Format of Shareholders Agreement: Its Concept and Clauses

Shivani Jain | Updated: Oct 16, 2020 | Category: Agreements

The term “Format of Shareholders Agreement” denotes an agreement that aims to protect the investment made by the shareholders by creating a Transparent and Fair relationship between the Shareholders and the Company.

Further, the Shareholders Agreement provides the Rights and Duties of the Shareholders, together with the Provisions for the Protection of the Minority Shareholders.

In this blog, we will discuss the concept of Format of Shareholders Agreement and its Clauses.

Table of Contents

Concept of Shareholders Agreement

As the name suggests, the term Shareholders Agreement denotes an agreement signed between the shareholders of the company. It acts as the basis on which a company is incorporated. Further, it defines all the rights and duties of the shareholders of a company.

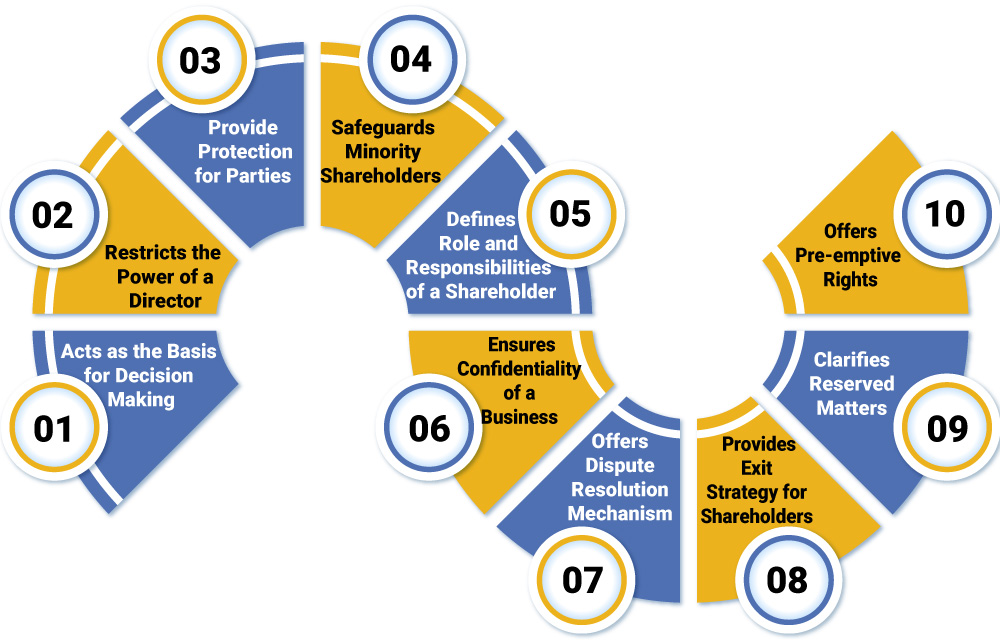

Need of Shareholders Agreement

The need of the Format of ths can be summarised as:

- Acts as the Basis for Decision Making;

- Restricts the Power of a Director;

- Provide Protection for Parties;

- Safeguards Minority Shareholders;

- Defines Role and Responsibilities of a Shareholder;

- Ensures Confidentiality of a Business;

- Offers Dispute Resolution Mechanism;

- Provides Exit Strategy for Shareholders;

- Clarifies Reserved Matters;

- Offers Pre-emptive Rights;

