Benefits and Types of FCRA Registration in India

Sanchita Choudhary | Updated: Oct 25, 2020 | Category: Foreign Trade

The term “FCRA” refers to the Foreign Contribution Regulation Act, 2010. The world today so well connected and linked that grant accessibility to anyone has become very easy. As a result of this the flow of any foreign currency in and out of the country has become easy and natural. However, in order to keep a check on these flow of currency the ministry of Home Affairs brought changes in the Foreign Contribution Regulation Act, 2010.

Table of Contents

Purpose of FCRA Registration in India

The Foreign Contribution Regulation Act, 2010 was enacted with a view to achieve the following objectives:

- To prohibit certain entities from accepting any foreign contributions,

- To restrict certain entities from accepting any foreign hospitality,

- To govern any acceptance of foreign contribution by any such person having a definite cultural social economic or educational background.

Types of Registration under FCRA, 2010

There are two ways by which registration under FCRA, 2010 can be done in order to receive any kind of foreign contribution:

- Proper Registration: https://fcraonline.nic.in/FC3.aspx?Resp_Id=1

- Prior Permission: https://fcraonline.nic.in/FC3.aspx?Resp_Id=6

What is the Eligibility Criteria for FCRA, 2010 in India

1. Eligibility for Proper Registration

- In order to grant registration under FCRA, 2010 an association must be registered under any existing statute like the Societies Registration Act, 1860 or under section 8 of Companies Act, 2013 or the Indian Trusts Act, 1882.

- The organisation shall be in existence for at least 3 years.

- The applicant should be involved in a reasonable activity for the betterment of society for which foreign contribution is to be required.

- The applicant must submit copies of financial statements at least 3 years duly audited by the concerned authority.

- Once done with the proper registration the certificate provided is known as a Permanent Certificate which is valid for up to 5 years.

Documents Required for Proper Registration

- Signature of Chief Functionary in JPG format,

- Self Certified copy of Trust Deed or Registration Certificate of the Association,

- Self-certified copy of Memorandum of Association and Article of Association focusing on the aims and objectives of the association.

- Detailed activity report of the last three years.

- Audited statements of the bank account for the last three years showing all the expenditures.

2. Eligibility for Prior Permission Registration

- Ideal for any newly registered organization which would like to receive foreign contributions.

- The association must be registered under any existing statute like Societies Registration Act, 1860, or Section 8 of the Companies Act, 2013 or The Indian Trust Act, 1882.

- The fund received must be used for the benefit of society.

- Must submit a specific commitment letter granted from the donor to the Ministry of Home Affairs indicating-

- Amount of contribution given,

- The purpose for which the amount is to be given.

- In case of an Indian recipient organization and foreign donor organization having common members, the FCRA registration permission is to be granted to the Indian recipient organization if:-

- If the Chief Functionary of the recipient organization is not part of the donor organization,

- A minimum of 75% of the members of the Governing Body of the recipient organization should not be a member of the donor organization.

Documents Required for Prior Permission Registration

- Signature of Chief Functionary in JPG format.

- Certified copy of the Trust Deed or Registration Certificate of the Association.

- Duly signed a letter of commitment from Donor.

