Buyback of Shares in India - An Overview

Section 68 of the Companies Act, 2013 deals with the concept of buyback of shares. It denotes that any company whether limited by shares or by guarantee, can buy or repurchase its securities. Further, the term company includes a private company, a public company and an unlisted company. Moreover, the best time to undergo the process of Buyback is when the market value of the shares is undervalued. This is because after absorbing the repurchased shares, the number of shares available in the market gets reduced.

Previously, the concept of buyback was covered under the Companies Act, 1956 until it was amended in the year 1999. Besides this, section 68, 69, and 70 of the Companies Act, 2013, read with Rule 17 of the Companies (Shares Capital and Debentures) Rules, 2014 regulates the process of buyback by an unlisted company.

The process of Buyback is recognised as one of the crucial methods of Capital Restructuring, as it assists in increasing the company’s EPS (Earning Per Share), and shareholder returns. It is also one of the methods of offering funds to the shareholders instead of dividends.

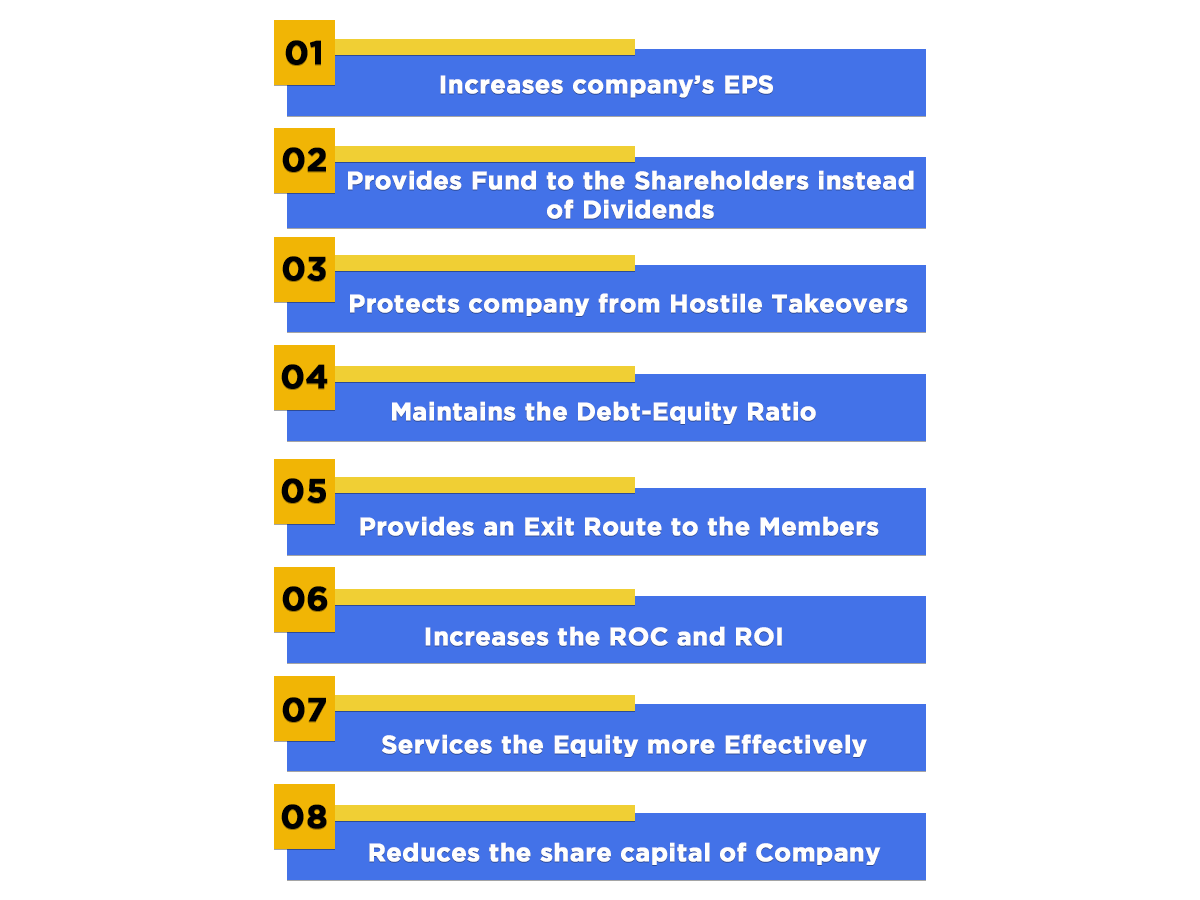

Reasons to opt for Buyback of Shares

There are several advantages of the buyback of shares in India, which can be summarised as follows:

- To increase the company’s EPS (Earnings Per Share);

- To provide Funds to the Shareholders instead of Dividends;

- To protect the company from Hostile Takeovers;

- To maintain the Debt-Equity Ratio;

- To provide an Exit Route to the Members;

- To increase the ROC (Return on Capital) and ROI (Return on Investment);

- To service the equity more effectively;

- To reduce the share capital of the Company.

Regulatory Framework for Buyback of Shares

The legal provisions regulating the buyback of shares are as follows:

- Section 68, 69, and 70 of the Companies Act, 2013;

- Rule 17 of the Companies (Share Capital and Debenture) Rules, 2014;

- SEBI (Buyback of Securities Amendment) Regulation, 2013, together with the subsequent amendment thereafter.

|

CLASS OF COMPANIES |

REGULATION |

|

Buyback of shares for the Private Limited Company and Unlisted Public Company |

a) Section 68, 69, and 70 of the Companies Act, 2013. b) Rule 17 of the Companies (Share Capital and Debentures) Rule, 2014. |

|

Buyback of shares for the Listed Companies |

a) Section 68, 69, and 70 of the Companies Act, 2013. b) Rule 17 of Companies (Share Capital and Debentures) Rule, 2014. c) The SEBI (Buyback of Securities Amendment) Regulations, 2013. |

