GSTN Decides To Unblock The Facility of E-Way Bill Generation

Shivani Jain | Updated: Dec 02, 2020 | Category: GST, News

Recently, GSTN (Goods and Service Tax Network) has released an advisory on the “Online Filing of Application by the Taxpayer for Unblocking the Facility of E-Way Bill Generation facility”, dated 28.11.2020. Further, the term application means Form GST EWB 05.

Moreover, this facility is available with only those whose EWB or E-way Bill generation facility is blocked on the E-way Bill Portal.

Till now, taxpayers were applying with the tax officials through the manual filing of the application for unblocking their E-Way Bill Generation facility. After that, the tax officials used to issue orders on the GST portal regarding the application filed in the Form GST EWB 06. However, from now onwards, this facility stands discontinued.

In this blog, we will discuss the concept of E-way Bill and the Procedure to file an unblocking application for the same, together with the process to view additional orders and notices issued.

Table of Contents

Concept of E-way Bill

The term “E-way Bill” denotes a unique bill number that is used for a particular consignment that includes the movement of goods from one place to another. Further, it is used for both inter-state and state movement of goods worth Rs 50000 and more.

The details covered under an E-way Bill are as follows:

- Details of the goods transported;

- Consignor Details;

- Recipient Details;

- Transporter Details;

Moreover, the concept of E-way Bill was introduced nationwide on 01.04.2018.

Reasons for Blocking the Facility for E-way Bill Generation

Earlier, the Facility for E-way Bill Generation was blocked by GSTN for the reasons as follows:

- To Curb Circumvention of Taxes;

- To Monitor the Rate of GST Return Filing;

- To Fix the Count of Tax Defaulters;

- To Reduce Tax Evasion;

- To Enhance Tax Revenue Collection;

- To Establish Transparency between Government and Businesses;

- To Mandate GST Compliance;

- To Eradicate the Chances of Malpractice;

Regulatory Framework for Blocking of E-way Bill Generation Facility

The facility of generating E-way Bill was blocked as per Rule 138E (a) and (b) of the CGST Rules 2017. Further, the same used to get blocked in the case, where a taxpayer fails to file either of the following for 2 or more consecutive tax periods:

- his/her returns in Form GSTR 3B; or

- Statement in Form CMP 08;

