Input Tax Credit under GST: A Complete Guide on ITC

Shivani Jain | Updated: Jul 02, 2020 | Category: GST, Income Tax

Goods and Service Tax or GST Act is one of the significant reforms in the Indian Financial Sector. However, the feature that became the talk of the town was the mechanism of Input Tax Credit (ITC). ITC means a person while paying tax on sales can reduce the tax already paid at the time of purchase.

In this learning blog, we will thoroughly discuss the concept of Input Tax Credit (ITC) and how to claim and calculate ITC.

Table of Contents

Concept of ITC

ITC means reducing the amount of tax paid on Inputs (purchases) from the amount of tax to be paid on output (sales). When any goods or services are supplied to a taxable person, the GST rates levied are known as Input Tax Credit.

The concept of ITC is not new to our country, as it existed in the pre-GST regime as well. However, the scope ITC has now been widened under the Goods and Services Act [1] . Earlier, a manufacturer was not eligible to claim an input tax credit for the different types of taxes as follows:

- Central Sales Tax;

- Entry Tax;

- Central Excise Duty;

- Luxury Tax and other taxes.

Who can claim ITC?

An ITC can be claimed by any person registered under GST if he satisfies all the conditions as follows:

- The registered dealer must have the tax invoice;

- The said goods or services have been received;

- Returns have been filed on time;

- The supplier has paid all the tax charged to the government;

- Whenever the goods are received in Installments, the ITC can be claimed when the last installment/ lot is received;

- A manufacturer cannot claim ITC if depreciation has been charged on the tax component of a capital good.

However, any person registered under the Composition Scheme [2] is not liable to pay tax.

What can be claimed as ITC?

A taxable person can claim ITC only for business purposes. That means a person cannot claim ITC on the goods or services as follows:

- Personal Use;

- Exempt supplies;

- Supplies for which ITC is explicitly not available.

What is the time-limit to avail ITC?

A registered person needs to claim ITC in a specific manner and time frame. Further, the table given below shows the different situations in which the ITC can be claimed for finished or semi-finished goods:

| Situations | Claim of ITC |

| If a person has applied for GST Registration or is granted registration | Day from when he is liable to pay taxes |

| When a person takes up a voluntary registration | Date of Registration |

| When a taxable person stops paying taxes under the Composition Levy Scheme | Day from which he is liable to pay tax normally under section 7. |

In these situations, the registered dealer can claim ITC only if one year has not passed from the date on which the invoice concerning supply was issued. For any other case, the Input Tax Credit can be claimed earlier of the following:

- Furnishing of Annual Return;

- Due date of filing the monthly GST return (GSTR-3) for the next financial year is September month.

How to Claim Input Tax Credit?

