IEC Certificate: How to Apply and Print Certificate?

Shivani Jain | Updated: Aug 20, 2020 | Category: IEC

The term “IEC Certificate” denotes proof of IEC Registration. It is a mandatory prerequisite for every Commercial Importer and Exporter operating in India. This certificate contains a 10 digit unique identification number and is issued by the DGFT (Director General of Foreign Trade), MoC&I (Ministry of Commerce and Industries), GOI (Government of India).

Further, an IEC code has lifetime validity. That means there is no need for the registration holder to get it renewed after expiry.

In this blog, we will discuss the concept of the IEC Certificate and the Procedure to apply and download it online.

Table of Contents

Latest Update on IEC Certificate

The Ministry of Commerce and Industry, together with DGFT, decided to launch a digital platform for the issuance of Import Export Code. This online platform is made in phases, and the first phase went live from 13.07.2020.

Further, this digital platform is made in consonance to the “Digital India Programme” and aims to promote the Ease of Doing Business.

Furthermore, the other remaining phases of this platform are as following:

- Advance Authorisation;

- EPCG (Export Promotion of Capital Goods);

- Export Obligation Discharge

Through this platform, the process of IEC Applications and Modification had been suspended with effect from 13.07.2020.

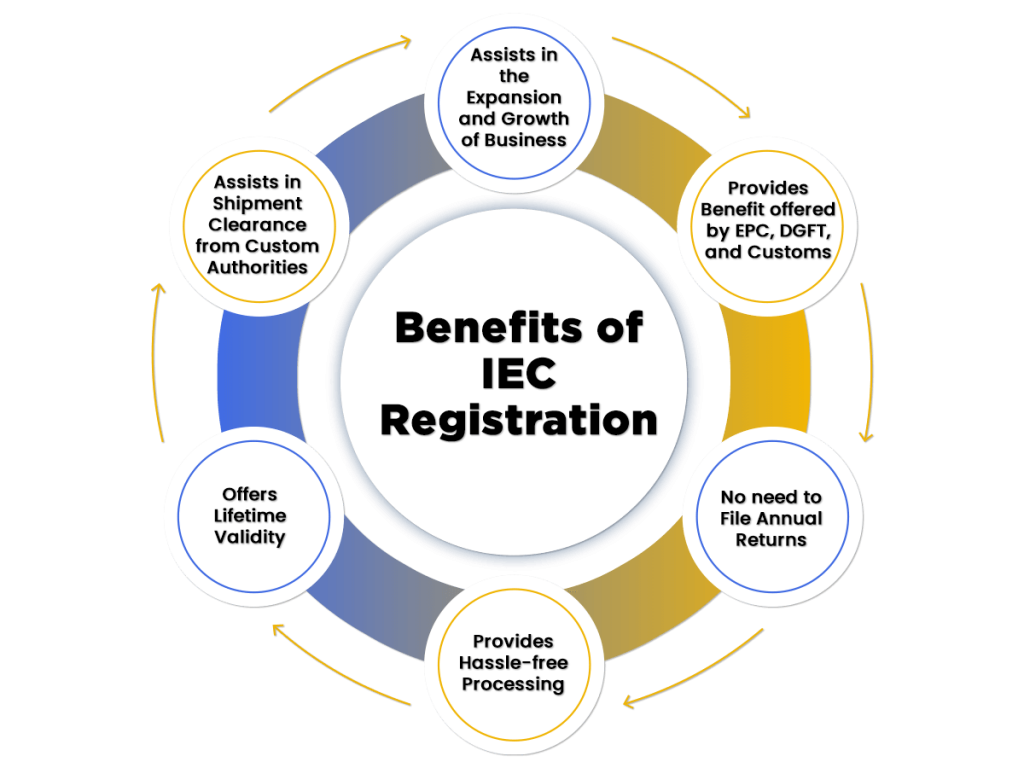

Benefits of IEC Registration

The benefits of IEC Registration are as follows:

- Assists in the Expansion and Growth of Business;

- Provides Benefit offered by EPC, DGFT, and Customs;

- No need to File Annual Returns;

- Provides Hassle-free Processing;

- Offers Lifetime Validity;

- Assists in Shipment Clearance from Custom Authorities;

