NSIC Schemes: A Complete Guide on the Schemes Offered

Shivani Jain | Updated: Aug 27, 2020 | Category: NSIC

The term “NSIC Schemes” denotes the various schemes offered by NSIC to uplift the MSME sector of India. These schemes include SPRS, ASPIRE, etc. However, the MSMEs registered under NSIC are only eligible to avail of the privileges offered by these schemes.

Further, the term “NSIC Registration” denotes a registration under a Mini Ratna Public Sector Unit (PSU) that aims to uplift the MSME sector of India. This PSU falls under the ambit of MoIT (Ministry of Information and Technology)[1]

Furthermore, NSIC stands for National Small Industries Corporation. It acts as an intermediary for the MSME Industry and bridges there need with various development schemes, such as Single Point Registration Scheme, Performance and Credit Rating Scheme, etc.

In this blog, we will thoroughly discuss the concept of NSIC Schemes, together with the process of registration.

Table of Contents

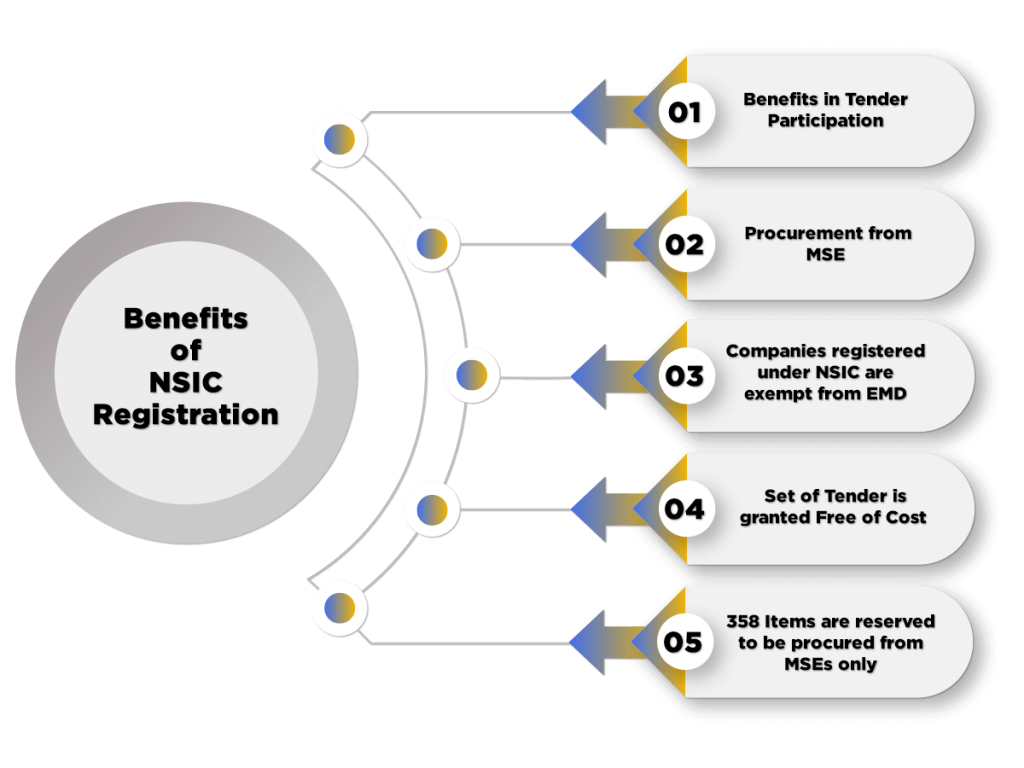

Benefits of NSIC Registration

The benefits of registration under NSIC Schemes are as follows:

- Benefits in Tender Participation;

- Procurement from MSE (Micro and Small Enterprises);

- Companies registered under NSIC are exempt from EMD (Earnest Money Requirement);

- Set of Tender is granted Free of Cost;

- 358 Items are reserved to be procured from MSEs (Micro and Small Enterprises) only;

Who Needs to Obtain Registration under NSIC?

The entities eligible to obtain registration under NSIC are as follows:

- Any MSME (Micro Small and Medium Enterprise) with a valid Udyog Aadhar MSME Registration;

- The MSMEs that have started their production but are not having the Audited Balance Sheet for the last year are eligible for NSIC Registration with one year validity.

