What is the Process of Acquiring an NBFC? Types of NBFC Takeover

Dashmeet Kaur | Updated: Jan 03, 2020 | Category: NBFC, RBI Advisory

NBFCs have played a vital part in strengthening the economy of India. It refers to a Non-Banking Financial Company that commences financial activities without procuring a license for the same. The Reserve Bank of India (RBI) regulates the operations of NBFCs to stabilize their functionality. Since NBFC registration is a multi-facet process wherein business aspirants have to meet several RBI guidelines. Thereby often Entrepreneurs choose to take over an already existing NBFC than clenching on registration. If you also seek to acquire an NBFC, then this blog will provide an extensive guide to its procedure. Further, it will also usher about the types of NBFC takeover.

Table of Contents

Emergence of NBFC Takeover in India

Lately, merger and takeover have left a mark in the corporate world. It has become a convenient source of business expansion in the short run. Considering the efficiency of the takeover process, RBI emphasizes the incorporation of takeover in NBFCs.

NBFC takeover proves to be a ray of hope for all those companies who fail to register an NBFC of their own. It implies to the purchase of a well-established NBFC by another company. In such a case, the buyer company is the acquirer while the other is the target company. As per the RBI, only that NBFC can undertake the procedure of NBFC takeover which got registered under the Companies Act, 2013.

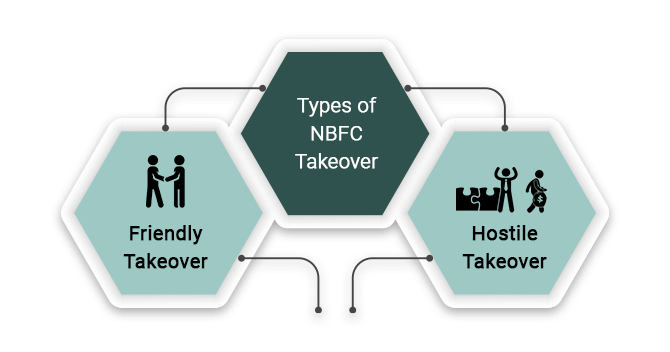

What are the Types of NBFC Takeover?

There are two ways of acquiring a target company which are as follows:

- Friendly Takeover: This form of takeover is based on the mutual consent of both the acquirer and target companies. During a friendly acquisition, an acquirer company simply offers the target company for being acquired, and the later willingly accepts its offer.

- Hostile Takeover: Under hostile takeover, an acquirer company tries to purchase the target company secretly. Generally, this type of NBFC takeover happens when the board of directors of a company shows resistant to accept the offer of the takeover.

Things to consider before taking over an NBFC

Before opting any type of NBFC takeover, consider these points in mind:

- Due Diligence: It is indispensable to conduct extensive research and do background verification before purchasing a company. Make a checklist of the aspects which need thorough analysis. Predetermine corporate goals before NBFC takeover and contemplate whether the target company will enable to meet that objective. An acquirer needs the information of capital structure, management skills and the financial status of the takeover company.

- Check the suitability: Prior sealing the dead and offering acquisition to any company, an acquirer must scrutinize the list of befitting candidates for takeover. During the process, a company will short-list that candidate who fits well to its business need and suffice the central objective of the acquirer.

- Reckon Financial Position: Irrespective of the friendly or hostile takeover, if you choose amidst these types of NBFC takeover, your company may have to face major repercussions in the long run. Therefore, carefully evaluate the financial stature of the company which you want to acquire. Estimate the maximum amount payable for takeover, cash flows and finalize the best mode to finance the takeover. As a target company will reject your offer below the market value of its share, so it’s better to evaluate the finances beforehand.

RBI Regulation for NBFC Takeover in India

There are numerous provisions that Reserve Bank of India has laid in the context of both types of NBFC takeover. Let’s take a look at the variant requirements that a company needs to meet while acquiring the target company.

A company needs to obtain prior approval from RBI in the following cases:

- A company requires RBI approval if there may or may not be a change in management after the acquisition.

- Secondly, it applies to a scenario in which any variance in the shareholding of an NBFC turns into 26% acquisition of the paid-up equity capital.

- Further, while taking over a listed NBFC, an acquirer must procure RBI approval.

- Get approval from RBI if the NBFC takeover tends to change management of about 30% of the number of directors.

A prior RBI approval is not needed in cases of:

- When shareholding of the company goes beyond 26% as an outcome of buyback of shares/ share reduction in the capital. It only implies after the approval of the competent court.

- In case, there is a change in management by 30%, comprising the Independent Directors or by the rotation of directors in Board.

Encoding the Procedure to acquire RBI Prior Approval

If you fall into the category of prior approval, then you must apply to the RBI to sanction the aforesaid approval. Entail these details in your application:

- Provide all the information of the Proposed shareholders/ directors;

- Also, give information about the sources of funds which your company’s proposed shareholders will utilize to acquire shares in an NBFC;

- Bankers’ Report for proposed shareholders/directors;

- A declaration which specifies non-association of your company with any other entity that has denied a Certificate of Registration by RBI.

- Further affix a statement, declaration, and affidavit of non-criminal background. As well as provide non-conviction proof under section 138 of the Negotiable Instruments Act by all the proposed directors/shareholders.

Note: Submit the application for approval to the Regional Office of the Department of Non-Banking Supervision which controls the Registered Office of the situated NBFC.

Once you obtain RBI approval follow these steps:

Publish the Public Notice

The first step that you need to undertake is to publish the Public Notice in two regional languages. Amongst them, one should be English, and the other is vernacular language. Ensure that you publicize the notice after 30 days of RBI approval.

Enter into Formal Agreement

The next step is to enter into a formal agreement with the target company to purchase share/ transfer of management/ transfer of shares/ or such interest for NBFC Takeover.

Publication of the Second Public Notice

When your company is about to complete 30 days of entering into the stated agreement, it’s time to publish a second public notice. Likewise, the notice has to be in two regional languages of English and other in vernacular language.

- Intention to sell or transfer control/ ownership;

- All the relevant particulars of the transferee; and

- Mention Reasons for NBFC takeover agreements or the transfer of control/ownership

Conclusion

NBFC takeover is a potent mode of enlarging the business. It is a perfect get through for those companies who fail to register an NBFC. If you desire to purchase an NBFC, then you can choose from two different types of NBFC takeover, namely friendly and hostile. In case, you need any assistance to form your NBFC takeover agreement, contact Swarit Advisors.

Also, Read: A Complete Checklist for Takeover an NBFC