What is RERA Advisory?

RERA Advisory is an exclusive term for the Real Estate Sector, that intends to set up an authority working for the benefits of the consumers or buyers of this particular sector. It also brings into light the important concerns which in the past have created troubles for the homebuyers like, on-time delivery of the housing project, quality of construction, etc.

What is Real Estate Sector?

In today’s era, the Real Estate industry is significantly one of the most internationally acknowledged sectors. This sector embraces four sub-sectors in it, i.e.,Housing Sector, Retail Sector, Hospitality Sector, and Commercial Sector.

The growth and progression of this industry is well supplemented by the augmentation of the corporate culture, continuous demand for the office space along with urban and semi-urban housings. At present, the construction sectors and third among the fourteen major industries in terms of direct, indirect, and persuasive effects in all industries of the economy.

As per some latest reports published by IBEF (Indian Brand Equity Foundation), by the end of the year 2040, the Indian Real Estate sector is anticipated to expand to US $ 9.30 Billion (Rs. 65,000 crores) from US $ 1.72 billion (Rs. 12,000 crores) in 2019. Moreover, the market size of the Indian Real Estate Sector is projected to reachUS$ 1 Trillion by the end of 2030 from US$ 120 Billion in the year 2017.

Also, by the end of the year 2025, this sector will contribute around 13 percent of the country’s total GDP (Gross Domestic Product).Likewise, various other real estate sectors such as retail, commercial, and hospitality are not only mounting significantly, but are also offering the much-required infrastructure for India's increasing needs. Lastly, the Indian Real Estate Sector will increase by 19.5 percent CAGR (Compound Annual Growth Rate) from the year 2017 to 2028.

What is the RERA Act?

The Real Estate Act, 2016, (RERA) was enforced on 01 May 2016. The RERA Act was implemented to bring accountability, transparency, and unambiguousness to the real estate sector. Due to this Act, it is now obligatory and compulsory not only for all the Real Estate Projects but also for the Real Estate Intermediaries and Agent to get them registered under this act.

Moreover, RERA contains significant penalties for non-compliance. Also, now all the stakeholders are conferred with various legal rights, such as approaching to the prescribed authorities for grievance redressal in case of any non-compliance.

What are the Objectives of the RERA Act?

The prime objective of the RERA, 2016, is to engender faith and trust among all the stakeholders whether buyer, developer, or promoter in the Real Estate Industry. The listed below are some of the significant objectives of the RERA:

- To establish a regulatory authority known as the Real Estate Regulatory Authority for regulating and administering the Real Estate Sector.

- To bring transparency, accountability, and grievance redressal mechanism in the Real Estate Sector.

- To protect and safeguard buyers right.

- To check the authenticity, professionalism, and genuineness of not only the concerned real estate project but also of the promoters, developers, and real estate agents

- To curtail unnecessary delay in the approval of the project, and also in the delivery of the project, etc.

- To set up an appellate mechanism for the grievance redressal machinery.

- To bring confidence in the real estate sector,

- To specify the penalties and imprisonment for the defaulters.

What are the benefits given to a Buyer under RERA Act?

The listed below are the benefits given to a buyer under the RERA Act, 2016:

- Principally, the RERA Act and all the associated rules thwart the promoters and developers from making false promises to the consumers by guaranteeing them on time completion of projects.

- The RERA Act aims at bringing transparency and clarity by safeguarding buyers from the seller’s false promises.

- The RERA Act prevents the possibility of indirect build-up of the black money by the developer or the promoter. It also safeguards the buyer from seller’s misrepresentation, and false tactics.

- “Agreement for the Sale Rules" has brought an end to the unfair and biased agreement favouring sellers, and the buyer manipulation in the sector.

- Both the Real Estate Regulatory Authority, and the Real Estate Appellate Tribunal facilitates speedy, effectual, and more expedient resolution of disputes concerning the real estate industry.

- The RERA Act also fetches parity in operations.

- The RERA Act has defined the term, “carpet area”, and therefore, has eliminated various standards being adopted by the developers and promoters for determining carpet area.

- The RERA Act ensures that the consumers are having a legal right of RTI (Right to Information) about the projects in which are keen in investing.

- The Act obligates the builder and the promoter to maintain an escrow account for every project. The reason behind preserving an escrow account is to avoid diversion funds.

- All the issues like, defective legal title, allotment of wrong premises have been Selling on wrong promises, defective titles and defective projects have been barred by the implementation of the RERA Act.

