Real Estate Act 2016: A Detailed and Conceptual Analysis

Shivani Jain | Updated: Jul 24, 2020 | Category: News, Rera

The RERA Act or the Real Estate Act 2016 came into force on 01.05.2016. It is effective and binding on all the residential and commercial projects. This act aims to safeguard the interest of buyers, along with a simultaneous boost in the investments of the Real Estate Sector. Further, this act establishes RERA (Real Estate Regulatory Authority) in each state and operates as an adjudicating body for the speedy and quick dispute redressal.

In this blog, we will thoroughly discuss the Real Estate (Regulation and Development) Act, 2016.

Table of Contents

Need for Real Estate Act 2016

Over a period of time, India, as a nation, has emerged as one of the few economies that have achieved both successive growth and economic perspective in the global arena. Therefore, it is a widely accepted fact that India is on the way to become a prospective world leader as it aims to provide sustainable development in every field.

Further, Real Estate is one of the significant contributors to the Gross Domestic Product (GDP) of the Country. This sector forms a part of around 8.53% of the total GDP. Moreover, the growth rate of this sector is about 30% each year.

Therefore, due to the significant performance and growth rate, the government felt that there is an urgent need for some regulatory attention.

The structure of the Real Estate Act 2016 focuses on both the supervision and development of the Real Estate Sector. The key features of this are as follows:

- Capping on Realisation;

- Establishment of RERA;

- Establishment of Specialized Appellate Tribunals;

- Registration and Regulatory Authorities;

- Internal Audit and Valuations.

These features ensure effective, directed, and oriented implementation of this law in the country.

Growth Analysis of Real Estate Industry

As per a recent report published by IBEF[1] (India Brand Equity Foundation), the Indian Real Estate Industry is expected to cross the US $1 Trillion by the year 2030. Further, it is projected that this sector will increase its contribution to 13% of the country’s total GDP.

Also, as per a report published by STATISTA on 07.07.2020, the growth rate of the real estate sector was estimated to be 11.2% from the financial year 2015 to 2020.

Further, as per a report, named “India Real Estate Market Update Q1 2020”, published by the JLL, even though the COVID-19 pandemic has adversely affected the business activities in India, still there is a 3% rise in the new launch of the residential housing projects in comparison to last year.

Objectives of the RERA Act

The objectives of the RERA Act of 2016 are as follows:

- Regulate the Planned Development and Growth in the Real Estate Sector;

- Ensure Sale of Immovable Properties in a Transparent and Effective Manner;

- Safeguard Interest of Consumers;

- Deal with Every Matter related to Real Estate Sector.

Applicability of the Real Estate Act 2016

Normally, the provisions of the RERA Act 2016 are applicable to every builder, developer, and promoter, except the situations as follows:

- In case when the number of proposed apartments does not exceed the count of 8;

- The area of the proposed land does not exceed 500 sq meters;

- The promoter has received the certificate of completion before the implementation of RERA Act;

- In the case of Repair, Redevelopment, or Renovation as these do not involve advertising, marketing, selling, or allotment of any new plot, apartment, or building.

How can a Builder and Developer become RERA Compliant?

The factors to consider by a builder or developer to become RERA Compliant are as follows:

- Timely Project Registration;

- Proper Advertisement and Marketing;

- Withdrawal through POC method;

- Disclosures on Website;

- Carpet Area;

- Alteration in Project after the approval of 2/3rd allottees;

- Timely Audit of the Project Accounts;

- Needs to deposit 70% of the funds collected from allottees in the respective Project Account;

- Withdrawals to cover Land and Construction Cost;

- Withdrawals must be in proportion as per the Percentage Completion Method;

- Engineer, Chartered Accountant, and Engineer must certify the Withdrawal;

- Interest on the late payment will be the same for both Customer and Promoter.

Key Provisions of RERA to Benefits Home Buyers

The benefits of the Real Estate Act 2016 on the Home Buyers are as follows:

- Timely and quick grievance redressal;

- Clear and defined timelines for time-bound and faster dispute resolution between home buyers and builders;

- Cheaper cost of litigation as compared to NCLT (National Company Law Tribunal) and Consumer Court.