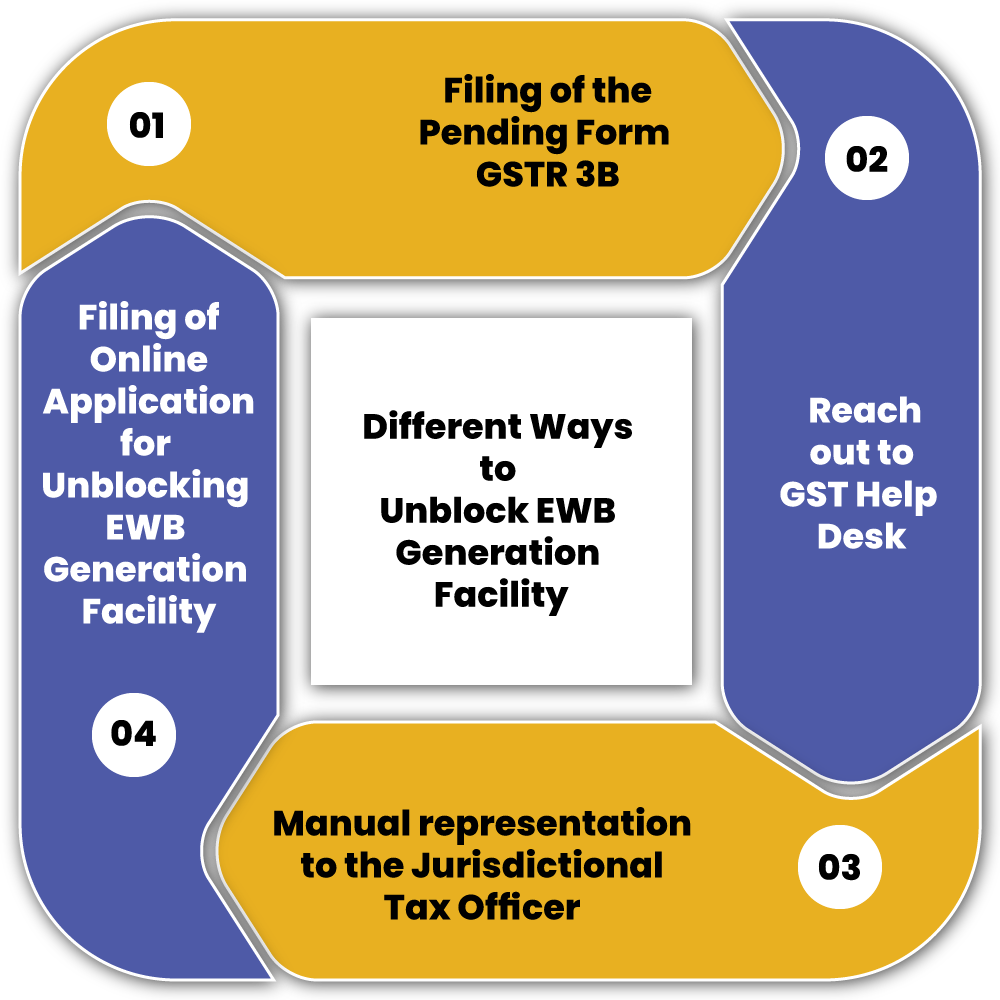

Different Ways to Unblock the Facility of EWB Generation

The different ways to unblock the facility of E-way Bill Generation are as follows:

- Filing of the Pending Form GSTR 3B;

- Reach out to GST Help Desk;

- Manual representation to the Jurisdictional Tax Officer;

- Filing of Online Application for Unblocking EWB Generation Facility (Based on the Advisory released on 28.11.2020);

Process to File Application for Unblocking EWB Generation Facility

The steps involved in the process to file Application for Unblocking EWB Generation Facility are as follows:

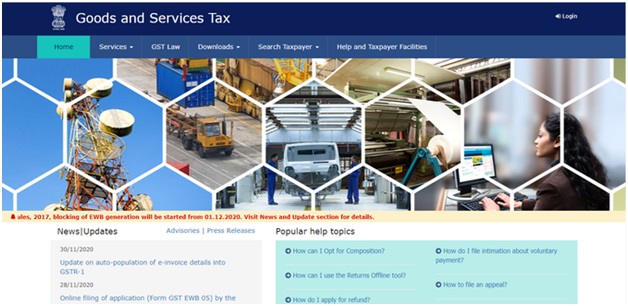

Visit the Official GST Portal

In the first step, the applicant needs to visit the official GST portal[1] .

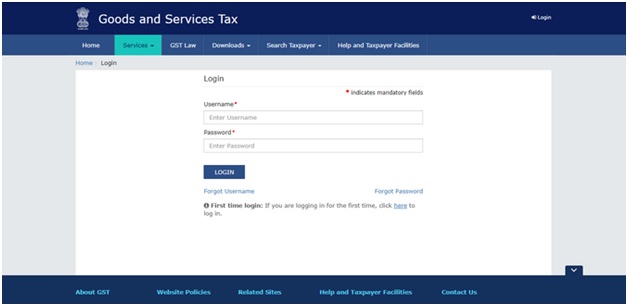

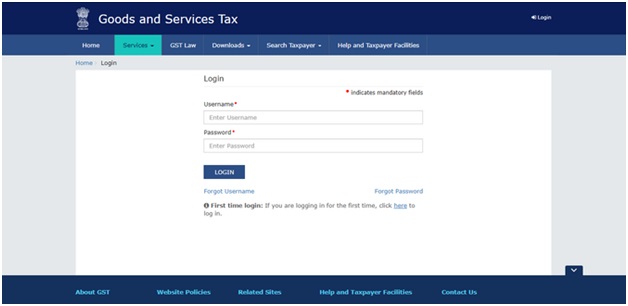

Log in to GST Account

Now, the taxpayer requires to click on the option “Login”, located at the top right of the webpage. After that, he/she requires to enter the provided Login Credentials. The term Login Credentials include Username and Password.

