Gift Deed Registration: How to Draft a Gift Deed Format?

Shivani Jain | Updated: Sep 17, 2020 | Category: Agreements

The term “Gift Deed Registration” denotes the registration of a legal document that assists in transferring an asset as a gift from one person to another. Further, the word “Gift” signifies the Transfer of Ownership, and it includes both Immovable and Movable Property.

In this blog, we will discuss the concept of Gift Deed Registration, together with the process of drafting a Gift Deed Format.

Table of Contents

Concept of a Gift Deed

The term “Gift Deed” is defined under section 122 of the Transfer of Property Act 1882. It is a legal document that denotes the transfer of a property from one person to another. The parties involved in the process of transfer are the Donor (one who gifts a property) and Donee (one who receives the property).

Further, as per section 17 of the Registration Act 1908, it is compulsory for the donor to get the gift deed registered for transferring an Immovable Property. The donor can obtain Gift Deed Registration from the Sub-registrar Office.

Who is Eligible to Gift a Property?

Every individual who is above the age of 18 years and is of sound mind can make a gift of a property. That means a minor is not eligible to make a gift of a property, but he is qualified to accept or receive a gift.

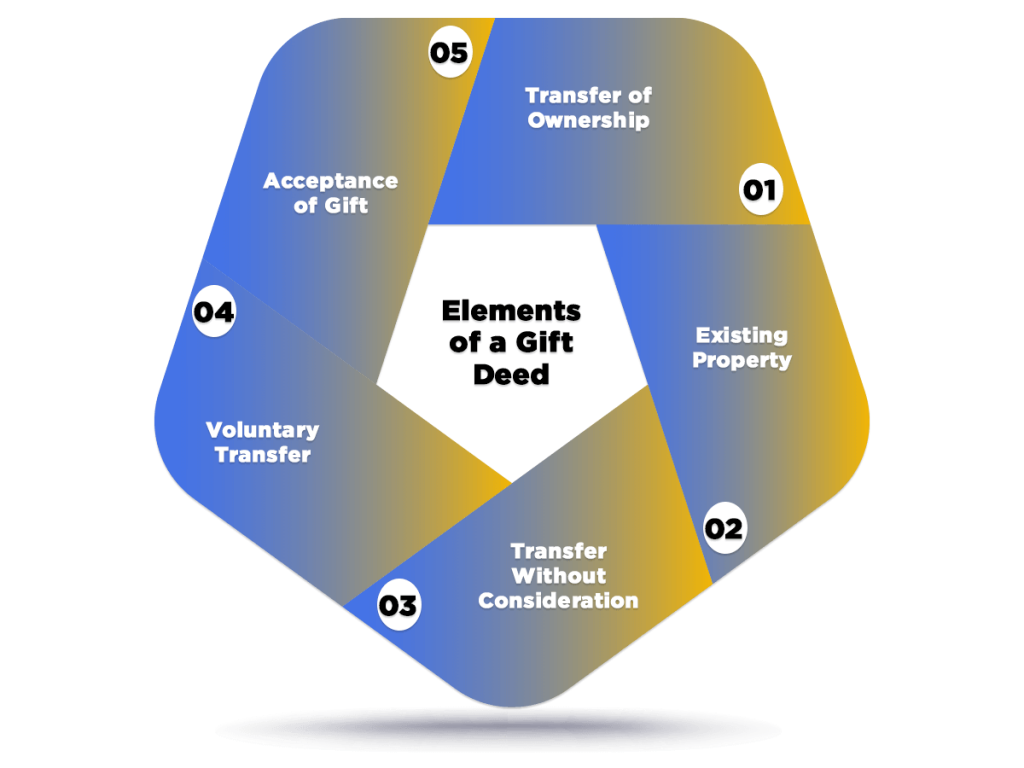

Elements of a Gift Deed

The five main elements of a Gift Deed are as follows:

Transfer of Ownership

The term “Transfer of Ownership” denotes that a Donor is ready to vest the absolute interest of the transferee in the property. Further, the term “Absolute Interest” signifies that all the rights and liabilities of a donor regarding the property are now transferred to the donee.

Existing Property

For a gift deed, the term “property’ includes the different types of property as follows:

- Movable;

- Immovable;

- Tangible; or

- Intangible;

However, it shall be relevant to note that at the time of transferring the property must be in existence and must be of transferable nature as per section 5 of the Transfer of Property Act.

Further, the properties that are not eligible to be transferred as a gift are as follows:

- Future Property;

- Spes succession;

Transfer Without Consideration

The property transferred as a Gift must be of “Gratuitous” nature. That means the donor needs to transfer the ownership of property without any consideration.

Further, the term “Consideration” will have the same meaning as defined under section 2 (d) of the Indian Contract Act.

Voluntary Transfer

The term “Voluntary Transfer” signifies that the donor is ready to transfer the ownership of his/her property with free will and consent.

Further, the term “Free Will and Consent” denotes that the donor is transferring his/her property without any Fraud, Force, Undue Influence, and Coercion.