- A builder cannot take more than 10% of the apartment cost as Earnest or Advance Money;

- Compulsory registration of Real Estate Agents;

- The on-going project which has not received the Certificate of Completion needs to obtain registration within 30 days of the commencement of Real Estate Act 2016

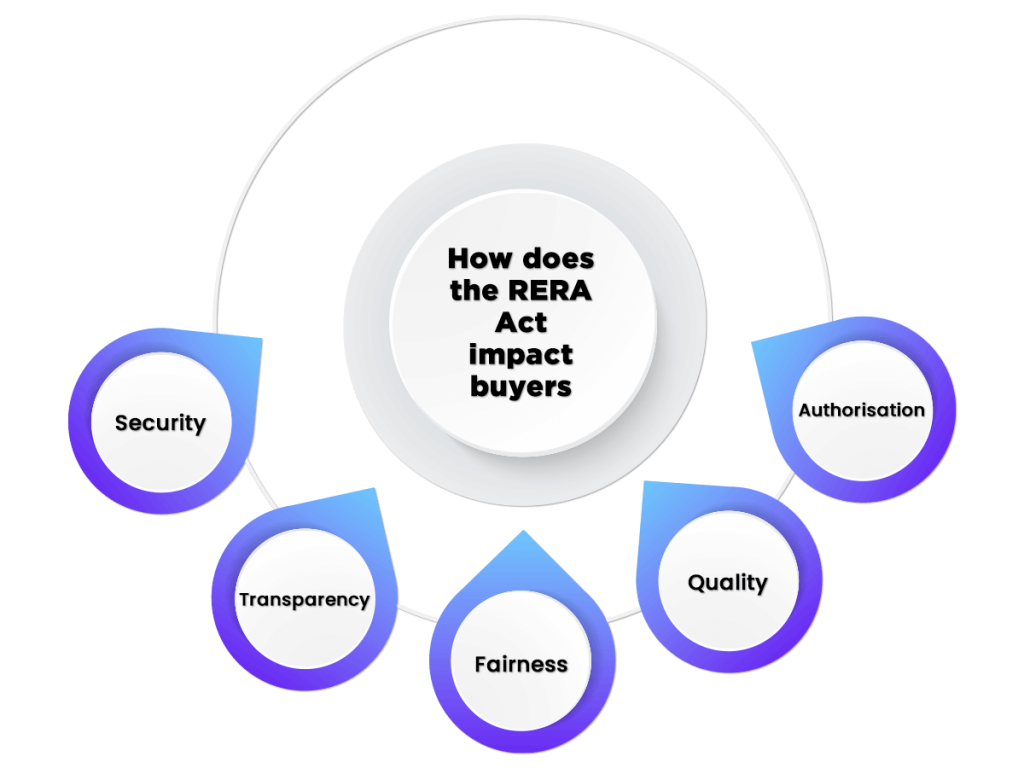

Impact of RERA Act on the Home Buyers

The impact of the provisions of the Real Estate Act 2016 on the home buyers are as follows:

- Security: As per the provisions of the Act, a builder needs to maintain a separate escrow account for depositing 70% of the amount collected from buyers. This account will confirm that the project will not use the money in other activities than the prescribed one. Further, a builder cannot demand more than 10% as the earnest money from the buyers.

- Transparency: A builder needs to provide the original documents for all the real estate projects he/she undertake. Further, a builder is not allowed to make any changes or modifications to the layout/ plan of the project without the prior consent of the buyers.

- Fairness: As per the Real Estate Act 2016, the builders and developers need to sell and advertise their project on the basis of the Carpet Area instead of the Super Built-up Area. In case of delay, the home buyer is eligible to claim a refund of the amount paid.

- Quality: A buyer has the power to raise issues and defects before the builder for a period of 5 years, starting from the date of purchase. Further, the builder is under an obligation to resolve the issue within 30 days starting from the date of notification.

- Authorization: A builder cannot market, book, advertise, and sell his/her project before obtaining registration from the RERA Authority.

When can a Buyer File RERA Complaint?

The situations in which a buyer can file a RERA Complaint under the Real Estate Act 2016 are as follows:

- Delay in Possession: In case a builder delays in giving possession, the home buyer has the right to file a complaint against the builder and also has the right to claim a refund, along with interest.

- False Advertisement: A buyer can file a complaint against the promoter, developer, or builder with the RERA Authority, if he/she was misled by the faulty advertisements due to which he/she decided to deposit money with the builder.

- Advance Payment: A builder cannot ask more than 10% of the apartment cost as the earnest money. However, if he still demands, the buyer has the power to file a complaint.

- Faulty Registration of the Project: A buyer can file a complaint against the builder if the real estate project is not properly or unregistered, and still, the builder is trying to sell the units.

- No Details regarding the Project: All the builders need to update their official website with the details regarding plan, layout, and government approvals for the project.

