Form ITR 2: Latest Updates and Procedure to File Online

Shivani Jain | Updated: Aug 31, 2020 | Category: Income Tax, News

The term “Form ITR 2” denotes an Income Tax Return filed by the individuals or HUFs (Hindu Undivided Family), who are not earning income from PGBP (Profit and Gain from Business or Profession). Moreover, it does not apply to the individuals who are filing Form ITR 1 (Sahaj).

Further, the term “income” under ITR Form 2 includes the following:

- Income from Capital Gains;

- Foreign Income; and

- Agricultural Income above Rs 5000;

In this blog, we will discuss the concept of Form ITR 2, together with the latest updates and the procedure to file it online.

Table of Contents

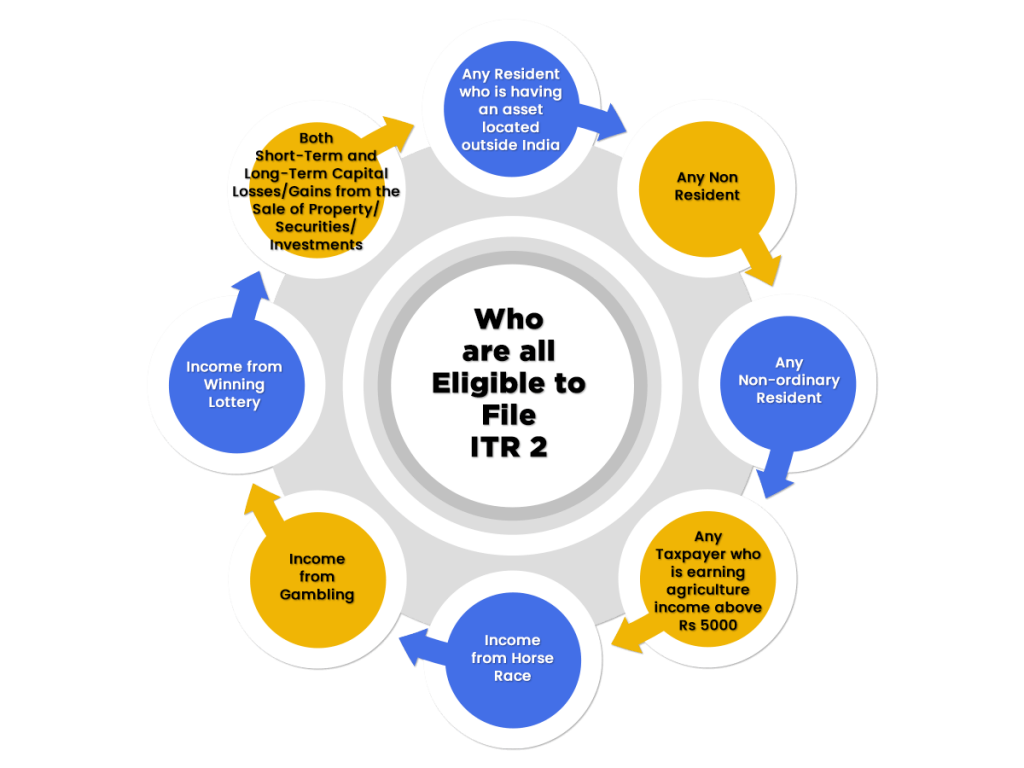

Who are all Eligible to File ITR 2?

The taxpayers who are eligible to file Form ITR 2 in India are as follows:

- Any Resident who is having an asset located outside India;

- Any Non Resident;

- Any Non-ordinary Resident;

- Any Taxpayer who is earning agriculture income above Rs 5000;

- Income from Horse Race;

- Income from Gambling;

- Income from Winning Lottery;

- Both Short-Term and Long-Term Capital Losses/Gains from the Sale of Property/ Securities/ Investments;

Note:

If in the case, there is only long-term capital gain, then the same is exempt under section 10(38), and Form ITR 1 can be filed.

