A Complete Overview of the GST Registration Procedure in India

Swarit Advisors | Updated: Dec 18, 2018 | Category: GST

GST registration was brought into action to achieve the mission of one nation one tax, so as to remove the multiple hands involved in the taxation process. It came into effect on 1st July 2017. GST registration provides the 15 digit GST registration number and it allows you to obtain a separate GST number for every state you operate your business in. In this article, we will discuss the GST Registration Procedure.

If you are running a business and the annual turnover of your business is more than Rs. 20 lakhs (or Rs. 10 lakhs in some special cases) then you can willingly apply for the GST registration. When you are involved in a business, you need to claim the input tax credit; for which the GST registration is mandatory. And in accordance with the latest changes into the taxation process, business such as E-commerce, Export or Import business, online aggregator, casual dealer, and foreign supplier etc. must apply for the GST registration number.

If an entity dealing in supply of goods and services, and falls into the taxable group is found not be operating the business without completing the GST registration process, then the business will be liable to pay a big amount of penalty under the GST Act. In the case of Export and Import business, do apply for IEC code along with the GST registration.

If you are looking to get the GST registration certificate, you just need to contact swarit advisors. We have a team of professionals who will help you to get your GST registration certificate within a stipulated amount of time. Further, we will discuss the complete GST registration procedure, documents required for the registration, and other important aspects related to the GST registration procedure.

Table of Contents

What are the steps involved in the GST registration process?

There are certain steps that need to be followed to get the GST registration certificate. Below are the steps to get the certificate of GST registration-

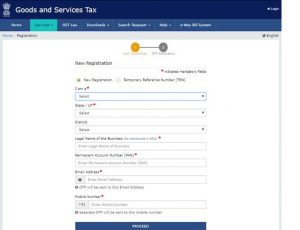

Step1: Visiting the web portal of GST registration

The first step is to visit the web portal of the GST registration. Then you are required to click on the “New GST Registration” tab which is present under the registration section of the services.

Step2: Filling the basic information

After this, you need to select the option of “Taxpayer” and provide the following information-

- Legal name of your business

- Location of your business

- PAN of your business

- E-mail address

- Mobile number

3. Step3: Verification through OTP

Once you provide the contact information, it will be verified b sending the One time password to your mentioned contact number

Step 4: Filling the online registration form

In this step, you have to complete the online registration form by providing all the necessary details and attach the necessary documents. Please keep in mind to verify all the details before submitting the application.

Step 5: Application reference number

Once you have submitted the online registration application of GST, Application Reference Number (ARN) will be shared through the mail or text message.

Step 6: Examination of the application

After submitting the application of GST registration, it will be thoroughly inspected by the designated GST officer. You will receive your GST certificate upon the approval of the application. In case the application is not approved, you will be asked to submit the further necessary documents for the approval.

Checklist of Documents Required for GST Registration

When you apply for the application of GST registration, there is a list of documents that need to be handy at the time of registration-

- PAN card of the applicant (Company/ LLP/ Individual/ NGO)

- You need to submit the identity proof and address proof of all the promoters involved in the business

- You have to provide the proof of registration of business, or partnership deed if you have a partnership firm

- Address proof for the location of a business

- Bank account details of the business

- Class 2 or Class 3 DS for signatories or OTP verification via Aadhar

Who can apply for the GST registration?

Registration; subject to the annual earnings of the business

- There is limit specified under Section 22 of GST Act for filing the application of GST registration-

- If the annual turnover of your business is more than Rs. 20 lakhs then GST registration is mandatory for you.

- There is a special category under which the maximum limit is Rs. 10 lakhs. It involves few states such as Himachal, Uttarakhand and Jammu & Kashmir etc.

Compulsory registration

There is a list of businesses for which the GST registration is mandatory. Let’s take a look at the list of businesses

- If the supplier comes under the reverse charge

- If your business is involved in claiming or remitting Input Tax Credit

- When an individual is affecting the inter-state supply

- When the taxable supply is altered by the casual taxable person

- Altering of a taxable supply by the non-resident taxable person

- Input service distributor

- E-commerce operator

- If there is any individual who is involved in supplying on behalf of other, whether as an agent or not

- Individuals who deal in supplying online information and database or retrieval service from a place outside India to a person in India

- Supplying of goods and services through E-commerce, collecting tax at source u/s 52

Who needs a GST registration in India?

