A Complete Guide on Memorandum of Understanding Format

Shivani Jain | Updated: Oct 17, 2020 | Category: Agreements, Compliance, Legal, Legal Agreements

The term Memorandum of Understanding Format denotes the Performa of an agreement that is signed between the parties. This legal document describes the rights and duties of the parties involved.

Further, it shall be relevant to state that all the terms and conditions stated in an MOU are mutually agreed.

In this blog, we will discuss the concept of the Memorandum of Understanding Format, together with the process to draft it.

Table of Contents

Features of MOU

The features of a Memorandum of Understanding are as follows:

- An MOU must include the Name and Details of the parties involved;

- It must specify the Purpose and Objective of drafting MOU;

- All the details regarding the Meetings must be clearly mentioned;

- A Memorandum of Understanding must specify the Amount of Capital contributed by each party;

- It must contain the details concerning the Authorities eligible to take Major Financial Decisions;

- An MOU must include all the details regarding the financial record keeping of the assignment or program being undertaken;

- It must include the roles, duties, responsibilities, remuneration, etc., of every party involved;

- It should include details regarding a person who is authorised to manage the day to day affairs and operations of the program;

- Once the MOU is duly drafted, it needs to be mandatorily signed by both the parties;

- An MOU must include the duration of the agreement signed. Further, the term “duration” includes the starting and ending date of the agreement;

- It should include the situations in which the agreement signed stands terminated;

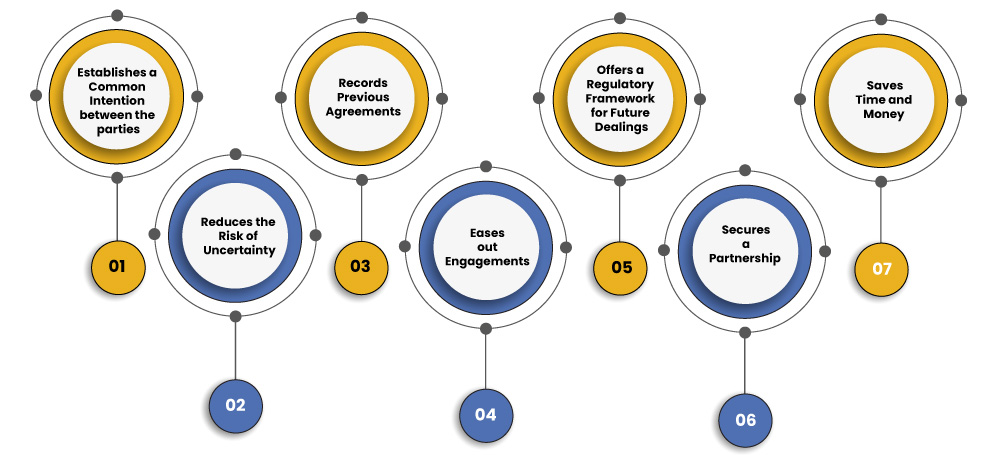

Benefits of a Memorandum of Understanding Format

The benefits of an MOU Format are as follows:

- Establishes a Common Intention between the parties;

- Reduces the Risk of Uncertainty;

- Records Previous Agreements;

- Eases out Engagements;

- Offers a Regulatory Framework for Future Dealings;

- Secures a Partnership;

- Saves Time and Money;

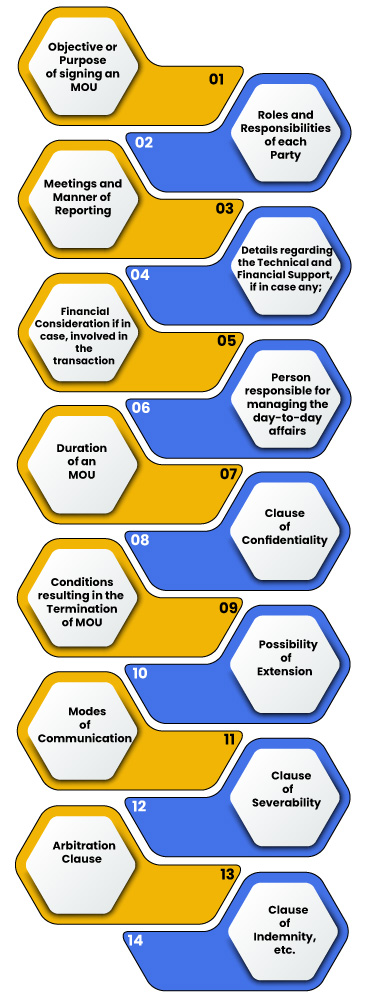

Clauses of Memorandum of Understanding Format

The essential clauses of a Memorandum of Understanding Format are as follows:

- Objective or Purpose of signing an MOU;

- Roles and Responsibilities of each Party;

- Meetings and Manner of Reporting;

- Details regarding the Technical and Financial Support, if in case any;

- Financial Consideration, if in case, involved in the transaction;

- Person responsible for managing the day-to-day affairs;

