Format of Share Purchase Agreement: Its Concept and Clauses

Shivani Jain | Updated: Oct 12, 2020 | Category: Legal Agreements

The term “Format of Share Purchase Agreement” denotes a formal legal document that lays down the terms and conditions for the seller and buyer of shares. That mean, through this document, the buyer steps into the shoes of the seller.

Further, it shall be pertinent to note that a Share Purchase Agreement will include both Share and its Price.

In this blog, we will discuss the concept of Format of Share Purchase Agreement, together with its Concept and Clauses.

Table of Contents

Concept of Share Purchase Agreement

The term “Share Purchase Agreement” means a legally binding agreement which includes all the terms and conditions regarding the Sale and Purchase of shares. Further, the main aim of this document is to ease out the process of transferring the ownership of shares of a company.

The parties involved in the agreement are known as Buyer and Seller. Under this agreement, the seller decides to sell his/ her some shares to the buyer at a specific price rate. Also, the parties involved needs to sign the document to complete the process of transferring shares.

Moreover, it shall be pertinent to note that a Share Purchase Agreement or SPA is normally used by the parties when transferring a large number of items.

Need for Format of Share Purchase Agreement

A Share Purchase Agreement or SPA is used when an entity or an individual is selling or purchasing the shares in the company with some other person or organisation.

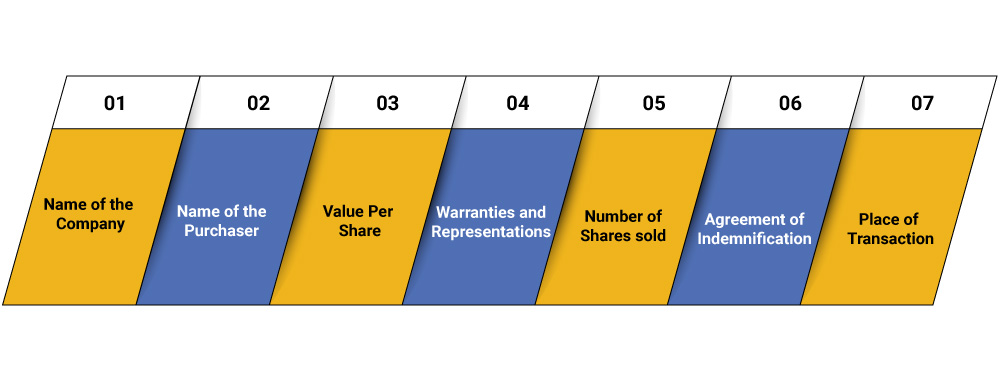

Elements of an SPA

The elements of a Share Purchase Agreement are as follows:

- Name of the Company;

- Name of the Purchaser;

- Value Per Share;

- Warranties and Representations;

- Number of Shares sold;

- Agreement of Indemnification;

- Place of Transaction;

Benefits of Share Purchase Agreement

The benefits of the Format of Share Purchase Agreement can be summarised as:

- A Share Purchase Agreement or SPA being formally executed for the sale of shares makes the transaction legally correct and organized by evidently specifying the expectations of the parties involved;

- An SPA is a detailed document that covers all the ambits involved in the transaction of sale and purchase of a share. That means it reduces the possibility of confusion and makes the transaction unambiguous;

- It assists the companies in maintaining a record of the shareholder’s agreement and involves them in the processes of decision making as well;

- Such an agreement helps the regulatory authority to keep check of similar transactions and enforce them;

- An SPA protects and safeguards the rights and interests of both the parties and minimizes the risk of getting conned as well;