What are the benefits given to a Developer under RERA Act?

The listed below are the benefits offered to a Developer or the Promoter under the RERA Act:

- The RERA Act encourages the genuine and sincere developers by guaranteeing them more safety and security in the sector.

- As already mentioned, this Acts brings more transparency, clarity, and answerability into action.

- The RERA Act imparts confidence in the investor by guaranteeing him more flow of investment in the sector. Moreover, it even enlarges the potentials for foreign investments in the form of FDI (Foreign Direct Investment) and ECB (External Commercial Borrowing) in the real estate sector.

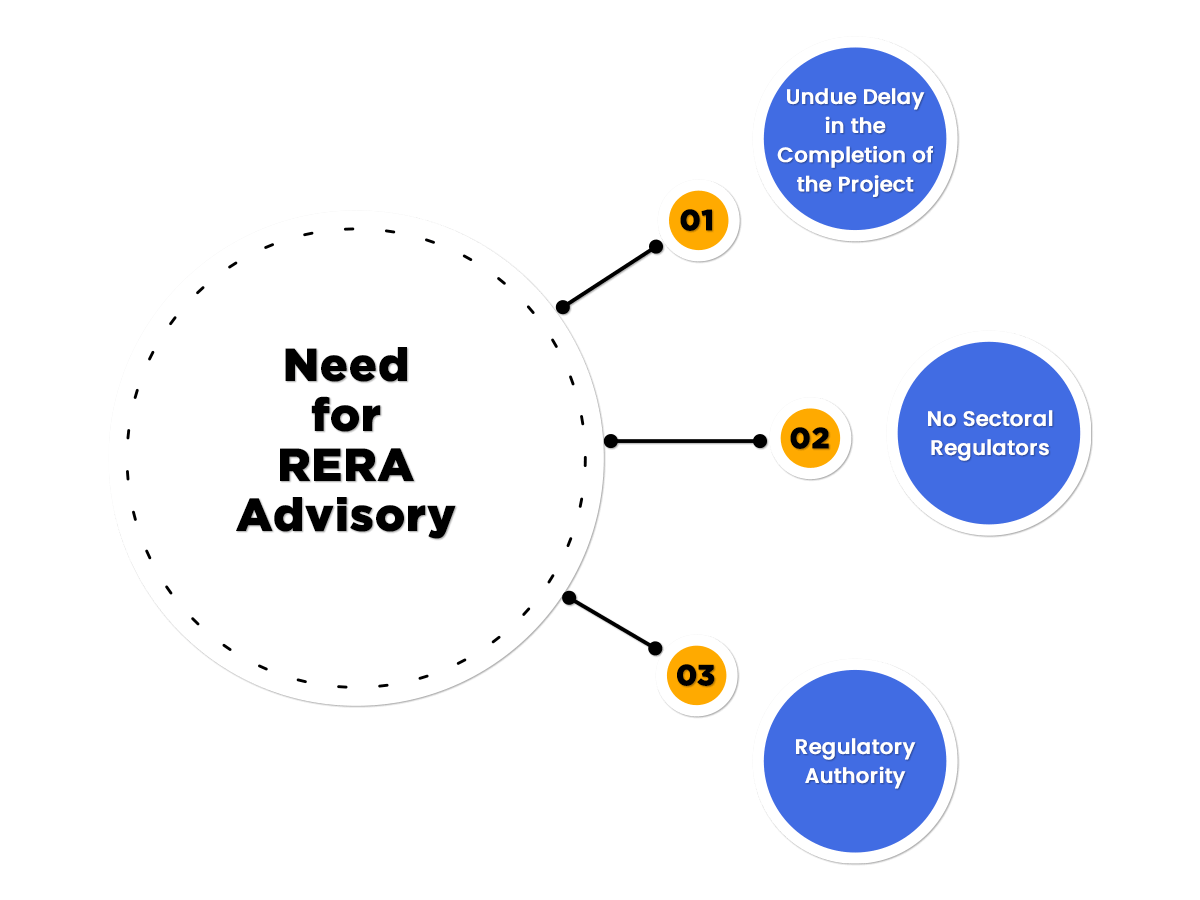

Why was there a Need for RERA Advisory?

