Tax Residency Certificate (TRC)

Sanchita Choudhary | Updated: Oct 20, 2020 | Category: Income Tax

A tax residency certificate (TRC) is issued to verify which country the citizen belongs. The TRC is considered to be a must have certificate for any such resident whose income has strings attached to more than one country.

Usually it is considered difficult to obtain any such relevant tax residence certificate for taxpayers of the country. However, the tax authorities may refuse to grant such tax residence certificate if any document fails to achieve any required criteria.

Table of Contents

Overview of TRC

In order to avoid double taxation on an income any resident can take advantage of “Double Taxation Avoidance Agreement (DTAA)” signed between the countries. However, TRC discards the probability of double taxation by applying relevant DTAA along with the benefits stated therein.

In order to seek DTAA benefits for Indian citizen it is necessary to obtain a Tax Residency Certificate (TRC).

However, in case of non resident Indian in order to seek the benefits stated in DTAA one might need TRC to submit to their native country.

To obtain a Tax Residency Certificate in India the residents had to fill Form 10FA. Similarly, the TRC in respect to the foreign country residents could be obtained from the relevant tax authority.

Also, Read: A Complete Guide to Income Tax Return Filing

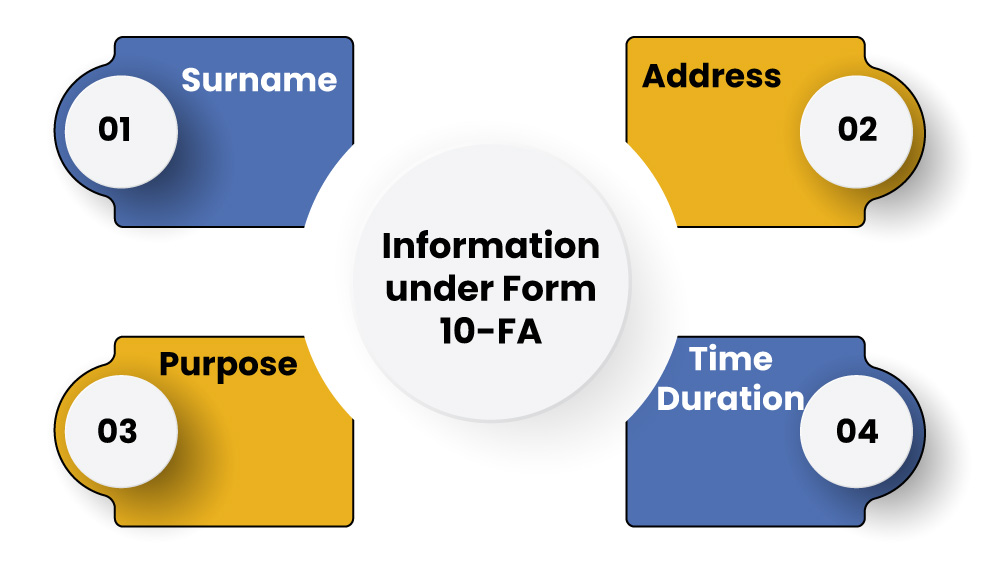

Requirements to File Form 10 FA

Tax payer citizens or resident of India can get TRC immediately by producing a request in Form 10 FA to tax professionals. The form required information such as:

- Surname,

- Address of taxpayers,

- Purpose for having residency in India, and

- Time duration for which TRC is required.

Once the application form is received along with all the approved documents, the tax professionals will check the data and then publish a TRC in form 10 FB[1].

Validity of Tax Residence Certificate (TRC)

Once issued, a TRC is considered to be valid for one financial year and no other such document in lieu of TRC is considered for availing DTAA benefits. Thus, it is considered mandatory to submit TRC every year in order to avail the benefits related to DTAA.

Conclusion

In order to keep a check on the taxpayers of the country thus it is necessary for the residents to file for the Tax Residence Certificate. To conclude it can rightly be said that TRC discards any such probability of double taxation along with the benefits stated therein.

Also, Read: All about Professional Tax Registration in India