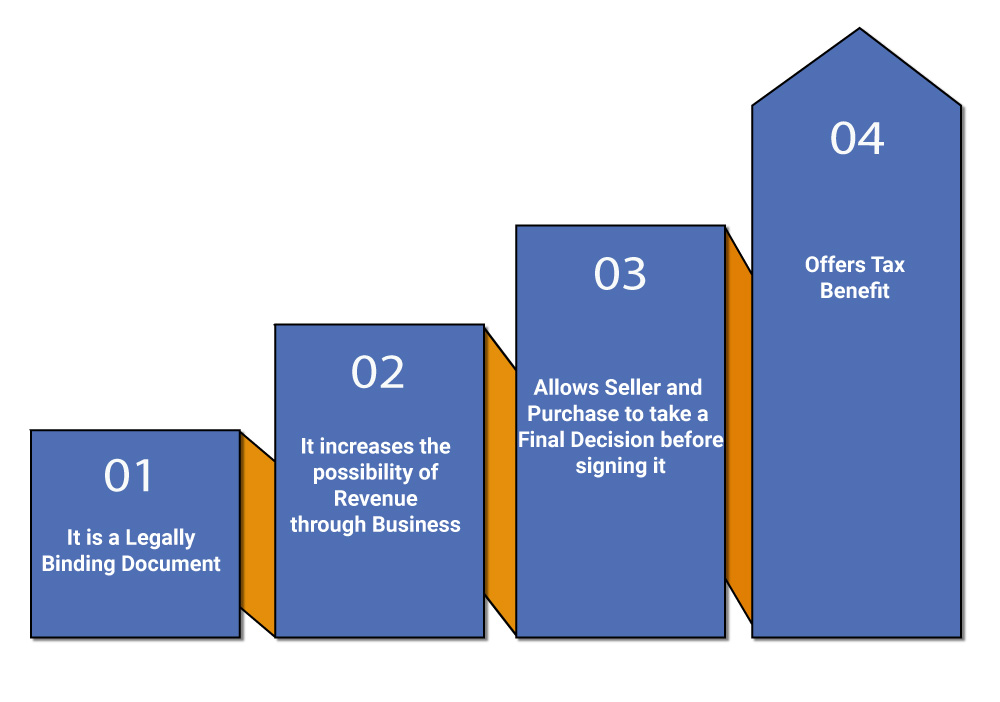

Reasons to Choose Share Purchase Agreement

The reasons to choose the Format of Share Purchase Agreement are as follows:

- It is a Legally Binding Document;

- It increases the possibility of Revenue through Business;

- Allows Seller and Purchase to take a Final Decision before signing it;

- Offers Tax Benefit;

Significance of the Share Purchase Agreement

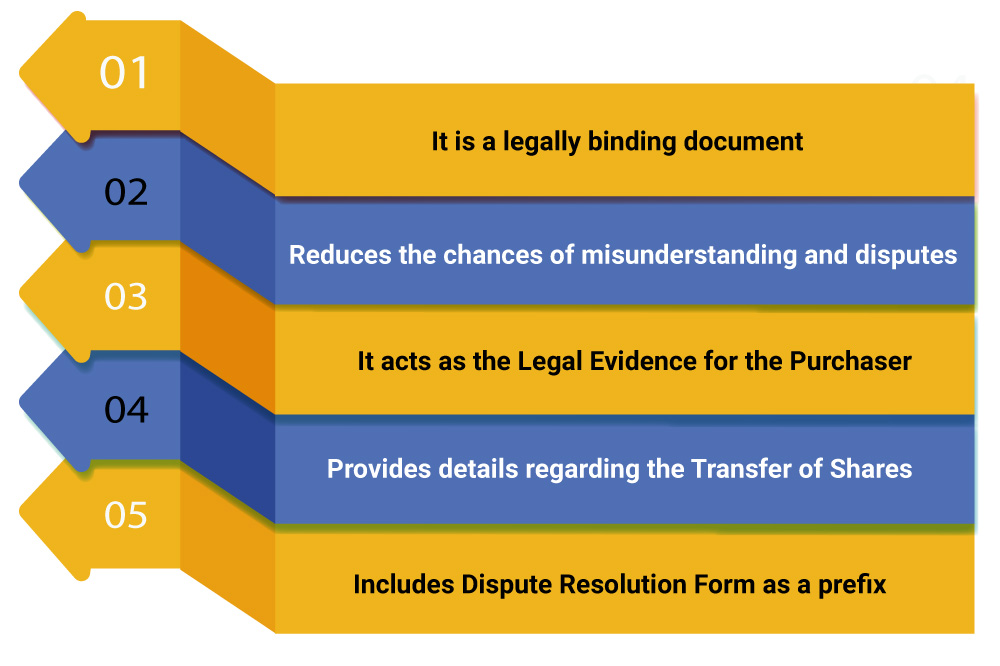

The significance of the Format of Share Purchase Agreement can be summarised as:

- It is a legally binding document;

- Reduces the chances of misunderstanding and disputes;

- It acts as the Legal Evidence for the Purchaser;

- Provides details regarding the Transfer of Shares;

- Includes Dispute Resolution Form as a prefix;

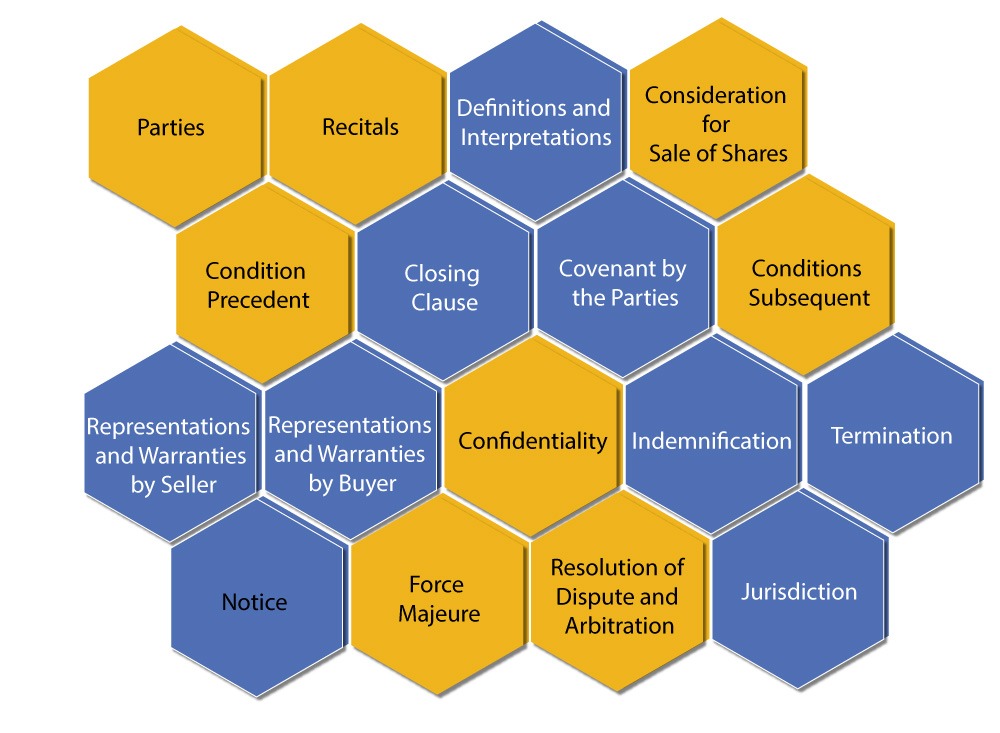

Clauses of a Share Purchase Agreement

The clauses of the Format of Share Purchase Agreement are as follows:

Parties

In a Share Purchase Agreement, the parties involved are known as Seller and Purchaser.

Recitals

The term “Recitals” means that the factual background, consideration, objectives, roles of the parties involved must be clearly defined.

Definitions and Interpretations

The term “definition” means that the words used in the agreement must be clearly defined regarding their meaning and use. Further, the term “interpretation” means that the terms used must be interpreted in the same way as stated.

Consideration for Sale of Shares

This clause deals with the Payment Structure involved in the transaction. Further, the term “Payment Structure” includes the particular as follows:

- Closing Balance;

- Deposits Given;

- Amount to be Set-off;

- Warranties, etc.;

Moreover, it shall be relevant to note that the buyer can either make a one-time payment or can pay the same in installments. However, all these details must be mentioned in the consideration clause.

