IEC Registration Process in India– Meaning and Procedure

Sanchita Choudhary | Updated: Nov 12, 2020 | Category: IEC

In this era of tough competition where nothing can survive if you do not work hard, everyone wants to expand their business beyond the limits of the existing domestic market. However, it can noted, that doing business on a global basis isn’t just everyone’s cup of tea. But before reaching to the global market, every business needs to follow several procedures and laws so that they can get different kind of registrations and license. IEC license is considered to be one of such prerequisite which is required for importing or exporting from India.

Hence, it is important for each and every start-up’s and the entrepreneur should know the legal policies, rules and procedures by which one can start the business of export in India.

Table of Contents

Meaning of Import Exchange Code

Import Export Code or better known as IEC is such mandatory license which is required by anyone who is looking to start their business related to import or export in the country. This Import Exchange License can be issued by the Director General of Foreign Trade or DGFT. IEC is a 10-digit code having validity for lifetime.

Further, it can be understood that any importer merchant cannot import their goods for business without having a proper Import Exchange Code. Similarly, any merchant who is related to export business cannot run their business or avail any kind of benefits for the export scheme from the Director General of Foreign Trade without the import exchange code.

Moreover, this IEC Registration has been made mandatory by the Foreign Trade policy issued by the Government of India. It is stated under laws that no commercial export or import can take place without having a valid IEC code. Further, doing export or import without the IEC code is deemed to be illegal in India.

Features of Import Exchange Code

Below are some of the basic features related to the Import Exchange Code in India:-

- IEC code is termed to be nothing but just the PAN Card number registered with the department of Director General of Foreign Trade (DGFT).

- This process of getting one’s PAN Card number registered under DGFT is known as IEC code registration.

- However, a separate number for registration was issued for IEC code earlier, but later on, the government in the year 2017 amended the policies and thus making PAN as the universal IEC code, once the registration is done with DGFT.

- Import Exchange Code once allotted to a merchant is valid for lifetime.

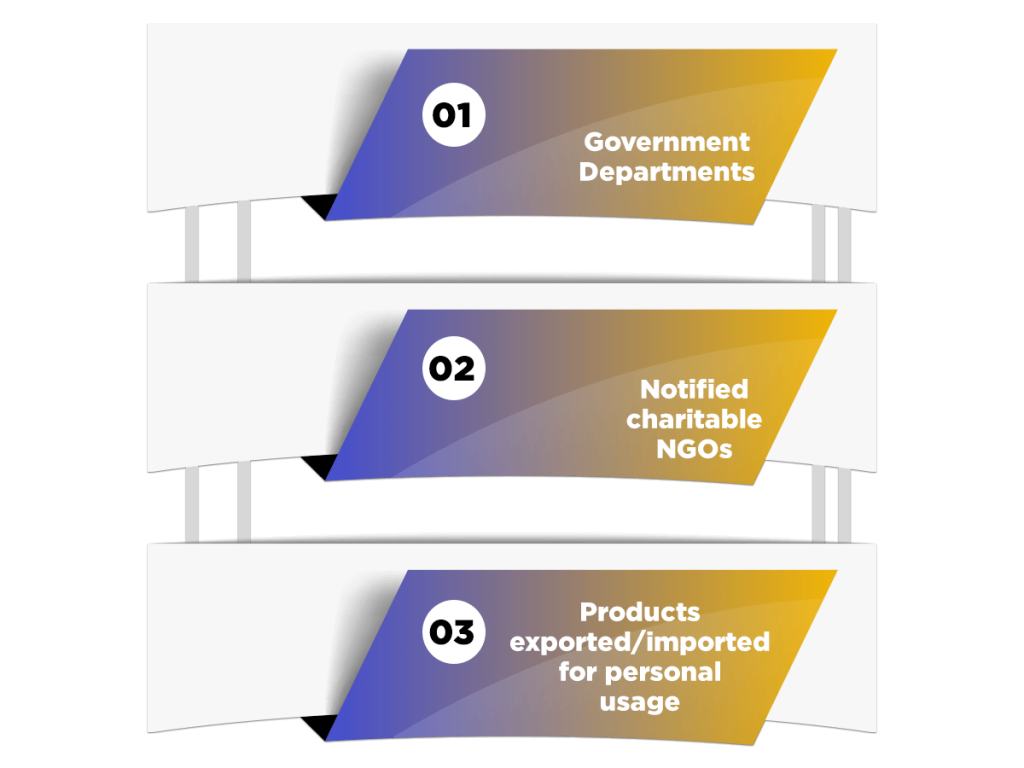

Exemptions under IEC Registration

There are various situations or circumstances when IEC registration code is not required for the purpose of either export or import outside India. Some of these situations are mentioned below:

- No IEC registration code is required at the time when any of the government departments are importing or exporting.

