Income Tax Exemption through 12A Registration Online in India

Khushboo Priya | Updated: Aug 20, 2019 | Category: NGO

12A Registration is imperative for all kinds of NGOs- whether Trust, Society, or Section 8 Company. Usually, companies register themselves under Section 12A of the Income Tax Act to avail the income tax exemption.

Therefore, NGOs registered under Section 12A relish the tax exemption on their surplus income completely. Hence, it’s substantial for every NGO and Trust to be aware of the registration under Section 12A.

Furthermore, they must ensure that they obtain the registration soon after the incorporation. So, to help you to understand every significant aspect of 12A registration completely, we have discussed Section 12A in-depth.

Table of Contents

What is 12A Registration?

Under Section 12A of the Income Tax Act, 1961, all the NGOs such as Section 8 Company, Trusts, and Societies obtain registrations to exempt themselves from paying Income Tax. Such registration is known as 12A Registration.

It is the foremost step after the NGO incorporation that one must obtain from the Income Tax Department. After registration, you receive a 12A certificate which helps you acquire permission from the government as well as organization abroad.

Besides, a 12A certificate serves as a legitimate proof to demonstrate the existence of your NGO. Therefore, if you’re an NGO and haven’t obtained the respective registration, get it soon to enjoy the benefits it offers.

Who should acquire registration under Section 12A of the Income Tax Act?

Every Non-Governmental Organization namely-

- Trust Registration.

- Society.

- Section 8 Company.

are required to obtain 12 Registration under the Income Tax Act, 1961.

Eligibility for obtaining 12A Registration in India

For obtaining a 12A certificate in India, the applicant must satisfy the following criteria:

- Under existing rules, only NGOs that are formed with an aim to offer benefits to the public such as Religious Trusts, Charitable Trusts, Welfare Societies, etc. may apply for 12A registration.

- Any private or family trust can’t apply for registration under Section 12A.

Documents required for obtaining 12A Registration in India

According to Income Tax Rules, 1962, any Trust or NGO that wishes to register under Section 12A must submit the following documents to the Income Tax Department:

- Form 10A: It’s an application for registration of a charitable or religious trust or institution under clause (aa) or clause (ab) of sub-section 12A of the Income Tax Act, 1961;

- Copy of the documents that must be certified and acts as evidence of modification or adoption of the objects, if any;

- Additionally, a certified copy of the document that serves as evidence of the establishment of the institution or creation of the trust, if applicable;

- A certified copy of the instrument under which the institution or trust was established or created, if applicable;

- A certified copy of the registration with Registrar of Firms (RoC) & Societies or Registrar of Public Trusts, whichever applicable;

- Certified copy of the annual reports of the trust/institution for a maximum three immediately preceding financial years, if applicable;

- Note on activities;

- Certified copy of existing order granting registration under Section 12A or Section 12AA, if any;

- Furthermore, a certified copy of the order of rejection of application for grant of registration under Section 12A or Section 12AA, if any;

- Any other (Please Specify).

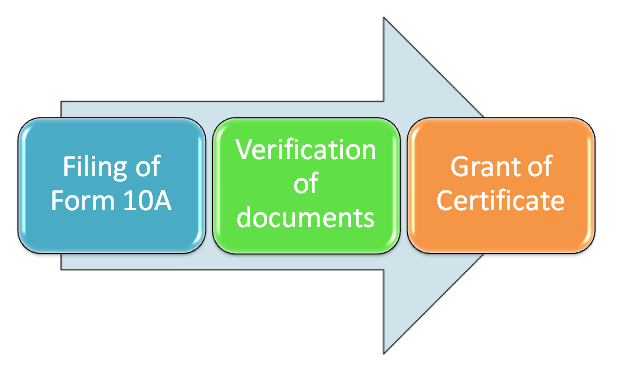

Steps for obtaining 12A Registration Online

The applicant can obtain a 12A certificate by following the steps as described below:

Step 1: Filing Form 10A

According to Rule 17A of the Income Tax Act, 1961, the applicant NGO requires filing Form 10A with the Jurisdictional Commissioner of the IT (Income Tax) Department.

Step 2: Verification of the documents

Secondly, the Commissioner will scrutinize the application form along with the documents attached. Furthermore, he will ensure that the information furnished is authentic. If something isn’t there, the Commissioner will demand additional documents.

Step 3: Issuance of Certificate of 12A registration

If the Commissioner is contented with the report, he will grant the Certificate of 12A registration. However, if your documents are incomplete and aren’t much relevant, then the Commissioner holds the power to reject the application.

Benefits of registering your NGO under Section 12A

Such registrations offer several advantages to its applicants. Here are some of the benefits of 12A registration:

- If anybody applies income for the religious or charitable purpose, it will be deemed as an application of income. It implies that the expenditure incurred for the religious or charitable purpose will be allowed while calculating the income of the trust.

- The advantage of accruing or setting aside income not surpassing 15% for the religious or charitable purpose would be present.

- NGOs with such registrations receive several grants from the government and other agencies. They are worthy of receiving financial funding and grants from a number of agencies. Mostly, such agencies make grants to NGOs registered as 12A.

- Moreover, the accumulation of income must not be involved in the total income.

- Easy to obtain FCRA registration for NGOs seeking foreign contributions.

- Besides, it’s a one-time registration and doesn’t require any renewal. It works well until the cancellation of registration. Hence, the applicant enjoys the benefits for a lifetime.

12A Registration- Income Tax Exemption for NGOs

Hence, being an NGO or Trust, if you wish to get an income tax exemption, then you must register your NGO under Section 12A. Apart from tax benefits, it has got several other advantages to offer you. Hence, if you are going to incorporate an NGO, then get the registration done as soon as after the incorporation process.

Even if you are a registered NGO but haven’t registered under Section 12A, then you must register it and savour the advantages. In case of any doubts, please leave a comment below. We will get back to you sooner.

Also, Read: How to check Society Registration online?.