Different Types of NSIC Schemes

The different types of NSIC schemes are as follows:

Single Point Registration Scheme

The aim behind the implementation of this scheme was to increase the level of government purchases from SSIs (Small Scale Industries). Further, the MSMEs that are registered under this scheme are exempted from the Earnest Money Deposit (EMD) in government purchases. Also, this scheme was launched in the year 1955-1956.

Performance and Credit Rating Scheme

PCRS aims at building trusted and Independent Third-party Opinions regarding the Credit-worthiness and Competence of Micro and Small Enterprises (MSEs).

Further, this scheme makes the credit available at low-interest rates and ensures better productivity as well. Moreover, the Ministry of SSI (Small Scale Enterprises) reimburses the fee charges by the CRA (Credit Rating Agency) as per the Annual Turnover of the MSEs.

Bill Discounting Scheme

Under this scheme, all the bills generated out of the genuine trade transactions, i.e., supplies of goods made by MSMEs to well-known State and Central Government Departments; Private and Public Limited Company; and Undertakings engaged in Manufacturing or Service Activities. However, it will be significant to note that Traders are not included under this scheme.

Raw Material Assistance Scheme

This NSIC schemes aims to provide support to the MSME industry by financing their Raw Material Purchase for both Imported and Indigenous Products.

It also offers an opportunity for MSMEs to emphasis on manufacturing or producing quality products.

MSME Global Mart

This specific scheme is a B2B (Business to Business) portal. It was started with the motive to offer technology, business, and financial assistance to MSMEs at affordable rates.

Further, it shall be relevant to note that the enterprises having Annual Membership can only benefit from this scheme.

Skill and Development

All the MSMEs that are registered under NSIC are offered various level skill development training and technical support. These skill development trainings are provided at the NSIC Technical Services Centres (NTSC).

Besides this, it has several LBIs (Livelihood Incubation Centres), and Training Incubations stretched across the country.

Consortia and Tender Marketing Scheme

The only aim of this scheme is to promote the products manufactured and produced by the MSMEs. Further, these products or goods can be promoted either individually or collectively by way of “Consortium”.

Marketing Intelligence Services

This scheme aims to promote the business growth of the Indian MSME sector by way of the Marketing Intelligence Web Portal.

This portal gathers and analyzes the data to determine the prospective customer; current and future preferences and needs; attitudes and behavior of the market.

Moreover, the vision of the government through MIS (Marketing Intelligence Scheme) is to evaluate the changes going in the market and find opportunities and threats in the future market as well.

ASPIRE Scheme

The main reason for implementing this scheme is to provide the required set of skills for setting-up business enterprises in India. It also aims to facilitate market linkages available to the budding entrepreneurs. Lastly, for ensuring self-sustainability, it offers hand holding for a critical time as well.

Further, the main objectives of this NSIC scheme are as follows:

- Provide New Jobs;

- Minimize Unemployment;

- Promote Entrepreneurship Culture in India;

- Aims at grassroots economic development;

- Offer Innovative Business Ideas for ignored social needs;

- Promote innovation to strengthen and boost the competitiveness of MSME Industry;

Further, there are various other schemes offered by NSIC, such as MSME Databank; National Scheduled Caste and Scheduled Tribe Hub; and Conduction Exhibitions for boosting the marginalized and backward sections and SSIs associated in India.

Documents for NSIC Registration

The documents required for NSIC Registration are as follows:

- Udyog Aadhar Memorandum (UAM) Number;

- Date of Purchase; Rate of Depreciation Charged; and Value of Asset of the Plant and Machinery installed;

- COI (Certificate of Incorporation);

- In the case of Partnership Firm, Form A issued by the Registrar of Firms;

- In the case of Limited Liability Partnership, a copy of LLP Agreement;

- A copy of MOA and AOA;

- For Ownership Proof, self-attested documents;

- Declaration from all the directors concerning the no-connection with any large scale unit;

- Bank Report showcasing the Financial Health of the Applicant;

- List of Finished Goods, In-process Goods; and Raw Materials;

- PAN Card of the Company;

- Preceding year Audited Balance Sheet;

- BIS License;

- ISO 9000;

- Details concerning the installation of Quality Control Machinery in the Factory;

- Details concerning Manpower and Technicians employed;

