Money Changer License: Eligibility and Application Process in India

Shivi Gupta | Updated: Jun 05, 2020 | Category: FFMC

Foreign exchange is crucial for a country to stay in the global trade mixture. Foreign exchange deals with trade of foreign currency in case of any transaction that happens internationally. This may include business transactions, money spent on tourism, etc. To carry out these transactions, it is mandatory to have licensed places where individuals and businesses can get their foreign currency exchanged. These licensed places are called Authorised Money Changers and to operate a currency exchange business, a Money Changer License or FFMC license is required. This guide talks about money changer license, eligibility to obtain FFMC license, application procedure, documents requirements, and much more.

Table of Contents

What is a Money Changer License in India?

Any company that wishes to start foreign currency exchange operations in India is required to obtain a Full-Fledged Money Changer License or FFMC License. The license is granted by the Reserve Bank of India, that also issues annual guidelines to be followed by all FFMC license holders in the country. These guidelines are issued vide a master circular by RBI on Memorandum of Instruction on Money Changing Activities.

The Full-Fledged Money Changer License or FFMC License registration, renewals, revocations, and other provisions that must be followed by FFMC holders in India are laid down under the FEMA- Foreign Exchange Management Act, 1999.

The Act, under Section 10(1) authorises a company to engage in foreign exchange or foreign security after obtaining the Money Changer License. Section 10(1) allows Authorised Money Changers or AMCs, including businesses or individuals who have received permission from the Reserve Bank of India to carry out Forex or money change activities in India. The AMCs allowed to carry out such operations are also known as Full-Fledged Money Changers.

The act and the RBI guidelines prohibit anyone from carrying out any money changing activities or display advertisements regarding the same unless a Full-Fledged Money Changer License or FFMC License is obtained from the RBI.

Activities Permitted for FFMC License Holders

Any entity or individual that holds the Money Changer License or FFMC License can carry out the following activities in India:

- The FFMC license holder can enter into a Franchise Agreement to carry out Restricted Money Changing business. This business performs activities relating to the conversion of foreign currency notes, coins or travellers’ cheques into Indian Rupees (INR).

- The FFMC license holder can also freely purchase any country’s currency, notes or coins, and traveller’s cheques from Indian residents and Non-Residents. It can also extend its license to allow its franchisee to carry out these activities legally.

- The FFMC license holder is also allowed to sell INR to foreign visitors or tourists against their International Debit or Credit Card.

- The FFMC license holder can also sell foreign exchange currency for the purposes of business transactions, personal visits, and Forex prepaid cards.

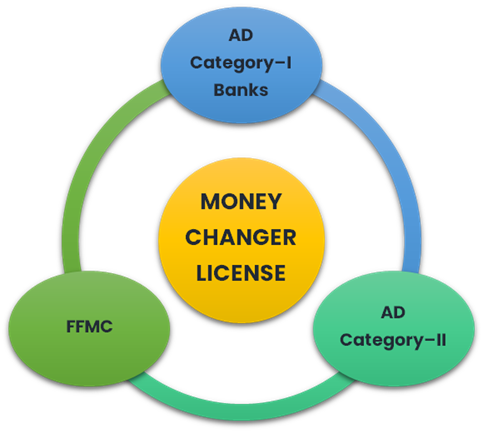

Kinds of Money Changer License or FFMC License

A company or individual may file for any of the following types of Money Changer License or FFMC License in India:

- Authorised Dealer Category-I Banks (AD Category–I Banks)

- Authorised Dealers Category-II (AD Category–II)

- Full-Fledged Money Changer (FFMC)

Eligibility to Obtain Money Changer License

Any business that wishes to obtain a Money Changer License or FFMC License in India must fulfil the following criteria:

- The entity must be registered under the Companies Act, 2013 in order to undertake the activities of foreign currency exchange.

- The business must possess at least INR 25 lakhs as its net-owned funds to operate a single branch. However, when a business wishes to operate via multiple branches, it must possess net-owned funds of at least INR 50 lakhs.

- The Memorandum of Association of the business must include an object clause that states that the company intends to undertake the activity of money exchange in India.

- No criminal or civil cases must be pending against the business with the Department of Revenue Intelligence.