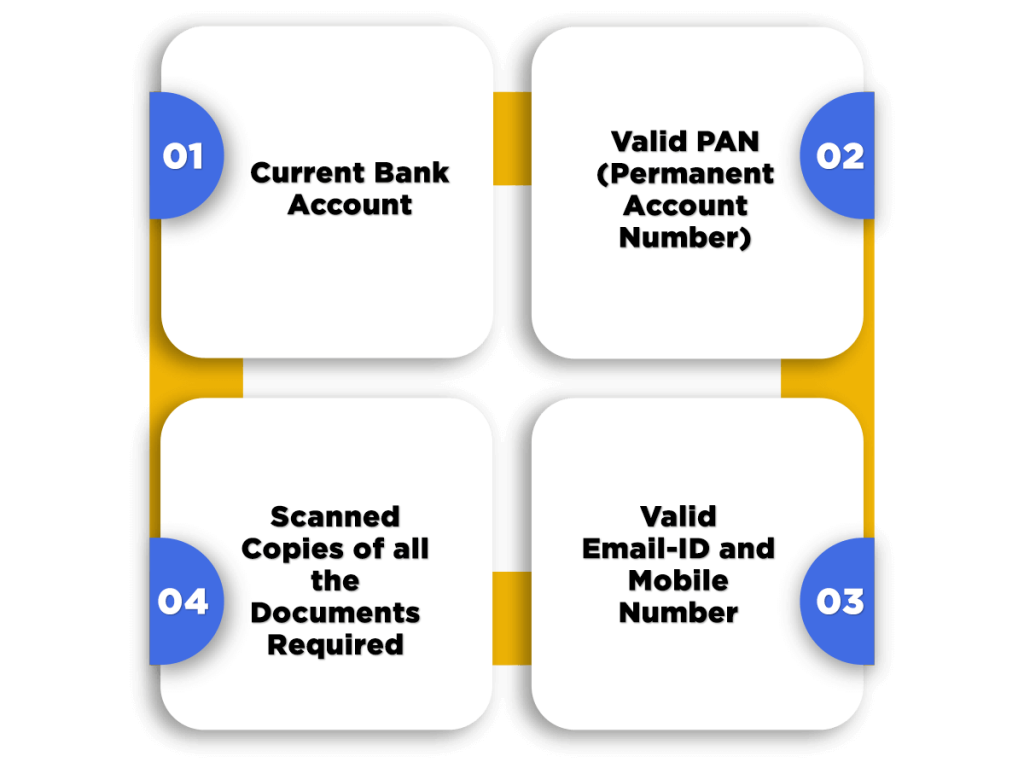

Minimum Requirements for IEC Certificate

The minimum requirements for obtaining IEC Code in India are as follows:

- Current Bank Account;

- Valid PAN (Permanent Account Number);

- Valid Email-ID and Mobile Number;

- Scanned Copies of all the Documents Required;

Documents Needed for IEC Registration

The documents needed for IEC Certificate are as follows:

In the case of Sole Proprietorship Firm

The documents required from a Sole Proprietorship Firm are as follows:

- (3*3) Digital Photograph of the Sole Proprietor;

- PAN Card details;

- A copy of the Sole Proprietor’s Voter ID, Passport, UID, and Driving License;

- In the case of Self-owned Business, a copy of the Sale Deed;

- In the case of Rented Business, a copy of Rent or Lease Deed;

In the case of Partnership Firm

The documents required from a Partnership Firm are as follows:

- (3*3) Digital Photograph of the Managing Partner;

- A copy of the Partnership Agreement or Deed;

- PAN Card details of the Managing Partner;

- A copy of the Managing Partner’s Voter ID, Passport, UID, and Driving License;

- In the case of Self-owned Business, a copy of the Sale Deed;

- In the case of Rented Business, a copy of Rent or Lease Deed;

- Bank Certificate or Cancelled Cheque according to form ANF 2A. The cheque must contain the name and account number of the applicant entity;

In the case of Limited Liability Partnership

The documents required from a Limited Liability Partnership are as follows:

- (3*3) Digital Photograph of the Designated Partner;

- A copy of the Limited Liability Partnership Agreement or LLP Agreement;

- PAN Card details of the Designated Partner;

- A copy of the Designated Partner’s Voter ID, Passport, UID, and Driving License;

- In the case of Self-owned Business, a copy of the Sale Deed;

- In the case of Rented Business, a copy of Rent or Lease Deed;

- Bank Certificate or Cancelled Cheque according to form ANF 2A. The cheque must contain the name and account number of the applicant entity;

