What are the Benefits of GST on Retail Sector in India

Swarit Advisors | Updated: Aug 28, 2017 | Category: GST

The good thing about GST on retail sector is going to be huge. Indian Retail sector is one the quickest growing trade within the world. It’s expected to grow to1.3 trillion USD by 2020, registering a CAGR (Compound Annual Growth Rate) of sixteen.7% over the five years starting from 2015-2020. India is ranked as the fifth-largest retail destination in the world. The retail sector is booming every place be it railway cities or the Tier-II and tier-III cities. The government has also introduced major reforms to draw in FDI within the retail trade.

The government has approved up to 100 percent FDI[1] in single whole retail and fifty-one within the multi-brand- retail. All of those stats signify that the retail sector is as dominant as ever and any reform within the country that anyhow affects the operating of the world shall have an enormous impact on that. And GST is not any normal tax reform. It’s one in all a sort reform that is poised to alter the state of affairs of taxation within the country and licitly its effects on the retail trade should be thought about.

Table of Contents

Following are the benefits of GST in the Retail Sector:

Reduced Taxes

GST will reduce the burden of taxes on the details as previously they were required to pay different forms of taxes such as Vat, CST, Octroi service tax etc. As the motto of GST is “One Nation, One Tax” it will be easier and simpler to the retailer to understand, implement and pay GST easily.

Input tax credit

GST will reduce the burden of taxes as the set-off is available starting from the stage from where the production is initiated till the stage up till it reaches to the customer. As previously the retailer making sales interstate was not allowed to take input tax credit under CST paid against the vat liability.

Taxes on samples and gifts

Under the GST regime, the goods provided as free samples and gifts are taxable. As previously, under the old indirect tax regime, the goods and services provided as free samples and gifts were tax-free. Thus due to the introduction of taxes on samples and gifts the retail’s will have to rethink on the advertisement strategies.

Overall Growth

Due to the unification of overall market under GST through similar tax rate all over the country has extended the boundaries of the retailers to enable them to carry on their operations in all the states. This will boost the overall growth of the retail market and the economy.

Fewer Complications

The retailers will be able to carry on the business easily as the GST rules are streamlined in such a manner that it will enable the retailer to comply with the legal policies, calculate and pay taxes in an effective manner.

Opportunity for Startups

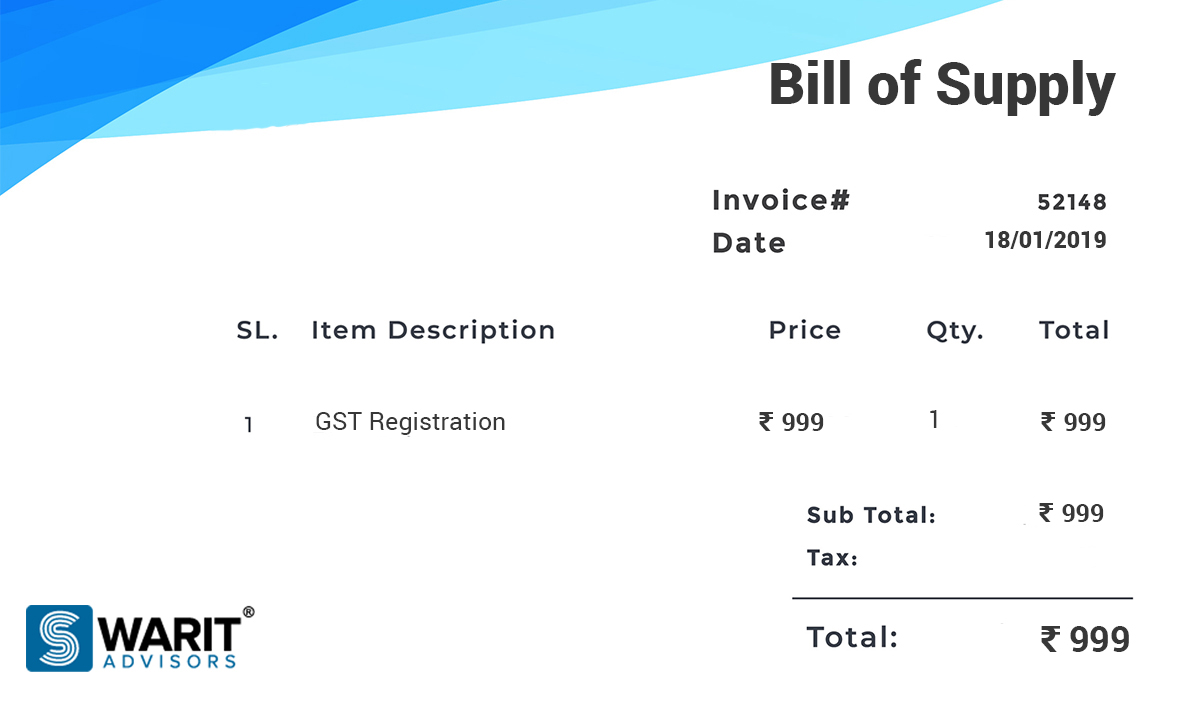

The registration process under GST is very easy and simple as the registration is to take only once while starting the business. The startups can also claim benefits of taxation by registering under GST. It will also enable to carry on their operations under the new policies under GST.

There are much more benefits under the GST regime which will turn out to be a great boost for the retail sector as the policies and taxation are streamlined one roof. This will enable the retail sector to carry out the business without any obstacles, carry on the business freely and expanded their business in multiple states that will help the retailers to scale their profit and this could lead to a reduction of prices for the final consumer.

Also, Read: Eligibility for GST Registration.