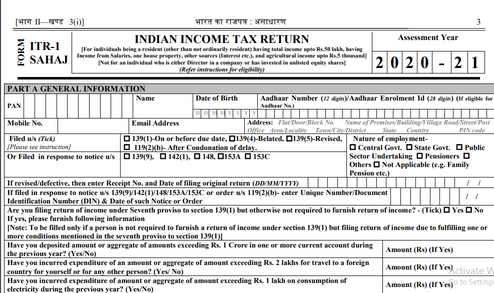

Form ITR 1: Changes made for the Assessment Year 2020-2021

Shivani Jain | Updated: Aug 28, 2020 | Category: Income Tax, News

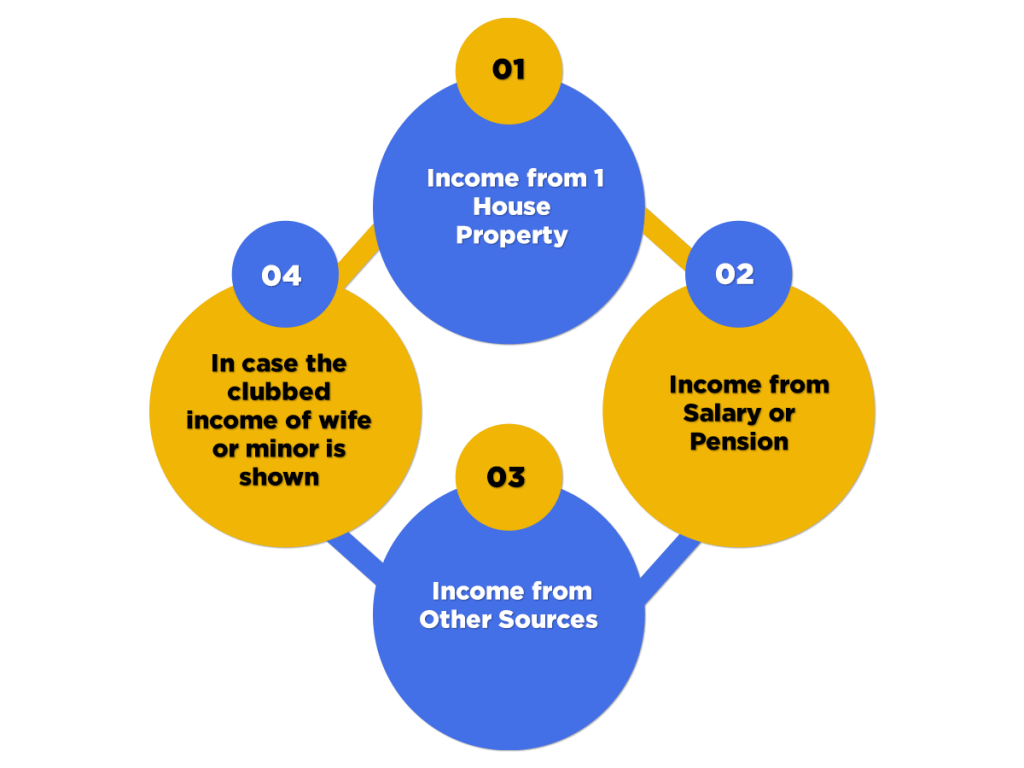

The term “Form ITR 1” denotes an Income Tax Form filed by the individuals who are Resident other than Not Ordinarily Resident and having Annual Income up to Rs 50 lakhs. The term “Annual Income” includes income from the following:

- Salaries;

- Agricultural Income up to Rs 5000;

- House Property; and

- Other Sources

Further, another name of this form is “Sahaj”. Moreover, it shall be significant to note that submitting PAN Card and Aadhar Card details have now been made compulsory by the Income Tax Department.

In this article, we will discuss in detail the changes made by the IT Department in Form ITR 1, together with the procedure for filing it.

Table of Contents

Eligibility Criteria for Form ITR 1

Form ITR 1 is filed by those individuals who have an annual income up to Rs 50 lakhs from the sources as follows:

- Income from 1 House Property (applicable to the case where losses of the previous year are carried forward but are not included in the ITR);

- Income from Salary or Pension;

- Income from Other Sources;

- In case the clubbed income of wife or minor is shown, then Form ITR 1 can only be filed if the source of their income is stated in the points mentioned above.

