GST On Travel Agents and Tour Operators

Swarit Advisors | Updated: Mar 30, 2019 | Category: GST, News

We are well aware that GST is levied on the supply of goods and services. And hence, travel agencies are no exception. Therefore, GST on Travel Agents and Tour Operators are also imposed since they offer travel services to the people.

Table of Contents

Definition of Travel agents and Tour operators

“Travel agents” or “Tour operator” are the person who is engaged in the business of planning, organizing, scheduling or arranging tours that also includes the accommodation along with the mode of transportation. Tour Operators are defined based on the entry No. 23 of notification No. 11/2017-Central Tax (Rate).

Tour Package is the total booking mainly done by modern tour operator along with the total fees charged are included in the margin.

Normally, Tour Operator is considered as the service provider who would mainly receive the services across varied counterparts such as the Airline Companies, Local Taxi Operators, Hotel, Embassy issuing visas, and many others.

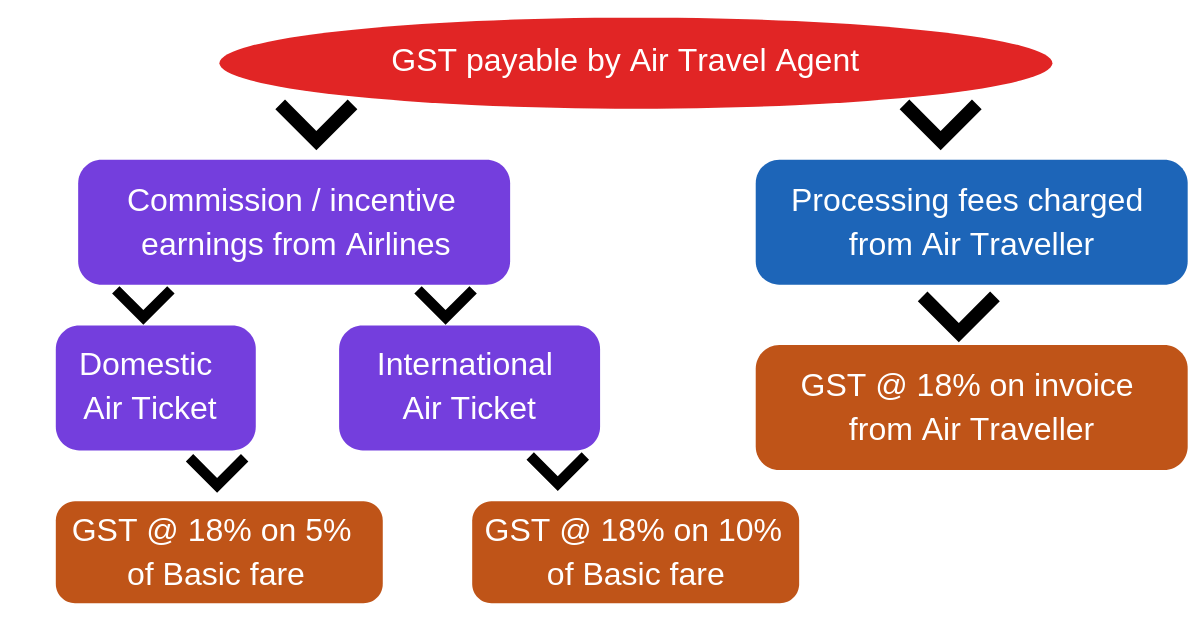

What Are The Types Of Income Earned By Air Travel Agent?

Air Travel Agent mainly earns 2 different income ranges that is mainly denoted as

- Getting commission from Airlines to book air tickets

- Getting income with forming processing the fees that mainly includes client mainly booking a ticket

- Air Travel Agent mainly raising 2 types of invoices that contains details of

- Name

- Address

- GST Registration Numbers along with Place of Supply

Commission for Selling Air Tickets

Air traveller is charged with the processing fees, facilitation charges, and service charges.

According to the 32(3) of CGST Rules, the value of supply of services mainly enabled with a relation on booking with the ticket to travel by Air with the complete travelling agent deemed are calculated.

Based on the complete rule 32(3) of CGST Rules, booking the complete supply services for relation mainly be helpful with the amount calculated according to the rate of

- 10% basic fare with international bookings

- 5% basic fare in domestic bookings

For easily enough complete sub-rule, that has been enabled with the airfare for the commission on the normally paid for the air travel agent

GST rate is mainly enabled with the 18% on this Commission

- Tour Operator 5%

- Agent model 18%

Hotel Sales @18% and 18% GST for availing the input credits. Check on the GST on Travel agents which would mainly give you the complete option for more number of aspects.

