Form ITR 7: A Comprehensive Guide on This Income Tax Return

Shivani Jain | Updated: Sep 18, 2020 | Category: Income Tax

The term “Form ITR 7” denotes an Income Tax Return that is filed by all the companies and entities which are claiming exemption under section 139(4A), 139(4B), 139(4C), and 139(4D) of the Income Tax Act 1961.

In this blog, we will discuss the concept of “Form ITR 7”, together with the changes made and the procedure for filing it.

Table of Contents

Meaning of Income Tax Return

The legal document in which a taxpayer or assessee informs the government and income tax department about the income earned by him/her in a financial year is known as Income Tax Return.

Further, it is a yearly affair. That means the taxpayer needs to furnish the details of his/her income earned before the set deadline, i.e., 31st July of every year. However, due to the COVID-19 pandemic, the due dates of filing ITR for the Assessment Year 2020-2021 has been extended to 31.08.2020 and 30.11.2020.

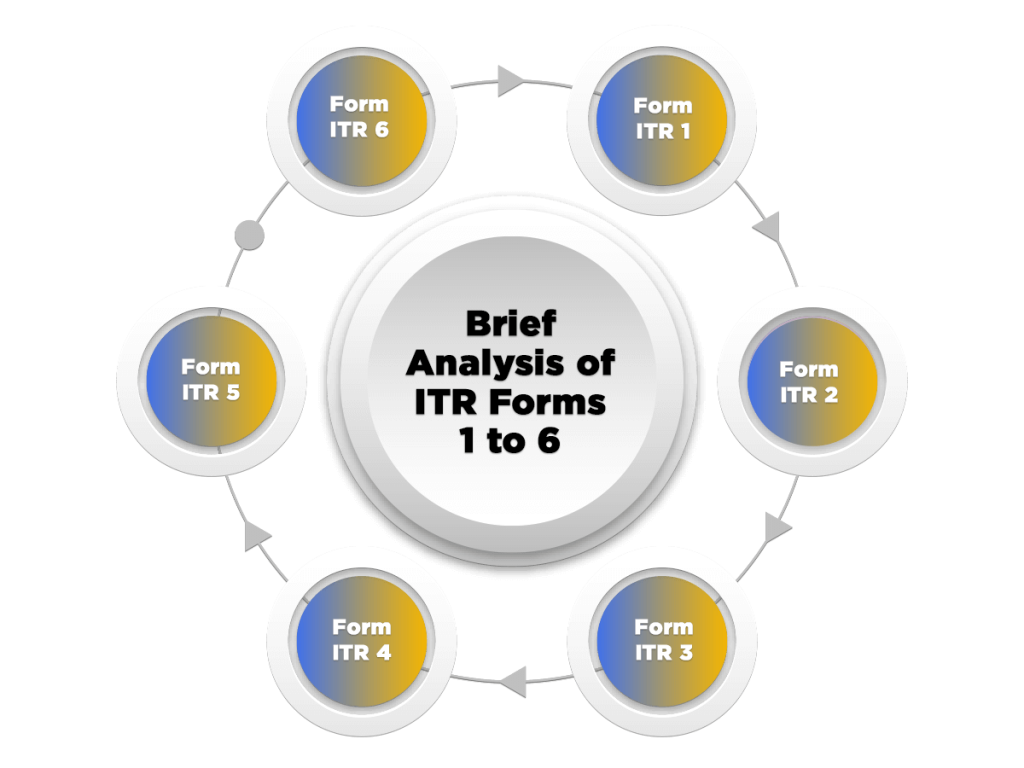

Moreover, there are different ITRs forms available for different individuals and businesses, and the process of filing Tax Return is known as Income Tax Return Filing.

Brief Analysis of ITR Forms 1 to 6

The brief analysis of ITR Forms 1 to 6 can be summarised as:

Form ITR 1

The term “Form ITR 1” means an Income Tax Return or ITR that is filed by the individuals who are Resident other than Not Ordinarily Resident (RNOR) and are having an annual income of Rs 50 lacs. Further, the other name for Form ITR 1 is Sahaj.

Form ITR 2

The term “Form ITR 2” means an ITR or Tax Return that is filed by the HUFs (Hindu Undivided Families) and Individuals who are not earning income under the head of Profit and Gain from Business or Profession (PGBP).

Further, this tax return is not applicable to the individuals who are furnishing Form ITR 1 or Sahaj for their Income Declaration.

Form ITR 3

The term “Form ITR 3” means an ITR or Tax Return that is filed by the HUFs (Hindu Undivided Families) and Individuals who are not generating income from the Profit and Gain from Business or Profession (PGBP).

Further, this tax return is not applicable to the individuals who are furnishing Form ITR 2 with the Income Tax Department for their Income Declaration.

Form ITR 4

The term “Form ITR 4” means an ITR or Tax Return that is filed by a taxpayer, who is falling under the domain of “Presumptive Income Scheme”, mentioned under section 44AD, section 44ADA, and section 44E of the Income Tax Act 1961. Further, the other name for Form ITR 4 is Sugam.

