Concept and Process for Temple Registration under NGO

Shivani Jain | Updated: Oct 24, 2020 | Category: NGO, Trust Registration

The term “Temple Registration” denotes the process for registering a place of worship as an NGO in India. Further, the term NGO signifies the registration of a worship place as either of the following:

- Trust;

- Society, and;

- Section 8 Company;

In this blog, we will discuss the concept of Temple Registration, together with different modes and process for obtaining registration in India.

Table of Contents

Concept of NGO Registration

The term NGO or Non-Governmental Organisation is a legal unit formed by natural persons. It operates independently without any government’s interference and works towards the welfare of public and social agenda.

Further, all the profits earned by an NGO are fully utilised towards its agenda and objectives. That means there will be no distribution of dividend among members.

Moreover, it shall be significant to state that an entity that has obtained either of the following registration will be termed as an NGO in India:

- Trust Registration;

- Section 8 Company Registration, or;

- Society Registration;

Therefore, for obtaining Temple Registration in India, the applicant needs to obtain registration under either of the modes mentioned above.

Concept of Temple Registration as Trust

In India, the basic prerequisite for obtaining Trust Registration is to draft a Trust Deed. That means the individuals who are forming a Temple needs to first draft a trust deed on a non-judicial stamp paper and then requires to visit the sub-registrar office for its execution.

Documents Required for Registering a Temple as Trust

The Documents required for Registering a Temple as a Trust are as follows:

- Trust Deed;

- Self-attested copies of Id Proofs, in the form of Aadhar Card, Passport, Voter ID, Driving License, etc.;

- PAN Card;

- Address Proof of the Place being used as Registered Office;

- NOC (No Objection Certificate) from the owner;

Process for Registering a Temple as Trust

The steps involved in the process to obtain Trust Registration from a Temple are as follows:

Choose a Name

In the first step, the members of a Trust needs to select an appropriate name for the Trust. Further, the term “Appropriate Name” denotes that the name chosen must be in accordance with the provisions of the Emblems and Names Act 1950.

Decide the Authors and Trustees

In the next step, there is a need to decide the number of authors and trustees. Usually, there is only one author of a Trust, but there is no upper limit provided for the maximum number of trustees. Also, it shall be pertinent to mention that an author cannot become the trustee of a Trust, and he/ she needs to mandatorily be a Resident of India.

Prepare MOA and Trust Deed

Now, there is a need for the members of a Trust to draft a Trust Deed, which will act as a Legal Evidence for the existence of a Trust. Further, all the laws concerning addition and removal of Trustees are covered under this document.

Also, they need to prepare an MOA or Memorandum of Association, which will act as the Charter for a Trust. Further, all the rules and regulations, duties, relationship, obligations, objectives, etc. are covered under this legal document.

Printing of Trust Deed on Stamp Paper

For obtaining Temple Registration, the applicant requires to get the trust deed printed on a non-judicial stamp paper. Further, the value of stamp paper must not exceed a certain percentage of the total value of the property.

Submission of Trust Deed

In this step, the applicant needs to submit a copy of the Trust Deed, together with the attested copy the necessary documents at the local office of the Registrar.

Issuance of the Certificate of Registration

In the last step, after the submission of the Trust Deed, the registrar will preserve a photocopy of the same and will return the original deed. After that, the registrar will issue a certificate of Trust Registration within a period of 7 business working days.

Concept of Temple Registration as Section 8 Company

The term Section 8 Company denotes a business format that is incorporated under the provisions of the Companies Act 2013[1] but works with the aim to promote science, art, commerce, sports, education, research, social welfare, charity, religion, and protection of nature or any such other similar object.

Further, if an applicant obtains Temple Registration by forming a section 8 company, then such an entity will not be allowed to distribute a dividend to its member and will be termed as a Non-profit Organisation.

