Funds Transfer Mechanism on Peer to Peer Lending Platforms

Dashmeet Kaur | Updated: Apr 23, 2020 | Category: Peer to Peer lending, RBI Advisory

Peer to Peer abbreviated as P2P is an online lending platform that enables an individual to avail loans from another individual without the need of any intermediary. P2P platform connects lenders and borrowers by forming a link between the borrowers who want unsecured personal loans and investors who seek to lend their money for earning a higher return on investment. The Reserve Bank of India regulates Peer to Peer lending platforms. On 4th October 2017, RBI laid down the Master Directions –NBFC-P2P Lending Platform (Reserve Bank) Directions, 2017, which obligates every existing P2P and prospective P2P business entities to comply with it. One such guideline is regarding the Funds Transfer Mechanism. This blog will provide complete information about the mechanism of fund transfer under NBFC-P2P.

Table of Contents

Key Features of Peer to Peer Lending

P2P lending is a source of debt financing that allows a person to borrow or lend money without any intrusion of a bank or financial institution. Usually, the Peer to Peer lending License is mainly through an online platform that matches lenders with potential borrowers. Here are the fundamental characteristics of a P2P platform:

- All the borrowing and lending transactions on P2P happens digitally or online.

- It eliminates the prerequisite to forming a relationship between the borrower and the lender prior to commencing the lending and borrowing process.

- Financial institutions and intermediaries have no role to play amidst the borrower and the lender.

- P2P facilitates borrowers and lenders to make their choice of borrowings and investments, thus gives them flexibility.

Eligibility Criteria to commence Peer to Peer Business

RBI has set a list of criteria that every company must meet for starting a P2P lending platform:

- No non-banking institution other than a company can undertake the Peer to Peer lending business.

- All companies which either carry or strive to do the P2P lending business must obtain a Certificate of Registration from the Reserve Bank of India.

- An applicant of P2P License must have a minimum net owned funds of rupees twenty million, i.e., INR 2 Crores or a higher amount as prescribed by the RBI.

- As per RBI regulations, the company seeking a P2P License must be incorporated in India. It must have a potent IT system; also, the directors and promoters of such a company should fulfill the fit and proper.

Fund Transfer Mechanism for P2P Lending

RBI guidelines on lending and borrowing on the Fund Transfer Mechanism P2P platform is a progressive step to systemize the localized market of money lenders with a well-structured platform. Besides, it provides an array of benefits to borrowers like easy access to the credit facility, and the small lenders get an opportunity to lend their surplus funds in a more secure manner in order to yield a higher rate of return in contrast to bank deposits.

Further, RBI has set a fixed cap on the amount of lending/borrowing to safeguard the customers from any deceitful acts. These are the prudential norms issued by the RBI for all NBFC-P2P lenders and borrowers:

- The aggregate exposure of a P2P lender to P2P borrowers at any point of time shall be a cap of INR 10 Lakh.

- The aggregate loan taken by a P2P borrower at any point of time shall be subject to a cap of INR 10 Lakh.

- The exposure of a single lender to the same borrower, across all P2P lending platforms must not exceed INR 50,000.

- The maturity of such loans must not exceed 36 months.

Apart from the above-mentioned norms, RBI has also prescribed guidelines for Fund Transfer Mechanism to be used by the P2P borrowers and lenders.