Acceptance of Gift

In order to complete the process of a Gift, it is necessary for the donee to accept the gift. That means a donor cannot gift a property against the will of the donee.

Further, the cases in which a donee has a right to refuse a gift are as follows:

- Non-beneficiary Property;

- Onerous Gifts;

Moreover, the term “Onerous Gift” denotes a situation in which the burden of liability on a property is more than its actual market value.

Modes of Making a Gift

As per Section 123 of the Transfer of Property Act, it is mandatory to undergo formalities for the completion of a gift. The law prescribes two modes of registering a Gift Deed in India that are as follows:

- In the case of Movable Property;

- In the case of Immovable Property;

Movable Property

In the case of a Movable Property, there is no need to undergo the process of Gift Deed Registration. That means a mere delivery of possession is enough to complete the gift of movable property.

Immovable Property

In the case of an Immovable Property, it is mandatory for the donor to undergo the process of gift deed registration before delivering the possession of the property. That means the oral transfer of immovable property is not possible.

Clauses of a Gift Deed Format

The important clauses of a Gift Deed Format are as follows:

Consideration Clause

There is no consideration involved in the process of a gift. Moreover, it should be clearly specified in the gift deed that the ownership of a property has been transferred out of love and affection.

Possession of a Property

The donor must be the owner of the immovable property that he/ she want to gift. Moreover, the property in question must be in existence at the time of transfer, i.e., one cannot gift a future property.

Free Will

The term “Free Legal Will” signifies that the process of transfer of property must be free from any sort of threat, coercion, fear, or undue influence. Further, the gift deed format should clearly mention that the transfer is voluntary.

Details Regarding Property

A Gift Deed Format must have a detailed and specific description regarding the property in question. Further, the term “description” includes address, colour, structure, area, etc.

Relationship of the Parties Involved

One of the main elements of a Gift Deed Format is the relationship between the parties, i.e., the donor and donee, are connected through blood or not.

Further, it shall be pertinent to note that some of the state governments offer a special concession on the stamp duty if the gifts are made to the blood relations.

Rights and Liabilities

This section includes additional details, such as whether the owner of the property has the right to further sell or lease the property in question or not.

Donee Rights

A Gift Deed Format must specify the rights of the Donee. The term “rights” includes the points as follows:

- Right To Reside;

- Right To Peaceful Enjoyment;

- Right to Make Alterations in the Property;

- Right to Receive Rent from the Property;

- Right to Collect Profits accrued from that Property;

Delivery of Property

The delivery clause in a gift deed signifies whether the said transfer is implied or express, which will directly confirm the delivery of the possession.

Revocation Clause

It is not mandatory to include a revocation clause in a Gift Deed; however, the same is advisable to evade future complications.

Further, the nature of the revocation clause is express and not implied, and both the parties must accept the clause for undergoing the process of Gift Deed Registration.

Factors to Consider For Gift Deed Registration

The factors to consider for a Gift Deed Registration are as follows:

- The gifting property can be either movable, tangible, immovable, or Intangible;

- One can obtain Online Gift Deed Registration from the Sub-Registrar’s Office;

- The donor must transfer the property out of Free Will and Consent;

- The Donee can accept a Gift only during the lifetime of the donor;

- One cannot transfer property to an Unborn Child;

- Both Donor and Donee needs to be alive during the process of Gift;

- The Donor of the Gift must be above 18 years of age;

Process to Draft a Gift Deed

The steps involved in the process to draft a Gift Deed are as follows:

Draft a Gift Deed

In the first step, the parties involved in the process of gift need to draft a Gift Deed with the details as follows:

- Date of Execution of Deed;

- Place of Execution of Gift Deed;

- Details of the Donor, such as Name, Date of Birth, Residential Address, etc.;

- Details of the Donee, such as Name, Date of Birth, Residential Address, etc.;

- Details regarding the Relationship between the Parties involved;

- Details of the Property in question;

- Name of the two witnesses;

- Signature of the Donor and Donee;

- Signature of the Witnesses;

Print the Gift Deed

In the next step, the donor needs to get the drafted deed printed on a Stamp Paper with the accurate Stamp Duty depending on your state.

Register the Gift Deed

Lastly, the parties involved in the process of Gift needs to get the deed registered at the Sub-registrar Office by the Sub-registrar.

