Form MSME-1: A Guide on Due Dates and Filing Procedure

Shivani Jain | Updated: Aug 21, 2020 | Category: Government Registration, MSME

The term “Form MSME-1” denotes a Half-yearly Return under which a registered MSME needs to make certain disclosures regarding its vendor to the ROC (Registrar of Companies). Further, all the companies which are receiving goods and services from MSMEs need to file this form with the MCA (Ministry of Corporate Affairs) as well.

In the year 2019, the MCA decided to make some amendments in Schedule III of the Companies Act 2013.

Further, these amendments were introduced on 22.01.2019, by way of the Companies (Furnishing of Information about Payment to Micro and Small Enterprise Suppliers) Order 2019.

In this blog, we will discuss the concept of Form MSME-1, together with its Due Dates and Filing Procedure.

Table of Contents

Concept of MSME

The term “MSME” denotes all the companies that are registered under the MSMED Act 2006. Further, the term “Companies” includes Sole Proprietorship, HUF (Hindu Undivided Family), Partnership Firm, Co-operative Society, and Limited Company, etc.

Earlier, the MSME sector was bifurcated in 2 parts, i.e., Manufacturing Sector and Service Sector. However, after the announcement of amendment in the MSMED Act 2006 made by our Finance Minister on 13.05.2020, the distinction between both the sectors has been eliminated.

Further, in the same meeting, it was declared that there will be a revision in the Investment Limits, and a new concept known as Turnover Criteria will be introduced.

As per section 7 of the MSMED Act 2006, the new limits are as follows:

Micro-Enterprise

| Type of Sector | Type of Investment | Investment Limit | Turnover Limit |

| Manufacturing and Service Sector. | In Plant and Machinery. | Less than Rs. 1 Crore | Less than Rs. 5 Crore |

Small-Enterprises

| Types of Sector | Type of Investment | Investment Limit | Turnover Limit |

| Manufacturing and Service Sector. | In Plant and Machinery. | Rs. 1 Crore to Rs. 10 Crore. | Rs. 5 Crore to Rs. 50 Crore |

Medium Enterprises

| Types of Sector | Type of Investment | Investment Amount | Turnover Amount |

| Manufacturing and Service Sector. | In Plant and Machinery. | Rs. 10 Crore to Rs. 20 Crore | Rs. 50 Crore to Rs. 100 Crore |

Therefore, all the companies falling under the criteria mentioned above will are eligible to obtain MSME Registration in India.

Applicability of Form MSME-1

All the Companies specified in the guidelines issued by the MCA (Ministry of Corporate Affairs) need to file Form MSME-1. Further, the term “specified” includes the companies satisfying the conditions as follows:

Condition 1

All the companies who are receiving goods or services from the MSMEs (Micro Small and Medium Enterprises)

Condition 2

All the MSMEs (Micro Small and Medium Enterprises), which are supplying goods and services to the companies need to file this return with the ROC (Registrar of Companies).

However, such MSMEs must have remained unpaid for more than 45 days, starting from the date of deemed to be acceptance or acceptance.

Definitions

The meaning of two terms “Date of Acceptance” and “Date of Deemed Acceptance” are as follows:

Date of Acceptance

The term “Date of Acceptance” denotes two meanings that are as follows:

- The day of actual delivery or rendering of goods or services;

- In case an objection is raised by the buyer concerning the acceptance of goods and services within 15 days, starting from the date of delivery or rendering of goods or services, then the day on which the supplier removes such an objection will be the Date of Acceptance.

Date of Deemed Acceptance

The term “Date of Deemed Acceptance” denotes the day of actual delivery or rendering of goods or services, where no objection has been raised by the buyer concerning the acceptance of goods and services within 15 days, starting from the date of delivery or rendering of goods or services.

