Private Limited Company Registration Procedure in India

Gonica Verma | Updated: Jun 29, 2019 | Category: Private Limited Company

Nowadays, every business entity wants to register as Private Limited Company because in India, out of 1.9 million registered companies, 95% of companies are Private Limited and, are doing absolutely great business. Everyone is aware about the benefits of registering themselves as Private Limited such as, limited liability; separate legal entity etc. Small entities in India which are having less capital for their business prefer to register under Private limited over any other form of business entity. This type of business entity lies between Partnership and Public Limited companies in India. Directors and shareholders of the company can run operations according to their own rules and regulations and can improve their credibility by registering themselves as Private limited. Let’s proceed further for Private Limited Company Registration Procedure and benefits.

Table of Contents

What is Private Limited Company?

Private Limited Company is the most popular corporate entity of India. The Private Company Registration is governed by Ministry of Corporate Affairs (MCA) under Companies Act, 2013 and Companies Incorporation Rules, 2014. Under Private Limited Company, two directors and two shareholders form a company in which directors should be the natural person but shareholders may be a corporate entity. The maximum number of directors under Private Limited is 15 and there is no limit on shareholders. The profits of the company are divided among shareholders in the form of dividends and the annual account reports must be submitted to the Registrar of Companies (RoCs) on regular basis.

Eligibility for Private Limited Company Registration

- The company should have minimum of 2 directors and maximum 15 directors.

- At least one director should be the citizen of India.

- Minimum share capital required to form up Private Limited Company is Rs1 lakh.

- As per Companies Act, 2015, Government of India has been removed the minimum paid up capital requirement to form a Private Limited Company.

Documents Required Private Limited Company Registration

- Identity proof of all Directors (Aadhar card, Driving License, PAN card, Passport)

- Address Proof all directors (Voter ID card, Passport)

- Form No. INC-33 for Memorandum of Association

- Form No. INC-34 for Article of Association)

- Address proof of company registered office (Rent agreement, Possession letter etc.)

- Electricity Bill of the office building

- Bank statement of company’s bank account

- Copy of Company’s Incorporation Certificate in case of Foreign Corporate Body

- Trademark registration Certificate

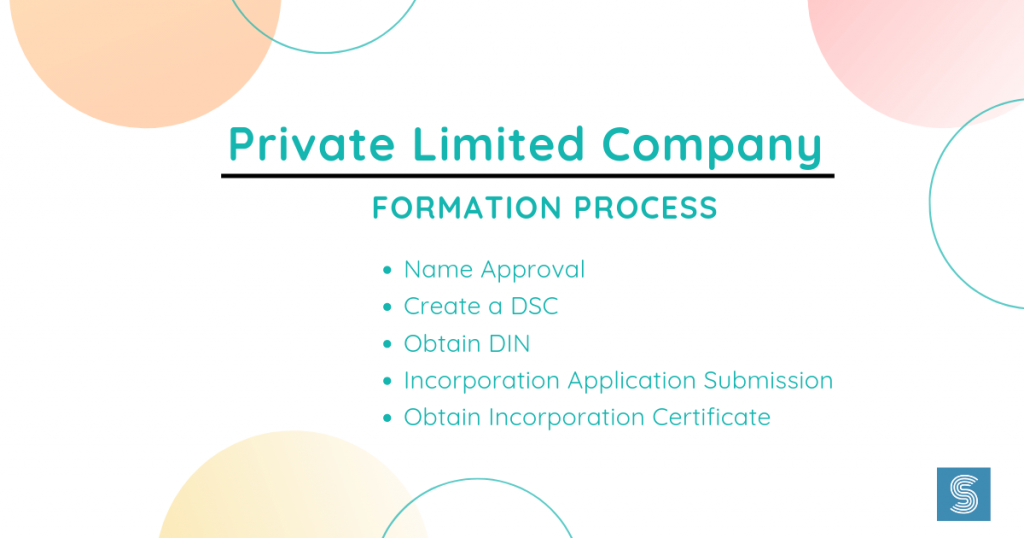

Procedure of Private Limited Company

Name approval

Firstly, the directors of the company must obtain the name of their proposed company from Ministry of Corporate Affairs (MCA)[1]. The latest government portal RUN (Reserve Unique Name) allows the directors to fill 2 suggestions of their company’s name and in other section they can also check the existing companies’ name. The name can be approved through RUN in 2-3 working days. In case of subsidiary company, the name can also be approved by filing up SPICe (INC-32) by submitting Resolution from parent company for the use of main name and trademark.

Create a DSC

Digital Signature Certificate (DSC) is the electronic copy of the identity of Directors. DSC can be obtained in 3-7 working days from the Certifying Authorities with the validity of maximum 2 years. In case of foreign nationals, they can submit the self attested copy of the passport notarized by Indian Embassy in their home country.

Obtain DIN

After creating the Digital Signature Certificate, the directors may obtain their 8 digits Digital Identification Number (DIN) by submitting their Passport copy and Address proof. DIN can be signed by their electronically generated DSC. The director can obtain DIN once in a lifetime even if in case he is the director of more than one business entity. From 2018, maximum three directors of the company can obtain DIN by submitting SPICe Form INC-32. DIN has lifetime validity and can be obtained in 2-4 business days.

Incorporation application submission

The incorporation application can be submitted with SPICe Form with all the required documents as mentioned above to Ministry of Corporate Affairs. The application can be prepared and submitted in 1-2 working days.

Obtain Incorporation Certificate

After submitting your Incorporation application, the MCA verifies the entire submitted documents for the approval. When the ministry approved your application, then you can obtain your Incorporation Certificate along with Company’s PAN and TAN.

Also, Read: Articles of Association (AOA) and Its Importance for the Company

Benefits to form a Private Limited Company

Limited liability

If you registered your company as Private Limited, then the personal assets of the directors or shareholders are protected if in case the business is not doing well.

Separate legal Entity

All the Private Limited companies have separate legal entity which opens the door of multiple national and international opportunities for them.

Access to funding

Once you are Private Limited Company, then you can invite equity shareholders to invest in your company for its operations.

Debt taking capacity

Private Limited companies can take funds easily from private financial institutions, banks etc. and in the form of debenture and convertible debentures.

Easy exit

Companies registered as Private Limited can be easily transferred or sold to any individual or entity without disturbing the operations of the business.

Brand Value

If you registered your company as Private Limited, then it automatically increases the company’s brand value as public came to know about the company and its operations.

Greater credibility

Private registered companies have greater credibility as they maintain transparency in submitting MOA, AOA, list of directors, stakeholders to Ministry of Corporate Affairs.

Capital

Private limited company can raise more capital by issuing more and more shares of the company as there is no limit on the number of shareholders for their company.

Tax advantage

Private limited companies can also enjoy tax benefits. The corporate taxes for Private limited companies are lower than other form of companies. They can also enjoy tax redeemable cost and benefits which can be redeemed against the profits of the company.

Conclusion

Companies registered as Private limited are ideal for startups and growing private business entities like proprietorship or partnership. They should register themselves under Private limited to enjoy the benefits of raising funds and limited liability. The process of registering under Private Limited has became easy from past few years but still, the whole process is time consuming to secure the required approvals from the regulating authorities.

So, it is advisable for them to take professional services for their private Limited Companies registration as there is a long list of required documents and notarized documents for submission which can only be managed by professionals. For professional assistance, please contact Swarit Advisors.

Also, Read: Minimum Paid-Up Capital for Private Limited Company