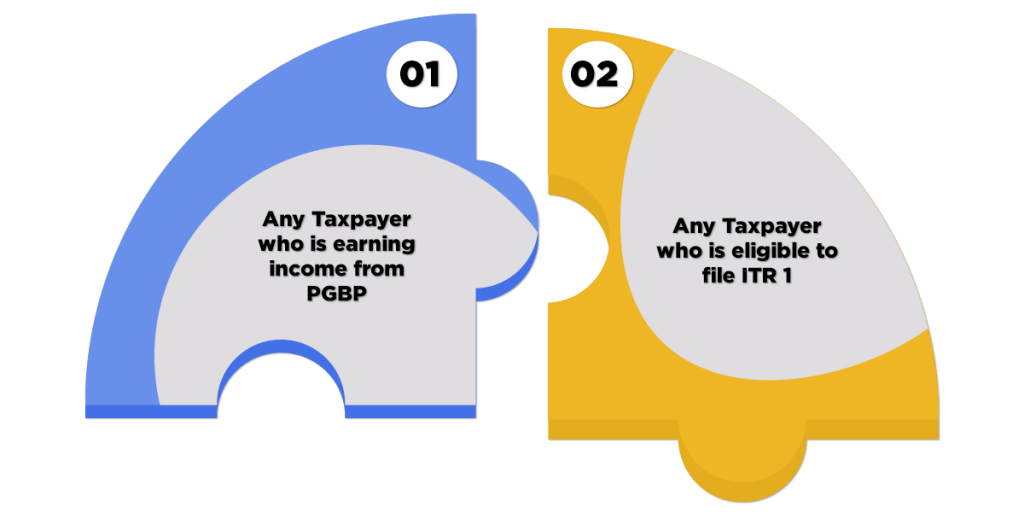

Who are all Not Eligible to File ITR 2?

The taxpayers who are not eligible to file Form ITR 2 are as follows:

- Any Taxpayer who is earning income from PGBP (Profit and Gain from Business or Profession);

- Any Taxpayer who is eligible to file ITR 1;

Latest Updates on Form ITR 2

As per the latest notification announced by the IT Department, the due date for filing ITR 2 in the Assessment Year 2020-2021 has now been extended to 30.11.2020.

That means the returns that were supposed to be filed by 31.07.2020 and 31.10.2020 can now be filed up to 30.11.2020.

Structure of Form ITR 2

The structure of ITR 2 can be summarised as:

- Part A: General Information;

- Schedule S: Details of the Income derived from Salaries;

- Schedule HP: Details of the income derived from House Property;

- Schedule CG: Computation of Income under the head Capital Gains;

- Schedule OS: Computation of Income under the Income from Other Sources;

- Schedule CYLA: Statement of Income after Setting off Losses of the Current Year;

- Schedule BFLA: Statement of Income after Setting off of the Unabsorbed Loss brought forward from the Earlier Years

- Schedule CFL: Statement of the Losses to be Carried Forward in the Future Years;

- Schedule VIA: Statement of the Deductions (from the Total Income) under Chapter VI A;

- Schedule 80 G: Statement of the Donations entitled for deduction under section 80 G;

- Schedule 80 GGA: Statement of the Donations made for Scientific Research or Rural Development;

- Schedule AMT: Computation of the Alternate Minimum Tax (AMT) payable under section 115 JC

- Schedule AMTC: Computation of Tax Credit under section 115 JD;

- Schedule SPI: Statement regarding the Income arising to minor child/ spouse/ son’s wife or any other person or AOP (Association of Persons) to be included in the income of the Assessee in Schedules: HP, CG, and OS;

- Schedule SI: Statement of the Income which is chargeable to tax at the Special Rates;

- Schedule EI: Details of the Exempt Income;

- Schedule PTI: Pass through Income details from the business trust or investment fund according to Section 115 UA, 115 UB;

- Schedule FSI: Statement of the Income arising or accruing Outside India;

- Schedule TR: Details of the Taxes paid Outside India;

- Schedule FA: Details of the Foreign Assets and Income from any other source outside India;

- Schedule 5A: Statement of the Apportionment of Income between spouses Regulated by the Portuguese Civil Code;

- Schedule AL: Asset and Liability at the year-end (applicable in case the total income exceeds Rs 50 lakhs);

- Schedule DI: Schedule of the Tax-saving Investments or Payments or Deposits to claim deduction or exemption for the extended period from 01.04.2020 until 30.06.2020

- Part B -TI: Computation of the Total Income;

- Part B -TTI: Computation of the Tax Liability on the Total Income;

- Details to be filled if in case the annual return has been prepared and filed by a Tax Return Preparer;

Who can File ITR 2 offline?

Any Taxpayer who is above 80 years in age is eligible to file form ITR 2 offline. That means he/she is eligible to file the Return in a Physical Paper Format.

Procedure to file Form ITR 2

There are 2 ways of filing ITR 2, which are as follows:

- Offline Procedure;

- Online Procedure

Offline Procedure to File Form ITR 2

The modes for Filing Income Tax Return 2 are as follows:

- By Furnishing the Income Tax Return in a Physical Paper Format;

- By Furnishing a Bar-coded Return;

