Procedure for GST Number search by PAN

Swarit Advisors | Updated: Apr 01, 2019 | Category: GST

Goods & Service Tax Identification Number (GSTIN) is a unique identification number allotted to business enterprises and taxpayers when they get themselves registered under the Goods & Services Act. It’s a state-specific number consisting of 15 digits. These 15 digits are comprised of the ten digits PAN no. of the enterprise or individual, two digit state code of the office or business premise of the applicant, and other characters assigned on the basis of the registration process. But the question arises, how you will search GST number. There are several ways through one can search GSTIN but one of the easiest ways introduced is the GST number search by PAN.

The procedure for searching GSTIN by PAN has been described later in this blog. Let us first understand a few things necessary before plunging on to the procedure.

Table of Contents

Purpose of GST Act and Eligibility

The GST Act came into effect on 1st July 2017.This Act was enacted with a view to abolish multiple tax systems prevailing in the Indian economy and to bring them under one umbrella. This was a step of the government towards facilitating ease of doing business.

Under the Goods & Services Tax regime, obtaining Goods & Services Tax (GST) Registration is mandatory for the following:

- Any business or service provider with a total turnover exceeding 20 lakhs in a financial year and Rs 10 lakhs for North Eastern and hill states. However, if you are engaged in the supply of exempted goods or services, the same shall not be applicable to you.

- Every person/business who has a registration under Excise, VAT or Service Tax needs to register under Goods & Services Tax (GST) through migration.

- If any GST registered business is transferred to someone, the transferee shall assume the registration with effect from the transfer date.

- Any person who is involved in the inter-state supply of goods irrespective of turnover.

- Casual taxable persons (a business provider who does not have a fixed place of business and provides good and services occasionally)

- Non-Resident taxable persons (Persons who indulge in an occasional supply of goods & services with no fixed place of business)

- Agents of a supplier

- Those taxpayers on whom reverse charge mechanism is applicable

- Input service distributor

- Any E-commerce operator aggregator* or Person(s) who supplies goods via e-commerce aggregator

- Any person supplying online information and database access or retrieval services from a foreign country to a person in India

GST Number search for Business through GST Portal

Earlier there were no options of finding GST no. of any business organization or taxpayer with the help of PAN or any other mode. Recently, the GSTIN portal of the government has recently allowed the option of GST number search by PAN. This can be done by visiting the official website of the Goods & Services Act

PAN Number and its Importance

PAN stands for Permanent Account Number. It is a unique 10-digit identity number allotted by the Income Tax Department. This number contains alphanumeric characters and serves as an identity proof. PAN is mandatory for financial transactions such as receiving taxable salary or professional fees, sale or purchase of assets above specified limits, buy mutual funds and more.

The primary objective of issuing PAN by the Income Tax Department is to track financial transactions of taxpayers to prevent evasion of taxes.

Who must apply for PAN?

- Any person (including a foreign national) who earns taxable income in India.

- Anyone who is involved in a running business with total sales or turnover or gross receipt more than Rs 5 lakh in the previous financial year.

Importance of PAN number

Having a PAN is important for the following reasons:

- PAN is mandatory for filing your income tax return and for the payment of direct taxes.

- Having a PAN helps one in availing various deductions under the Income Tax Act, thus resulting in lower tax liability.

- For transacting in the sale of immovable property or Jewellery, you cannot exceed a certain limit unless you are holding a PAN in your name.

- PAN is mandatory for mutual fund purchases.

- PAN is mandatory for making payments to various vendors after a certain limit.

- For making cash payment beyond a certain limit to certain vendors or making deposits exceeding a certain sum.

Procedure for GST number search by PAN

Described below is the detailed procedure for GST number search by PAN:

Step 1–First step is to visit the official website of the GSTIN portal at www.gst.gov.in

Step 2–After landing on the home page, go to the fifth tab at the top named “Search Taxpayer”.

Step 3–Click on “Search Taxpayer” and you will be given with three options.

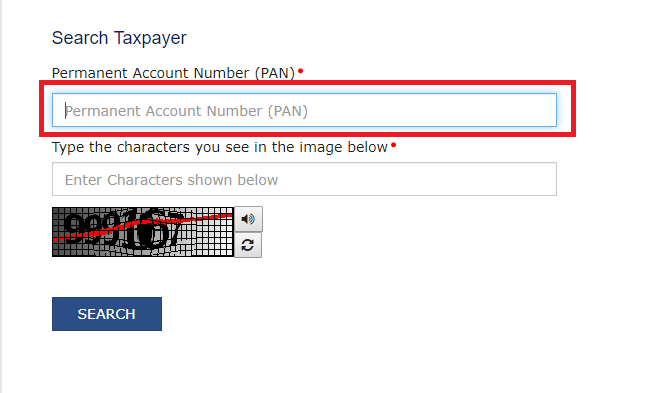

Step 4– Click on the second option i.e. “Search by PAN”.

Step 5-Put the PAN no of the assesse and click on “search”.

The website will show the details of the GST registration number held against the PAN which has been provided.

Mandatory compliances for GST

Persons/businesses registered under the Goods & Service Tax Act should adhere to the following Mandatory compliances for GST.

- All GST registered persons should mandatory charge GST on their invoices at the rate as may be applicable to their businesses.

- All GST registered persons should mandatory file monthly, quarterly and annual returns reporting their total outward supplies, inward receipts and GST collected on their invoices.

- The invoices raised by GST registered persons should be GST compliant and shall have all the information such as GSTIN of customer and vendor, invoice no. & date, SAC/HSN codes, description of items, taxable value and taxable amounts and so on.

Conclusion:

The option of GST number search by PAN has provided a facility for identifying whether business enterprises have GST registration or not. Many business enterprises indulge in collecting GST from their customers and later using them as their personal income. Only registered enterprises have the right to charge GST on their invoices. With this option, it can be tracked whether they have GST or not thus preventing illegal collection of GST.

For any further query and assistance on GST related services, contact Swarit Advisors.

Read, Also: CGST, SGST, and IGST: Understanding the difference.