Exemption from Filing the Form

The companies exempted from filing the Form MSME-1 are as follows:

- The provisions regarding this form will not apply to the companies who do not satisfy the eligibility criteria to fill MSME-1;

- In case the payment against the supplier exceeds the period of 45 days, but the said supplier or creditor submits a declaration that they do not fall under the criteria of MSMEs (Micro Small and Medium Enterprises);

Objective of MSME Form 1

The main reason for the implementation of MSME Form 1 was to assist the MSMEs, which have been remained unpaid by the large ventures. Earlier, there were many companies that used to acquire goods and services from the MSME sector but tend to delay in making payment, which in result, made MSMEs suffer massive losses.

Moreover, by way of this form, the companies now need to disclose the amount due from their side, together with the reason for the delay.

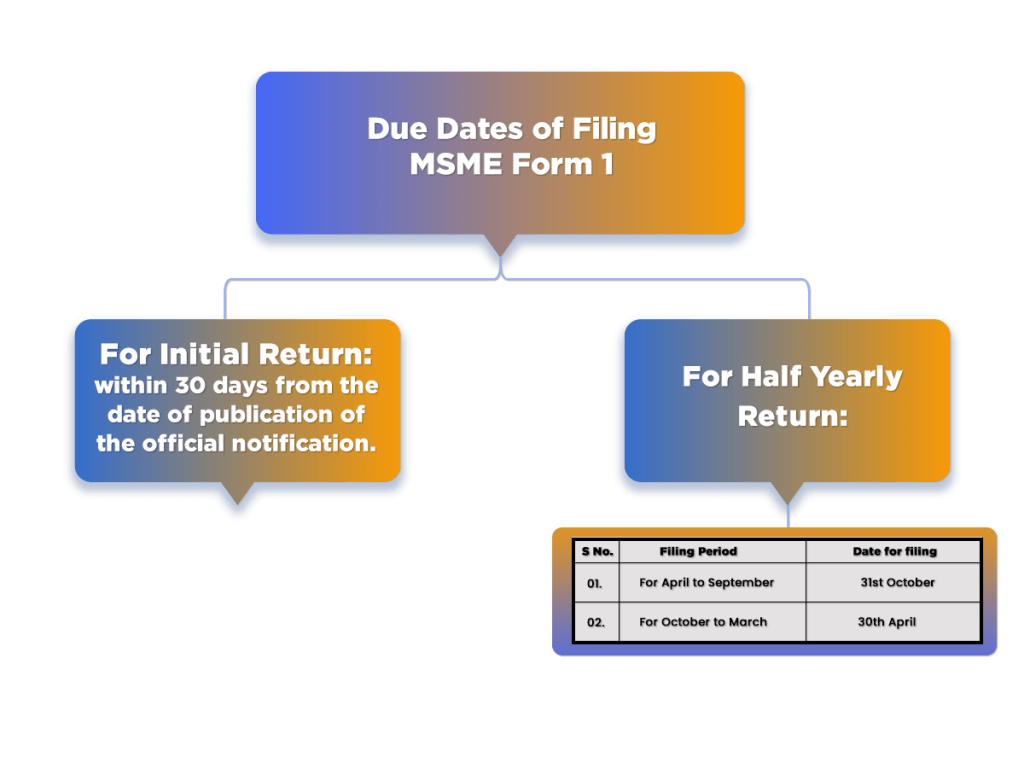

Due Dates of Filing MSME Form 1

The Due Dates for filing Form MSME-1 are as follows:

For Initial Return

As per the notification issued by the Government, every specified company having an outstanding payment to MSMEs, need to file a return in Form MSME-1, within 30 days from the date of publication of the official notification.

For Half Yearly Return

The due dates for filing MSME-1 as Half-yearly Return are s follows:

| S No. | Filing Period | Date for filing |

| 1. | For April to September | 31st October |

| 2. | For October to March | 30th April |

Details to be Furnished in Form MSME-1

The details to be furnished in MSME Form 1 are as follows:

- Name of the Supplier;

- PAN Card details of the Supplier;

- Outstanding Amount against the Supplies of Goods and Services;

- Date from which the Amount is Outstanding;

- Reasons for Delay in Making Payment of the Amount Due;