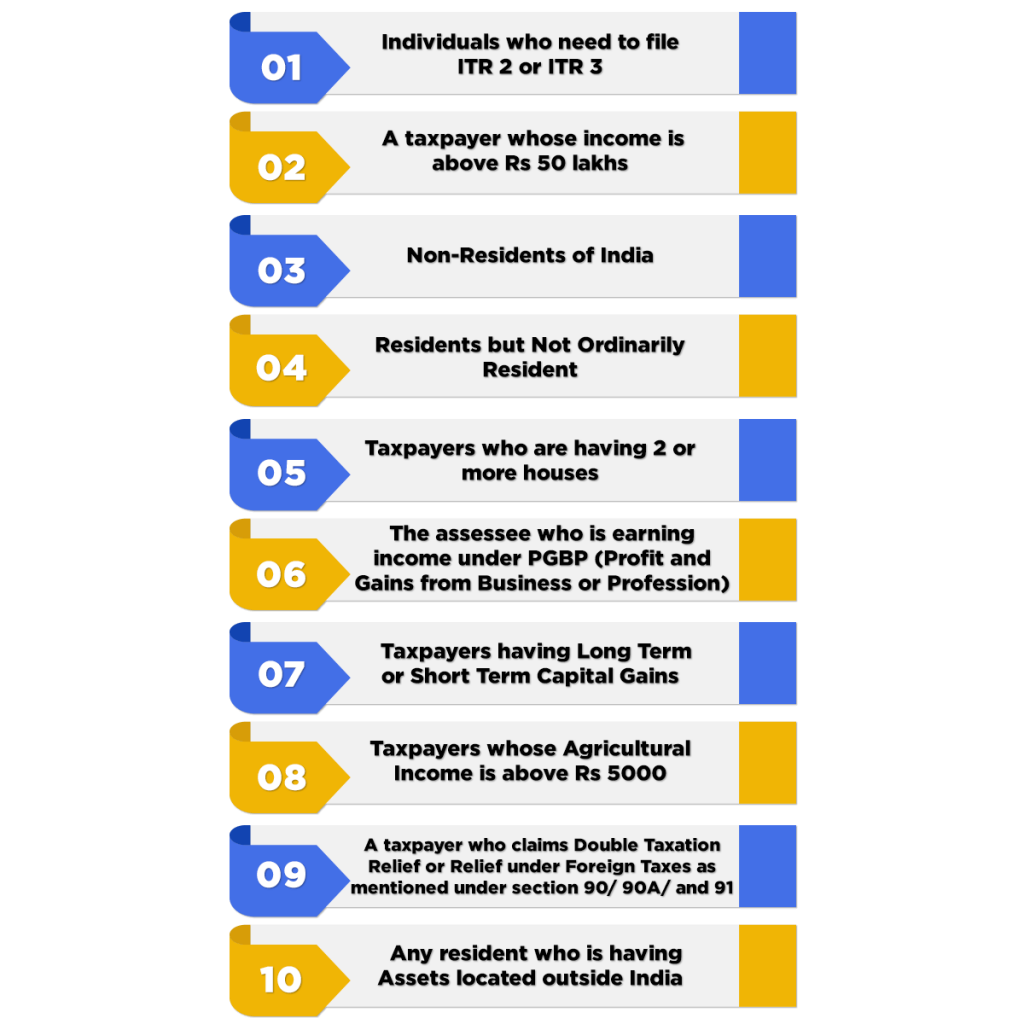

Who are all Not Eligible to File ITR 1?

The entities not eligible to file ITR 1 are as follows:

- Individuals who need to file ITR 2 or ITR 3;

- A taxpayer whose income is above Rs 50 lakhs;

- Non-Residents of India;

- Residents but Not Ordinarily Resident;

- Taxpayers who are having 2 or more houses;

- The Assessee who is earning income under PGBP (Profit and Gains from Business or Profession);

- Taxpayers having Long Term or Short Term Capital Gains;

- Taxpayers whose Agricultural Income is above Rs 5000;

- A taxpayer who claims Double Taxation Relief or Relief under Foreign Taxes as mentioned under section 90/ 90A/ and 91;

- Any resident who is having Assets located outside India.