- Structural Defects: A buyer can file a complaint regarding the structural defects in the quality or workmanship with the RERA Authority. The builder will be under an obligation to pay compensation to the allottee.

- Ownership Transfer: A promoter or builder cannot transfer the majority of rights to any third party. If in case he/she is found of doing that without the consent of 2/3rd allottees, one can file a complaint regarding this with authority.

Documents to Obtain RERA Registration

The documents required to obtain RERA Registration under the Real Estate Act 2016 are as follows:

Business Details From Promoters

- Certificate of Registration;

- Chairman’s Name of the Governing body/ Partners/ Directors;

- Chairman’s Address of the Governing body/ Partners/ Directors;

- Date of Incorporation of the Company;

- Passport-sized Photograph;

- Registered Address of the Company;

- PAN Card of the Builder;

- Registered Email Id;

- A copy of the Company Identification Number (CIN);

- A copy of the Tax Deduction and Collection Account Number (TAN);

- Details of the prior Project experience;

- Previous financial year Audited Balance Sheet;

- Details of the Official Website;

- Previous 3 years Income Tax Return (ITR);

- Details about the previous real estate projects taken up in the last 5 years;

- Name of the Real Estate Project;

- Till date Status (Completed or Under Progress);

- Any pending case (if yes, then the case name and number).

Personal Details From Promoters

- Applicant’s Name;

- Father’s name;

- Occupation;

- Passport-sized photograph;

- Permanent Address;

- A copy of Aadhar card;

- An Audited Balance Sheet for the previous fiscal year;

- Promoter’s official website;

- Last 3 years Income Tax Return;

- PAN Card details;

- Builder’s Email Id.

Details From Real Estate Agent

- Name of the Applicant;

- Name of the Applicant’s Father;

- State;

- District;

- Tehsil;

- Permanent Address;

- Passport-sized Photograph;

- A copy of the PAN Card;

- Email Id;

- Registration fee (in Rs);

- Date of Making Payment;

- Bank Account Details;

The process to Obtain RERA Registration

Today, the process of obtaining RERA Registration has become completely online. That means the applicant just needs to visit the official website of the respective state in which he/she want to acquire registration. However, it is relevant to note that the process of registration varies from one to another state.

Procedure to File RERA Complaint

The steps included in the process to file a RERA Complaint under the Real Estate Act 2016 are as follows:

- Step 1: In the first step, the complainant needs to visit the official website of the respective state. For example, http://www.rera.mp.gov.in/complaint/ for filing a RERA Complaint in Madhya Pradesh and https://rera.delhi.gov.in/ for filing a RERA Complaint in New Delhi.

- Step 2: Now, click on the option saying “Online Registration” to create a Buyer Account. Without a buyer account, a person cannot file a RERA complaint against the Builder.

- Step 3: Next, the buyer needs to back on the Home window and then choose the option “Login”.

- Step 4: After clicking on the option, the buyer needs to enter the login credentials to access his/her account.

- Step 5: Now, he/she needs to click on the “Online Complaints” link.

- Step 6: The complainant will be redirected to the RERA Complaint form, wherein he/she requires filling the details asked. The term “details” include personal details, contact details, and project details. After that, the complainant needs to attach all the supporting documents.

- Step 7: After completing the form, the complainant requires to submit the prescribed fee of Rs 1000 for filing the case or Rs 5000 for filing it before the Adjudicating Officer. Further, the online mode of paying the fees is also acceptable.