Documents Required for Registering a Temple as Section 8 Company

The Documents Required for Registering a Temple as a Section 8 Company are as follows:

- PAN Card of all the Members;

- Aadhaar Card/ Voter ID Card/ Passport/ Driving License of all the Members;

- Latest Bank Statements for both Members and Company;

- Utility Bill in the form of Telephone Bill and Electricity Bill;

- Passport size photographs of all the members

- True Copy of the Rent Agreement, in case of the Rented Accommodation;

Process for Registering a Temple as Section 8 Company

The steps involved in the process to obtain Temple Registration by incorporating a Section 8 Company are as follows:

- In the first step, the applicant needs to apply for DSC (Digital Signature Certificate) and DIN (Directors Identification Number) for all the proposed directors;

- Now, the members of the proposed company need to apply for Name Approval with the MCA (Ministry of Corporate Affairs), and also needs to check the name availability for NGO Registration;

- In the next step, the members of the company need to draft an MOA and AOA;

- After that, they require to file an application in form INC 12 to the ROC (Registrar of Companies) for the incorporation of a Section 8 Company;

- Lastly, after the proper verification of the documents submitted and the application filed, the ROC will issue a Certificate for NGO Registration;

Concept of Temple Registration as Society

The term Society denotes a group of individuals who decide to work together for achieving a common aim. Further, society needs to be registered under the provisions of the Society Registration Act 1860.

Also, it shall be relevant to state that, only after obtaining registration under the provisions of the Society Registration Act, society becomes a legal entity.

Documents Required for Registering a Temple as Society

The Documents required for Registering a Temple as a Society are as follows:

- Name of the Society;

- Address Proof for the premise being used as Registered Office;

- Identity Proof for all the Members in the form of Aadhar Card/ Driving License/ Passport/ Voter ID, etc.;

- Two copies for Memorandum of Association (MOA);

- Two copies for Society By-Laws;

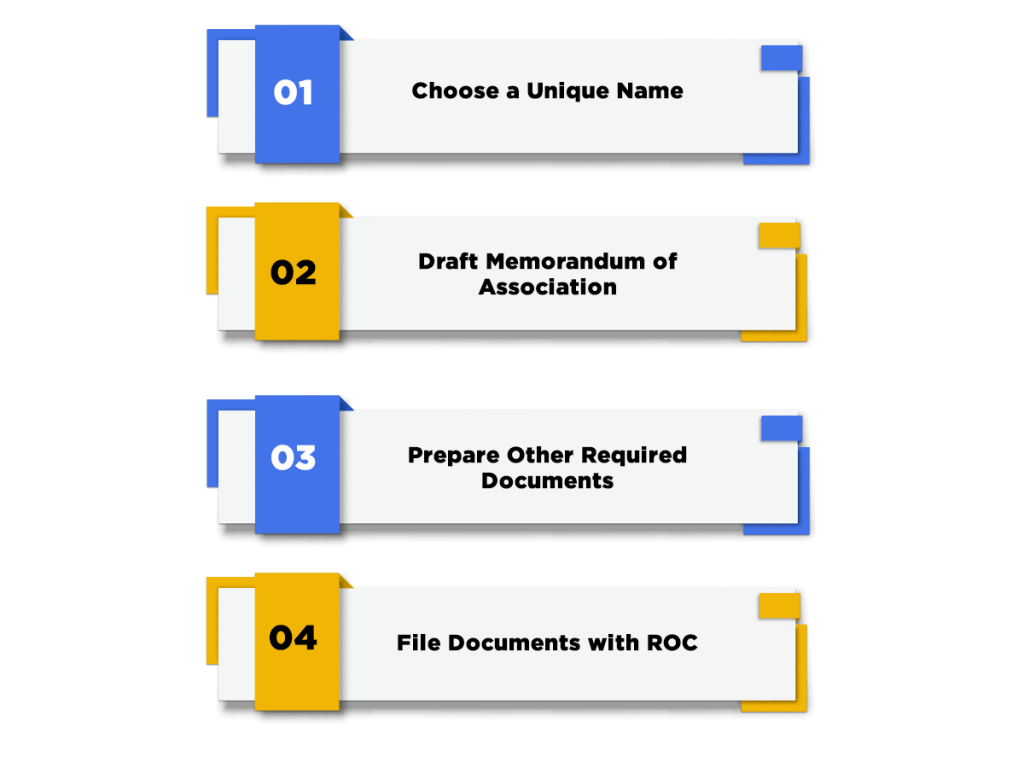

Process for Registering a Temple as Society

The steps involved in the process to obtain Temple Registration by incorporating a Society are as follows:

Choose a Unique Name

In the first step, the applicant needs to apply for the unique name of the proposed society. Further, the term “unique” denotes a name that is neither deceptive in nature nor identical to any existing name.

Also, it shall be significant to mention that if an applicant decides to select an existing name, then he/ she needs to apply for the same in written form with the Registrar.