- Whenever any notified charitable NGO are involved in the export or import business then in such situations no IEC Registration is required.

- IEC registration code is not required in case if a person does any export or import of products for their personal use.

Validity of IEC Code

The IEC code is a ten digit code which has the validity of a lifetime. However, the validity of such IEC code is till the business is in function. Once the business is over the IEC registration can either be revoked or surrendered.

Eligibility Criteria for Obtaining IEC

- Those businesses dealing with the export or Import of goods should register themselves for IEC, irrespective of the size of the business or of the company.

- IEC is not required for Import or export of any goods related to personal use since they are not directly connected with trade, manufacture, or even with agriculture.

- IEC is not required during the process of setting up of any business.

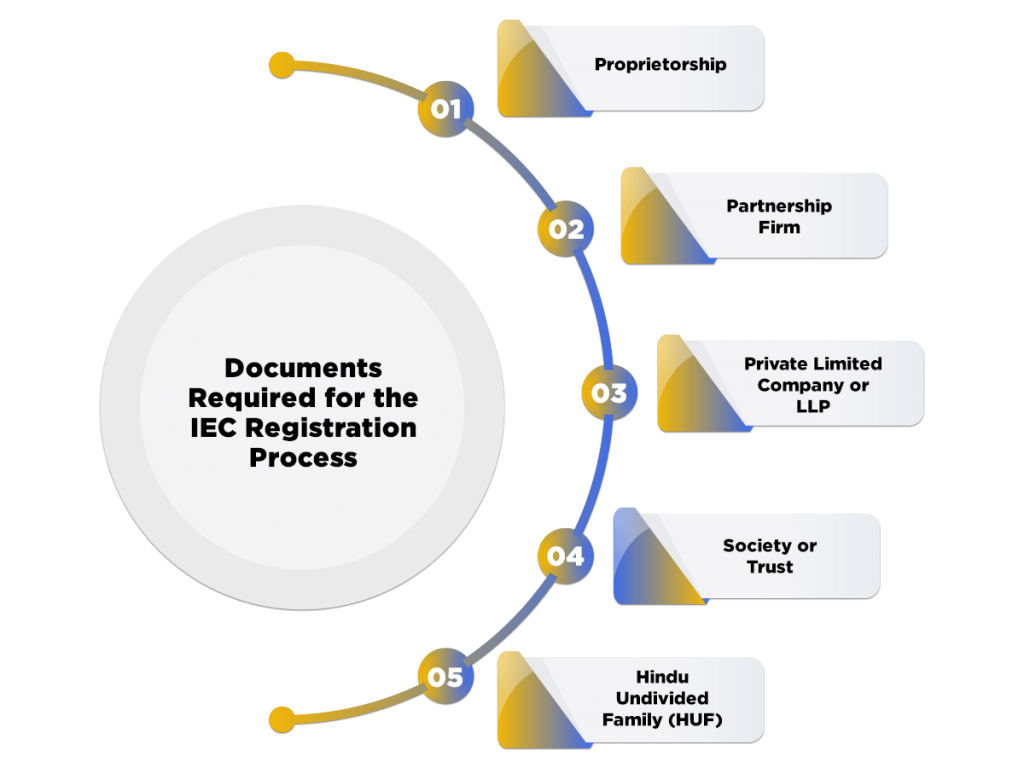

Documents Required for the IEC Registration Process in India

Following set of documents are required for the successful completion of IEC registration process in India-

1. Proprietorship

In case of Proprietorship following are the set of documents required for the IEC registration process in India:-

- Photograph of the Proprietor,

- Copy of the PAN Card of the proprietor,

- Copy of Passport of the proprietor,

- Copy of Voter ID or Driving Licence of the proprietor,

- Copies of latest electricity bill,

- Cancelled Cheque bearing the name of the proprietor along with the account No. of the proprietor.