Sample Format of RERA Complaint

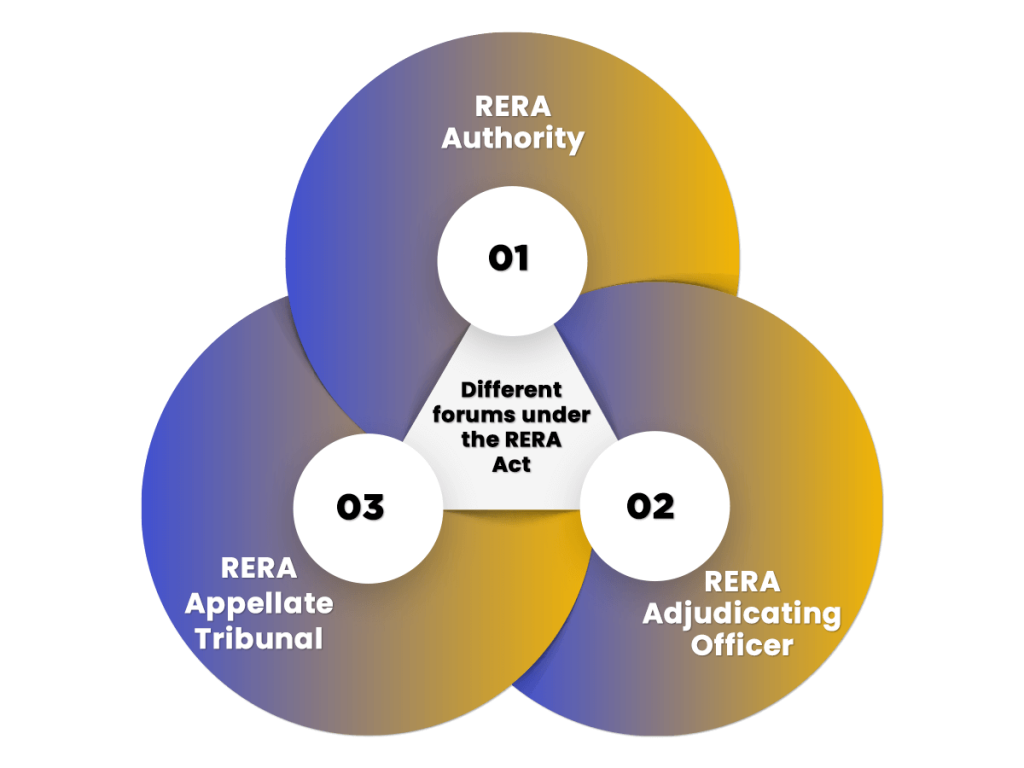

rera_Form-MDifferent Forums under the Real Estate Act 2016

The different forums for filing a RERA Complaint under the Real Estate Act 2016 are as follows:

- RERA Authority: RERA Authority was established by the Central Government to regulate Real Estate Industry. Further, this authority has the power to order investigations, levy penalties, and pass directions. It is mandatory for every state government to establish a RERA Authority in their state. Moreover, the power to grant RERA Registration is only with RERA Authority.

- RERA Adjudicating Officer: The reason behind the appointment of the Adjudicating Officer is to exercise powers, the jurisdiction conferred by the Act. An Adjudicating Officer has the power to award a remedy to the buyers in the cases as follows:

- Faulty Advertisement;

- Alteration and Modification in the Layout of the Project;

- Structural Defect;

- Delay in Delivery of Possession.

- RERA Appellate Tribunal: An appellate tribunal is constituted to hear the appeals against the decision or judgment passed by the RERA Authority, Adjudicating Officer, and Central Advisory Council. Further, the powers of the RERA Appellate Tribunal are the same of a Civil Court under the Code of Civil Procedure Act, 1908.

Penal Provisions under the RERA Act

The penal provisions under the Real Estate Act 2016 are as follows:

| Offences | Punishment Prescribed |

| In the case of Promoters | |

| Non-registration of the Real Estate Projects | 10% of the total estimated cost of the real estate project. |

| Furnishing Untrue and False Information | 5% of the total estimated cost of the real estate project |

| Violation of the provisions of the Real Estate Act 2016 | Imprisonment up to a period of 3 years, or a fine of 10% of the total estimated cost of the real estate project, or even both |

| In the case of Buyers | |

| Non-compliance with the Guidelines and Regulation specified in the RERA Act | Continuous Penalty up to 5% of the total estimated cost of the real estate project |

| Non-compliance with the Order, Directions, and Guidelines passed by the Real Estate Appellate Tribunal | Imprisonment up to a period of 1 year, or a fine of 10% of the total estimated cost of the real estate project, or even both |

| In the case of Real Estate Agents | |

| Non-Registration of the Real Estate Projects | Rs 10000 every day up to 5% of the total estimated cost of the real estate project |

| Non-compliance with the guidelines issued by the RERA | Day-to-day penalty up to 5% of the total estimated cost of the real estate project |

| Non-compliance with the order or the direction passed by the RealEstate Appellate Tribunal | Imprisonment up to a period of 1 year, or a fine of 10% of the total estimated cost of the real estate project, or even both |

Conclusion

Prior to the enforcement of the RERA Authority, there was nobody or authority which was responsible and accountable for monitoring the activities of the Indian Real Estate Sector. Therefore, after the implementation of the Real Estate Act 2016, this sector transformed to be more transparent from the end of builders, promoters, real estate agents, and developers.

Our Experts at Swarit Advisors will provide end-to-end assistance to both buyer and builder, i.e., in filing a RERA complaint with the RERA Authority, in short, RERA Advisory or obtaining RERA Registration.

or obtaining RERA Registration.

Read, More:Duties and Functions of RERA Authority