Condition Precedent

The term “Condition Precedent” denotes a clause that includes the details of the person accountable for authorisation, permits, and permissions. Further, it shall comprise of details regarding Representations, Obligations, Warranties, and Execution of Agreement as well.

Closing Clause

All the significant details, such as time, place, and manner in which the closing shall take place are included under this clause.

Covenant by the Parties

The term “covenant by the parties” denotes the conditions that are mutually accommodated by the parties.

Conditions Subsequent

This clause is used only in the case of breach of a condition to safeguard the rights of a subsequent purchaser.

Representations and Warranties by Seller

The term Representations and Warranties by Seller includes the particulars as follows:

- Number of Shares owned by them;

- List of the Directors;

- Transparency of Accounts;

- Pending Disputes;

- Loan Details;

Thus, all the details regarding the vendor’s right to sell his/ her share to the purchaser are covered under this clause.

Representations and Warranties by Buyer

This clause works the same as the seller’s clause and safeguards the rights and interest of the buyer.

Confidentiality

It is one of the significant clauses of a share purchase agreement. Under this clause, the parties need to share the confidential information of their companies. That means this clause assists in sealing the price sensitive information.

Further, the term “Price Sensitive Information” denotes the details that cannot be revealed without the Mutual Consent of the parties involved.

Also, the Clause of Confidentiality is usually kept time-barred from 18 months to 2 years.

Indemnification

This clause of the Share Purchase Agreement deals with the claim amount, time limit, procedure, and the subject matter.

Notice

The Notice Clause includes the details, such as the location of the parties, date of dispatch, etc. Further, the form and the format of acceptance must be disclosed in this clause as well.

Force Majeure

These types of clauses act as a resort in the unforeseen crises and strengthen the parties involved in the share purchase agreement. Further, this clause works as a measure for the financial crisis and fluctuating market.

Resolution of Dispute and Arbitration

This clause explicitly contains all the details regarding the Seat of Arbitration Language, Arbitrators Name, and Number of Arbitrators.

Jurisdiction

A Share Purchase Agreement will be based on Indian laws. Further, the city in which the buyer resides will have the jurisdiction of the court.

Termination

This clause will include all the details as to how a contract will be terminated.

Common Mistakes While Drafting the Format of Share Purchase Agreement

The common mistakes while drafting the format of Share Purchase Agreement are as follows:

- Considering any template for the Share Purchase Agreement;

- Executing the agreement without any prior knowledge and experience;

- Not Consulting any Legal Expert Opinion;

- Not knowing the Tax Implications;

Procedure for Drafting the Format of Share Purchase Agreement

The steps involved in the process to draft the format of Share Purchase Agreement are as follows:

- Reach out to Swarit Advisors, our experienced lawyers will get in touch with you and will assist you in the process of drafting and other requirements of a Share Purchase Agreement;

- After deciding the aims and objectives, our lawyer will draft a Sample Format of Share Purchase Agreement based on your needs;

- After that, we will send the sample Share Purchase Agreement[1] to you for review purpose;

- The whole process will take around 3 to 4 days to complete;

Difference Between Asset Purchase and Share Purchase

The term “share purchase” denotes that an individual or entity will have the ownership in a company. However, the term “asset purchase” denotes the sale of the assets and liabilities of the company. Further, the term assets include Goodwill, Intellectual Property, and Machinery.

Also, it shall be relevant to note that an individual will lose the ownership in Share Purchase but will retain the same in Asset Purchase.

Conclusion

In a nutshell, the Format of Share Purchase Agreement acts as a formal legal document that lays down the terms and conditions for both the seller and buyer of shares. Further, through this document, the buyer steps into the shoes of the seller.

However, drafting a Share Purchase Agreement is a time-consuming task and requires prior experience as well. At Swarit Advisors, our professionals will cater all your needs and will make draft the Share purchase Agreement based on your requirements.

Sample Format of Share Purchase Agreement

SHARE-PURCHASE-AGREEMENTAlso, Read: A complete Guide on Residential Rental Agreement Format