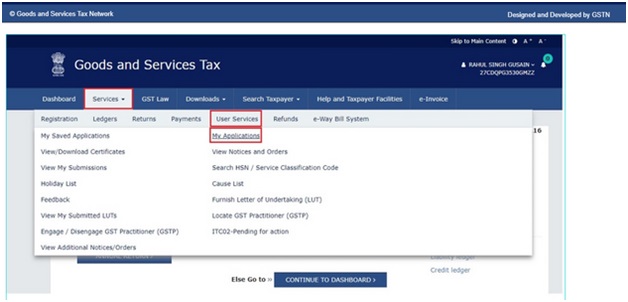

Click on Services

Now, the applicant requires to click the option “Services” > “User Services” > “My Application”.

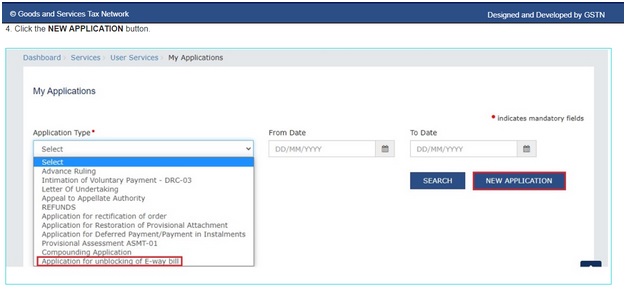

Choose Application for Unblocking EWB Facility

After selecting “My Application”, the applicant will be re-directed to a new page, wherein he/she needs to choose the option “Application for Unblocking of E-way Bill” from the drop-down menu. After that. Click on the option “New Application”.

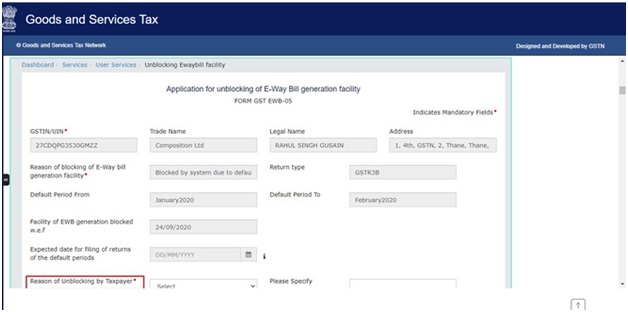

Fill in the Application for Unblocking

Now, the applicant will be redirected towards the application form for unblocking of EWB Generation Facility. Further, Form GST EWB 05 acts as the application form for unblocking of E-way Bill Generation Facility.

Over here, the applicant or the taxpayer needs to furnish the details as follows:

- GSTIN/ UIN;

- Trade Name;

- Legal Name;

- Address;

- Reason for Blocking the E-way Bill Generation Facility;

- Return Type;

- Default Period From;

- Default Period To;

- The facility of EWB Generation blocked (date);

- Reason of Unblocking by Taxpayer;

Further, he/she requires to choose the reason for unblocking the EWB Facility from the options available in the drop-down menu.

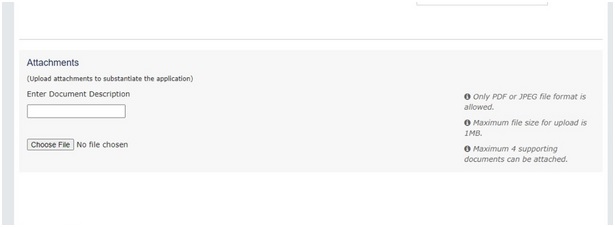

Attach Required Documents

Moving further, the applicant needs to attach the documents required in the application form. However, the documents uploaded must only be in JPEG or PDF form, and should not be more than 1 MB in size. Also, it shall be relevant to state that an applicant cannot upload more than 4 supporting documents.