Below are the following individuals that must obtain the new GST Registration Certificate-

Current Taxpayers

All the taxpayers who were already registered under the VAT, CST and Excise / Service tax regimes must obtain the GST registration certificate.

Added taxpayers

If your business is making more than Rs. 20 lakhs (Rs. 10 lakhs in some special cases) then you have to get the new GST registration certificate.

Normal Taxable Person

If there is an Indian taxpayer, who is planning to start any business for the limited period of time regarding any field of work has to apply for the GST registration certificate. In this case, you need to make an advance GST payment while filing the application GST registration.

Normal/casual taxable person includes a list of individuals, HUF[1], NGO, Private limited company, Limited liability partnership, One person company, a Government company, Firm, Co-operative society, the local authority etc.

Non-resident taxable person

Non-residents taxable person includes foreign citizens or foreign entities

E-commerce businesses

If you deal in the businesses involved in the supply of goods and services through e-commerce businesses such as Food Panda, Flip Kart, and Amazon etc, in addition to that every food business operator in India has to get the FSSAI registration certificate as well.

How the taxes are levied under the GST

GST is basically categorized into three levels-

- CGST (Central Goods and Service Tax)

- SGST/ UTGST (State/ Union Territory Goods and Service Tax)

- IGST (Integrated Goods and Service Tax)

Let’s take a look at the GST tax slab below-

GST Tax Slabs

0 % tax slab

It includes all the necessary goods such as milk, curd, food grains, raw foods, fresh meat, fish, chicken, eggs, natural honey, flour, fresh fruits, and vegetable etc. And services such as education services, health services etc.

5 % tax slab

It includes goods such as sugar, tea, coffee, edible oil, branded paneer, sweets, bread, frozen vegetable, life-saving drugs, coal, domestic LPG etc.

12 % tax slab

It includes fruit juices, ayurvedic medicines, tooth powder, umbrella, coloring, books, picture books, sewing machine, cell phones, computers etc

18 % tax slab

It includes chocolates, cocoa butter, fat and oil, vinegar, electronic toys, petroleum oils, petroleum gases, deodorants, shaving creams, aftershave, hair shampoo, etc and services such as transfer of IPR

28 % tax slab

There are very few products and services that fall under the category of 28% tax slab. It includes only 35 items that are included under the 28 % tax slab.

Points to be taken into consideration

There are certain points that need to be taken into consideration if you are looking to file an application of GST registration-

- Most of our clients ask during the filing of an application of GST registration, what do they need a separate GST registration certificate if they are running two business units within the same state?

There are two options available to choose from, either you can get a GST registration certificate for one of your branches and add others as an additional place of businesses you run or,

You can also apply for the separate GST certificates for every branch you operate.

- It happens with most of us, oops I filled the wrong details and submitted the form; what do I do now? If it is the same case with you then don’t you worry.

If you are filing an application of a GST registration and made a mistake while entering your details in the application, then you can file Reg-14 online (in case you have mentioned an incorrect address or business description).

- We all ask the same question whether who can apply the application of GST registration, but have you ever thought of who is not required to apply for the GST registration?

There is a certain list of entities that do not need to have the GST certificate, below is the list of entities-

- If there is a supplier whose annual turnover is lesser than the prescribed limit and is not even covered under the mandatory GST requirement list

- If thee supplies are covered under the reverse charge mechanism

- When your business supplies non-taxable goods and services under GST

- If you are an agriculturists

- Many a time our client asks who can apply for the composite scheme and how they can apply?

If there is a taxpayer whose annual turnover is lesser than Rs. 1 crore can apply for the composite scheme. If you have a business operating in the north-eastern states then the limit is Rs. 75 lakhs.

There are basically two ways of enrolling your business into the composite scheme-

- If you are filing an application for the new registration, you can choose for the composite scheme then and there.

- In case your business is already registered you can opt for the composite scheme by submitting GST CMP-02 on the portal. You have to apply it at the beginning of the financial year.

The composite scheme provides several benefits such as-

- Lesser compliance to adhere

- It provides limited tax liability

- It also ensures the high liquidity as taxes are at a lower rate

If you are on the way to start your own business and looking for the GST registration certificate, you just need to connect with our team at swarit advisors.

Also, Read: How to Change GST Registration details of a Business.