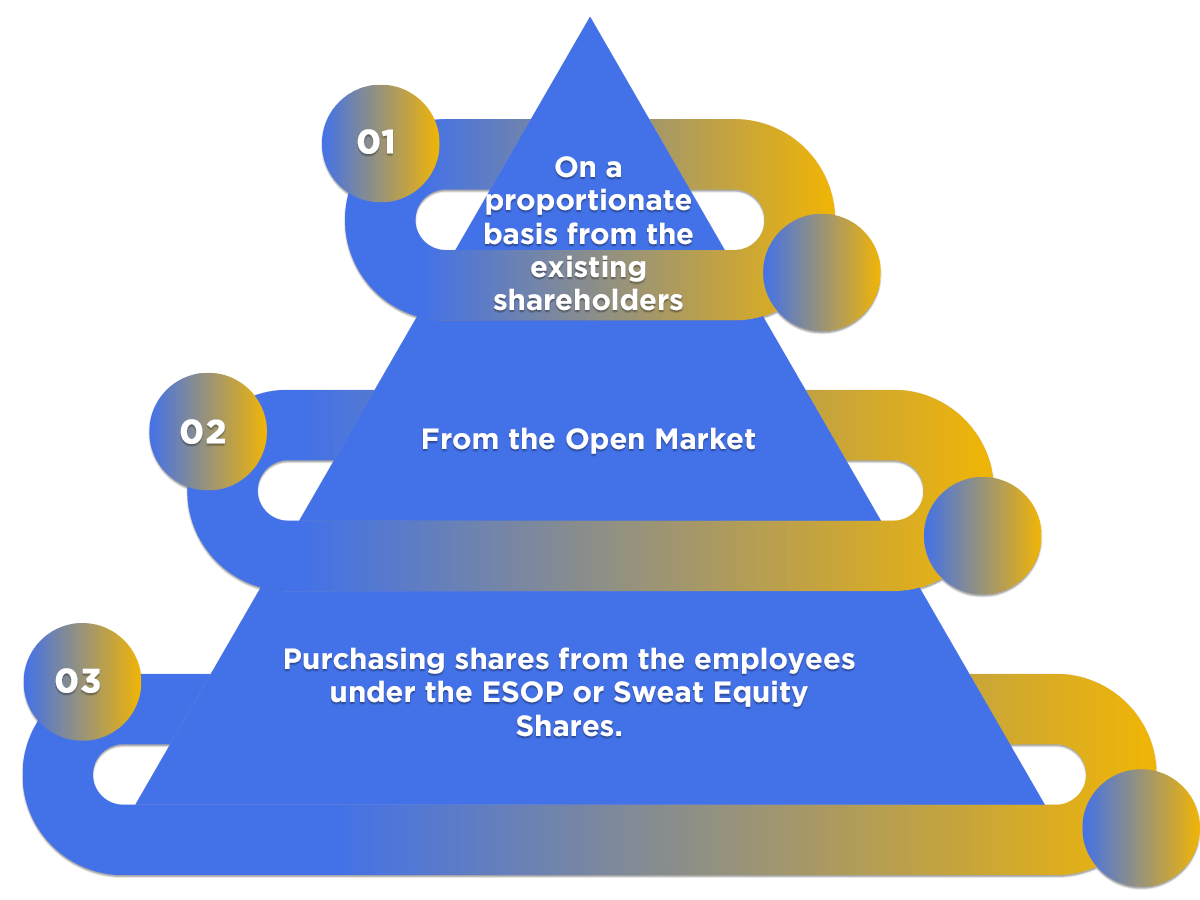

Modes of Buyback of Shares

Section 68 (5) of the Companies Act, 2013 talks about the different modes for the Buyback of Shares. The modes of buyback of shares are as follows:

- On a proportionate basis: from the existing shareholders;

- From the Open Market;

- Purchasing shares from the employees under the ESOP (Employee Stock Option Plan), or Sweat Equity Shares.