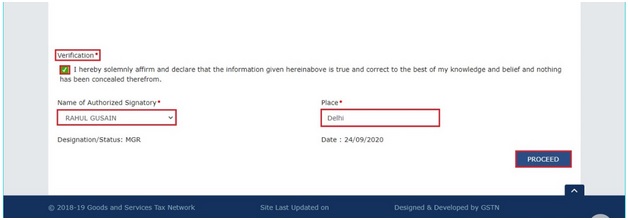

Tick Verification Box

Now, tick the verification box and choose the Name of the Authorised Signatory and Place from the drop-down menu.

Click Proceed Button

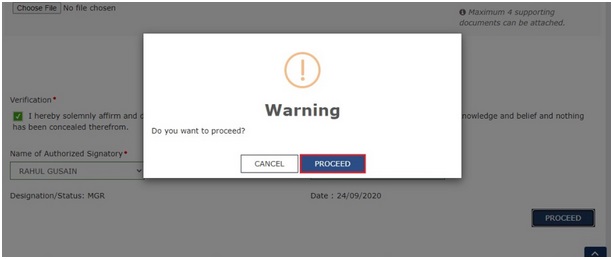

Lastly, the applicant will require to click on the option “Proceed” to get redirected to submit the application form page.

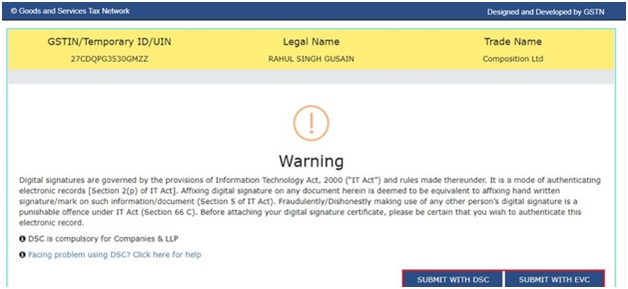

Submit Application Form Page

After clicking on Proceed, the applicant will be directed to submit the application form page, wherein he/she requires to choose the mode of filing the application form.

Further, the 2 modes of filing the application form are as follows:

- Submit with DSC

- Submit with EVC

Submit with DSC

If the applicant chooses the option to submit with DSC (Digital Signature Certificate), he/she needs to upload the certificate of DSC. After that, click on the “Sign” button.

Submit with EVC

However, if the applicant chooses the option to submit with EVC (Electronic Verification Code), then an OTP (One Time Password) will be sent on the registered email address and mobile number of the person registered as Authorised Signatory with the GST portal. After that, click on the option “Validate OTP” button.

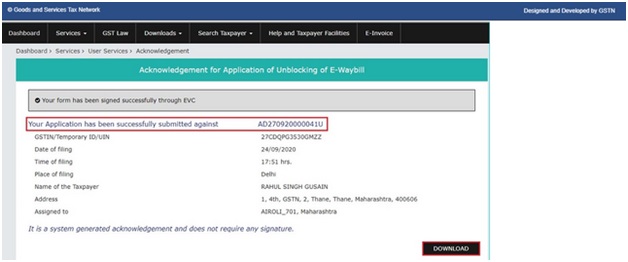

Display of Acknowledgement Page

Now, the applicant will be redirected towards the Acknowledgement Page with the generated ARN (Application Reference Number). Further, he/she will receive the same on the registered email address and mobile number as well.

Further, to download the application filed, the applicant needs to click the “Download” button. Also, once the application form is successfully filled, the status of the same will be changed to “Pending with Tax Officer”.

Also, Read: CGST, SGST, and IGST: Understanding the difference

What will happen after the Filing of Application Form?

Once the application for unblocking the facility of E-way Bill is successfully filed online, the same will be forwarded to the Jurisdictional Tax Official. Further, such an official will issue the notice for a personal hearing to the said taxpayer.

