Buyback of Shares: Meaning and Its Purpose

Sanchita Choudhary | Updated: Oct 23, 2020 | Category: SEBI Advisory, Share Purchase

Table of Contents

Overview of Buyback of Shares

Buyback of shares is defined under section 68 of the Companies Act, 2013. Earlier, the concept of buyback of shares was dealt under the Companies Act, 1956. Later on, it was amended in the year 1999.

Buyback of shares is a kind of financial strategy followed by any company for the purpose of restructuring and realignment of its shares and securities in order to prevent any unwanted takeovers.

Meaning of Buyback of Shares

It is defined as the process by which any company can buy back its own shares and securities from any existing shareholders usually at a price which is higher than the market price. This process by which a company is allowed to repurchase its own shares and securities at a price higher than the existing market price is referred to as “Buyback of shares”.

However, the number of outstanding shares in the market declines, when any company buybacks its own shares along with other securities.

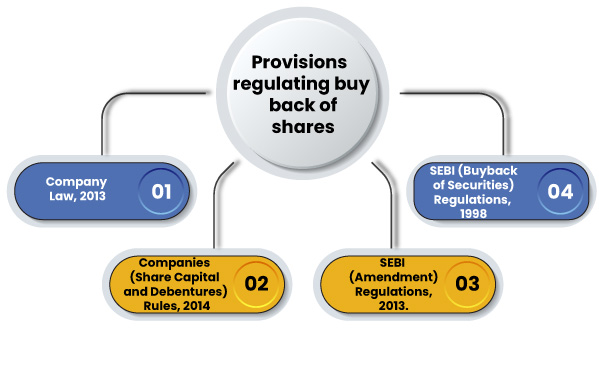

Provisions Regulating Buyback of Shares

Buyback of shares is regulated by law under the following provisions:

- Section 68 to70 of Companies Act, 2013[1].

- Rule 17 of the Companies (Share Capital and Debentures) Rules, 2014.

- SEBI (Buyback of Securities) Regulations, 1998.

- Securities and Exchange Board of India (Buyback of Securities) (Amendment) Regulations, 2013.

These are some of the provisions which regulate the concept of Buyback of shares in India.

Rules laid down for Buyback of Shares

Following are some of the rules or criteria which must be followed for the procedure of Buyback of shares:

- As mentioned in SEBI guideline, the maximum upper limit for the buyback of shares is 25 percent or less than the total paid up capital of the company along with the company reserves.

- The ratio of aggregate secured or unsecured debts of any company should always be more than the twice paid up capital of the company.

- This should be allowed only for the fully paid up shares and securities of the company.

- As reflected by SEBI guideline, no company has the power of Buy back of share for decreasing share capital.

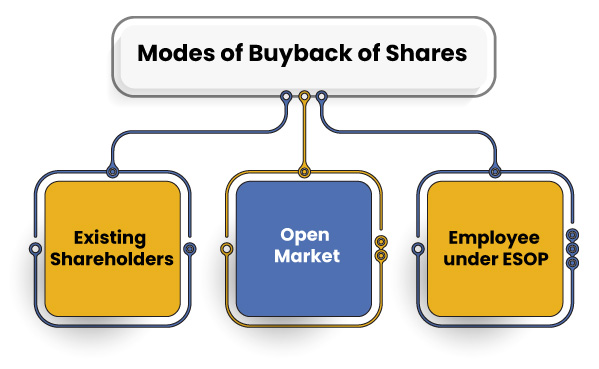

Modes of Buyback of Shares

Section 68(5) of the Companies Act,2013 deals with the concept of different modes of buyback of shares and securities. This can be achieved by the following modes:-

- From the existing shareholders or the existing security holders

- Open Market,

- Shares purchased from employees under Employee Stock Option Plan (ESOP).

Procedure of Buyback of Shares

In order to file for the buyback of shares and securities of any company following are the procedures to be followed:

- An offer letter must be filed with the registrar dated and duly signed on behalf of the board of directors of the company.

- The letter filed must be dispatched to the shareholders of the company in not less than 21 days of filing with the Registrar of the Companies.

- The offer made for the buyback of share shall remain open for more than 15 days and but not more than 30 days from the date of filing of letter of offer.

- Register of buy back of shares and securities must be maintained by every company under FORM No. SH. 10.

- Shares to be bought by the process of buy back must be a fully paid up shares.

- The process of the valuation of shares for buyback must be completed within a time period of one year from the date of passing of special resolution.

Why do Companies Consider Buyback of Shares?

With the increasing number of companies in India, various companies look for the buyback of its shares and securities. The directors of the existing companies are of mind that the buyback of shares and securities of one’s own company have a positive impact or effect on the existing shareholders of the company.

Reasons

Here are some of the reasons why a company is interested in buying back its own shares and securities:

Increase in Earnings per Share (EPS):

In order to boost or increase the earnings per share of a company, various companies are interested in buyback of their own shares and securities. This is because buyback of share reduces the value of outstanding shares in the market.

Distribution of Excess Cash:

Another important reason for buyback of share of one’s own company is to distribute excess cash to the shareholders of the company. This is done because the offer price is always more than the current price.

Buyback of Share Helps in Improvement of Valuation of Companies:

Whenever a company buybacks its own shares and securities, the outstanding shares of the company and the capital base are reduced. Further, this helps in the improvement of not only EPS but also the ROE of the company.

Conclusion

Thus, Buyback of shares can be considered to be an efficient way to increase the price of the undervalued share of a company. This should be allowed only for the fully paid up shares and securities of the company. However, it can be said that not every Buy back of shares is considered to be profitable for a company. Thus, investors should always look at the time and purpose of the buyback of shares. We at Swarit Advisors have the team of experts who can help you with this process

Also, Read: Checklist for Buyback of Shares under Companies Act 2013