- Duration of an MOU;

- Clause of Confidentiality;

- Conditions resulting in the Termination of MOU;

- Possibility of Extension;

- Modes of Communication;

- Clause of Severability;

- Arbitration Clause;

- Clause of Indemnity, etc.;

Also, Read: Steps to Change of Name of the Company: A Complete Guide

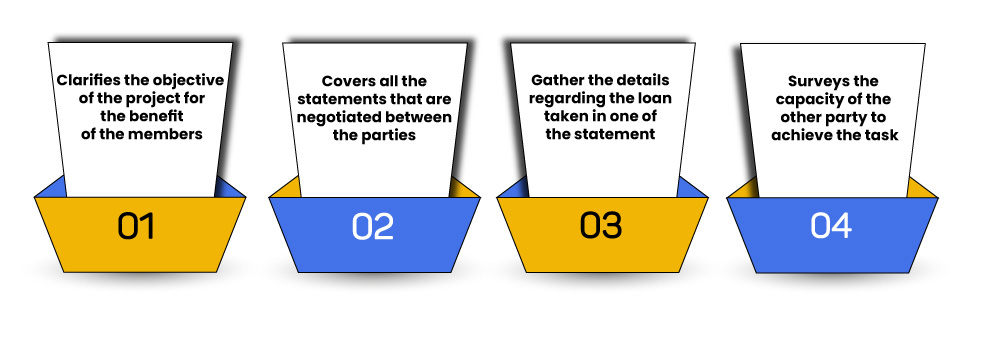

Purpose of Memorandum of Understanding Format

The objectives of a MOU Format are as follows:

- Clarifies the objective of the project for the benefit of the members;

- Covers all the statements that are negotiated between the parties;

- Gather the details regarding the loan taken in one of the statement;

- Surveys the capacity of the other party to achieve the task;

Documents Required for Drafting MOA

It shall be worthy to note that as such no specific documents are needed for drafting and executing a Memorandum of Understanding Format.

However, the basic details of the parties, such as ID Proofs, Names, and Permanent Address, must be provided for the process of scrutiny.

Moreover, the paper evidencing the rights of the parties to carry out the business as per the regulation of MOU and provide the service in question could be scrutinized as well.

Process of Drafting Memorandum of Understanding Format

The steps involved in the process of Drafting Memorandum of Understanding Format are as follows:

- First, Identify the Parties to the MOU (Memorandum of Understanding);

- Now, understand the objective and aim of creating this MOU;

- After that Plan the requirements for achieving these objectives;

- Decide the duties, roles and responsibilities of each party;

- Decide on the events when such an MOU becomes inapplicable;

- Plan on sharing the economic benefits;

- Covers the clauses where it provides the circumstances where one of the parties has the right to can the MOU;

- Start drafting Memorandum of Understanding with professional assistance;

- A final draft of the MOU will be sent for review purpose;

- Both the parties must sign the MOU drafted;

Legality of MOU in India

It shall be pertinent to mention that an MOU [1] does not create any legally enforceable obligation. That means it is a non-binding contract that defines the intention of the businesses or parties involved.

However, if an MOU has been drafted for consideration, such as for the exchange of money, etc., then the said document will have a binding effect on the parties.

Also, the intent of the parties involved can be decoded from the material provisions and contents of the MOU.

Moreover, the clauses, such as Applicable Law, Jurisdiction, Indemnification, etc., will have a binding impact on the agreement.

Therefore, the legality of an MOU depends on the duties, rights, obligations, it creates among the parties involved.

Enforceability of Memorandum of Understanding Format

In India, an MOU is governed by the provisions of the Indian Contract Act 1872. Further, if the conditions stated under the Indian Contract Act are duly satisfied, then the performance of a Memorandum of Understanding can be enforced under the provisions of the Specific Relief Act 1963.

Moreover, as per the provisions of the Specific Relief Act, a relief is granted only when the parties cannot determine the compensation in monetary terms.

However, it shall be relevant to state that in case the conditions mentioned under the Indian Contract Act, 1872, are not fulfilled, then the Memorandum of Understanding Format will not be recognised as a legally enforceable contract. But then again, it shall be relevant to state that the court of law has the power to enforce an MOU based on the principles of “promissory estoppels and equity”.

Stamp Duty on MOU Format

There is no need to pay any Stamp Duty on the Memorandum of Understanding Format. However, it shall be relevant to mention that in case the value of the property involved is more than Rs 100/-, then the parties must get the document stamped on a mandatory basis to use it as legal evidence before the court of law.

Conclusion

In a nutshell, an MOU plays a significant role in the business world. Further, it does not involve any transaction regarding the exchange of money.

Also, a Memorandum of Understanding Format is not legally binding until stamped. However, if in case there is an exchange of money, then the document will be considered as a legally binding contract.

In case of any other doubt, visit Swarit Advisors, our experts will assist you in drafting a Memorandum of Understanding.

Also, Read: Guide to Alter Memorandum of Association