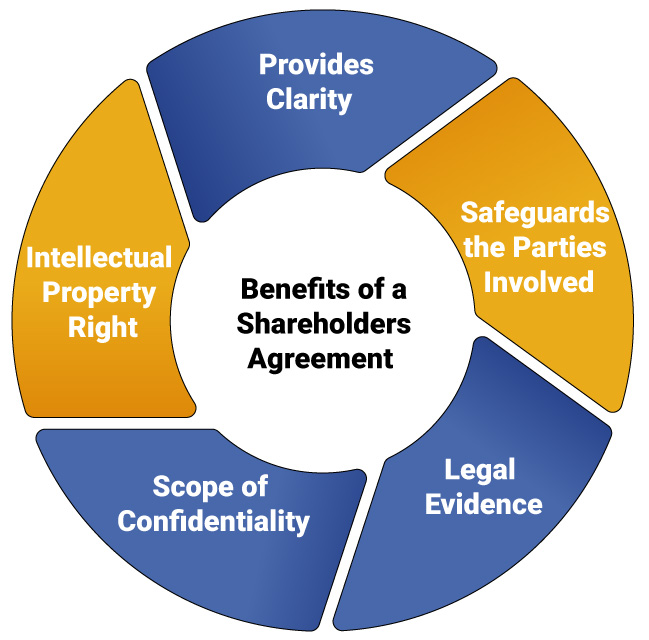

Benefits of a Shareholders Agreement

The Benefits of the Format of Shareholders Agreement are as follows:

Provides Clarity

A Shareholders Agreement involves a detailed explanation regarding the nature of work and the relationship shared between the shareholders and the company. That means it will assists in reducing the chances of future confusion and disputes.

Safeguards the Parties Involved

It clearly and expressly defines the rights, duties, roles, and responsibilities of the parties, which ultimately reduces the scope of future disputes between the parties.

Legal Evidence

It acts as a Legal Evidence for the parties regarding their duties, responsibilities, and rights.

Scope of Confidentiality

All the details that are of confidential nature between the parties are covered under the Clause of Confidentiality.

Intellectual Property Right

This Agreement will clearly include the details regarding the ownership rights and usage rights of the trademark or trade name. That means it will clearly establish the rights of parties involved.

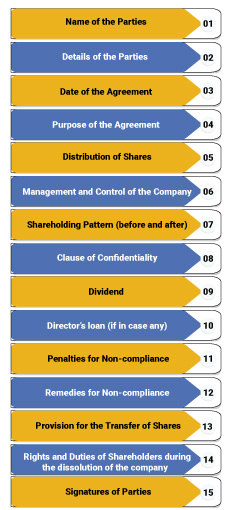

Essential Components of a Shareholders Agreement

The components to be involved in this Agreement are as follows:

- Name of the Parties;

- Details of the Parties;

- Date of the Agreement;

- Purpose of the Agreement;

- Distribution of Shares;

- Management and Control of the Company;

- Shareholding Pattern (before and after);

- Clause of Confidentiality;

- Dividend;

- Director’s loan (if in case any);

- Penalties for Non-compliance;

- Remedies for Non-compliance;

- Provision for the Transfer of Shares;

- Rights and Duties of Shareholders during the dissolution of the company;

- Signatures of Parties;

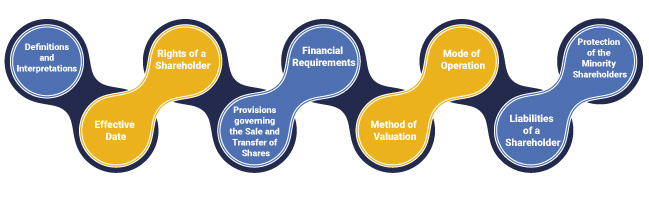

Clauses of a Shareholders Agreement

The clauses of the Format of Shareholders Agreement are as follows:

Definitions and Interpretations

A Shareholder Agreement needs to begin with the definitions and interpretation of the legal terms used in the agreement. Further, the word “Legal Terms” includes the terms like Agreement, Act, Affiliate, Article, Angel Investors, Confidential Agreement, CCPS, Equity Shares, Encumbrance Certificate, Reserved Matters, Transfer, etc.

Furthermore, the main aim of the clause is to reduce the chances of dispute and misconception between the parties.

Effective Date

The term “Effective Date” deals with the date on which the said agreement will come into force.

