E-Form INC-22A: Registered Office Inspection

Khushboo Priya | Updated: Feb 22, 2019 | Category: Compliance, News

Recently, on 21st February 2019, the Ministry of Corporate Affairs issued a notification regarding specific amendments to the Companies (Incorporation) Rules, 2014. The MCA introduced new form, namely e-Form INC-22A. According to the notification, every company incorporated or registered before or on 31st December 2017 shall file the particulars before 25th April 2019 mandatorily.

To learn more about the e-form INC-22A, keep reading the blog until the end so that you don’t miss any significant details regarding the same.

Table of Contents

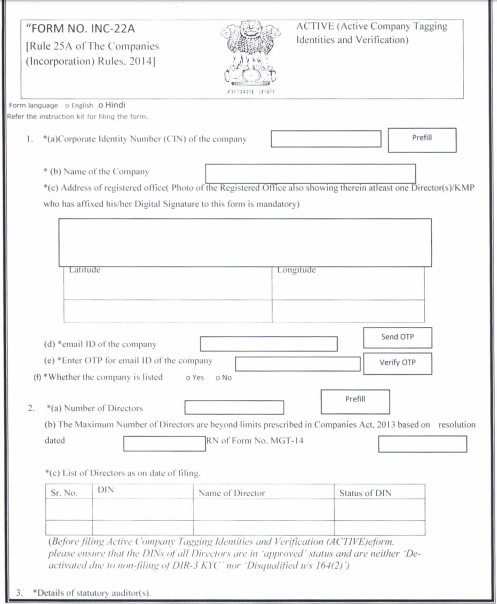

What is e-Form INC-22A?

The e-Form INC-22A is also named as the e-Form ACTIVE. The term ACTIVE, in the e-form, stands for Active Company Tagging Identities and Verification. Typically, the form is introduced with the intent to ensure companies are actively following or complying by the provisions of Companies Act, 2013. Furthermore, it ensures the particulars of the registered office are true and valid.

Applicability for filing e-Form INC-22A

All those companies enrolled under the Companies Act, 2013 on or before 31st Dec. 2017 can or should compulsorily file the particulars of the corporations and their registered office. The companies can file the e-From ACTIVE only when the companies have filed their due annual returns under Section 92 or due financial statement under Section 137 or both with the ROC (Registrar of Companies).

When shall it come into force with effect?

It shall be applicable from 25th February 2019.

What’s the last date for filing e-Form ACTIVE?

The last date for filing e-Form ACTIVE is 25th April 2019.

What are the mandatory details that need to be furnished in the e-Form ACTIVE?

Following details are mandatory to furnish in the concerned e-form:

- CIN (Corporate Identity Number) of the company;

- Name of the Company;

- Address of the registered office, along with the photograph showing therein at least 1 Director/KMP;

- Email Id of the company;

- Details of the number of Directors;

- List of Directors as on the date of filing;

- Information of Statutory Auditors;

- Details of Managing Directors or CEO or Manager or Whole-time Director of the company;

- Information of Company Secretary of the company;

- Details about CFO; etc.

Who all have exemptions from filing the INC-22A e-form or e-Form ACTIVE?

Following companies have exemptions from filing e-form INC-22A:

- Companies that have struck off or in the process of being struck off;

- Those which are in the state of liquidation;

- Such companies which are dissolved; and

- Those in the process of amalgamation or have already amalgamated.

However, they shall intimate the above particular to the ROC before the last date.

In what case the company will get the status of ‘ACTIVE non-compliant’?

In case, the company doesn’t intimate the above particulars, it will achieve the status of ‘ACTIVE non-compliant‘ on or after 26th April 2019. Moreover, the company shall be held liable for action under sub-section (9) of section 12 of the Act.

Consequences of delay/non-filing of e-Form INC-22A or ACTIVE

In case the company fails to file the form till 25th April 2019, or it delays, then the company would have to face the following consequences:

- The company would be subject to pay the fine of Rs. 10,000;

- It will get the status of ACTIVE non-compliant;

- Furthermore, such companies won’t be able to file the following e-forms:

- SH-07-for stating any alteration in the authorized capital;

- PAS-03-for stating any change in the Paid-up capital;

- DIR- 12-in case the Director changes, except cessation;

- INC-22-in the registered office changes; and

- INC-28-for amalgamation and de-merger.

A sample of the e-Form INC-22A

Image Source: mca.gov.in

For any further queries regarding the latest update on e-Form ACTIVE or e-form INC-22A, contact Swarit Advisors.

Also, Read: Mandatory ROC compliances that every company must follow.