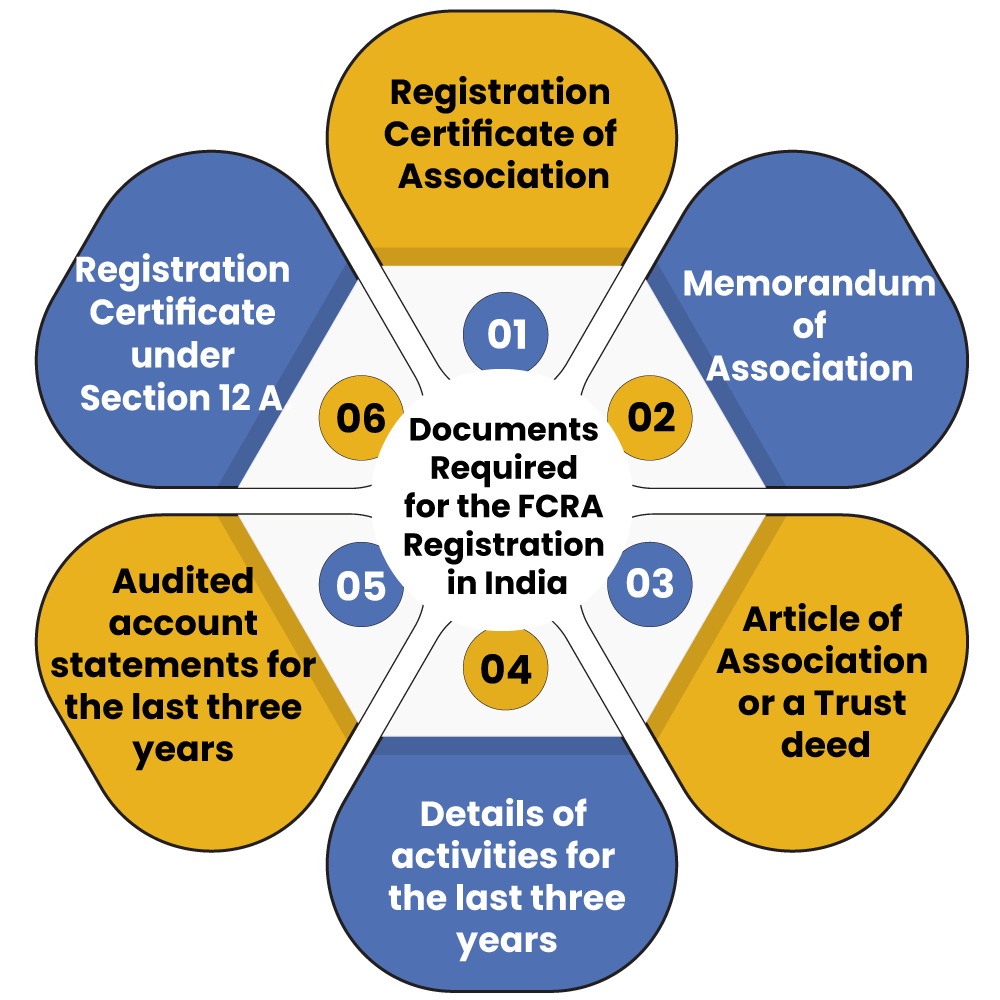

Documents Required for the FCRA Registration in India

- Registration Certificate of Association (Self-certified Copy),

- Self-certified copy of Memorandum of Association,

- Self-certified copy of Article of Association or a Trust deed,

- Details of activities for the last three years,

- Audited account statements for the last three years is to be shown,

- Registration Certificate under Section 12 A.

Benefits of FCRA Registration, 2010

The purpose of the FCRA commonly termed as Foreign Contribution Regulation Act, 2010 is to help those organizations which work for the benefit and betterment of society and is involved in social work such as NGO’s. Below are some of the benefits of FCRA registration:-

- Helps in legally receiving any foreign contribution or government aid if registered under FCRA, 2010,

- As per section 8 of the Companies Act, 2013 any company or NGO or public trust registered under FCRA, 2010 can receive donations from foreign bodies. Some of them are:-

- Oxfam

- UNESCO

- Infinity Foundation

- British High Commission

- Canada High Commission

- New Zealand High Commission

- Ford Foundation

- SWISSAID

- AUSAID

- European Commission

- BORDA

- GIFRID

Conclusion

Thus, it can be noted that the burden of the onus of getting registered under FCRA (Foreign Contribution Regulation Act, 2010) lies on the NGO’s or any other such association.

Therefore, before accepting any such foreign contribution or funds it is the responsibility of such associations to ensure that all the formalities are complied with and thus registration is granted for any foreign exchange.