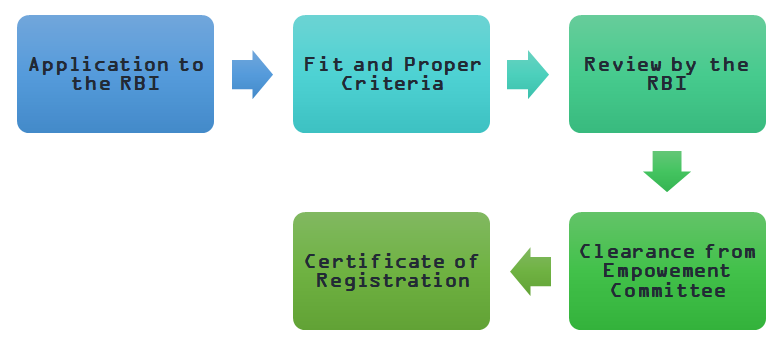

The process to Obtain Money Changer License

To start a money-changing business in India, it is mandatory to obtain the approval of the Reserve Bank of India. The process involved in obtaining a Money Changer License or FFMC License includes the following steps:

Application to RBI For Money Changer License

The first step is to file a comprehensive application with the regional office of the RBI to obtain the money changer license. The application must be accompanied by the requisite documents as prescribed by the RBI.

Fit and Proper Criteria

To obtain Money Changer License or FFMC License in India, the applicant must fulfil the ‘Fit and Proper Criteria’. This criterion states that no proceeding in the form of the criminal or civil case must be pending against the applicant with the Department of Revenue Intelligence. If any such case is pending against the applicant, they will not be eligible to obtain an FFMC license.

To ensure that the fit and proper criteria is met, the Board of the applicant company must undertake due diligence to confirm that the person chosen or appointed as the Director of the company is suitable to receive or continue to hold such appointment. This must be done by determine the person’s expertise, qualifications, integrity, and track record.

Additionally, the applicant must fit the following criteria:

- The applicant must not exceed the age of 70 years.

- The applicant must not be a Member of Parliament, Member of Legislative Assembly, or a Member of Legislative Council.

- The applicant must not have any criminal record or civil action against them relating to apersonal debt.

- The applicant must not have received a refusal of admission to or expulsion from any professional bodies.

- The applicant must not have received any sanctions from regulators or similar bodies.

- The applicant must not have a history ofold questionable business practices.

In case the applicant has any case pending with the Directorate of Enforcement (DoE), the Directorate of Revenue Intelligence (DRI) or any other law enforcing authorities, the company would disqualify from obtaining the Money Changer License or FFMC License. The Board of the company must also obtain a self-declaration from the Directors stating that they meet the fit and proper criteria.

Review by the RBI

The RBI reviews the documents and applicant submitted by the applicant company, and assesses whether or not the company meets the fit and proper criteria before forming a decision regarding the issuance of Money Changer License. If the RBI is satisfied with the documents and applicant, it considers the application for approval.

Empowered Committee Clearance

The applicant must also obtain the clearance from the Empowered Committee. The RBI only considers an application for approval if the Empowered Committee issues the clearance to the applicant company.

Certificate of Registration

Upon confirming the authenticity of the details and documents provided by the applicant company, and confirming the clearance by the Empowered Committee, the RBI issues the Money Changer License or FFMC License within 2 or 3 months.

The RBI’s decision to approve or reject a registration application for Money Changer License or FFMC License is final and binding upon the applicant.

Upon receiving the license to operate as a Money Changer Business or FFMC, the company must commence its activities within 6 months from the date on which the license was issued. The company must also inform the Regional Office of the RBI that it has started its money-changing operations in India.

Documents Needed to ObtainMoney Changer License

The registration application must be filed in the format as prescribed by the RBI with the Regional Office of the Foreign Exchange Department of the RBI. Additionally, the applicant must attach the following documents with the money changer license application:

- Copy of Company Incorporation Certificate.

- Memorandum and Articles of Association laying down the object provision that states that the company would undertake money changing activities.

- A copy of the latest audited accounts of the company.

- Certificate from Statutory Auditors that certifies the net-owned funds of the company.

- Audited Balance Sheet and Profit and Loss Account of the company for the previous three years.

- Confidential Report from the banker of the company.

- Details regarding any associated companies or sister firms that function as NBFCs in India.

- Certified copy of the Board Resolution that allows the company to perform money changing activities.

