NBFC DSA Registration: A Guide on NBFC Direct Selling Agent

Shivani Jain | Updated: Sep 01, 2020 | Category: NBFC, RBI Advisory

The term “NBFC DSA Registration” denotes the registration of a person who works as a referral agent for NBFCs and Banks. However, in rural areas, these people are known as Business Correspondents.

The main job of a Direct Selling Agent is to find potential customers for banks or NBFCs they represent. Further, the leads generated by these people are then forwarded to the concerned bank or NBFC.

In this blog, we will talk about the concept of Registration of Direct Selling Agents, and the benefits of becoming an NBFC DSA.

Table of Contents

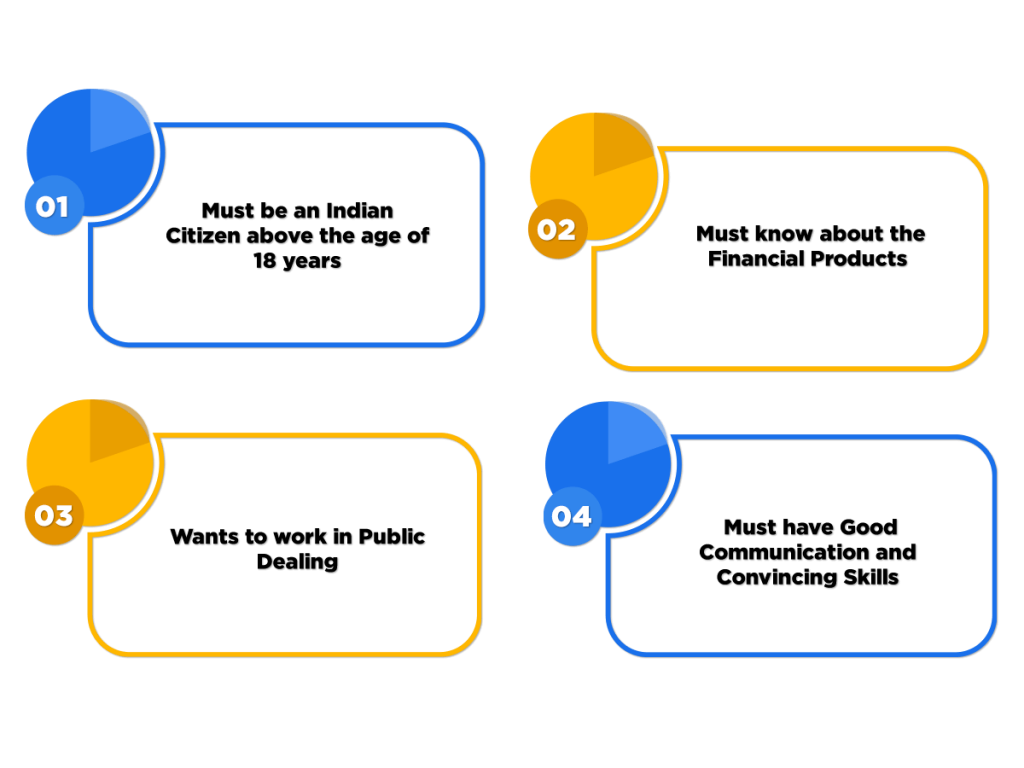

Eligibility Criteria for Direct Selling Agent

The eligibility criteria to become DSA in India are as follows:

- Must be an Indian Citizen above the age of 18 years;

- Must know about the Financial Products;

- Wants to work in Public Dealing;

- Must have Good Communication and Convincing Skills;