After that, the said taxpayer needs to file his/her reply to the notice, together with the supporting annexures.

Once, the process of verification is complete and the tax officer designated is satisfied with the form and documents submitted, then he/ she will issue an order in Form EWB 06 for approving the application for unblocking the EWB facility. However, the facility for EWB generation will only be restored for the period mentioned in the order.

Also, the notice or the order passed will be intimated to the taxpayer or applicant by way of SMS and mail on the registered mobile number and email address.

Process to View Application and Additional Notices

The steps involved in the process to view the application and additional notices are as follows:

Visit the Official GST Portal

In the first step, the applicant needs to visit the official GST portal

Log in to GST Account

Now, the taxpayer requires to click on the option “Login”, located at the top right of the webpage. After that, he/she requires to enter the provided Login Credentials. The term Login Credentials include Username and Password.

Click on Services

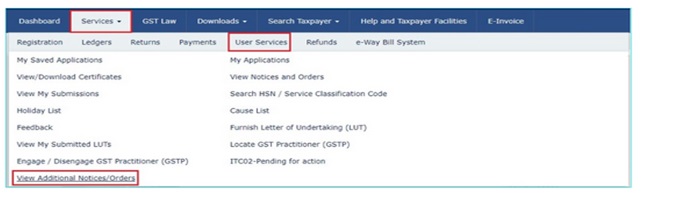

Now, the applicant requires to click the option “Services” – “User Services” “View Additional Notices/Orders”.

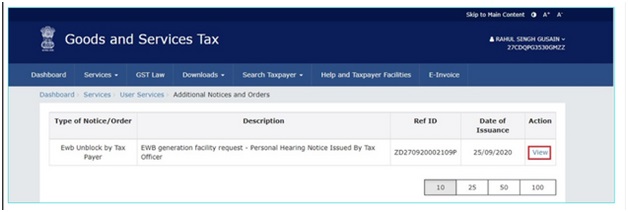

Press View Button

Now, the applicant will be redirected towards the webpage of additional notices and order. Over there, he/she requires to click on the option “view”, from where he/she will be taken to the case details webpage.

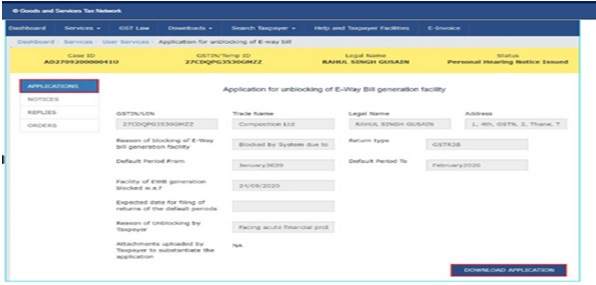

Case Details Page

On reaching the case details webpage, the applicant needs to select the option “Applications” if the same is not selected by default. After that, he/ she will get the option to view the PDF of the application filed.

Further, for downloading the application, the applicant needs to choose the option “Download Application”.

What will happen if the Jurisdictional Tax Officer rejects the Application Filed?

If in case the Jurisdictional Tax Officer rejects the application filed by the taxpayer by way of an order in Form EWB 06, then, in that case, the E-way bill will remain blocked, and the said taxpayer will require to file his/her pending return in either of the formats within 2 tax periods for the restoration of EWB generation facility:

- Form GSTR 3B;

- Statement in Form CMP 08;

Conclusion

In a nutshell, E-way Bill denotes a unique bill number that is used for a particular consignment that includes the movement of goods from one place to another.

Further, the facility to file an online application in Form GSTR EWB 05 is available with only those whose EWB or E-way Bill generation facility is blocked on the E-way Bill Portal.

However, the facility for EWB generation will only be restored for the period mentioned in the order. Moreover, for any other details and dilemma regarding the advisory releases and the process of get GST Registration and GST Return Filing, reach out to Swarit Advisors.

Also, Read: Updates Regarding The New Functionalities on GST Portal