In the case of Company

The documents required from a Private Limited Company are as follows:

- (3*3) Digital Photograph of the Managing Director;

- PAN Card details;

- A copy of the Director’s Voter ID, Passport, UID, and Driving License;

- In the case of Self-owned Business, a copy of the Sale Deed;

- In the case of Rented Business, a copy of Rent or Lease Deed;

- Bank Certificate or Cancelled Cheque according to form ANF 2A. The cheque must contain the name and account number of the applicant entity;

In the case of Trust

The documents required from a Trust registration are as follows:

- (3*3) Digital Photograph of the Signatory (Chief Executive or Managing Trustee);

- Society’s COR (Certificate of Registration);

- A copy of the Trust Deed;

- A copy of the Signatory’s (Chief Executive or Managing Trustee) Voter ID, Passport, UID, and Driving License;

- In the case of Self-owned Business, a copy of the Sale Deed;

- In the case of Rented Business, a copy of Rent or Lease Deed;

- Bank Certificate or Cancelled Cheque according to form ANF 2A. The cheque must contain the name and account number of the applicant entity;

In the case of HUF (Hindu Undivided Family)

The documents required from an HUF (Hindu Undivided Family) are as follows:

- (3*3) Digital Photograph of the Karta;

- PAN Card details;

- A copy of the Karta’s Voter ID, Passport, UID, and Driving License;

- In the case of Self-owned Business, a copy of the Sale Deed;

- In the case of Rented Business, a copy of Rent or Lease Deed;

- Bank Certificate or Cancelled Cheque according to form ANF 2A. The cheque must contain the name and account number of the HUF;

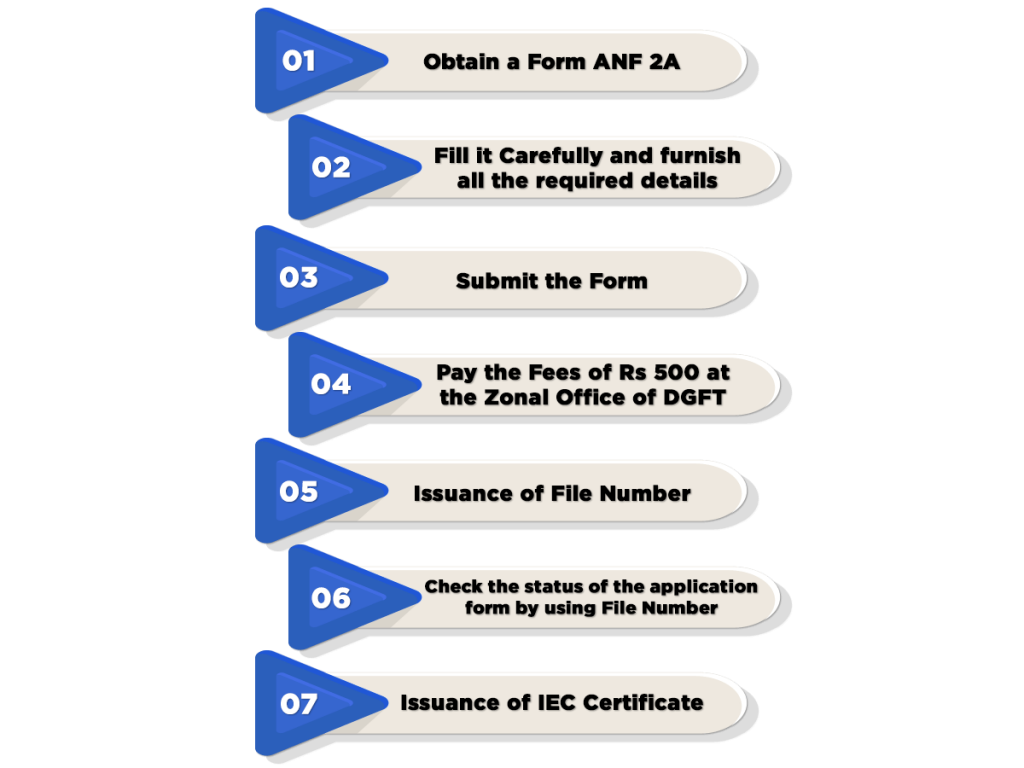

Offline Process to Obtain IEC Certificate

The steps included in the offline process to obtain IEC Certificate are as follows:

- Obtain a Form ANF 2A;

- Fill it Carefully and furnish all the required details;

- Submit the Form;

- Pay the Fees of Rs 500 at the Zonal Office of DGFT (same can be sent by a registered post as well);

- Issuance of File Number;

- Use the File Number to check the status of the application form on the official DGFT Portal;

- Issuance of IEC Certificate normally takes 1 to 2 weeks time.