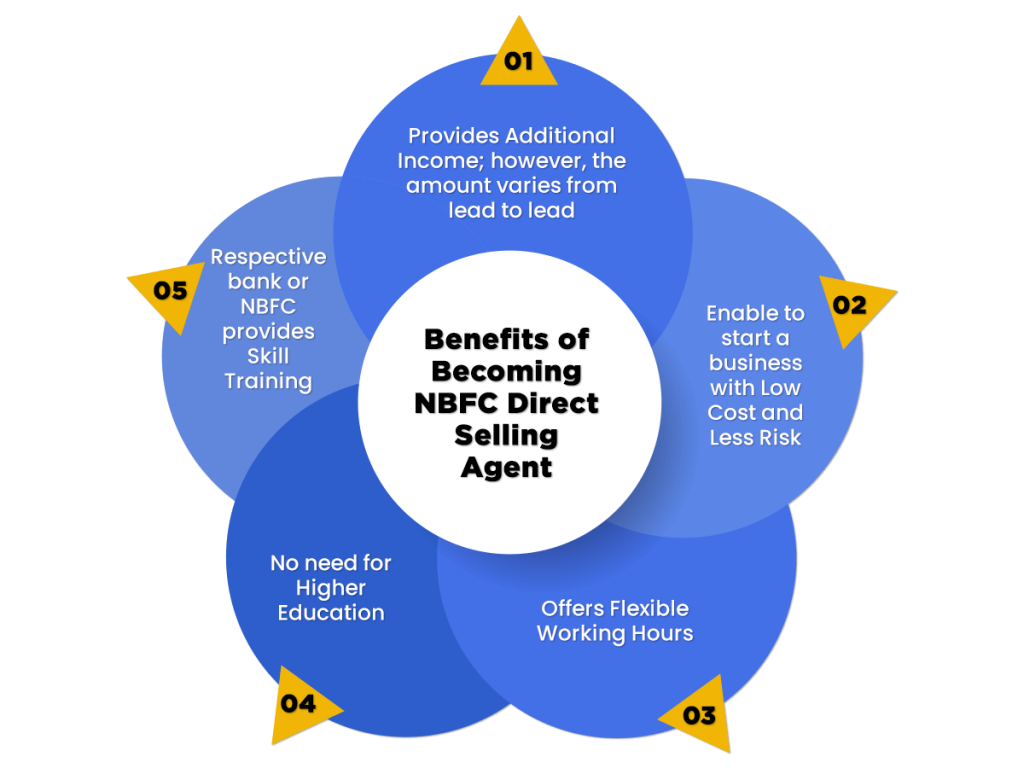

Benefits of Becoming NBFC Direct Selling Agent

The benefits of obtaining NBFC DSA Registration are as follows:

- Provides Additional Income; however, the amount varies from lead to lead;

- Enable to start a business with Low Cost and Less Risk;

- Offers Flexible Working Hours;

- No need for Higher Education;

- Respective bank or NBFC provides Skill Training;