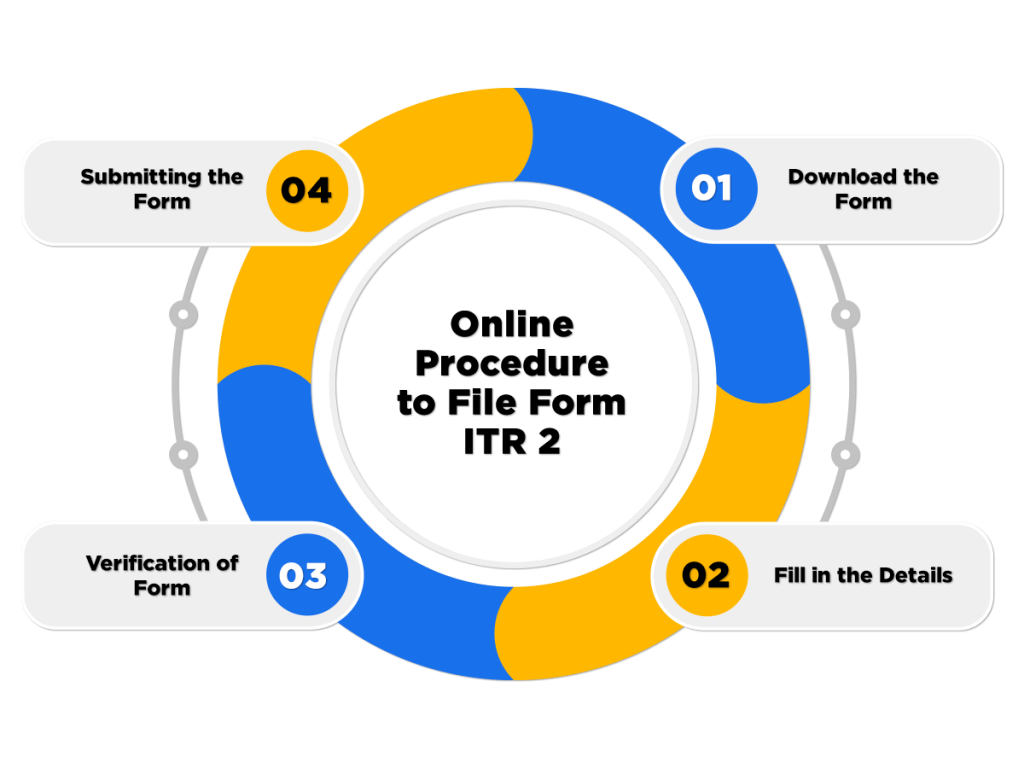

Online Procedure to File Form ITR 2

The steps involved in the procedure to file Form ITR 2 online are as follows:

Download the Form

In the first step, the applicant needs to download the form by visiting the official website at http://www.incometaxindiaefiling.gov.in/home;

Fill in the Details

Now, the taxpayer needs to fill in details in different sections of the form.

Verification of Form

In this step, the taxpayer needs to get his/her ITR Form 2 verified or authenticated in the following ways:

- By getting it digitally signed;

- By authenticating the Form through EVC (Electronic Verification Code);

Submitting the Form

Now, if the taxpayer submits his/her form online, and then an acknowledgment will be sent to his/her registered email id.

However, if he/she chooses to send it manually by downloading it from the official portal, the taxpayer is required to send the same to the IT Department’s CPC office in Bangalore within 120 days, starting from the date of e-filing.

Moreover, it shall be relevant to note that Form ITR 2 is an annexure less form, i.e., there is no need to attach any document.

Modifications Made in ITR Form 2 for the Assessment Year 2020- 2021

The modifications made in Form ITR 2 are as follows:

- Introduction of Pensioners Column;

- Introduction of new deduction named 80 TTB in the Deductions Column;

- From this Assessment Year, the Assessee is required to disclose his/her Directorship in any Unlisted Company;

- Now, Assessee needs to provide details of his/her PAN (Permanent Account Number) and DIN (Director Identification Number);

- From this Assessment Year, the Assessee is required to provide details of his/her Shareholdings in any Unlisted Company. That means the taxpayer needs to disclose the details of shares purchased and sold by them.

- From this Assessment Year, the Assessee who is above 80 years of age has the facility to file Physical Format Returns;

- The applicant who is having possession of Foreign Assets needs to disclose the details as follows:

- Disclosure of FDA (Foreign Depository Account);

- Foreign Custodian Accounts;

- Equity;

- Debt Interests;

- Details of the Overseas Cash Value Insurance Contract; or

- Annuity Contract;

- From this Assessment Year, the Assessee who is having Agricultural Income needs to disclose the additional details as follows:

- Land Measurement in Acres;

- Name of the District;

- Pin Code of the District in which the land is located;

- Quality of Land, such as Irrigated or Rain-fed;

- Details whether the Land is Owned or Leased;

- From this Assessment Year, the Assessee who is earning Income from the Residential House Properties need to furnish details as follows:

- Name of the Tenant;

- PAN Card Details;

- TAN (Tax Deduction or Collection Account Number);

Conclusion

Therefore, it can be rightly said that the government is working hard to benefit the taxpayers of all levels in the middle of the COVID-19 crisis. The same can be proved by the fact that the due dates for Filing ITR Form 2 have been extended to 30.11.2020.

For more information and details, reach out to our Income Tax Return Filing Service Page.

Also, Read:Complete Guide to Income Tax Return Filing