The below listed are some of the instances which made the government felt that there is an urgent need to enforce a law that significantly and considerably deals only with the Real Estate Sector in India:

- Undue Delay in the Completion of the Project

In India, before the enforcement RERA, the real estate sector had faced a lot of unjustified delays regarding the project completion, frauds and misconducts by some builders and brokers result into a massive rise in the complaints and cases pending before the various courts and government in India.

- No Sectoral Regulators

As we know that, the Real estate sector acts as a heavy-handed industry in our Indian economy. However, before the enforcement of RERA, this sector was unregulated, as it had no sectoral regulators, like TRAI, SEBI, and IRDAI, etc. Moreover, it is a well-recognized fact that whenever any sectoral regulators are established, they make the mechanism robust.

- Regulatory Authority

The consumers of the Real Estate industry prior to the enforcement of RERA Act used to approach the consumer courts under the Consumer Protection Act, 1986, for the grievance Redressal, but the said alternative was just curative and not suitable to address all types of concerns that a buyer has.

What are the Prescribed Responsibilities of a Promoter and Developer?

The promoter is the person who either finances or incorporates a project settled by a developer. However, there are many cases, in which both the promoters and developers of a real project are the same:

- Primarily, a promoter or a developer is a person who commences a real estate project with over eight units or 500sq. Meters is required to obtain RERA registration.

- All the promoters and builders are required to establish a website. After that, they are required to display all the required details on the official portal of the RERA Authority. The same is done for the public to view and get assured about the genuineness and authenticity of the concerned project. The details displayed on the website include, RERA Registration number and all the relevant particulars of the proposed real estate project undertaken by them.

- Promoters are required to obtain a certificate of completion from the concerned regulatory authority to transfer the same to the allottees, either individually or collectively.

- All the pertinent documents and annexure are to be properly maintained and handed over while transferring the property to the buyer or allottee by way of a registered conveyance deed. Further, they are required to develop an association of the owners before transferring the property.

- It is pertinent to note that till the time actual transfer happens, the developer or the promoters are required to pay all the utility bills, like, electricity and water charges.

What are the Prescribed Responsibilities of a Buyer?

- The buyers or the allottees are required to make on time payments concerning the property. The buyers are also needed to pay other associated charges, like electricity or water, etc., as and when pertinent. Moreover, the buyers are also obligated to bear an additional interest in the case where there is a delay in making payment.

- Buyers are required to contribute to the creation of the association and are also expected to acquire possession of the said property within two months of the issuance of the occupancy certificate.

- The buyer or allottee is obligated to abide by the orders passed either by the regulatory authority, or by the appellate tribunal. If in case there are some delays in making payment, the same might result in imposing of penalties by the authority.