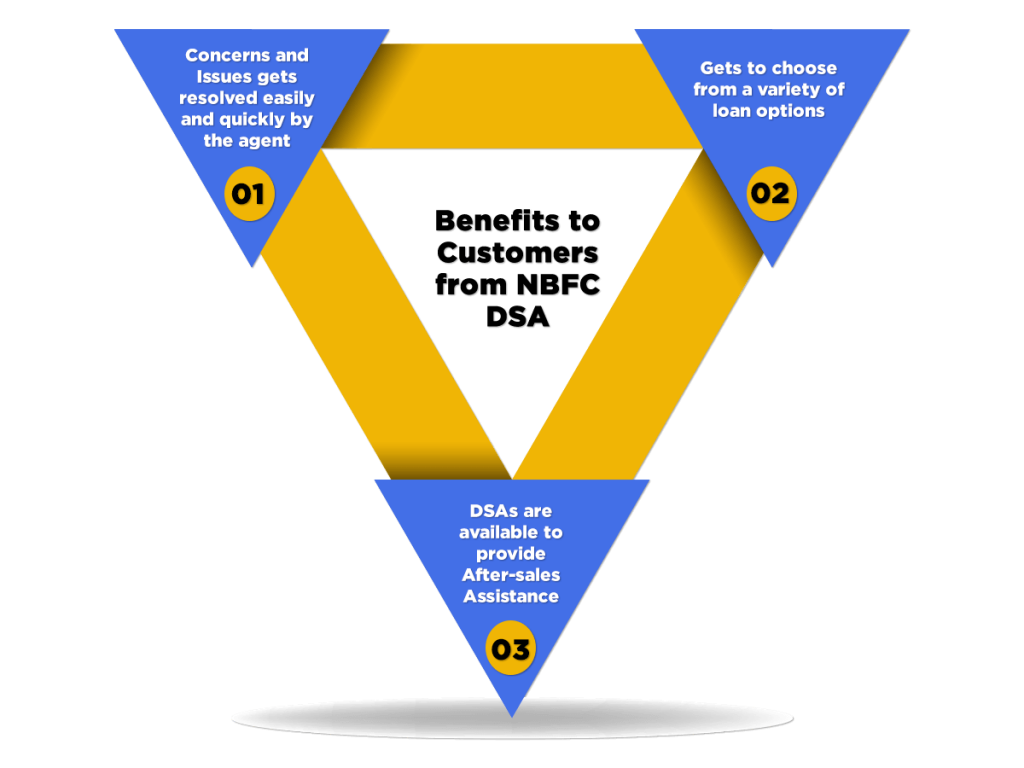

Benefits to Customers from NBFC DSA

The benefits to Customers from NBFC DSA are as follows:

- Concerns and Issues gets resolved easily and quickly by the agent;

- Gets to choose from a variety of loan options;

- DSAs are available to provide After-sales Assistance;

Benefits to Financial Institutions from DSAs

The benefits availed of by Financial Institutions from DSAs are as follows:

- Provides Ease in Local Approach;

- A Direct Selling Agent shortlists the Potential Customers;

- Increases Awareness about the Financial Products offered by Institutions to the Common People;

- DSAs efficiently address Loan Seekers;

- DSAs perform Preliminary Verification, and Register needs of the clients;

Duties of NBFC DSA (Direct Selling Agents)

The duties of a Direct Selling Agent are as follows:

- Collects the Completed Loan Application from the interested clients, together with the required documents;

- Conducts a Preliminary Check for both application and documents collected;

- Ensure the genuineness of the documents collected;

- Upload or Submits the application and documents;

- Provides his/her DSA (Direct Selling Agent Code), so the application can easily be traced back to him/her.

Documents Required for NBFC DSA Registration

The documents required for NBFC DSA Registration are as follows:

- Aadhar Card;

- PAN (Permanent Account Number) Card Details;

- Bank Account Details;

- Driving License;

Process of NBFC DSA Registration in India

Normally, every Bank, NBFC, and Lending Institution has its own way of registering Direct Selling Agents. However, the common steps involved in the process of NBFC DSA Registration in India are as follows:

- Visit and Submit the application to the respective NBFC, Bank, or any other Lending Platform;

- Make the required payment;

- After furnishing the payment, the applicant will be contacted by the concerned NBFC, Bank, or Lending Platform;

- Furnish the documents asked by the respective Institution;

- Now, the documents submitted will be verified;

- A team of legal professionals will conduct a process of Due Diligence, and will check the Credit History and CIBIL Score of the applicant;

- If the authorities are satisfied with the form and documents submitted, a duly stamped Agreement of DSA Registration will be sent to the applicant;

- Now, fill in all the necessary details asked;

- Sign the Agreement of DSA Registration;

- Submit the Agreement;

- The authorities will now issue a DSA Code, which will be used to track the status of the application;

- After receiving the DSA, a Direct Selling Agent can start uploading the loan documents;

Conclusion

A Direct Selling Agent or DSA acts as a bridge between the potential borrowers and lenders. Their main work is to collect leads and refer the same to the lending institutions.

Further, these people are paid on the basis of the efforts put in by them. That means they are paid out some percentage of the actual loan amount.

Furthermore, the services provided by these agents to banks or NBFCs are taxable under RCM (Reverse Charge Mechanism)[1] . For more details visit Swarit Advisors.

Also, Read:What are the NBFC Gold Loans