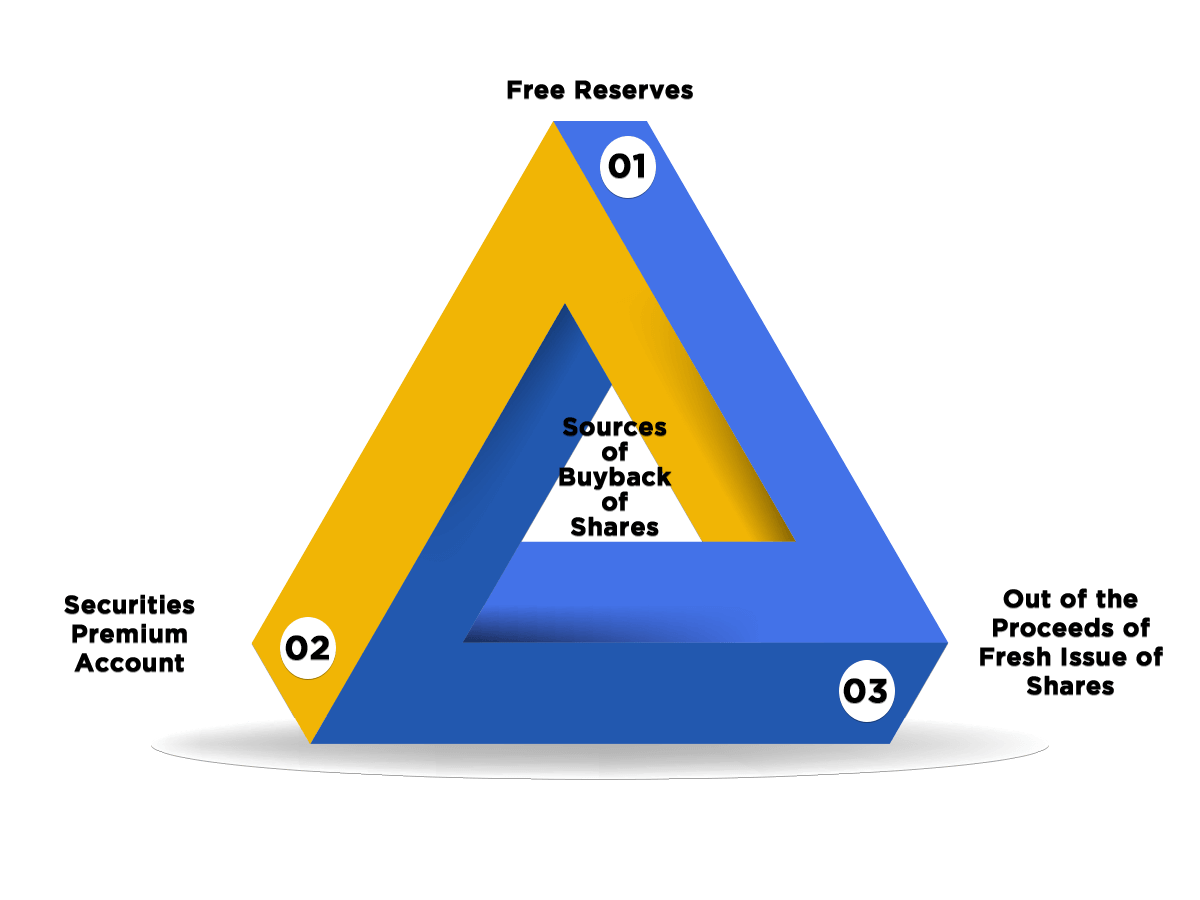

Sources of Buyback of Shares

A company may repurchase its shares out of the following:

- From its Free Reserves;

- From the Securities Premium Account;

- Out of the Proceeds of Fresh Issue of Shares.

However, a company is not allowed to repurchase its shares out of the proceeds from an earlier issue.

Conditions Relating to the Buyback of Shares

The following conditions must be fulfilled before undergoing the Process of Buyback of Shares:

- The Article of Association (AOA) of the company must authorise the process of buyback.

- A company can buy back its shares only up to 25% or less than the paid-up share capital and free reserves of the company.

- After the completion of the process of a buyback, the debt-equity ratio of the company should not exceed 2:1.

- All the shares and other securities should be fully paid-up.

- The company needs to pass an ordinary resolution, in the case of Buyback of only 10% shares.

- In the case of Buyback is up to 25% of the total paid-up capital and free reserves, the Company requires to pass a Special Resolution.

- A minimum of one-year gap should be there in between two buybacks.

- A company is not allowed to buy back its shares for six months, starting from the date of completion of buyback.

- A company is not allowed to withdraw the offer of a buyback, once the same has been announced to the shareholders.

- A company shall not utilize any amount borrowed from the financial institutions for buyback.

Prohibitions on Buyback of Shares

As per section 70 of the Companies Act, 2013 the prohibitions specified are as follows:

- A company cannot directly or indirectly choose to repurchase its shares and other securities from any Subsidiary Company which involves the company’s own subsidiary companies;

- A company cannot directly or indirectly choose to repurchase its shares and other securities from any Investment Company or group of Investment Companies;

- A company cannot directly or indirectly repurchase its shares and other securities, in case it has made a default in the following:

- Repayment of Deposits accepted either before or after the commencement of the Act;

- Payment of Interest thereon;

- Payment of Dividend to any member;

- Redemption of Debentures of the Company;

- Redemption of Preference Shares of the Company;

- Repayment of any interest or any term loan thereon to any Financial Institution or Banking Company.

Note: The process of Buyback is not prohibited if the default is resolved and a time-span of three years has elapsed after such default ceased to exist.

- If in case the company has not followed the provisions of Sections 92, 123, 127 and 129 of the Act, the company cannot directly or indirectly repurchase its shares and other Securities.

Buyback of Shares through Ordinary Resolution

In case the buyback of share is for 10% or less of the company’s total paid-up share capital and free reserve:

- The company needs to send a notice at least seven days before the BM (Board Meeting) to the Directors.