Rights of a Shareholder

The term Rights of Shareholders include the rights as follows:

- Right to Vote;

- Right to call a General Meeting;

- Right to Appoint Directors;

- Right to Appoint a Company Auditor;

- Right to have Copies of the Financial Statements of the Company;

- Right to Inspect the Books and Registers of the Company;

Provisions governing the Sale and Transfer of Shares

This clause includes all the rules and regulations regarding the Transfer of Shares, Protection of Shareholders Rights.

Financial Requirements

This clause includes the process and the modes for obtaining finances in a company. That means it assists in tracking the progress and growth of a company.

Method of Valuation

As we know the value of a share fluctuates as the market condition changes. So, to aid the proper preparation of the financial statements, the methods of valuation chosen by the company plays a significant role. Further, the different methods of valuation are as follows:

- Assets Approach;

- Income Approach; and

- Market Approach;

Mode of Operation

To ensure smooth and efficient managerial operations, a company needs to place certain procedures and policies. The Format of Shareholders Agreement[1] includes the guidelines and directions regarding the day to day affairs and workflow and also .

Liabilities of a Shareholder

The liability clause of a Shareholder Agreement includes the particulars as follows:

- A Shareholder will not be held liable for the company acts;

- A Shareholder can be made liable only to the extent of shares held by him/ her;

- In case a company is limited by shares, then a shareholder will be held liable only to the extent of shares held by him/ her;

Further, the main reason behind the limited liability of a shareholder is that a company enjoys the status of a separate legal entity, i.e., distinct from its shareholders.

Protection of the Minority Shareholders

The term “Minority shareholders” denotes those shareholders who do not benefit much in terms of powers and authority when it comes to the management and operations of the company.

However, it shall be relevant to state that after the introduction of the Companies Act, 2013, the rights of these shareholders have been given much significance. Further, the rights given to these shareholders in the Companies Act 2013 are as follows:

- In the case of Oppression and Management, the right to apply to the Board;

- Right to start a “Class Action Suit” against the Company and the Auditors;

- The need to appoint a Small Shareholder Director;

- In case the majority of shareholders want to sell their shares, then the rights of the minority shareholders must be included as well. Further, this concept is known as Piggy Backing.

Things to Remember While Drafting a Shareholders Agreement

The things to remember while drafting a Shareholders Agreement are as follows:

- It is important to understand the purpose and aim behind the Shareholders’ Agreement;

- It is used to create a balance of interests;

- All the terms and conditions of the agreement require to be clearly defined and expressed so as to avoid any further dispute and confusion;

- All the rights, roles, duties, and obligations of the shareholder and company must be specified in a concise manner;

- The agreement must be unquestionable bearing in mind the “Mutual Benefit” of both the company and the shareholders

- A Shareholder Agreement must set out all the policies, procedures and guidelines in a brief and coherent manner;

- All the matters defined in a shareholders’ agreement must be in accordance with the applicable laws in place;

Sample Format of Shareholders Agreement

SHAREHOLDER-AGREEMENTProcess to Draft a Format of Shareholders Agreement

The steps involved in the Process to Draft a Format of Shareholders Agreement are as follows:

- Consult an experienced advocate who has good drafting skills;

- Specify him/her the requirement for such an agreement;

- Once the advocate understands the aim of such an agreement, he/she will then draft a sample of Shareholders Agreement accordingly;

- Once the draft is duly prepared by the advocate, he/she will send the same for your review;

- Lastly, the entire process will take around a period of 3 to 4 days;

Conclusion

In a nutshell, the main reason behind the introduction of Shareholders Agreement was to improve the operations concerning the functioning of the company, and to offer a clarity and structure with respect to the relationship between the shareholders and company at any given point in time and also get your Online GST Registration done with us.

Further, a Shareholders Agreement helps in quick dispute resolution and leads to the smooth and undeterred working of the company and its operations.

Also, Read: Format of Share Purchase Agreement