2. Partnership Firm

In case of a partnership firm, following are the set of documents required for IEC registration process in India:-

- Copy of photograph’s of each partners.

- Copy of PAN Card

- Valid ID proof of the Managing Partner of a Partnership Firm.

- Copies of Partnership Deed

- Copy of latest electricity bill.

- Cancelled Cheque having the name as well as the account number of the entity.

3. Private Limited Company or LLP

In case of a Private limited company or a limited liability partnership, following are the set of documents required for the process of IEC registration in India:-

- Copy of the images of the director.

- Pan Card copies.

- Copy of valid ID proof’s of the director.

- Copy of Incorporation Certificate

- Copy of the latest electricity bill.

- Cancelled Cheque bearing the name of the company along with the account number.

4. Society or Trust

In case of a society or of a trust registration, following are the set of documents required for the process of IEC registration:-

- Digital Photographs of the Chief Executive of the society or of Trust.

- Copy of PAN Cards

- Copy of a valid ID proof of Trustee.

- Copy of the latest electricity bill.

- Cancelled Cheque having the name of either of the Registered Society or of the Trust along with the account number.

5. Hindu Undivided Family (HUF)

In case of a Hindu Undivided Family[1] or Joint Family, following are the set of documents required for the process of IEC registration:-

- Digital photographs of the Karta of the Hindu undivided Family.

- Copy of Karta’s PAN Card.

- Copy of valid ID proof such as Passport, Voter ID, Driving License or a UID of the Karta of the family.

- Copy of sale deed, if in case the business is self-owned.

- Copy of Rent Agreement if in case the business is on rent.

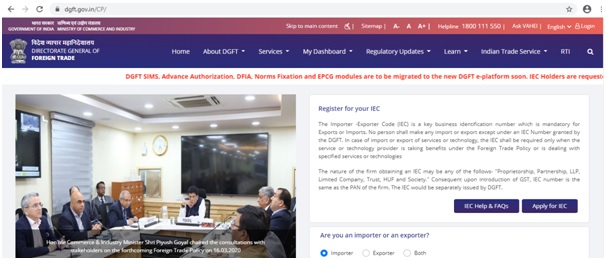

Procedure for Import Export Exchange Code Registration

- The only authority to issue IEC to any merchants in India is DGFT or Director General of Foreign Trade. Any merchant can apply for the issuance of IEC on its website.

- DGFT introduced an updated procedure and a new way to apply for the new IEC code online effective from 1st July 2020 in which DSC would be obligatory to upload.

- In order to stop fraud and to reinforce the IEC issuance procedure, DGFT announced the requirement of DSC in the latest guideline regarding the procedure of IEC registration process.

- Import export code is issued by DGFT (Director General of Foreign Trade), Department of Commerce an authority of Government of India, which is a ten digit identification number.

Steps to follow for IEC Registration Process in India

Step 1: Apply for IEC Icon

Click on https://www.dgft.gov.in/CP/. After visiting the website click on Apply for IEC icon.

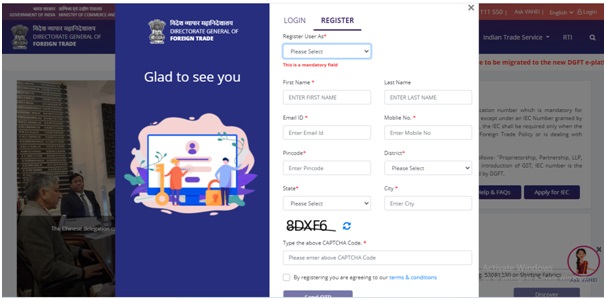

Step 2: Registration Details to be Entered

After clicking on Apply for IEC, enter the Registration Details as stated below:-

- Register Username as “Importer/ Exporter”

- First name and Last Name to be entered

- Email id of the applicant

- Mobile number of the applicant.

- Enter Pin code, District, State and City.

- Now, Click on the “Send OTP” button after entering all the details.

- Enter the OTP received by the applicant on the mobile no. and mail id.

- a notification comprising the temporary password on your mail id to be received by the applicant.

- Once the OTP is successfully verified change upon your first login.

- Now, click on “Apply IEC” button again.

- Click on start fresh application option once the user registers themselves and log – in to the “Customer Portal” using the identifications as entered in step 2.