- The directors then authorise the Buyback of Shares and other Securities by passing an Ordinary resolution in the company’s Board Meeting.

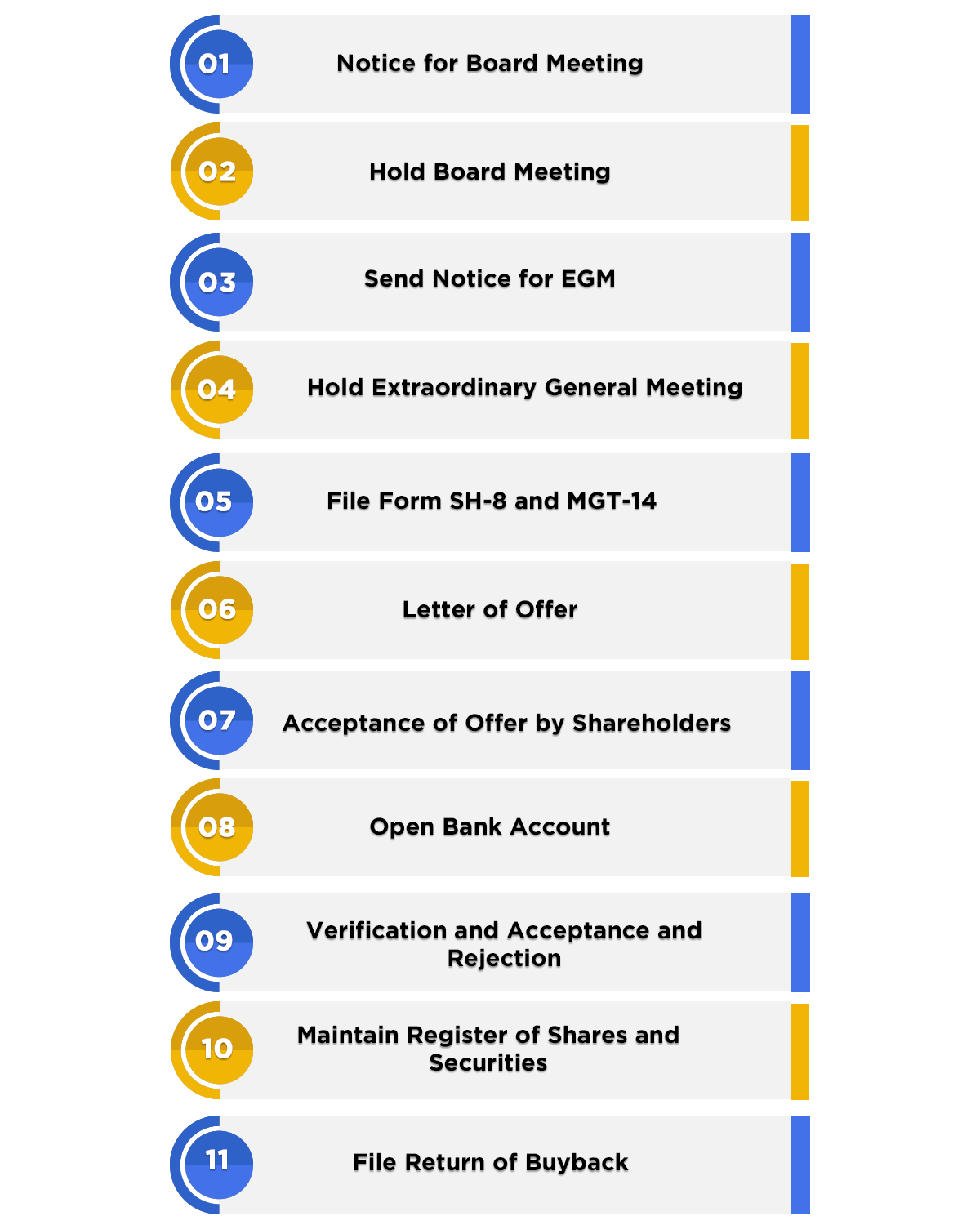

Buyback of Shares through Special Resolution

In case the Buyback is above 10% and up to 25% of the company’s total paid-up capital and free reserves:

- Notice for Board Meeting

A notice of the Board Meeting (BM) should be sent at least seven days before the date of BM. The notice must contain the agenda of the Board Meeting.

