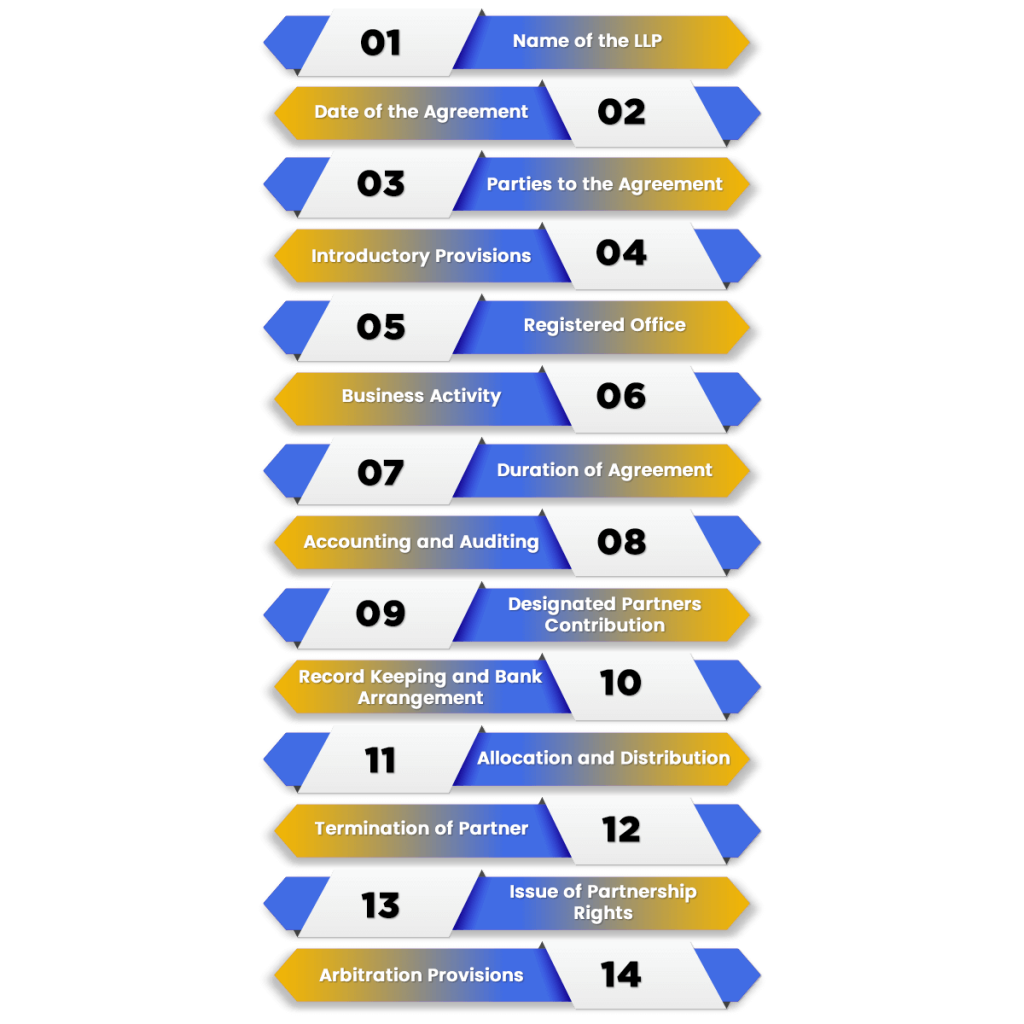

Contents of LLP Agreement Format

For the smooth functioning of an LLP Firm, a detailed LLP agreement format is a must. In India, the contents of a Limited Liability Partnership Agreement Format can be summarised as:

Name of the LLP

The name of an LLP Firm must end with the suffix “Limited Liability Partnership” of “LLP”.

Date of the Agreement

After LLP Registration, the partners need to execute a Limited Liability Partnership Agreement within 30 days. The agreement must include the date of entering into an agreement.

Parties to the Agreement

All the designated partners are the party to this agreement. It clearly defines the duties, functions, and capital invested by each designated partner. The agreement also contains the date on which the partner enters into an LLP Firm.

Introductory Provisions

These provisions mean a separate part of the agreement, which defines the terms used in it.

Registered Office

A limited liability partnership agreement must contain the details of the registered office of the firm. The Registered office of the LLP is also known as the place of business of LLP.

Business Activity

All the activities that a firm wants to carry out will be included in the agreement. However, the MCA (Ministry of Corporate Affairs)[1] must approve the nature of the activity during registration.

Duration of Agreement

An LLP firm can be made either for a fixed tenure or for some specific objective. If it is made for a fixed time period, the agreement must contain the date of automatic dissolution. However, if it is made for some specific purpose, the details of that purpose must be mentioned in the agreement.

Accounting and Auditing

How the books of accounts will be maintained is described under this section. The methods of maintaining accounts can be either on a cash basis or an accrual basis. Further, the requirement of conducting the audit is also mentioned under the agreement.

Contribution of Designated Partners

This section includes the profit loss sharing ratios, amount of capital invested by each partner, etc.

Record Keeping and Bank Arrangement

This part consists of the storage, maintenance, and recording of books and other required documents.

Allocation and Distribution

It specifies the method of sharing profit and loss partners. The term “distribution” includes both interim and final distribution in the LLP.

Termination of Partner

It specifies the terms and conditions in which a partner can withdraw from the LLP. It is considered as a crucial part of an LLP Agreement format. This section also states the rights of a partner on assets after termination.

Issue of Partnership Rights

It provides details concerning to admission of new partners and their rights thereafter.

Arbitration Provisions

In a dispute between partners who will have the power to arbitrate is included in this section. Further, it also consists of court, which will have jurisdiction in such situations.

In the Absence of LLP Agreement

In the absence of agreement, the provisions of Schedule I of the Act will apply to both Partners and Firm. However, the designated partners need to pass a resolution in a general meeting for the matters included in Schedule II.

Provisions in the Absence of an LLP Agreement

In case an LLP does not have and LLP Agreement Format, then the provisions of Schedule I will become applicable to the parties and firm. The same can be summarised as:

- The profit and loss will be shared equally among partners;

- The Partners will need to indemnify for any personal payments made by them in the ordinary course of business.

- The partners will be responsible for compensating the losses caused due to their fraudulent act;

- All partners can take part in the firm’s management;

- Partners are not entitled to any salary;

- The admission of a new partner will need permission from partners;

- Any other issue will be decided by the voting of all the partners.

- Any change in the nature of the business will require the consent of all partners;

- All the partners must have free consent, i.e., partners cannot force each other for a mutual decision;

- All the unresolved disputes among the partners will be referred for arbitration.

Disqualifications from Becoming Partners

A person is disqualified from becoming a Designated Partner in the situation as follows:

- Any Person of Unsound Mind; or

- Any Person who has been adjudicated as Insolvent by the Authorities;

Sample LLP Agreement Format

SAMPLE-RENT-AGREEMENT-FORMATConclusion

Considering the dynamic and changing nature of the Corporate Sector, a business structure that shifts the focus from a Partnership Firm was the need of an hour. A Limited Liability Partnership is a combination of a partnership firm and private company, whereas, an LLP Agreement format is a bible for Limited Liability Partnership Firm.

However, the formation of this document needs expertise and experience. Our expert team at Swarit Advisors can assist you in preparing the LLP agreement suitable to the LLP registration process requirements.

Also, Read:Lease Agreement Format: A Complete Guide on Lease Deed