RBI Guidelines for Full Fledged Money Changers

Dashmeet Kaur | Updated: Feb 18, 2020 | Category: FFMC, RBI Advisory

India sustains a steady growth in the volume of foreign trade which enriches our country’s communication system and makes room for the traders to outreach the domestic boundary. The persistent development of Forex industry drives young entrepreneurs to start a currency exchange business. Considering the prospect of earning substantial profits, many individuals strive to be a Full Fledged Money Changer. However, to commence foreign exchange activities, one needs to meet the stringent provisions of RBI Guidelines for FFMCs.

Table of Contents

An overview of FFMC License

As per Section 10 of Foreign Exchange Management Act, 1990, a person/entity duly authorized by RBI to deal in foreign exchange/foreign securities is known as an Authorized Money Changer (AMC) or a Full Fledged Money Changer. Such an entity aims to broaden the access of foreign currency exchange facilities to the tourists and residents, thereby elevates the customer experience.

Reserve Bank of India has made it mandatory to attain a valid FFMC License to carry the money exchange business. In case, an individual does not abide by RBI compliance and incur such activities without a valid License, then he/she will be subject to hefty penalties.

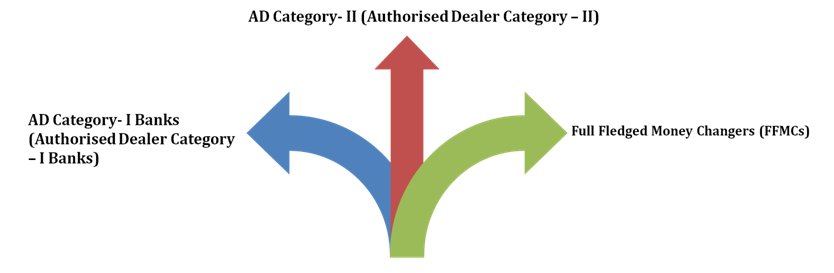

Classification of Money Changer License

RBI perquisites to obtain FFMC License

RBI guidelines for FFMCs has set some guidelines which are as follows:

- A registered institution under Companies Act, 2013 is only eligible to apply for FFMC License.

- The proposed Company must have at least INR 25 Lakh as Net Owned Funds (NOF) for a single-branch License whereas it extends to INR 50 Lakh for a multiple-branch License.

- The object clause of MOA (Memorandum of Association) must depict the money changing activities that shall be undertaken by the Company.

- The entity should not have any pending civil or criminal or cases with the Enforcement Department or Directorate of Revenue Intelligence.

- The newly Authorized Money Changer entity must execute its forex business operation within six months from the issuance of FFMC License.

- An entity registered under Companies Act with a net owned asset of INR 10 lakh and the chief object of money changing business is permitted to take the franchise of an existing FFMC.

Also, Read: How to Start Currency Exchange Business in India?

Activities carried by an Authorized Money Changer

Here is the list of operations that a company can take on after RBI grants it a FFMC License:

- An FFMC can enter a franchise agreement to carry out Restricted Money Changing business which includes the conversion of foreign currency like coins, notes, travellers’ cheques into Indian Rupees (INR).

- An Authorized Money Changer or its franchises can purchase any foreign currency from the residents and non-residents of India.

- RBI enables FFMC to sell Indian Currency (INR) to foreign visitors/tourists against International Debit Cards or Credit Cards.

- Full Fledged Money Changers may engage in foreign exchange dealings for the purpose of Forex prepaid cards, private visits and business visits.

Documents Required

As per RBI guidelines for FFMCs, here is the list of documents that an applicant must affix with his FFMC License Application:

- A copy of the Company’s Incorporation Certificate;

- Memorandum of Association (MOA) and Articles of Association (AOA) defining the details of money changing business;

- Copies of financial statements such as an Audited Balance Sheet and Profit & Loss Account of the immediate 3 years before the date of an Application for FFMC License;

- The proposed Company must also provide a copy of its latest audited accounts and a Certificate from the Statutory Auditors which certifies the Net Owned Funds (NOF) of the entity;

- A certified copy of the Board Resolution for undertaking foreign exchange business;

- A declaration to the effect that no proceedings were initiated or pending with the Directorate of Revenue Intelligence (DRI) and Directorate of Enforcement against the proposed entity. Also, provide evidence that the Directors of the Company were never involved in any criminal activities.

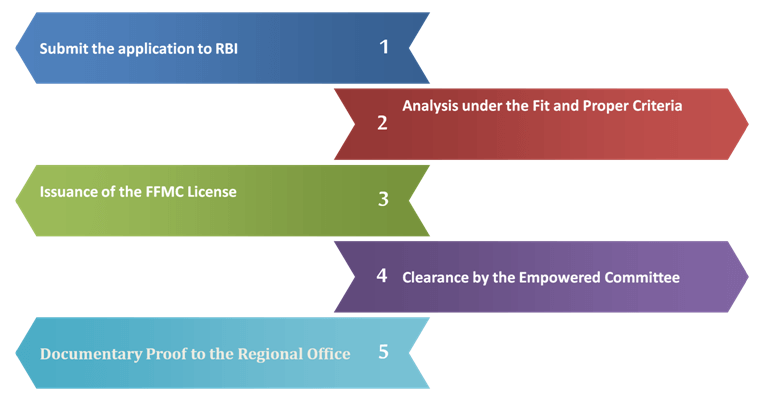

The Process to Start a Forex Business in India

No Company can set a currency exchange business. A person must have a Full Fledged Money Changer License under RBI provisions. The steps are given below to acquire FFMC License:

- File and submit a complete FFMC Application to the concerned Regional Office of RBI.

- Reserve Bank of India will assess the Company’s Director under ‘Fit and Proper’ criteria. If you pass each slot prescribed in the criteria, then you will get Full Fledged Money Changer License within 2 to 3 months.

- Clearance by the Empowered Committee is indispensable while Reserve Bank’s decision in the subject of granting approval shall be considered final.

- Before commencing the business, you must submit a copy of the Registration under Shops and Establishment Act along with other proofs like a rent receipt or lease agreement to the Regional Office.

FFMC License is valid for three years so a renewal Application should be filed before one month from the expiry date of the License. Moreover, no FFMC License restoration request shall be accepted post expiration.

RBI Guidelines for FFMCs

RBI compliances that all FFMCs ought to adhere to post-approval:

- FFMCs should maintain a register of purchase of foreign currency such as daily summary or balance book of traveller’s cheque and coins.

- All Full Fledged Money Changers need to submit consolidated statements of sale or purchase of the foreign currency notes every month to Reserve Bank.

- There should be a proper system of Concurrent Audit of FFMCs transactions.

- The newly formed FFMC shall submit a quarterly statement of Foreign Currency Accounts.

- Newly incorporated Full Fledged Money Changers have to undertake their business activities according to RBI guidelines that can be amended from time to time.

- FFMC must display a copy of RBI approved Money Changer License or FFMC License at each office.

- Every FFMC ought to submit its Annual Audited Balance Sheet to the concerned Regional Office of RBI.

Conclusion

RBI certainly plays a vital role in the functioning of money exchange entities. Anyone who seeks to be a Full Fledged Money Changer must comply with the RBI guidelines and provisions. If you need legal assistance in the procedure of obtaining FFMC License, consult Swarit Advisors.

Also, Read: How to Apply for FFMC License in India?