- Hold Board Meeting

In the Board Meeting, the directors must approve the following things:

- For the Buyback of shares and other Securities;

- Fix date, time, day, and place of the Extraordinary General Meeting (EGM);

- Approval of the notice for calling EGM together with the Explanatory Statements.

- Send Notice for EGM

The notice for the EGM must be sent at least twenty-one days before the date of the meeting.

- Hold Extraordinary General Meeting

A Special Resolution (SR) for authorising the Buyback of Shares and other Securities should be passed in the EGM.

- File Form SH-8 and MGT-14

After passing the Special Resolution, Directors are required to file form MGT-14 with the ROC (Registrar of Companies) within thirty days starting from the date of the Extraordinary General Meeting. Form MGT-14 requires the following attachments:

- A copy of the Special Resolution (SR) and Explanatory Statement.

- Both the copies must be certified by a Practising CA, CS, or by any Cost Accountant of the Company.

The company needs to file a Letter of Offer along with the Form SH-8, which shall be signed by at least two directors, one of whom must be MD (Managing Director) of the Company. Further, Form SH-8 requires the following attachments:

- Details of Promoters of the Company;

- Declaration made by the Auditors;

- A copy of the Board Resolution;

- A copy of the notice together with the Explanatory Statement;

- Financial Statements for the last three years;

- List of all the Holding and Subsidiary Companies;

- List of all Buyback for the past three years;

Furthermore, form SH-8 should be filed together with form SH- 9. It is a Declaration of Insolvency made by the Company. The same shall be signed by at least two directors, one of whom must be an MD (Managing Director) of the Company.

- Letter of Offer

After filing Form SH-8, a company needs to dispatch Letter of Offer to the Shareholders within twenty-one days. The said offer should not be open for less than fifteen days and must not exceed thirty days starting from the date of dispatch of the offer letter.

- Acceptance of Offer by Shareholders

If no communication of the rejection is made within twenty-one days of the closure of the offer, the offer will be considered as accepted by the Shareholders.

- Open Bank Account

Just after the closure of the offer, the director needs to deposit the collected money in a separate bank account opened for the Buyback of Shares and other Securities.

- Verification and Acceptance and Rejection

Within fifteen days starting from the closure of the offer, the verification and acceptance of the Buyback needs to be done.

The shares will be deemed to be accepted if in case no communication of rejection is made within twenty-one days commencing from the date of closure of the offer.

The payment of consideration needs to made to the respective shareholder whose shares and securities are being accepted. Further, the payment must be made within seven days from the date of Verification and Acceptance.

If the shares and securities of shareholders are not accepted, the Share Certificate of such shareholders needs to be returned within seven days of the Rejection.

Also, the share and securities brought back must be destroyed within seven days of the completion of the Buyback.

- Maintain Register of Shares and Securities

The company needs to maintain a register of shares and securities brought back as per Form SH- 10. The Register is kept at the company’s registered office.

- File Return of Buyback

After that, the company needs to file the return of the Buyback to the ROC (Registrar of Companies) within thirty days of the completion of the process. Further, the company needs to file the return as per SH-11 along the attachments listed below:

- A copy of the Special Resolution passed at the Extraordinary General Meetings;

- A copy of the Board Resolution passed at the Board meeting;

- A copy of the company’s Audited Balance Sheet;

- All the details of the shares brought back;

- Details of the securities holders, before Buyback.

Consequences of Violating the Provisions of Buyback of Shares

- By Company: A fine of not less than Rs. 1 lakh, which can go up to Rs. 3 lakhs.

- By Officer of Company: An imprisonment up to three years to every officer, who is involved in default, or with a fine which shall not be less than Rs. 1 lakh, but can go up to Rs. 3 lakhs, or with both.