Eligibility for GST Registration

Swarit Advisors | Updated: Aug 28, 2017 | Category: GST

As per the GST Council, businesses having an annual turnover of Rs. 20 lakhs & above are compulsorily required to take Eligibility for GST registration under GST.

- However, there are a certain special category of states (.i.e. northeastern states and hilly areas) which are required to obtain registration if their annual turnover is Rs. 10 lakhs or above.

- Every person registered under the earlier law is compulsorily required to register under GST.

- Anyone who makes the interstate supply of goods or services.

- Casual Taxable person.

- Non-Resident Taxable person.

- The agent of the principal supplier of goods or service.

- Input service distributor.

- The person providing E-Commerce Services.

- The person providing online information or database access, retrieval services from place outside India to a person in India.

- A person liable to pay tax under Reverse Charge Mechanism

A casual taxable person is a person providing a supply of goods or services occasionally in a taxable territory but does not have a fixed place of business.

A non-resident taxable person is a person providing a supply of goods or services occasionally in a taxable territory but does not have a fixed place of business in India. The validity of registration taken by a non-resident taxable person is valid for only 90 days. It can be extended for a further 90 days for a genuine reason.

Following are exempted from taking GST Registration

- Any specialized agency of United Nations organization or any entity or financial institution notified under the United Nations Act, 1947.

- Embassy of foreign countries.

- Central government or State government or any other person as notified by GST Council.

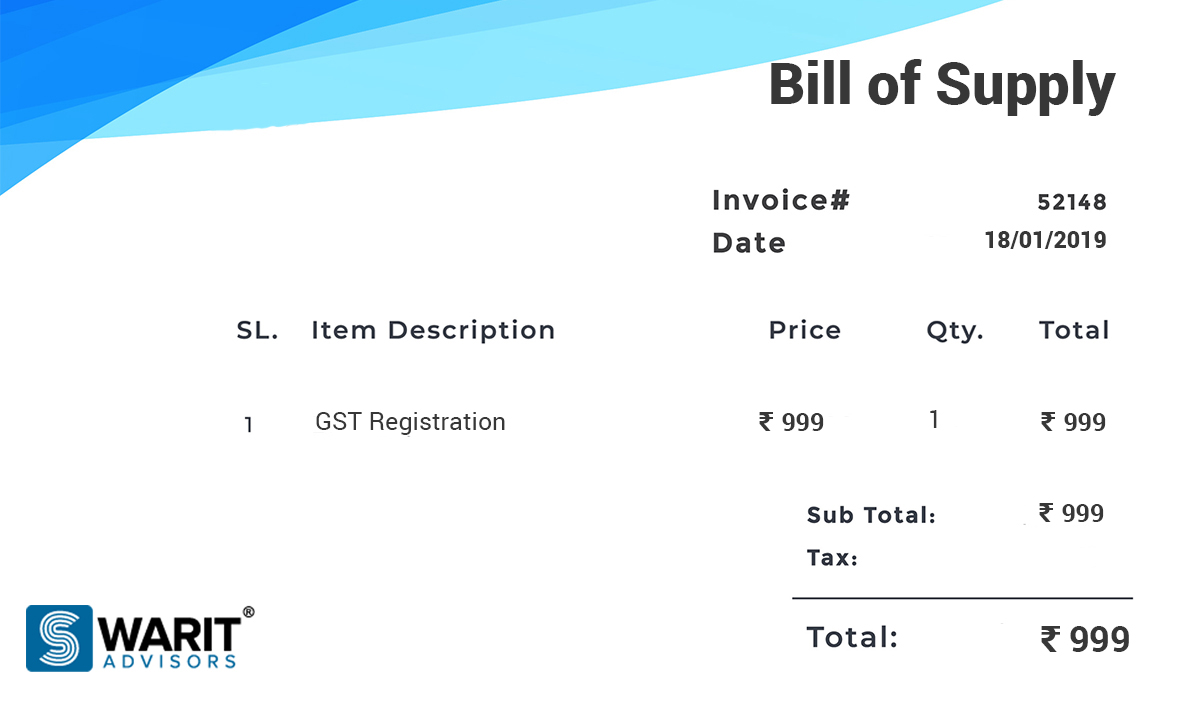

Also, Read: What is Bill of Supply under GST?.