In India, the Applicability of GST on Food Industry has always been the topic of Confusion and Dilemma. The reason behind this is that due to continuous change and modification...

MORE

The RERA Act or the Real Estate Act 2016 came into force on 01.05.2016. It is effective and binding on all the residential and commercial projects. This act aims to...

MORE

Over the years, technology has evolved at a fast-pace. Though the development in technology has streamlined our daily operation, perhaps it becomes a pathway for the hackers to commit their...

MORE

On 14th March 2020, the Finance Minister, Nirmala Sitharaman chaired the 39th GST Council Meeting in New Delhi to make certain amendments in GST Law. As per the proposed decisions,...

MORE

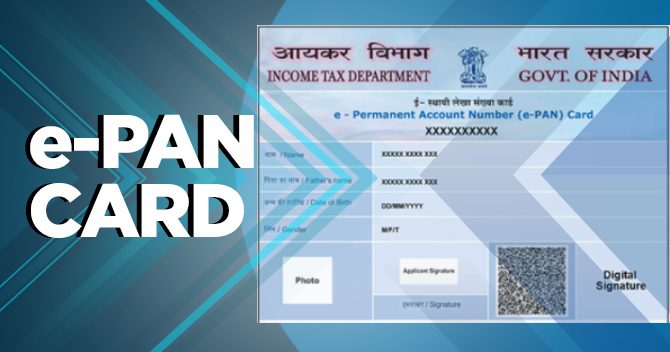

A lot has been circulated to link PAN and Aadhaar on television, radio, internet, newspapers and other channels. However, Income Tax Department has made it mandatory for PAN holders to...

MORE

Union Budget 2020 has set some new compliance for Charitable Trust, NGO and religious institutions to claim tax exemptions. The revised provision will bring a pivotal change for such organizations....

MORE

Section 139A of Income Tax Act, 1961 mandates a person to possess only one Permanent Account Number or PAN. If any individual has two or more PAN cards, then Income...

MORE

PAN or Permanent Account Number holds supreme importance not only for the taxpayers but also for all the citizens of India. An individual can avail several benefits from a PAN...

MORE

On November 18, 2019, the Ministry of Corporate Affairs in consultation with Government of India and RBI has issued a notification. It notifies the rules under Section 227 of the Insolvency...

MORE

On November 5, RBI has extended the deposit withdrawal limit for all the PMC bank depositors to ₹50,000. It's inclusive of the limit ₹40,000 which was relaxed earlier. This outrageous...

MORE