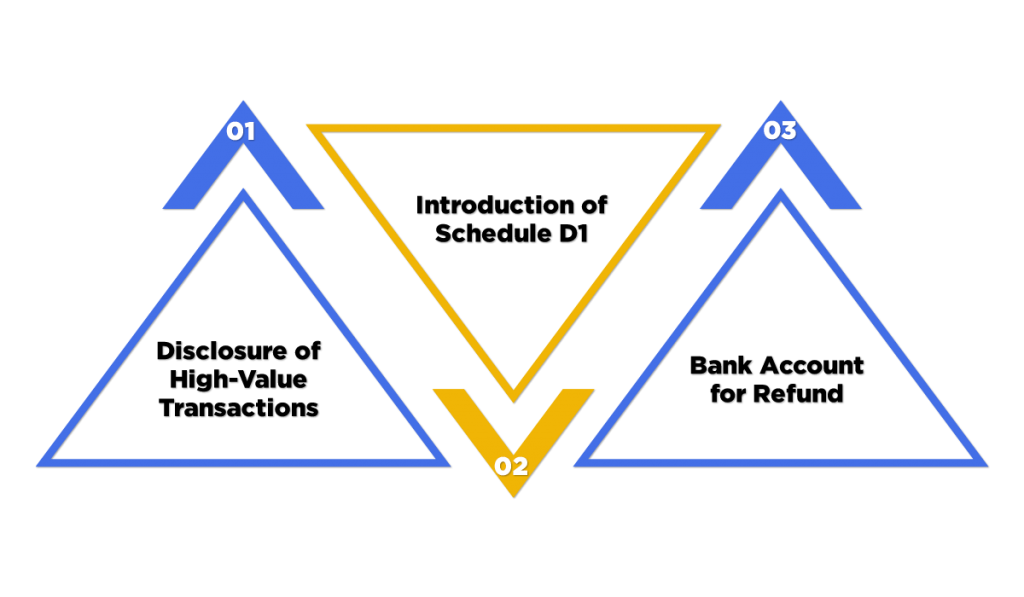

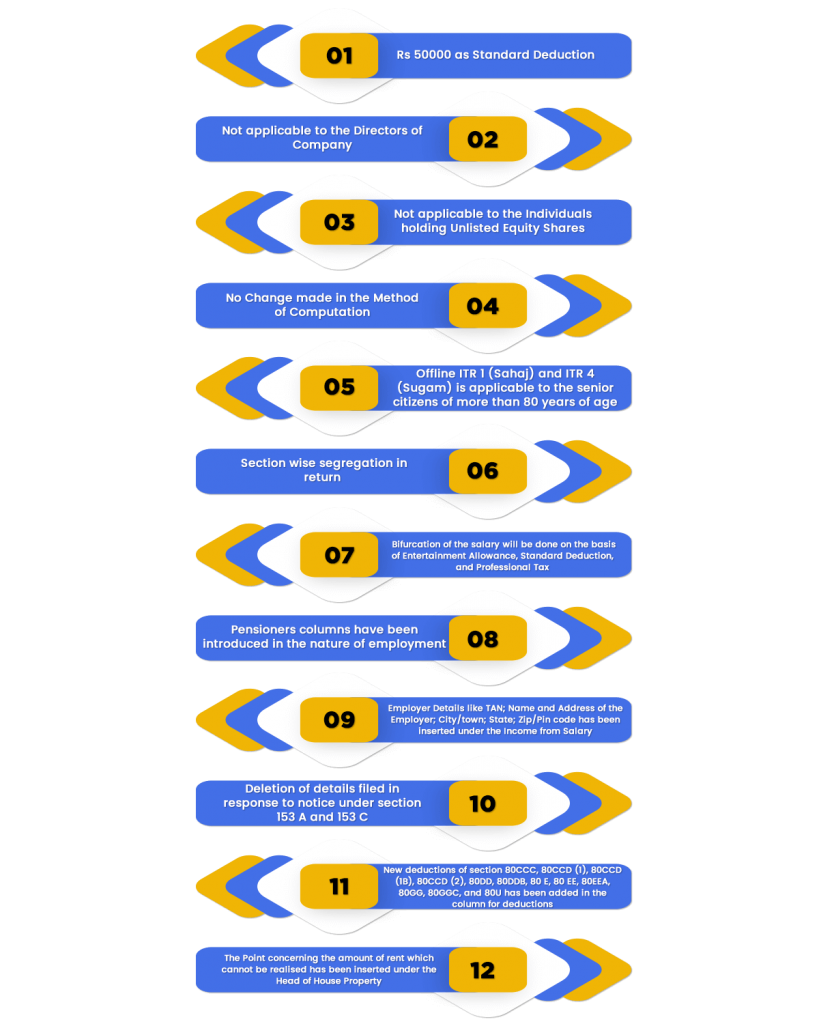

Latest Amendments Made in Form ITR 1: Sahaj Form

The changes made by the Income Tax Department in ITR 1 (Sahaj) are as follows:

Disclosure of High Value Transactions

Under Part A of the ITR 1, a taxpayer now needs to fill additional information under 7th Proviso of section 139 (1) of the Income Tax Act. Such additional details are as follows:

- If the taxpayer has deposited more than Rs 1 crore in one or more Current Bank Accounts;

- If the taxpayer has incurred more than Rs 2 lakhs on Foreign Travelling;

- If the taxpayer has incurred more than Rs 1 lakh on Electricity Consumption;

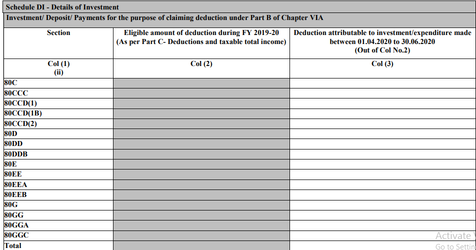

Introduction of Schedule D1

In this section of the Form, the taxpayer needs to provide details of every deposit, donations, and investments made by him/her up to 31.07.2020. These investments can claim deduction under chapter VI A of the Income Tax Act for the F.Y. 2019-2020.

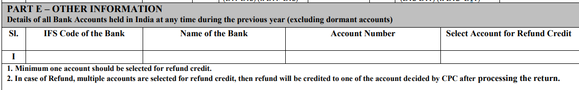

Bank Account for Refund

Earlier, there was a need for the taxpayer to select only 1 bank account in which he/she wants to get a refund. However, as per the new form of ITR 1, the taxpayer can now select more than 1 bank account to claim a refund. Further, the CPC (Centralised Processing Centre) will credit the amount of refund in 1 account after duly processing the return.

