Advisory on Auto-Population of E-Invoice Details into Form GSTR 1

Shivani Jain | Updated: Dec 03, 2020 | Category: GST, News

Recently, GSTN or the Goods and Service Tax Network has released an advisory on the “Auto-population of E-invoice Details into Form GSTR 1”, dated 30.11.2020. The main agenda of this advisory is to inform all the taxpayers who have been preparing and issuing invoices by generating IRN (Invoice Reference Number) from IRP (Invoice Registration Portal), that the details of such invoices need to be auto-populated in the respective tables of Form GSTR 1.

In this blog, we will discuss the Concept, Applicability, and Benefits of GST E-invoice system, together with the Advisory on Auto-Population of E-Invoice of Invoice Details in Form GSTR-1.

Table of Contents

Concept of GST E-Invoice System

The term “GST E-invoice” means the generation of digital invoice regarding the goods and services offered by a business entity. Further, the same can be generated on GST portal. The main reason behind the implementation of GST E-invoice system was to reduce the cases of Tax Evasion.

Moreover, it is compulsory for all the business entities that cross the prescribed threshold to generate e-invoices regarding each sale made from the GST Portal[1]. However, it shall be relevant to mention that only the government has the right to set the threshold limit for the businesses regarding the generation of e-invoices.

Applicability of GST E-Invoice System

All the business entities that are having the annual business turnover of Rs 500 crores or more need to generate e-invoice for each sale made.

However, it shall be relevant to state that the generation of E-invoice from GST postal is mandatory for Privileged Sectors. The term “Privileged Sectors” includes Insurance Banking Units, Cinemas, Passenger Transport Services, Goods Transport Dealer, etc.

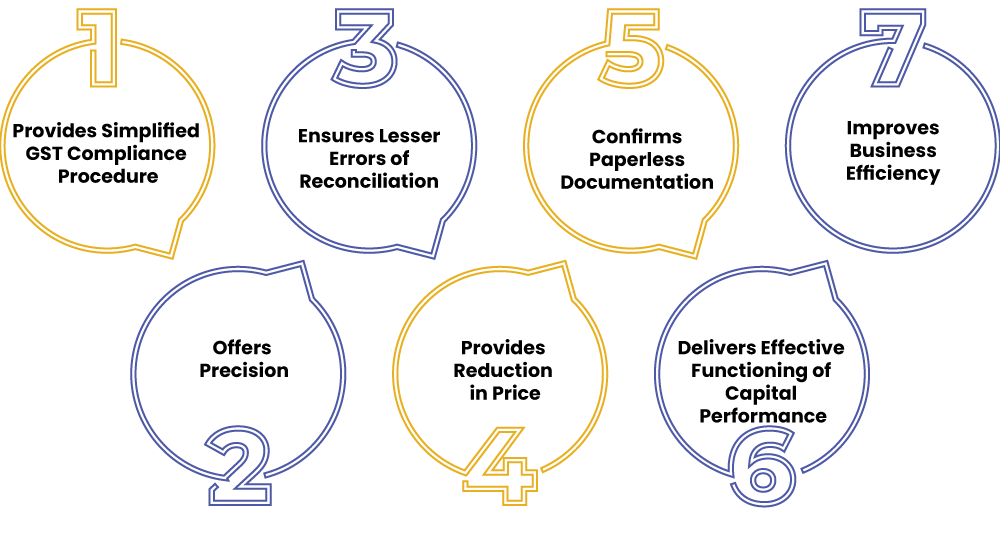

Benefits of GST E-Invoice System

The benefits of the E-invoice system under GST Law are as follows:

- Provides Simplified Filling of GST Returns and Compliance;

- Offers Precision;

- Ensures Lesser Errors of Reconciliation;

- Provides Reduction in Price;

- Confirms Paperless Documentation;

- Delivers Effective Functioning of Capital Performance;

- Improves Business Efficiency;

How will the Details of E-invoice be Auto-Populated in Form GSTR 1?