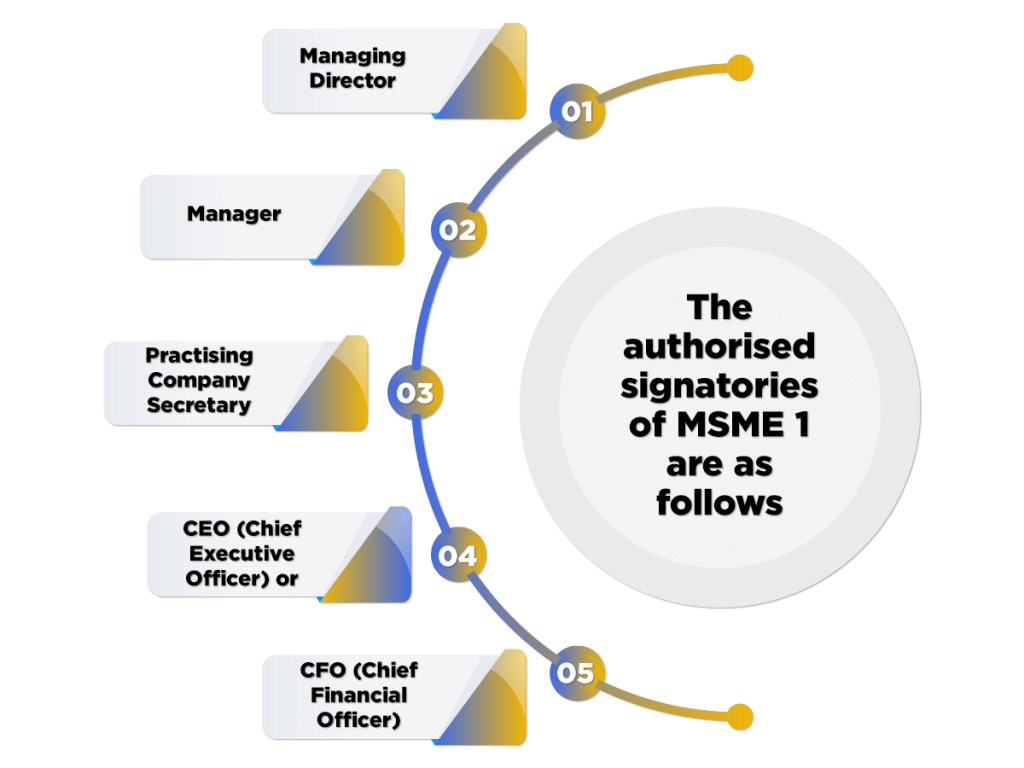

Authorised Signatories of MSME 1

The authorised signatories of MSME 1 are as follows:

- Managing Director;

- Manager;

- Practicing Company Secretary;

- CEO (Chief Executive Officer); or

- CFO (Chief Financial Officer);

Procedure for Filing Form MSME-1

The steps included in the procedure for filing MSME 1 are as follows:

Download E-Form

In the first step, the applicant needs to download the E-form and select whether he/she is filing an Initial Return or Half-Yearly Return.

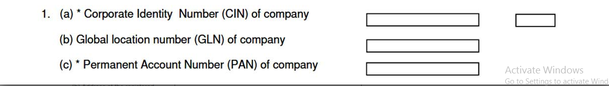

Fill Company Details

Now, the applicant needs to enter company details, such as the following:

- CIN (Corporate Identity Number);

- Global Location Number;

- PAN Card Number of the Company;

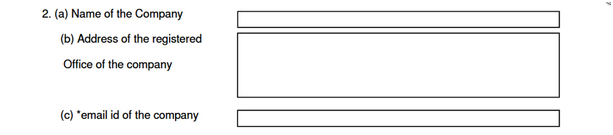

Enter Basic Details

In this step, the applicant requires to enter basic details, such as the following:

- Name of the Company;

- Address of the Registered Office; and

- Email ID of the Company

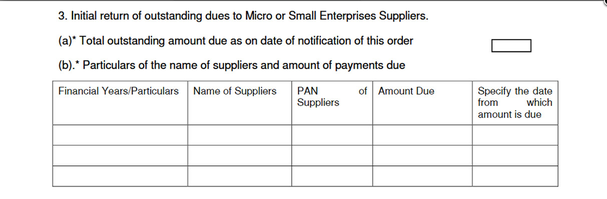

Details for Initial Return

In this step, the applicant needs to enter details of the amount due to the MSMEs, such as the following:

- Total Amount Outstanding as on the Date of Notification;

- Details of the Financial Year (“From” and “To”);

- Name of Suppliers;

- PAN Card details of Suppliers;

- Amount Outstanding;

- Specific Date from Which the Amount is Outstanding;

Details for Half-yearly Return

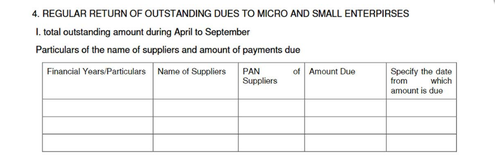

This return is also known as “Regular Return”. Further, the details required for this section are as follows:

Amount Outstanding From April to September

- Details of the Financial Year (“From” and “To”);

- Name of Suppliers;

- PAN Card details of Suppliers;

- Amount Outstanding;

- Specific Date from Which the Amount is Outstanding;

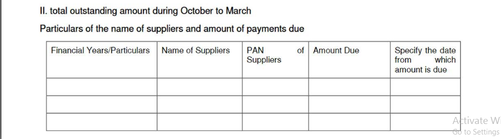

Amount Outstanding From October to March

- Details of the Financial Year (“From” and “To”);

- Name of Suppliers;

- PAN Card details of Suppliers;

- Amount Outstanding;

- Specific Date from Which the Amount is Outstanding;

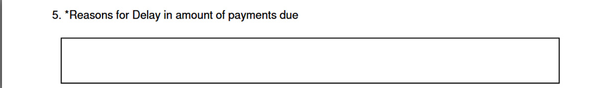

Reasons for the Delay

In this section, the applicant needs to specify the reason behind the delay caused in making payment outstanding.

Any Other Attachment

In case the applicant has any other particular which he/she wants to get validated, then they need to attach the said particulars in this part of the form.

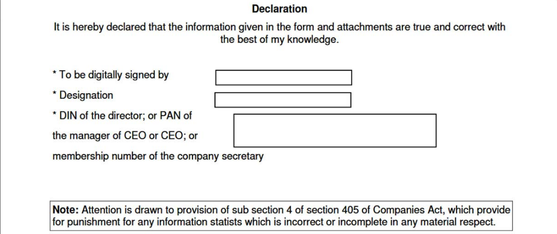

Declaration

Now, this section requires the applicant to accept that all the information and details given in the form of attachments are true and correct with the best of his/her knowledge. The details asked in this section are as follows:

- Name of the Person Signing Digitally;

- Designation;

- DIN (Director Identification Number) of director/ PAN (Permanent Account Number) of the Manager of CEO/ PAN of the CEO/ or Membership Number of the Practising Company Secretary.

Submit

Lastly, the applicant will have 4 options available, i.e., Modify/ Pre scrutiny/ Check Form/ and Submit. If the said applicant is well satisfied will all the details filed, then he/she just needs to click on the option “Submit”.

Penalties for Non-Filing of Form MSME-1

In case a company fails to file Form MSME-1 within 30 days or intentionally furnishes any information which is incomplete or incorrect in any material aspect, then the said company will be held liable to a fine up to Rs 25000.

Moreover, every officer of such defaulter company will either liable to imprisonment for a term up to 6 months or with a fine of a minimum Rs 25000 and a maximum Rs 300000, or both.

Conclusion

In India, the introduction of Form MSME-1 is another robust initiative started by the government. In this initiative, the government has prescribed mandatory filing of a return twice a year by the corporate clients, which, in result, will strengthen and boost the MSME sector.

Further, these corporate clients need to first determine whether their suppliers are registered under the MSMED Act 2006 or not. In case they are registered, and the payments are outstanding for more than 45 days, starting from the date of acceptance of the goods or services, then the enterprise will need to compulsorily file Form MSME-1.

Also, Read: Udyog Aadhar Registration Fees and Process: A Complete Guide