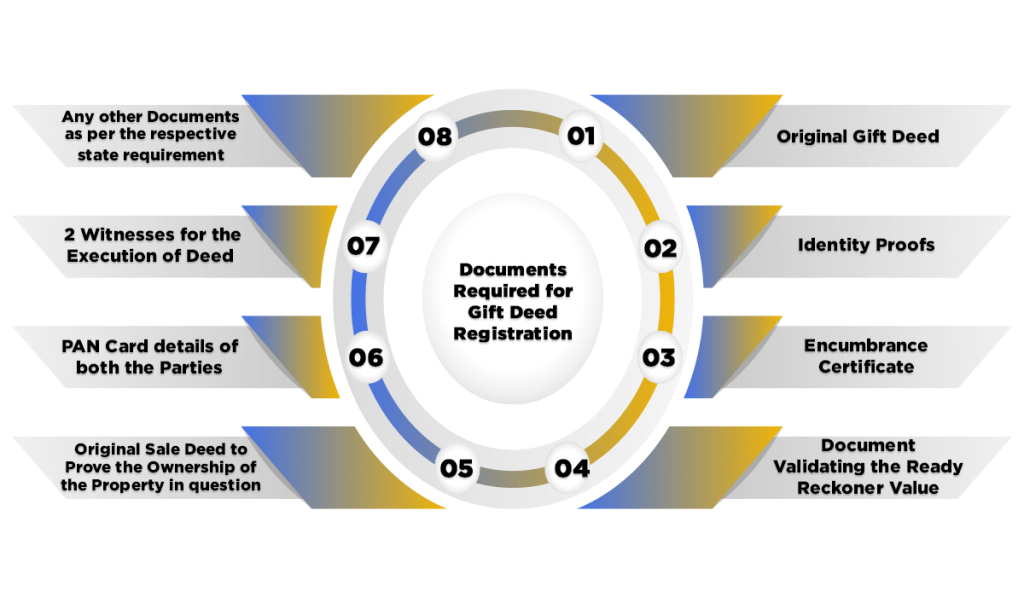

Documents Required for Gift Deed Registration

The documents required for the Gift Deed Registration are as follows:

- Original Gift Deed;

- Identity Proofs, such as Passport, Driving License, etc;

- Encumbrance Certificate;

- Document Validating the Ready Reckoner Value;

- Original Sale Deed to Prove the Ownership of the Property in question;

- PAN Card details of both the Parties;

- 2 Witnesses for the Execution of Deed;

- Any other Documents as per the respective state requirement;

Stamp Duty for the Execution of Gift Deed

The Stamp Duty Charges in some of the major states in India are as follows:

| State | Stamp Duty |

| Delhi | Women: 4% of the Actual Market Value of the Property; Man: 6% of the Actual Market Value of the Property; |

| Uttar Pradesh | Women: 6% of the Total Value of the Property; Man: 7% of the Total Value of the Property; |

| Karnataka | 5.6% of the Total Land Value if the Transfer is made to non-family members; However, in the case of family members, the same can range from Rs 1000 to Rs 5000 depending upon the location of the property; |

| Maharashtra | Family Members: 3% of the Actual Market Value of the Property; In the case of Relatives: 5% Actual Market Value of the Property; however, if an Agricultural land or a residential property is gifted, then the stamp duty charged is Rs 200; |

| Gujarat | 4.9% of the Actual Market Value of the Property; |

| West Bengal | Family Members: 0.5% of the Actual Market Value of the Property; In other cases: 6% of the Actual Market Value of the Property; 1% surcharge is charged if the value of the property is above Rs 40 lacs; |

| Tamil Nadu | Family Members: 1% of the Actual Market Value of the Property; Other relatives: 7% of the Actual Market Value of the Property; |

| Punjab | In case of a blood relative: No Stamp Duty is Charged; Else 6% of the Actual Market Value of the Property; |

| Rajasthan | Women: 4% of the Actual Market Value of the Property; In case of SC/ST or BPL: 3% of the Actual Market Value of the Property; Man: 5% of the Actual Market Value of the Property; Wife or daughter: 1% of the Actual Market Value of the Property; In case of a close family member, such as son, daughter, father, mother, in-laws, grandson or granddaughter: 2.5% of the Actual Market Value of the Property; |

Revocation of Gift Deed Registration

Normally, a gift deed that is not based on fraud, coercion, undue influence cannot get cancelled. However, after the completion of the process of a gift, a deed can be revoked only some situations.

As per section 126 of the Transfer of Property Act 1882[1], a registered gift deed can only be revoked in the situations as follows:

- If there is any previous agreement between the parties, i.e., donor and donee declaring that on the happening of certain events, a gift can be revoked;

- The event should be based on the mere will and consent of the donor;

- The conditions specified are not only illegal but immoral and repugnant to the property in question under the gift;

- A valid reason must be specified based on which a Gift Deed may be rescinded.

Conclusion

Whenever a property is transferred or delivered to another person in the form of a Gift Deed, there is a movement in ownership that is duly protected by law. Further, a Gift Deed acts as legal proof of transfer of property from the donor to the donee.

Once an immovable property is transferred or delivered through the registered gift deed, the donor becomes not eligible to claim it back unless he/ she proves that the same was done under the effect of threat, coercion, undue influence, or against his/ her will. Moreover, if in case a donee does not accept a gift, then a donor cannot force him/ her to take it.

Further, the asset received under a Gift Deed can be sold as well unless attached by any pre-condition.

Therefore, it is right to state that the transfer of property through gift deeds is one of the best-suggested options available; however, it is better to take the assistance from the professionals to make a transfer.

Performa of a Gift Deed Format

sample-gift-deedRead, Also: Partnership Deed Format: A Guide to Draft Partnership Deed?