Post-License Requirements by an FFMC License Holder

After receiving the Money Changer License or FFMC License, the company must carefully comply with the following post-approval compliance requirements:

- Copy of the Shops and Establishment Registration License or any other documentation including the rent receipt or copy of lease agreement must be filed with the Regional Office of the Reserve Bank of India before the business can undertake any money exchange operations.

- Compliance with the guidelines and circulars as issued by the RBI.

- Display of a copy of Money Changer License or FFMC License issued by the RBI at every place of business.

- Implement a system of Concurrent Audit for all the foreign exchange transactions performed by the company.

- Submit the company’s Annual Audited Balance Sheet to the regional office of the RBI.

Requirements for Maintenance of Records and Registers

A company with a Money Changer License must also maintain well-detailed records and registers as follows:

- Register stating the purchases of the foreign currencies from the public in Form FLM-3.

- Register stating the purchases of the foreign currency notes or coins from authorised dealers and money changers in the Form FLM-4.

- Daily summary and balance book of the Foreign currency notes or coins in form FLM-1.

- Daily Summary and Balance Book of Travellers’ cheques in form FLM-2.

- Register stating all the sales of foreign currency notes or coins and foreign currency travellers’ cheques to the public in the form FLM-5.

- Register mentioning all the sales of the foreign currency notes or coins to authorised dealers, Money Changers or overseas banks in the Form FLM-6.

- Register laying down the details of travellers’ cheques surrendered to authorised dealers or money changers, or travellers’ cheques exported in the Form FLM-7.

Inspection of Books of Accounts by the RBI

The Reserve Bank of India is authorised to inspect the books of accounts, any other documents of a Money Changer License or FFMC License holder under Section 12(1) of Foreign Exchange Management Act, 1999.

The FFMC license holder must adhere to such requirements and comply and cooperate with the Inspecting Officers for the smooth performance of such inspections.

In case, a company fails to present any books of accounts or is unable to provide any required information during the inspection, the Inspecting Officer may hold the company liable for violating the provisions of the FEMA, 1999. The Inspecting Officer may hold the FFMC license holder in contravention of the Act for any of the following irregularities:

- If the system of Concurrent Audit is not put in place.

- If the company is not performing its Concurrent Audits.

- If the company is not displaying or updating the foreign exchange rate at its place or places of business.

- If the company treats the foreign exchange transactions performed within a month as multiple transactions and not a single transaction.

- Form FLM-1 displays a negative balance of foreign exchange.

- The name of the principal officer or authorised persons is not mentioned in the records or stated to the FIU-IND[1].

- The copies of Circulars issued by the concerned authority is not available at the company’s place of business.

- The company has made a payment of more than US$ 1000 in cash instead of account payee cheque.

- The Currency Declaration Form (CDF) is not kept on record.

Process of Renewal of FFMC License

To renew the Full-Fledged Money Changer or FFMC License, a renewal application must be filed before 1 month from the date of the expiry of such license. The Money Changer License or FFMC License continues to be in force until the day of renewal of the license. In case the applicant for renewal is not filed, the license expires on the prescribed date, and when the renewal application is filed by rejected, the license is valid till the date such rejection is received by the company.

No application for license renewal can be filed once the validity period of the license expires. The application to renew a Money Changer License or FFMC License must be filed with the following documents:

- Original License issued.

- Copy of the latest audited balance sheet.

- Net-owned fund Statement which is certified by a practising Chartered Accountant.

- Confidential Report of the banker.

- Declaration for non-involvement in ED/DRI criminal cases on the company’s letterhead dated, stamped and signed.

- Certificate by a Chartered Accountant for compliance with AML guidelines, Concurrent Audit System and Internal Control.

- Updated Shop and Establishment licence.

- KYC policy as per the KYC guidelines issued by the RBI vides A.P. (DIR Series) Circular No. 17 dated November 27, 2009.

- Fit and proper criteria along with the details of all the Directors.

- List of directors and shareholders with the details of shareholdings.

- Details of branches/franchisees of the company.

Conclusion

An entity that plans to commence a foreign currency exchange business in India must obtain a Full-Fledged Money Changer License or FFMC License from the RBI. However, the RBI is stringent in granting such license, and therefore, it is important to consult experienced business consultants and FEMA experts who can help a business in complying with the all the license registration requirements, as well as post-license compliance needs of a Full-Fledged Money Changer or FFMC business.

Also, Read: How to Apply for FFMC License?.