When you are hotel booking then you could easily get the better travel package enabled with the high-end aspects. it is also mainly suitable for claiming about 18% which is more easier to avail the better input credit and availing about 5% amount.

GST applicable are mainly rent on the motor vehicle that is mainly enabled with the @ 5% and no ITC or 12% with ITC.

Also, Read: Invoicing for GST in India.

Separate Commission for the Hotel Booking 5% without ITC

Normally, 5% GST is payable on the gross amount that is charged with the Tour operator for customers. GST is mainly enabled with the uniformity for all services along with the hotel accommodation and package tours.

What are the Conditions for a 5% GST Rate?

Bill or invoice issued is based on the supply of the output services that mainly indicate with the inclusion of charges in the accommodation along with the transportation for the tour.

Input Tax Credit would be based on the Goods and services that are useful for the supply of the output services in the tour operator that are not taken

Narration is mainly given with the way of footnote based on the invoice

- 5% of the basic fare is mainly based on domestic bookings

- 10% of the basic fare is based on the case of international bookings

GST is payable based on the chart

Value of Supply of Services

Based on Rule 32 in Central Goods and Service Tax Rules, it is important to deal with the complete value in the case along with certain supplies with rule 32 (3) it provides the high-end value of supply.

What is The Liability for Registration Under GST?

Some of the common Liability for Registration under GST is listed below:

- The aggregate turnover that exceeds more than Rs. 40 Lakh in the Financial Year

- For other states like Manipur, Arunachal Pradesh, Mizoram, Sikkim, Jammu & Kashmir, Nagaland, Meghalaya, Assam, Tripura, Uttarakhand, and Himachal Pradesh Aggregate turnover is Rs. 10 Lakh.

What is the Rate and Service Accounting Code (SAC) Based On GST?

1. Tour Operator @ 5%

2. Commission @18%

3. Travel agent model @ 18%

4. Hotel Sales @18%

When you like to avail the input credit then it is more efficient to go for the GST @18%. When you are looking for the hotel bookings along with the travel packages then it would be easier to get the GST bills and you could easily claim it on about 18%.

Avail the best input along with the credit and it is a better option with 5% on the total amount as the burden.

What is The Place Of Supply Of Services?

When the appropriate service is offered by the Air Travel Agents for any Indian Software company, it is important to know that the Place of supply of services would be the same location where the service is received which is the place of registration of the Indian software company.

When services are provided by the Air Travel Agents for any foreign software companies, the agent comes under the “intermediary” along with the place of supply of services is mainly considered as the location of the services provider. It could mainly be a place of Air Travel Agent.

What Is The VISA AND PASSPORT ASSISTANCE Charged Based On GST?

Visa statutory authorities such as the embassies and consulates would charge the visa processing charges which are mainly exempt on payment of the GST.

Normally, the Visa or passport processing charges could be charged with the statutory authorities are quite exempt on the Tax.

Visa or passports would be specially done with the Visa Facilitation Centres (VFCs) authorized with Visa Handling Agents or the Embassies. It is mainly liable for the Tax.

GST on Tour operators is made with adding the liable option for paying the tax along with the Input Tax Credit with the 18% for every service.

What Is Domestic and International Mediclaim Policies By Travel Agents?

Most of the top Travel Agents issue the Mediclaim policies along with the travel insurance for the clients across the insurance service providers. They also get the commission for the service providers for the customers.

- Travel Agents are mainly registered with the Insurance agent for issuing the mediclaim policies as well as travel insurance in India.

- Normally, the travel agents are mainly required for registering the IRDA as per the Insurance Act, 1938.

Place of supply with Air Travel Agent (ATA) would be issued according to the travel or mediclaim insurance policies are based on the following requirement only when Air Travel Agent provides their services for a customer who is

- Located in India

- Registered under the GST law

- Place of Supply is the location of service receiver

Is There No Late Fee For GSTR-1 & GSTR-3B Return?

One of biggest relief that extends for small business is the waiver of late fee while filing GSTR-1 and GSTR-3B return by GST Council. Late fees are completely waived for taxpayers in FORM GSTR-1, FORM GSTR-3B and FORM GSTR-4 during months or quarters July 2017 to September 2018.

Conclusion:

Read, Also: CGST, SGST, and IGST: Understanding the difference.