Step 3: Details for IEC Code Registration Form

Start filing the details in the IEC code registration form which are as follows:-

1. General Information

- Nature of the Concern

- Firm or Company Name

- PAN of the Establishment

- Insert Name as per PAN Card

- Incorporation of the entity or Date of Birth.

- The category of the exporter.

- Select the option as per the location of the Firm, whether the firm is located in the Special Economic Zone (SEZ) or not.

- Select the option, regarding the location of the firm. Whether it is located in Electronic Hardware Technology Park (EHTP) Scheme, Export Oriented Unit (EOU) Scheme, Bio-Technology Park (BTP) scheme or Software Technology Park (STP) Scheme).

- Enter the CIN or LLPIN number in case of LLP or a private limited company.

- Enter the GST Number correctly.

- Enter the mobile no and mail id.

- Upload proof for the given entity.

- Enter details related to the address of the firm.

- Upload supporting documents as “Proof of Address” such as Rent agreement, Sale Deed, lease deed, mobile, electricity bill, MOU, telephone landline bill, post-paid bill.

Select “Save and Next” option after filling all the above details successfully.

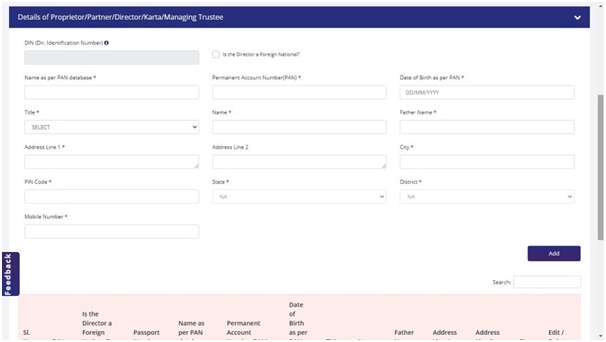

Add Details Of Proprietor/ Director/ Karta/ Partner/ Managing Trustee Of The Entity/Establishment Which Includes The Following Agendas:-

- Insert name as mentioned under PAN record.

- Enter PAN number of the concerned person i.e. Proprietor/ Director/ Karta/ Partner/ Managing Trustee.

- Enter Date of birth as per PAN Card.

- Enter complete address of the Proprietor/ Director/ Karta/ Partner/ Managing Trustee.

- Enter Mobile no of the Proprietor/ Director/ Karta/ Partner/ Managing Trustee.

- Select “Save and Next” button after filling the complete details successfully.

A. Enter Bank Information

- Bank Information’s such as account holder’s name, Name of Bank along with the Branch name, account number, IFSC code must be entered.

- Applicant shall also upload cancelled cheque of the bank account or Bank certificate as per the prescribed Performa.

- Select “Save and Next” button once filling the complete details successfully.

B. Now, The Applicant Needs To Select Other Details Such as Preferred Sectors Of Operations.

- Click on the “Save and Next” button after completely filling the above details successfully.

C. Select the box of Acceptance Of Undertaking and Declaration. Fill The Details Successfully.

- Once entered the details, click on “Save and Next” button to proceed further.

Step 4: Last Entry

- After completing step 3, click on “Sign” button at the lowermost part of the page.

- Now, the applicant needs to select the mode of submission

- Either through Aadhar OTP, or

- Digital signature certificate.

- Enter the ‘Virtual ID or Aadhar number’ and click on get OTP.

- Further enter the OTP received and then submit the form

- Confirm the details mentioned above and then proceed to make the payment against application after the signing of prescribed form is done. For Payment the applicant shall be redirected towards ‘Bharatkosh’ Payment Gateway. The Application of IEC Fee is Rs 500.

- After completing the process for IEC Registration, Page will be redirected to the DGFT Website after Successful Payment and the receipt shall be displayed to you. The applicant shall also download the receipt for the future reference.

- However, the applicant needs to wait for an hour so that the payment can be reflected from the ‘BharatKosh’ Payment Gateway in case of payment failure.

Conclusion

Thus, it can be understood from the blog that obtaining an IEC Registration code is a mandatory process for commencing any business related to import or export. If any merchant has not registered as per the IEC registration process then such business of export and import is considered to be illegal in India. Online import export code registration process makes it more simplified and hassle-free for any applicant. Since the IEC code has lifetime validity no renewal is required by the same. There are various regional offices of DGFT in the whole of India to commence this process and give approval of the same.

Also, Read: Procedure for Import Export Code in India