Details on Modifications made in ITR 1 Form

The details modified in Form ITR 1 are as follows:

- Rs 50000 as Standard Deduction;

- Not applicable to the Directors of Company;

- Not applicable to the Individuals holding Unlisted Equity Shares;

- No Change made in the Method of Computation;

- Offline ITR 1 (Sahaj) and ITR 4 (Sugam)[1] is applicable to the senior citizens of more than 80 years of age;

- Section-wise segregation in return;

- Bifurcation of the salary will be done on the basis of Entertainment Allowance, Standard Deduction, and Professional Tax;

- Pensioners columns have been introduced in the nature of employment;

- Employer Details like TAN; Name and Address of the Employer; City/town; State; Zip/Pin code has been inserted under the Income from Salary;

- Deletion of details filed in response to notice under section 153 A and 153 C;

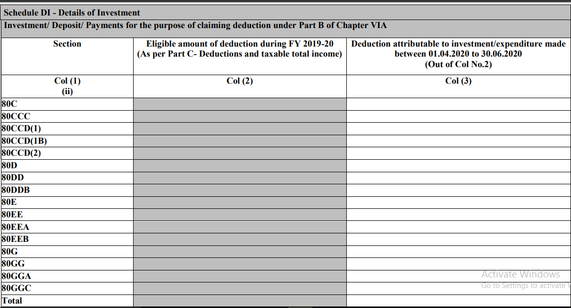

- New deductions of section 80CCC, 80CCD (1), 80CCD (1B), 80CCD (2), 80DD, 80DDB, 80 E, 80 EE, 80EEA, 80GG, 80GGC, and 80U has been added in the column for deductions;