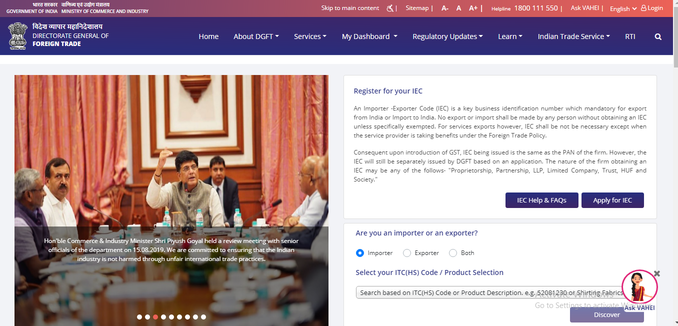

Online Process to Obtain IEC Certificate

The steps included in the online process to obtain IEC Certificate are as follows:

Visit the Official Portal

In the first step, the applicant needs to visit the Official DGFT Portal[1]. After that, click on the option saying “Apply for IEC”;

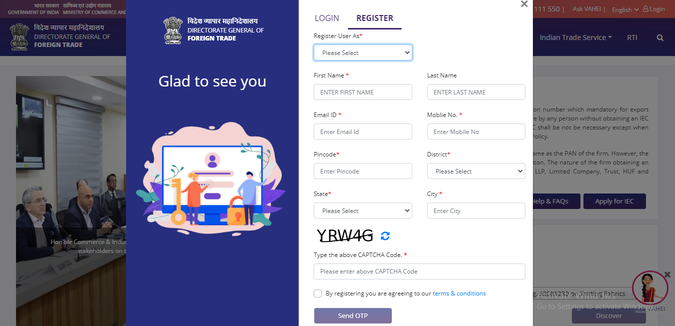

Enter the Required Details

Now, the applicant needs to provide the required details. The term “Required Details” include the following:

- Register User as “Exporter” or “Importer”;

- First Name;

- Last Name;

- Email Id of the Applicant;

- Registered Mobile Number of the Applicant;

- Pincode;

- District Name;

- City Name; and

- State Name;

After entering the required details, click on “Send OTP”. The applicant will receive an OTP (One Time Password) will be sent to the registered number and Email.

After successful verification of the OTP given, the applicant will receive a temporary password on his/her registered mail, which he/she needs to change after the first login.

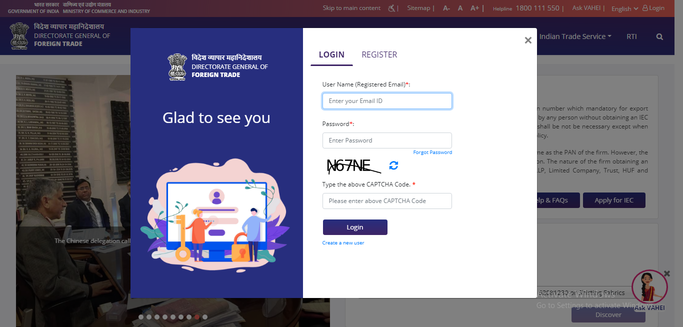

Enter Login Credentials

In this step, the applicant needs to go back to the home page and select the option “Apply for IEC”. After selecting the option, the applicant requires to enter his/her login credentials by clicking on “Login”.

Fill IEC Registration Form

After entering the Login Credentials, the applicant needs to select the option “Start Fresh Application” and provide the required details. The term “required details” include General, Specific, Bank, and Other Details.