As per the Advisory issued by GSTN (Goods and Service Tax) network on 13.11.2020, the taxpayers need to prepare and issue invoices by generating IRN (Invoice Reference Number) from IRP (Invoice Registration Portal).

After the successful generation of Invoice Reference Number, all the details of such E-invoices will be auto-populated in the tables of Form GSTR 1. Also, the same can be downloaded from the excel file as well.

However, it shall be significant to note that if a taxpayer has already filed Form GSTR 1 for the corresponding period, then the details of such e-invoice will be downloaded from excel file only.

GSTR-1 Table for Auto-Population of E-Invoice Details

| S. No | Type of Supply | Auto-Population in GSTR 1 Table |

| 1. | Taxable Outward Supplies made to the Registered Persons (other than Reverse Charge Mechanism) | B2B 4A – Supplies made other than the following listed: Those attracting Reverse Charge Mechanism; and Supplies made by way of E-Commerce Operator; |

| 2. | Taxable Outward Supplies made to The Registered Persons, which are attracting the Reverse Charge Mechanism | B2B 4B – Supplies that are Attracting Tax on the basis of RCM (Reverse Charge Mechanism) |

| 3. | Export Supplies | EXP 6A – Exports made |

| 4. | Debit or Credit Notes issued to the Registered Persons | CDNR 9B – Debit or Credit Notes (Registered) |

| 5. | Debit or Credit Notes issued to the Unregistered Persons | CDNUR 9B – Debit or Credit Notes (Unregistered) |

Need for Issuing a New Advisory on 30.11.2020

The main reason behind the issuance of new advisory on 30.11.2020 by GSTN (Goods and Service Tax Network) was to inform all the taxpayers who have been preparing and issuing invoices by generating IRN (Invoice Reference Number) from IRP (Invoice Registration Portal), that there will be a delay in the process of auto-population of e-invoice details into Form GSTR 1.

However, as per the advisory issued, there is no need for the taxpayers to wait for the auto-populated data and are suggested to proceed further with the preparation and filing of Form GSTR 1 for the month of October 2020 (in case the taxpayer has not filed the same on the due date) and for November 2020 (before the due date).

Also, the process of auto-population of e-invoice for the month of December 2020 will start from the first week of the month.

Further, the details of the e-invoices relating to the month of October and November 2020 will be made available from 13.12.2020 onwards. Also, the processing and availability of the complete data for the said months will take around 2 weeks’ time.

Things to Remember Regarding Auto-Population of E-Invoice Details

The things to remember regarding the Auto-Population of E-invoice Details are as follows:

- The facility of auto-population of details from GST E-invoices into GSTR 1 is available only with the taxpayer;

- After the auto-population of data, the taxpayer needs to verify the accuracy and authenticity of the data filed in each field;

- The taxpayer needs to fill in details in accordance with the pertinent legal provisions;

- Once the process of auto-population of details into Form GSTR 1 gets started, all the concerned taxpayers are requested to verify and authenticate the documents available in the excel and can share their feedback on GST Self Service Portal regarding the aspects as follows:

- All documents reported to Invoice Registration Portal are present in excel;

- Status of each e-invoice or IRN (Invoice Registration Number) is correct;

- All the details of the e-invoices are populated correctly and accurately;

Conclusion

In a nutshell, GST E-invoice signifies the generation of digital invoice concerning the goods and services offered by a business entity. Also, the main objective behind the implementation of GST E-invoice mechanism was to reduce the cases of Tax Evasion.

Further, GSTN has released an advisory on the Auto-population of E-invoice Details into Form GSTR 1 on 30.11.2020. The same was in continuance to the advisory issued by GSTN on 13.11.2020. The main aim behind its issuance was to inform the relevant taxpayers that there will be a delay in the process of auto-population of e-invoice details into Form GSTR 1.

Moreover, for any other details and confusion concerning the advisory releases and the procedure for acquiring GST Registration and Filing of GST Return, reach out to Swarit Advisors.

Also, Read: E-Invoice System under New GST Return- Its Benefits and Implementation