- The Point concerning the amount of rent which cannot be realized has been inserted under the Head of House Property;

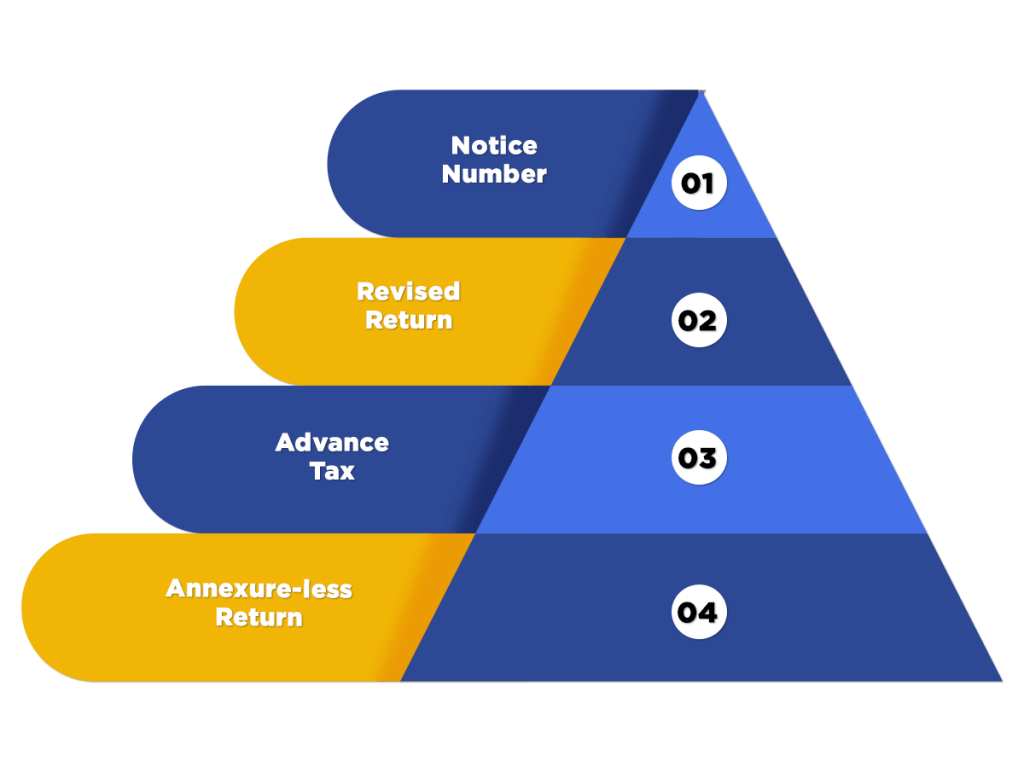

Important Terms for Form ITR 1

The important terms for Form ITR 1 are as follows:

Notice Number

A taxpayer needs to specify the “Notice Number” on the return furnished in answer to the income tax notice issued by the IT Department.

Revised Return

The term “Revised Return” denotes the option to re-file, given to the taxpayer in case he/she commits some mistakes. Further, for the F.Y. 2019-2020, the taxpayer can furnish a revised return on or before 31.03.2021.

Advance Tax

In case the income earned under the head of other sources is more than Rs 10000 in a year, then the assessee needs to determine and deposit the advance tax. Further, the assessee needs to pay the advance tax on a “Quarterly Basis”, i.e., June, September, December, and March.

Annexure-less Return

The term “Annexure-less Return” denotes that Form ITR 1 does not require any documents as annexure or attachments.

Due Dates for Filing Form ITR 1

The due dates for filing ITR 1 in the A.Y. 2020-2021 is 30 November of the following year. That means after that, a late fee will be levied on the taxpayer as per section 234F.