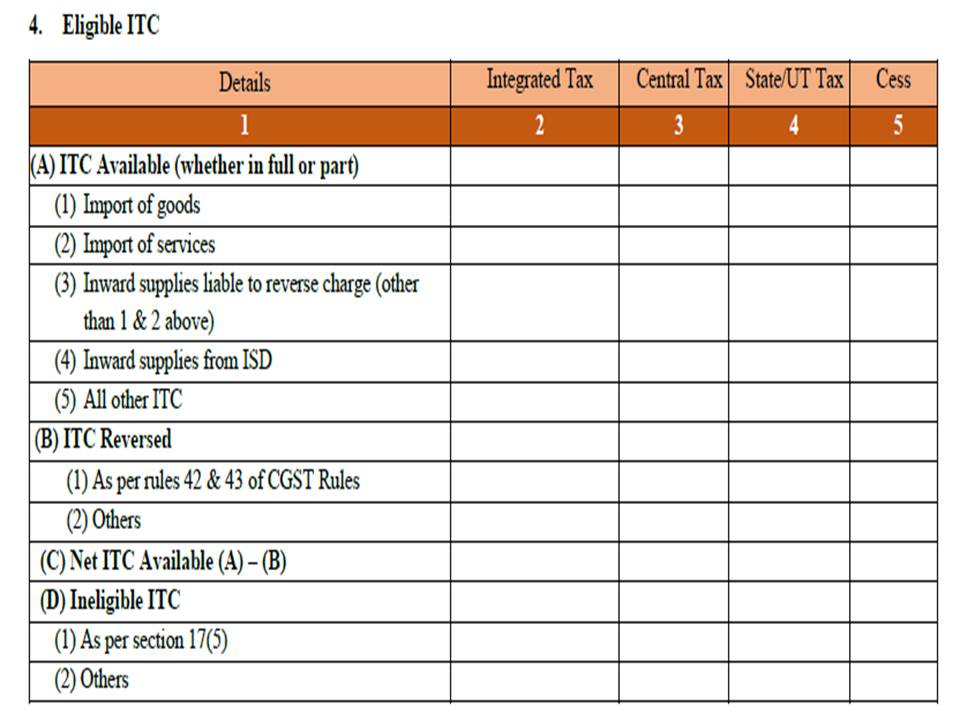

All the regular taxpayers need to report the amount of ITC in their monthly GST returns in Form GSTR-3B. Table 4 needs a summary figure of the eligible and ineligible ITC along with ITC reversed during the tax period. The specimen of Table 4 is provided below:

A registered taxpayer is eligible to claim ITC on a provisional basis in the form GSTR-3B. He can claim ITC up to 20% of the eligible ITC reported by suppliers in an auto-generated GSTR 2A return. Therefore, a taxpayer must verify the figures of GSTR 2A before filling GSTR 3B.

Normally, a taxpayer was eligible to claim provisional ITC till 09.10.2019. However, as per the new CBIC ruling, from 09.10.2019, a taxpayer cannot claim more than 20% of the eligible ITC. That means from 09.10.2019, GSTR 3B will be the total of the actual ITC in GSTR 2A and the provisional ITC in the GSTR-2A. Thus, matching of the expense ledger or purchase register with the GSTR-2A becomes crucial.

Reversal of Input Tax Credit

In India, the situations on which the ITC will be reversed can be summarised as:

- Non-payment of Invoices within 180 days;

- Seller issues credit note to the ISD (Input Service Distributor);

- Inputs which are partly for personal use and partly for business purpose;

- Capital goods which are partly for personal use and partly for business purpose;

- If the inputs of exempted goods are more than the ITC reversed, then the difference will be added to output tax liability.

Further, the details of the reversal of ITC must be furnished in GSTR-3B. Moreover, the ITC claimed by the taxable person must match with the details submitted by the supplier in his GST return. However, if there is a mismatch, the authorities would ask the recipient and supplier to file returns again.

Documents Needed for Claiming ITC

In India, the documents needed for claiming ITC can be summarised as:

- Tax Invoice issued by the supplier of services and goods;

- The Debit Note issued by to recipient by the supplier;

- Bill of Entry;

- An invoice issued under situations like:

- Issuance of Bill of Supply (BOS) instead of Tax Invoice;

- If the amount of invoice is below Rs 200; or

- Cases where the reverse charge mechanism is applicable as per the GST Act.

- A Credit Note or invoice issued by the ISD;

- BOS issued by the supplier of services or goods or both.

Eligible and Ineligible Claims of ITC

The purchases eligible to claim ITC benefits can be summarised as:

- Intra-State Sale or Resale;

- Interstate Trade or Commerce;

- Used as Consumables Stores, Raw Materials, or Packing Materials to be sold Intra-country or Abroad;

- Used for the Execution of the Work Contract;

- Used as Capital Goods for Manufacturing or Reselling the taxable good;

- Used for making Zero-Rated Sales.

The situations in which one can claim ITC benefits can be summarised as:

- Goods from Unregistered Dealers or Dealers Registered under the Composition Scheme;

- Goods mentioned in the Negative List;

- Goods bought without Tax Invoice.

- Goods bought with Tax Invoice but without a separate mention of tax amount;

- Goods bought for manufacturing exempted items other than exports.

- Goods purchased for personal use or received as a gift;

- Goods bought from abroad;

- Interstate goods purchases.

Conclusion

The Implementation of GST has changed the dynamics of Indian Indirect Taxation. Input Tax Credit acts as one of the prime features of the Act, as it assists in eliminating the cascading effect of taxes.

However, there are various conditions and restrictions imposed to avail the benefit of ITC. That means there is a need to abide by the several documents and the other criteria required. Our GST experts at Swarit Advisors will help you with in-depth knowledge and endless assistance on the concept of Input Tax Credit.

Also, Read:GST Registration Requirement