An Analysis of Debentures issued as Collateral Security

Dashmeet Kaur | Updated: May 08, 2020 | Category: Issue of Debentures

Insufficient funds are imperative for any business, whether small or large. Several companies either issue debentures to the public in exchange for money or takes loans from banks by issuing debentures as collateral security. Collateral security implies the supporting security for a credit, which can be realized by the creditor if there is any default in repayment of the original loan. A company’s debentures issued as collateral security is a secondary security for the original loan taken. Banks can realize the collateral security or debenture’s amount in this case, if the company fails to repay the original loan. This write-up will act as a complete guide about issuing debentures as collateral security and accounting treatment.

Table of Contents

An overview of Debentures

Debentures, in simple terms, refer to a debt instrument that is raised to meet the long-term capital needs. In case of debts, a debenture has two fundamental features of periodic payment of interests and repayment of the loan at a specified point of time.

Debentures include bonds, stocks, and other securities of a company. It is the type of document which acknowledges the borrowed money or loan. It outlines all the terms and conditions of the loan, redemption of the loan, payment of interest, securities offered by the company.

The debentures are also considered as a long-term source of finance. It is a form of long-term loan or bond which is issued by the company that incurs from a shortage of capital. The debenture usually carries a fixed rate of interest throughout a loan.

For investors, the debenture is a secure mode of investing in a company than investing in shares as the companies have to pay interest. Besides, the debentures issued as collateral security ensures the investment even in case of default payments. However, the debenture holders do not have any share in the company itself.

Salient Features of Debentures

Following are some fundamental characteristics of debentures that make them a suitable form of long-term borrowing for the companies:

- Debentures are the debt instruments, and the person who holds them becomes the creditor of the company.

- A debenture is the certificate of debt that entails the details like amount of repayment, interest to be paid, and date of redemption. This certificate is issued under the Company Seal.

- Debentures are issued on a fixed rate of interest that is payable either half-yearly or annually.

- As the debenture holders are the creditors of the company and not owners, so they don’t get any right to vote in the company’s general meeting. However, the debenture holders may leverage separate rights in regards to changes in debentures.

- The interest paid on debentures is charged against the profit of the company. Hence, companies are legally obliged to pay the interest on due dates irrespective of their level of earnings.

Debentures issued as Collateral Security for Loans

In general, the collateral security or secondary security is a security that can be realized by the party holding it, if the loan amount is not paid at the stipulated time or as per agreement sealed between the parties.

When a company or borrower issues debentures as collateral security for the loan, the nominal value of such debentures is always more than the lending amount. The debentures issued as collateral security are automatically redeemed by the company when it pays off the loan taken.

If a company takes a loan or borrow some money, then it needs to provide a document to its creditor which will act as evidence for the terms of the loan. This document is called a debenture.

The debenture specifies a capital sum borrowed, which is repayable at a prescribed future date.

During the period of loan taken, the company has to pay a fixed interest to the creditor. Often creditors take charge over some or all assets of the concerned company to improve the chance of recovering the debt in case the company becomes insolvent.

Accounting Treatment for the Debentures issued as Collateral Security

There are two methods of issuing debentures as collateral security stated in the accounting books:

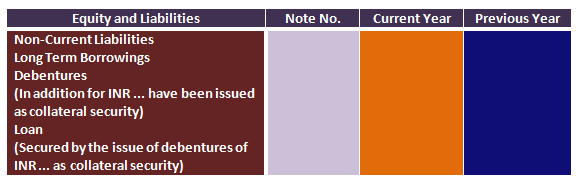

- First Method- In this method, the companies do not make any journal entry in the account books during of issue of the debentures. Besides, the company appends a note below the loan on the liabilities side of the balance sheet. It indicates that the loan has been secured by the issue of debentures. Such note shall be represented in the balance sheet, as shown below:

Balance Sheet (Extract)

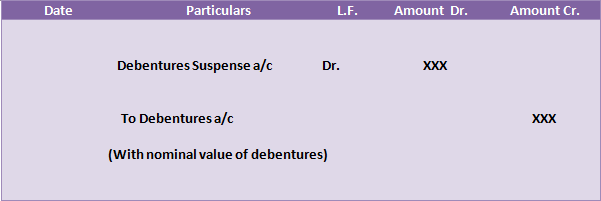

- Second Method- In the other method, the debentures issued as collateral security is recorded by making the following journal entry:

Journal Entry

The Debentures Suspense Account shall appear on the assets side of the balance sheet while the Debentures will be on the liabilities side. Once the company repays the loan, this entry will get reversed in order to cancel it.

Types of Debentures based on Security

There are two forms of debentures which are classified on the basis of security:

- Secured Debentures- This type of debentures are secured fully or partially by a charge over the fixed assets of the issuer company. When the company fails to pay the principal or interest amount, its assets can be sold to repay the liability to the investors.

- Unsecured Debentures or Naked Debentures– Unlike the secured debentures, unsecured debentures are not supported by a collateral security. Therefore, no particular assets of the company shall be set aside against the unsecured debentures. Basically, it is a loan without any protection and is backed only by the creditworthiness of the issuer company.

What are the conditions for issuing Secured Debentures?

Here is the list of prerequisites that a company must meet before issuing secured debentures:

- The company must issue secured debentures with the date of the redemption less than 10 years from the date of issue.

- Secured debentures shall be issued by creating a charge.

- The company must appoint a debenture trustee and execute the debenture trust deed before the issue of prospectus.

- The charge created must be in favor of a debenture trustee.

- Debenture trust deed needs to be in format SH-12.

Advantages of issuing Debentures

Issue of debentures serves various benefits to the company as well as to the investors. Let’s look at some of its advantages:

- Debentures cater to the long-term funds needs of the company.

- The rate of interest payable on debentures lower as compared to the rate of dividend paid on shares.

- The interest imposed on debentures is a tax-deductible expense, thus the effective cost of (debt-capital) debentures is much lower than the ownership securities wherein dividend is not a tax-deductible expense.

- Debt financing through debentures does not result in the dilution of control as the debenture holders are deprived of any voting rights.

- The companies can trade on equity by mixing debentures in their capital structure, thereby, increase their earnings per share.

- Many companies prefer to issue debentures because of the fixed rate of interest associated with them irrespective of any changes in the price levels.

Advantages of issuing Debentures from Investors point of view:

- Issue of debentures provide a regular, stable, and fixed source of income to the investors.

- Numerous investors choose debentures because of a definite maturity period.

- The debentures issued as collateral security are comparatively a safer investment. Since the debenture holders levy a specific or floating charge on the assets of the issuer company, so they avail the superior power in the case of the company’s liquidation.

- The debenture is a more liquid investment and allows investors to mortgage or sell his/her instrument to acquire loans from the financial institutions.

- The interest of debenture holders is protected by stringent provisions under the debenture trust deed and guidelines issued by the (SEBI) Securities and Exchange Board of India.

Conclusion

Debentures are certainty a robust debt instrument for the companies. It creates a win-win situation for both the lenders and borrowers. The debentures issued as collateral security helps the bank to gain authority during the insolvency of the issuer company.

If you also want to issue debenture to raise capital for your company, take legal assistance from Swarit Advisors. Our legal experts will help you set terms of issuance and prepare the essential documents needed for the issue of debentures.

Also, Read: How a Company Issue Debentures to Public?