Goods and Service Tax: Meaning and Its Impact on Diwali Gifts

Sanchita Choudhary | Updated: Oct 20, 2020 | Category: GST

On 29th March, 2017 Parliament passed an act with the concept of “One Nation, One Act”. This was termed as “Goods and Services Tax” which further into effect on 1st July, 2017. GST is an amalgamation of various Central as well as State taxes into a single tax. It is considered to be a comprehension of thirteen different taxes such as Excise Duty, Sale Tax, Entry Tax, Service Tax and so on. In this article we described about Goods and Service Tax: Meaning and Its Impact on Diwali Gifts.

Table of Contents

Meaning of GST in India

GST or Goods and Service Tax is an indirect tax levied on the supply of goods and services. In India, GST is a comprehensive and multilevel tax levied on every value addition. It is an indirect tax which is paid by the consumers to the government. However, this tax is levied on the manufacturer or by the seller or the businessman along with the providers of the services.

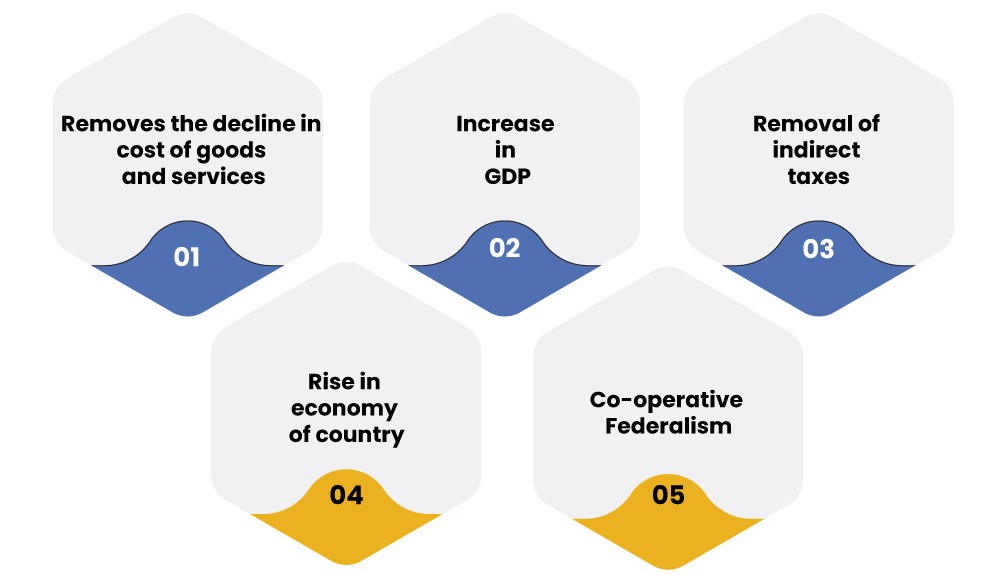

Objective of Goods and Service Tax

Following are some of the objective laid down of Goods and Service Tax:

- It helps in removing the effects of fall in production and distribution of cost of goods and services.

- It helps in the increase of GDP along with the economy of the country.

- This tax would be beneficial for both the manufacturers as well as the consumer as it would remove all the indirect taxes which they need to pay.

- Online GST registration would help in recovering from the fall in the existing VAT system which, would be beneficial for the economy of the country.

- It helps in the enhancement of cooperative federalism.

Meaning of “Gift”

The term gift has not been specifically defined under Goods and Service Tax. However, the same has been mentioned under Section 2(xii) of Gift Tax Act.[1]

“Gift” means the transfer by one person to another of any existing movable or immovable property made voluntarily and without consideration in money or money’s worth.

Thus, it can be said that the gift is a form of a gratuity made by one person to another and thus require no form of consideration. Further, it is considered to be important that there should not be any contractual obligation for anything to be considered as a “gift”.

Input Tax Credit

Input Tax Credit or ITC is a kind of tax which is paid by the consumer on the purchase of any goods or services. It further means that at the time of payment of an output tax, the consumer can reduce the tax already paid on inputs and then pay the remaining amount.

Who can apply for ITC?

ITC can be applied by any such person who is registered under GST and fulfils all of the following conditions:

a. The dealer must be in possession of tax invoice,

b. The goods or services provided should have been received by the consumer,

c. Filing of Returns.

d. Supplier must pay the tax charge to the government.

e. In case depreciation has been claimed of a capital good, no input tax credit should be allowed.

Impact of GST on Diwali Gifts

Even after the Impact on Diwali Gifts of the global pandemic, the Indian economy is trying hard to overcome the shortcomings of it. India is in full preparation for the upcoming festivities one of which includes the festival of lights, Diwali. The tradition of gifting each other is at its peak during this time of the year. Every employer is entitled to gift anything to its employee during this season.

As per the Goods and Service Tax law, if an employer gifts an employee a gift exceeding the amount of 50,000 Indian Rupees, then such gifts should be held liable under GST in India. Thus, if an employer is gifting anything luxury like card, gold coins, etc., to an employee and the amount exceeds the limitation then such gifts are to be held liable under GST in India.

Tax on Anything Paid Other Than Salary

Many diamond merchants or gold merchants during the festive season gifts their employee various luxury gifts such as luxury cars, gold coins, companies, cash, etc., which costs more than Rs 50,000. Such gifts from an employer to an employee shall be held liable under the Goods and Service Tax law. However, the same can be avoided if the gift is given as a part of the employees’ salary. It means no GST shall be levied on the same.

Yearly Bonus

The question which further arises is whether a yearly bonus is considered to be a part of GST or not.

- In case if the bonus is provided as a part of the salary and the same salary amount was earlier mentioned in the letter of employment, then such bonus being provided will not attract any GST.

- However, if the bonus is provided other than the salary amount and is not mentioned in the letter of employment then in such cases, GST shall be applicable.

Diwali Gifts to Business Clients

Any gift provided on the occasion of Diwali to the clients does not constitute to the promotion of business. Rather, it would help in maintaining a cordial relationship between both parties. Thus, since there is no involvement of any contractual obligation these will fall under the definition of the gift as mentioned in the Act. Therefore, ITC on such gifts will be reversed as per section 17(5) of the CGST Act.

Gift Vouchers

As per this, the retailer provides various vouchers as a scheme of doing business and attracting customers. These vouchers are to be used for making payment on the next purchase of any goods or services. Thus, in this condition, GST is to be applied only on the full value of payment.

Promotional Goods

Promotional goods are those goods which are provided to the customers without any consideration or contractual obligation. Hence, these goods will be eligible to be covered under the definition of goods as per the CGST Act; hence ITC should be reversed.

Conclusion

Thus, it can be said that enterprises or an employer should always be careful while identifying any such transactions. Impact on Diwali Gifts are something which is given voluntarily to someone in order to mend their relationship and thus should be considered out of any contractual obligations. However, in some cases gifts provided are considered under the ambit of supply while in others, it is not. Therefore, it is necessary to look for both the cases separately after taking legal provisions into consideration.

Also, Read: Types of GST Return in India