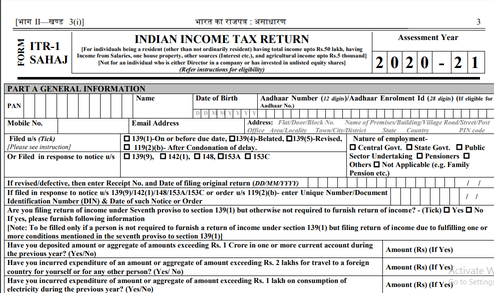

Procedure to File Online ITR 1

Normally, for filing of an Income Tax Return in Form 1, the taxpayer needs to fill in the information in 7 different sections, which are as follows:

Part A: General Information

This section includes general information and details, such as follows:

- Name;

- Address;

- PAN Card Number;

- Mobile Number;

- Email Address;

- Aadhar Number;

- Details of Income Tax Return Filing;

- Nature of Employment, i.e., Government/ PSU/ Pensioners/ other;

However, after the recent amendment made by the Income Tax Department, a taxpayer now needs to fill additional information under 7th Proviso of section 139 (1) of the Income Tax Act. Such additional details are as follows:

- If the taxpayer has deposited more than Rs 1 crore in one or more Current Bank Accounts;

- If the taxpayer has incurred more than Rs 2 lakhs on Foreign Travelling;

- If the taxpayer has incurred more than Rs 1 lakh on Electricity Consumption;

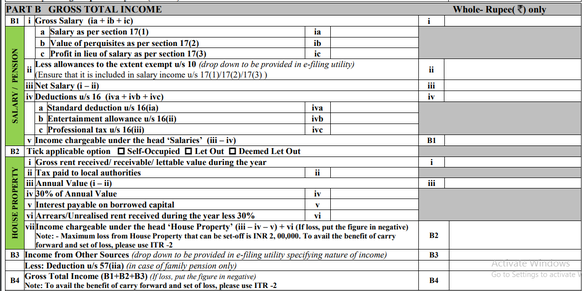

Part B: Gross Total Income

All the details concerning Gross Total Income are included in this section. It consists of 4 sub-parts which are as follows:

Part B1

This sub-section includes details, such as:

- Employer Details like Name, TAN, and Address;

- Salary Details;

- Exempted Allowances;

- Value of the Perquisites;

- Net Salary;

- Deduction under section 16;

- Income chargeable under the Income head “Salaries”;

Part B2

This sub-section includes details, such as:

- Gross Rent Received;

- Tax Paid to the Local Authorities;

- Annual Value;

- 30% of the Annual Value;

- Interest Payable on the Borrowed Capital;

- Arrears or Unrealised rent less than 30%;

- Income chargeable under the head “House Property”;

Part B3

This sub-section includes details relating to deductions under section 57 (iia)

Part B4

This sub-section includes total gross income, i.e., B1 + B2 + B3

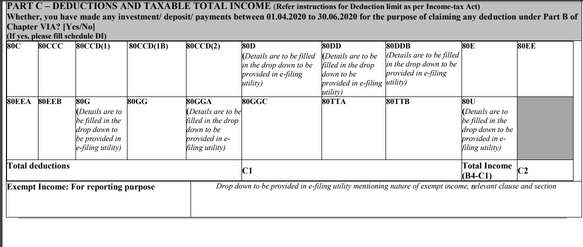

Part C: Deductions u/s VI- A and Taxable Total Income

All the details concerning Deductions and Taxable Total Income are included under section of Form ITR 1. The deductions included are 80CCC, 80CCD (1), 80CCD (1B), 80CCD (2), 80DD, 80DDB, 80 E, 80 EE, 80EEA, 80GG, 80GGC, and 80U. Further, after calculating all the deductions, the amount derived will be “Value of Total Deductions”. It will be mentioned in box C 1.

However, to calculate Total Income, the taxpayer needs to subtract Total Taxable Income from Total Gross Income, i.e., B4 – C1.