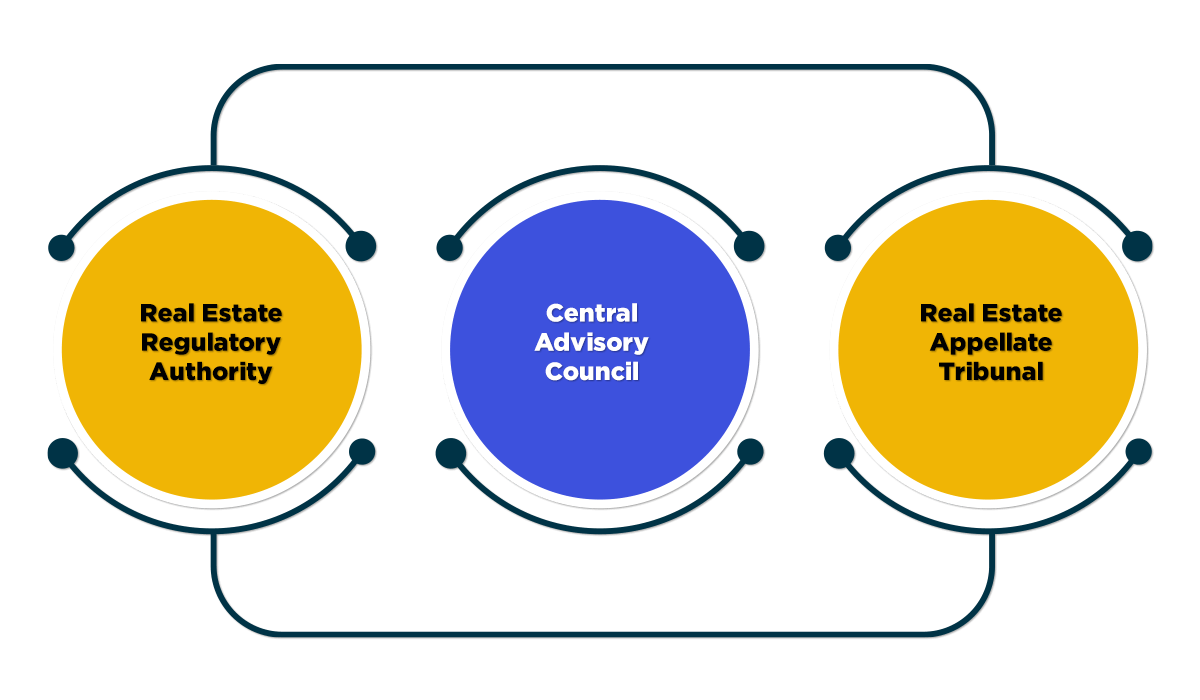

What are the Authorities under RERA Act?

According to section 5, 6, and 7 of the RERA Act, the listed below are the Authorities elucidated under it:

- Real Estate Regulatory Authority

This regulatory body not only has the authority to order investigations but also to pass directions, or orders. Moreover, it also has the power to levy penalties, or charges interests. Further, the Regulatory Authority has the power to take up issues on a Suo Motu basis, and can also refer the same issue to the CCI (Competition Commission of India). This authority act as the watchdog over the activities going on in the real estate sector. Moreover, both the developer and the promoter are needed to obtain registration under the RERA act for their project. The registration for the project is granted by the regulatory authority.

- Central Advisory Council

The Central Advisory Council (CAC) is a council formulated by the central government. This advisory has the power to look into the matters about the real estate industry. Moreover, this advisory council also has the authority to advise the government whenever needed on matters relating to the Real Estate Sector.

- Real Estate Appellate Tribunal

The Real Estate Appellate Tribunal is constituted by the government to listen to the appeal of the aggrieved party. It shall be relevant to note that the powers conferred on the Appellate Tribunal are at par with the powers of a Civil Court.