Enter General Information

Details required for the General Section are as follows:

- Name of Concern;

- Name of the Firm;

- PAN (Permanent Account Number) Card details of the Entity;

- Name as per PAN Card;

- Incorporation Date or DOB (Date of Birth) of the Entity;

- Choose the category from the following:

- Merchant Exporter;

- Manufacturer Exporter;

- Merchant cum Manufacturer Exporter;

- Service Provider; or

- Any other category;

- Choose whether the firm belongs to SEZ (Special Economic Zone) or not

- Select whether the concerned firm is located in any of the following schemes:

- EOU (Export Oriented Unit) Scheme;

- EHTP (Electronic Hardware Technology Park) Scheme;

- STP (Software Technology Park) Scheme;

- BTP (Bio-Technology Park) Scheme;

- In the case of LLP or Company, enter the LLPIN (Limited Liability Partnership Identification Number)/ CIN (Company Identification Number);

- Enter GST (Goods and Services Tax) No;

- Provide the Mail and Mobile Number for correspondence purpose;

- Upload the Proof of Establishment/ COR (Certificate of Registration) of the concerned entity. This document is mandatory in case of the following:

- Partnership Firm;

- Registered Society;

- Hindu Undivided Family;

- Trust; and

- Any other;

- Enter the Address for the Registered Office of the Firm;

- Upload the Proof for the Registered Office. The proof can include any of the following:

- Sale Deed;

- Rent Agreement;

- Electricity Bill;

- Lease Deed;

- Telephone Landline Bill;

- Mobile Postpaid Bill;

- MOU (Memorandum of Understanding);

- The documents acceptable only in case of a Sole Proprietorship Firm are as follows:

- Aadhar Card;

- Voter ID;

- Passport;

- In case the registered office is not in the name of the applicant, then he/she needs to obtain a NOC (No Objection Certificate) from the owner of the premises;

After providing all the details, click on the option “Save and Next” button.

Enter Specific Information

This section includes specific information of the Sole Proprietor/ Director/ Partner/ Managing Trustee/Karta. The information required under this section are as follows:

- Name mentioned on the PAN Card;

- PAN (Permanent Account Number) of the person, i.e., Sole Proprietor/ Director/ Partner/ Managing Trustee/ Karta;

- DOB (Date of Birth) as per PAN Card;

- Address of the Sole Proprietor/ Director/ Partner/ Managing Trustee/ Karta;

- Mobile Number of the Sole Proprietor/ Director/ Partner/ Managing Trustee/ Karta;

Now, after submitting the information required, click again on the “Save and Next” button.

Enter Bank Details

This section requires the information as following:

- IFSC Code;

- Account Number;

- Name of the Account Holder;

- Bank Name;

- Branch Name;

The applicant also needs to upload either the Cancelled Cheque of the respective bank account or bank certificate as per specified Performa.

Now, after submitting the information required, click again on the “Save and Next” button.

Enter Other Details

In this section, the applicant needs to choose the preferred sectors of operation from the options given.

Now, after choosing the preferred sectors, click again on the “Save and Next” button.

Accept the Declaration

Now, the applicant needs to check the box saying “Declaration” and fill the place. After that, he/she requires to press the “Save and Next” button.

Final Submission

In the next step, the applicant will be redirected to a page wherein he/she needs to select the option “Sign” placed at the bottom of the page.

Mode of Submission

There are two ways through which an applicant can submit or sign his/her registration form, i.e., Aadhar OTP or DSC (Digital Signature Certificate). In the case of Aadhar OTP, the applicant will need to enter Aadhar Number or Virtual ID and then submit the form.

Payment of Registration Fee

After successfully signing the E-registration form, the applicant needs to click on the option saying “Confirm and Proceed to Make Payment”.

For making payment, the concerned applicant will be re-directed to the Payment Gateway known as “Bharatkosh”. Further, the application fee for the IEC Certificate is Rs 500.

Display of Receipt

After successful payment, the applicant will be redirected back to the official DGFT (Director General of Foreign Trade) portal, wherein the payment receipt will be displayed on the screen. The applicant can now download the receipt.

How to Print IEC Certificate

Normally, the applicant will receive a copy of the IEC Certificate on his/her registered email address. However, he/she can download the same from the official portal as well.

The steps included in the procedure for IEC Print are as follows:

- Visit the Official Website;

- Login to the Account;

- Go to “Manage IEC”; and

- Select “Print IEC Certificate”;

Conclusion

It is quite obvious that if anybody who intends to start the business at a global level, then he/she must obtain the IEC from the DGFT. IEC full form is Import Export Code. Without an IEC License, you cannot carry on the business operations of import and export in any condition.

Therefore, we advise you to hire a professional who has good prior experience over providing IEC License. At Swarit Advisors, we have a team of experts who rank high in providing clients with on-time registration and the fastest service ever.

Read, Also:Documents Required for IEC Code for Partnership Firm