Functions of Fund Transfer Mechanism

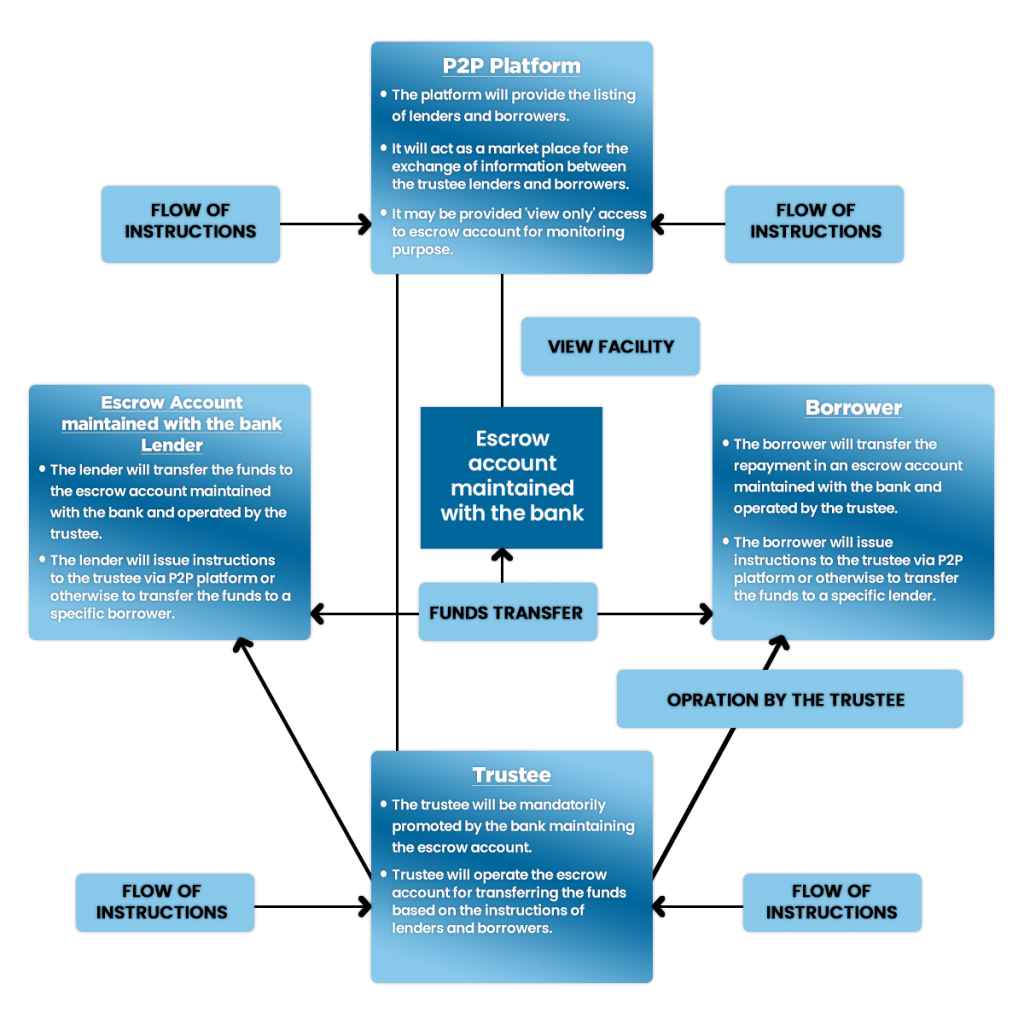

Mainly the dealings of fund transfer happen between three parties, trustee, lender and borrower. Here is how the mechanism of P2P fund transfer functions.

- P2P Platform- The online Fund Transfer Mechanism P2P lending platform provides a list of lenders and borrowers. It is a market place for the exchange of information and instructions between all the three parties’ trustee lenders and borrowers. The platform provides a ‘view only’ access to escrow account for reporting and monitoring purposes. The bank maintains the escrow account.

- Lender- By using the platform, the lender transfers funds to the escrow account, which is maintained with the bank and operated by the trustee. Lenders can choose to issue some instructions to the trustee through the P2P platform, else instruct to transfer the funds to a specific borrower.

- Borrower- Similarly, the borrower transfers repayment in the escrow account. He/she may also issue instructions to the trustee via the Fund Transfer Mechanism P2P platform or otherwise to transfer the funds to a specific lender.

- Trustee- Lastly, the trustee will operate the escrow account for transferring funds as per the instructions issued by the lender and borrower. The trustee must be promoted by the bank, maintaining the escrow account.

RBI guidelines for Fund Transfer Mechanism

- All the fund transfers amongst the participants on a Peer to Peer lending platform must be through an escrow account mechanisms that shall be operated by a trustee.

- At least two escrow accounts must be maintained wherein; one shall be for funds received from the lenders & pending disbursal, while the other will be for collections from borrowers.

- The trustee must mandatorily be promoted by the bank that shall be maintaining the escrow accounts.

- All fund transfers shall be done through and from bank accounts as the cash transactions are strictly prohibited under this mechanism.

The objective of the Fund Transfer Mechanism is to ensure that the lender’s money is only utilized for the disbursement to borrowers and not be used for any other purpose. RBI guidelines[1] on fund transfer emphasizes on transparent dealings and disclosure requirements to the lenders, borrowers in the public arena. It encompasses an overview of credit score/assessment methodology, protection of data, grievance redressal mechanism, segregation by age and portfolio performance on NPAs on monthly assets.

Also, Read: How to Start a Mobile Wallet Business in India?

RBI aimed to develop a sustainable and robust online lending system through P2P. However, due to the stringent guidelines of RBI, the Peer to Peer players realized that the limited cap on exposure is confining the growth of the sector. As RBI has capped the lending & borrowing exposure, it has made a drastic impact on the prospective P2P players and shrunken their participation. The total number of Peer to Peer lenders registrations is much lower than the numbers estimated to be operating in this segment before the regulations were issued. Stringent conditions like the minimum requirement to have net owned funds of INR 2 Crore along with RBI regulations has compelled the budding entrepreneurs to take a step back. Following is the list of activities that peer to peer entities can undertake: There are several advantages that both borrowers and lenders can avail by using P2P lending platform. In

a nutshell, one can determine that the Funds Transfer Mechanism on Peer to Peer

lending is a game-changer for the financial sector. It will not only provide

swift credit facilities but also ensure to keep the security intact. No P2P

platform can conduct any illegal practices under the surveillance of RBI. If you also want to start a Fund Transfer Mechanism peer to peer lending business in India, then the first step is to obtain an NBFC-P2P license from RBI. The process of registration might be a tedious job for all the newbie’s, so take the assistance of Swarit Advisors to help you establish your Peer to Peer Platform. Also, Read: P2P Lending RBI Regulations – Future of P2P Lending in IndiaImpact of RBI fund transfer

guidelines on Peer to Peer Lending Platform

Scope of activities of P2P Lending platforms

Benefits of P2P- Fund

Transfer Mechanism

Perks of Peer to Peer Lenders for Investors

Benefits of P2P Lending for the Borrowers

Conclusion