Draft Memorandum of Association

Now, in the next step, the members of the society require to get the MOA drafted by an experienced professional. Further, an MOA acts as the Charter for the society and includes all the rules and regulations concerning it.

Also, an MOA must contain details like Name Clause, Objectives Clause, Registered Office Clause, etc.

Prepare Other Required Documents

Now, the applicant requires to draft all the documents required for the process of Society Registration. After that, he/ she requires to attach the same with the application for registration.

File Documents with ROC

In the last step, the applicant requires to furnish all the documents with the ROC, together with the fees prescribed. Also, if the registrar is satisfied with the documents and application filed, he/she will declare the said society as registered.

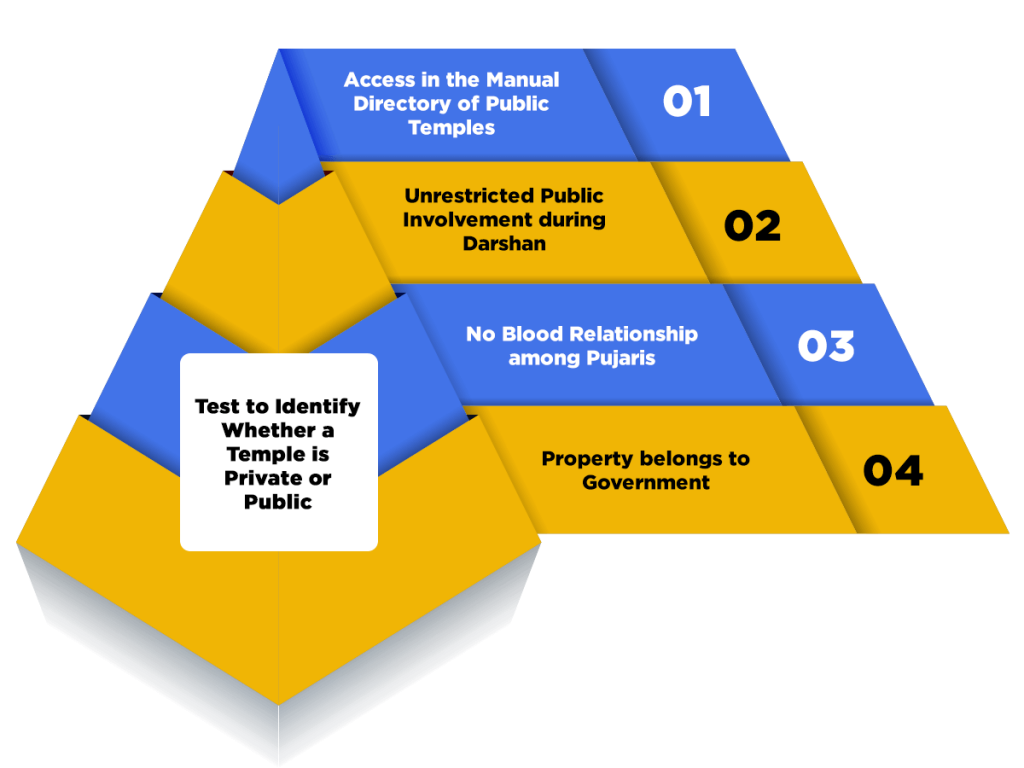

Test to Identify Whether a Temple is Private or Public

As per the clarifications made by the Justice R. Bhanumati and Justice Subash Reddy, the steps included in the test to Identify whether a Temple is Private or Public are as follows:

Access in the Manual Directory of Public Temples

If a temple has been documented in the Mandatory Directory of Temples issued by the respective state government, the same will be termed as Public Temple.

Unrestricted Public Involvement during Darshan

If in case there is an unrestricted public involvement during the time of darshan in the temple, then the same will be termed as a public temple.

No Blood Relationship among Pujaris

In case a temple is private in nature, then the same would be of hereditary and ruled by the beliefs of Hindu Succession, i.e., marriage, blood, and adoption.

The property belongs to Government

In case the land on which the temple is made belongs to the government, then the pujari does not have the right to object its administration.

Conclusion

In a nutshell, Temple Registration is a concept that usually features all over the place. There are also several benefits attached to the registration of the temple, such as safety and security of public money, various tax exemptions, protection against liquidation, etc.

Also, Read: Society Registration for Schools