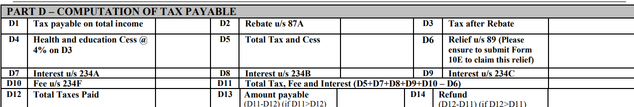

Part D: Computation of Tax Amount Payable

All the details concerning the computation of tax payable are covered under this section. Such details are as follows:

- D1: Tax Payable on Total Income;

- D2: Rebate under section 87A;

- D3: Tax after Rebate;

- D4: Cess on D3;

- D5: Total Amount of Tax and Cess;

- D6: Relief under section 89(1);

- D7: Interest under section 234A;

- D8: Interest under section 234B;

- D9: Interest under section 234C;

- D10: Fee under section 234F;

- D11: Total amount of Tax, Fee, and Interest, i.e., D5 + D7 + D8 + D9 + D10 – D6;

- D12: Total Tax Paid;

- D13: Amount Payable;

- D14: Refund; and

- Exempt income

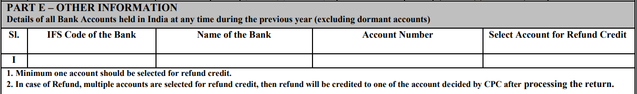

Part E: Other Information

This section includes bank information and details, such as follows:

- IFSC Code of the Bank;

- Name of the Bank;

- Account Number;

Earlier, there was a need for the taxpayer to select only 1 bank account in which he/she wants to get a refund. However, as per the new form of ITR 1, the taxpayer can now select more than 1 bank account to claim a refund. Further, the CPC (Centralised Processing Centre) will credit the amount of refund in 1 account after duly processing the return.

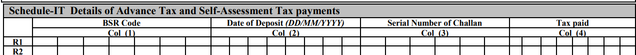

Schedule IT: Details Concerning Self Assessment and Advance Tax Payment

This schedule includes information and details, such as follows:

- BSR Code;

- Date of Deposit;

- Serial Number of Challan;

- Tax Paid;

Schedule TDS: Details Concerning TDS/ TCS

This schedule includes information and details TDS (Tax Deducted at Source) and TCS (Tax Collected at Source), such as follows:

- TAN of Deductor/ PAN/ Aadhar Number of the Tenant;

- Name of the Deductor;

- Gross Payment;

- Year of Tax Deduction;

- Tax Deducted/ Collected at Source;

- TDS/TCS Credit;

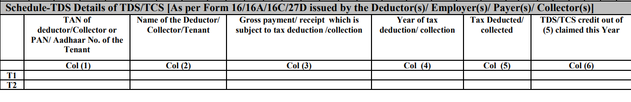

Schedule D1: Details of Investment

In this section of the Form, the taxpayer needs to provide details of every deposit, donations, and investments made by him/her up to 31.07.2020. These investments can claim deduction under chapter VI A of the Income Tax Act for the F.Y. 2019-2020.

However, only the investments made in between 01.04.2020 to 30.06.2020 are eligible for deductions under chapter VI-A of the Income Tax Act.

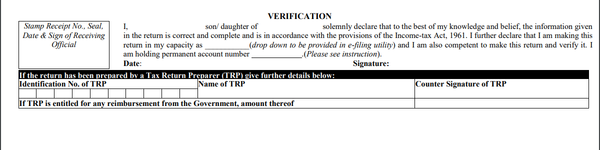

Verification

In the last section, the taxpayer needs to verify and self-attest Form ITR 1 by signing the content of verification, after filing all the details, such as Name, Parent Name, and PAN Card details.

Medium to Furnish Form ITR 1

An ITR can be filed both offline and online. In online mode, the taxpayer can either upload the XML sheet or can directly submit the ITR by visiting the website and choosing the option “Press and Submit Online”.

However, the senior-most citizens, i.e., one above the age of 80 years, can file this form offline. The term “offline” denotes furnishing the return in a paper format.

Further, in the online mode, the taxpayer will receive the acknowledgment on his/her registered email id once the form is submitted successfully. However, he/she can download the same from the official portal as well.

Moreover, after downloading and signing it, the taxpayer needs to send the same to the IT Department’s CPC office in Bangalore with 120 days of e-filing. Conversely, he/she can verify his/her return.

Conclusion

Thus, it is clear that, at present, the government, together with the IT Department, is putting all the efforts to reduce tax leakages. Further, it permits the law-abiding citizen to avail of the benefits of the expenditures and investments made during the tough times, even if they are made after the completion of the assessment year.

Moreover, the government is working hard to make the process of Income Tax Return Filing simple and hassle-free.

Also, Read:Complete Guide to Income Tax Return Filing