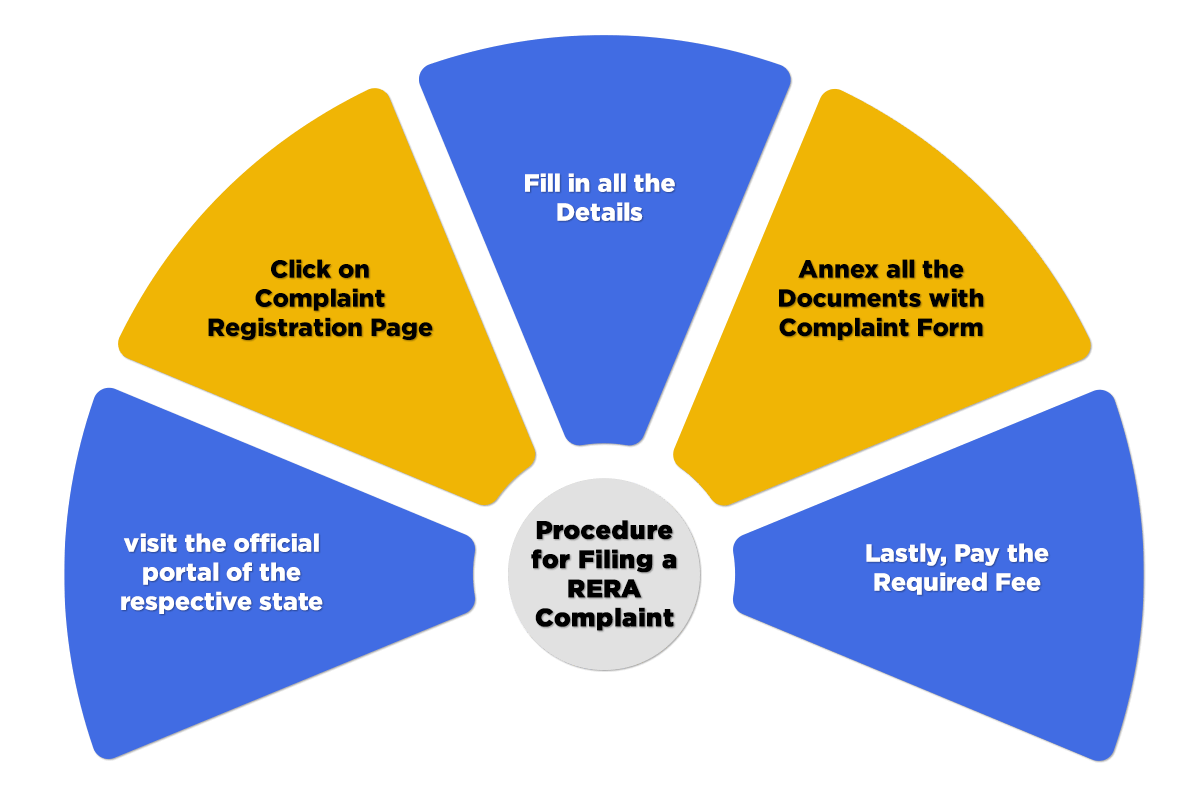

What is the Procedure for Filing a RERA Complaint?

The listed below are the steps involved in the process for filing a RERA Complaint in India:

- Step 1

The first and the foremost step is to visit the official portal of the respective state.

- Step 2

In the next step, the complainant is required to file his complaint on the concerned portal by going to the “Complaint Registration Page”. An individual can find a link regarding the same.

- Step 3

The concerned link will then take the applicant to the complaint form.

- Step 4

The said applicant is then required to fill in all the necessary details like the Name, Contact Number, Registered Address, and the details regarding his Real Estate Project.

- Step 5

After that, the applicant is required to annex all the required documents along with the Complaint Form.

- Step 6

Finally, in the last step, the applicant is required to pay the prescribed registration fee to finish the process. After, paying the fee prescribed, the form will then be taken up by the regulatory authority.

Frequently Asked Questions

The CAC or Central Advisory Council advises the Central Government on the Matters concerning the Enforcement of the RERA Act 2016; Protection of Consumers Interest; Policy Implementation; Verification of the Builders or Promoters; Growth of the Real Estate Sector; and Any other matter assigned by the Central Government.

Yes, an individual who is aggrieved by the order or decision passed by the Appellate Tribunal can file an appeal for the same in the respective High Court.

As per the provisions prescribed under section 44 of the RERA Act 2016, the Appellate Tribunal shall attempt to dispose of the appeal filed on a speedy basis. However, the same must not exceed the period of 60 days, starting from the date of filing the appeal.

If in case the Appellate Tribunal is unable to dispose of appeal with the prescribed tenure, the same must record the reasons for the same.

According to section 64 of the RERA Act, if in case a promoter fails or omits to abide by the orders passed by the Appellate Tribunal, he/she will be held liable to pay a per day penalty for the default. Further, such a penalty will be cumulative to the extent of 10% of the total estimated cost of the real estate project. Moreover, the defaulter may also be punished with imprisonment for up to 3 years or both.

According to section 65 of the RERA Act 2016, if in case a Real Estate Agent fails or omits to abide by the orders passed by the Appellate Tribunal, he/she will be liable to pay a per day penalty for the default. Such penalty will be cumulative to the extent of 5% of the total cost of the apartment or plot, for which the sales have been aided by him.

The Adjudicating Officer appointed under the RERA Act works as a quasi-judicial authority. He/she is authorized to decide the disputes arising under the provision of sections 12, 14, 18, and section 19 of the RERA Act 2016. Further, any person who had been appointed as a District Judge will be acting as the Adjudicating Officer under the RERA Act.

According to section 2(d) of the RERA Act, the term “allottee” comprises of a person who gets a plot or apartment by way of sale or transfer. However, the definition does not include a person to whom such an apartment or plot is given on rent.

Yes, the provisions of the RERA Act 2016 include both commercial and residential real estate. Section 2(e) of the RERA Act, defines the term “apartment”, whereas section 2 (j) of the Act, defines the term “building”. However, both terms include commercial as well as residential real estate.

According to sections 4 and 11 of the RERA Act, a promoter needs to upload a detailed list of all the disclosures on the official portal of the Regulatory Authority. The same is done for the public to view and get clarity about the respective real estate project. Moreover, the detailed list must adhere to the prescribed company’s rules.

According to the provisions of section 18 of the RERA Act, there are various situations in which a promoter needs to compensate an allottee. The reason for the same is the delay caused in the completion of the real estate project.

According to the provision mentioned under section 29 of the RERA Act, the time frame prescribed for the Regulatory Authority to dispose of a complaint or questions brought before it is 60 days. Further, the period of 60 days begins from the date of filing the matter before the regulatory authority.