- Copy of Utility Bills, such as Electricity Bill, Water Tax Receipt;

Process for Obtaining NSIC Registration

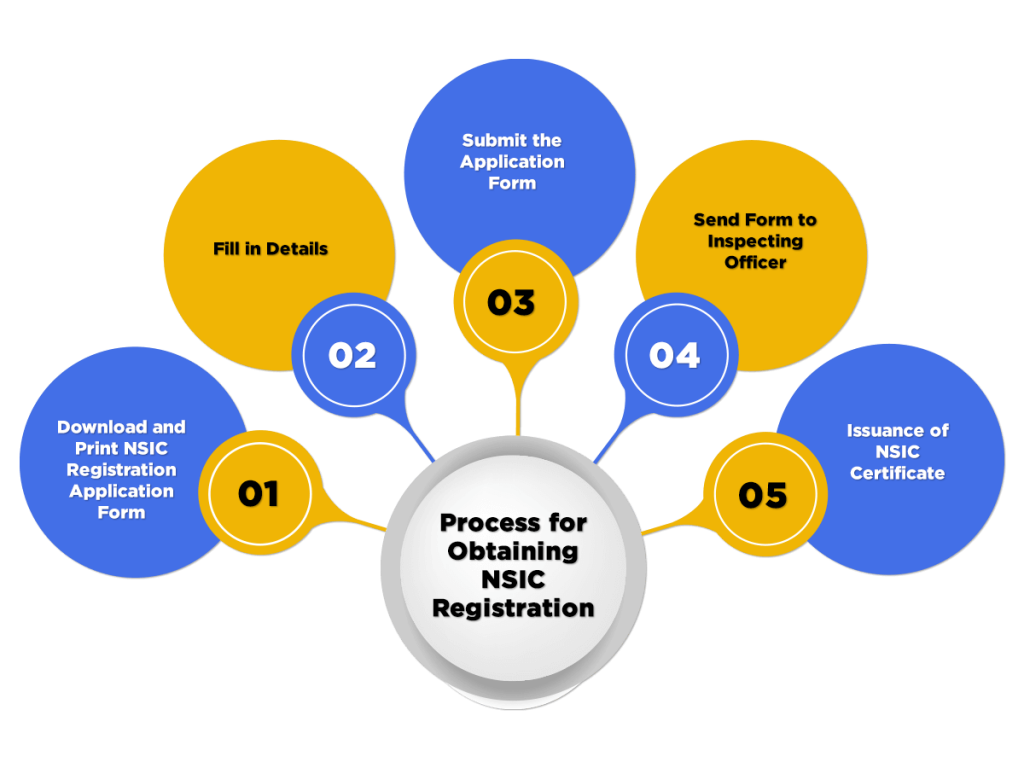

The steps involved in the Procedure for NSIC Registration are as follows:

Download and Print NSIC Registration Application Form

In the first step, the applicant needs to download and print the registration form for NSIC.

Fill in Details

Now, the applicant needs to fill in all the details asked in the form of NSIC Registration.

Submit the Application Form

In the next step, the small and medium enterprises need to submit the filled application form to the Branch or Zonal Extension office of NSIC. Further, the form should be filed with the prescribed Registration Fees.

Send Form to Inspecting Officer

Now, the applicant needs to send the said application to the inspecting officer, together with the duplicates of all the required documents. He/she is also required to send the imperative proof of the Pay Order of Investigation Charges. Further, these documents assist the inspection agency in conducting its Technical Inspection on MSEs.

Issuance of NSIC Certificate

After obtaining a Positive Report from the Inspection Agency, the NSIC will issue a certificate of GP to MSME.

Validity of NSIC Registration

A Registration under any of the NSIC Schemes remains valid for a period of 2 years. Therefore, the applicant needs to get it renewed in every 2 years. Further, the main reason for renewal is to check the CTC (Commercial and Technical Competence of MSME.

Also, a Provisional NSIC Registration Certificate has a validity of 1 year.

Conclusion

At last, we can say that only the MSMEs registered under the NSIC are eligible to avail of the benefits of the NSIC schemes. Further, the main aim of these schemes is to uplift the backward section of the society and MSME, and to promote their goods and services.

Read, Also: Procedure, Fees and and definition of NSIC Registration.