Form ITR 5

The term “Form ITR 5” means an ITR or Tax Return that is filed by a taxpayer, who is neither filing ITR 7 Form nor furnishing any return under the provision of section 139 (4A), 139 (4B), 139 (4C), or 139 (4D).

Further, all the Heads of Income except the income stated under section 11 of the Income Tax Act 1961 are covered under this Tax Return.

Form ITR 6

The term “Form ITR 6” means an ITR or Tax Return that is filed by the companies which are not eligible for exemption under the provisions of section 11 of the Income Tax Act 1961. Further, this section deals with the income from property held for Charitable and Religious Purposes.

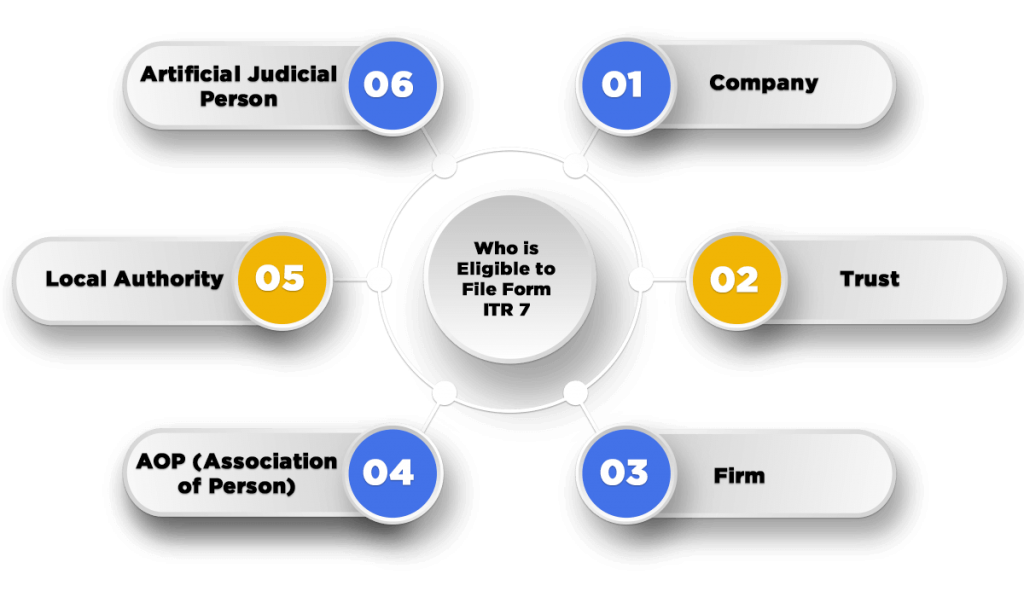

Who is Eligible to File Form ITR 7?

The ones who are eligible to file Form ITR 7 are as follows:

- Company;

- Trust;

- Firm;

- AOP (Association of Person);

- Local Authority;

- Artificial Judicial Person;

However, such entities can fill this Tax Return only if the same is eligible to claim an exemption under the provisions of section 139(4A), 139(4B), 139(4C), and 139(4D) of the Income Tax Act 1961.

Further, the individuals whose income are exempt under the provision of section 10 and is not filing any return under section 139 can file this ITR as well. The list of such individuals is as follows:

| S.no | Category of persons | Exempt under Section |

| 1. | Local Authority; | Section 10 (20) |

| 2. | Regimental Fund or Non Public Fund created by the Armed forces of the Union; | Section 10 (23 AA) |

| 3. | Fund, by whatever name called, established by the LIC Life Insurance Corporation of India on or after the 01.08.1996, or by any other insurer; | Section 10 (23 AAB) |

| 4. | Authority (whether called as the KVIC (Khadi and Village Industries Board) or by any other name); | Section 10 (23 BB) |

| 5. | Body or any Authority; | Section 10 (23 BBA) |

| 6. | SAARC Fund for the Regional Projects established by the Colombo Declaration; | Section 10 (23 BBC) |

| 7. | IRDA (Insurance Regulatory and Development Authority); | Section 10 (23 BBE) |

| 8. | CERC (Central Electricity Regulatory Commission); | Section 10 (23 BBG) |

| 9. | Prasar Bharati; | Section 10 (23 BBH) |

| 10. | Prime Minister National Relief Fund | Section 10 (23C) (i) |

| 11. | Prime Minister Fund for Promotion of Folk Art; | Section 10 (23C) (ii) |

| 12. | Prime Minister Aid to the Students Fund; | Section 10 (23C) (iii) |

| 13. | National Foundation for the Communal Harmony | Section 10 (23C) (iiia) |

| 14. | Swachh Bharat Kosh | Section 10 (23C) (iiiaa) |

| 15. | Clean Ganga Fund | Section 10 (23C) (iiiaaa) |

| 16. | Provident fund on which the provisions of the Provident Funds Act, 1925 applies; | Section 10 (25) (i) |

| 17. | Recognized Provident Fund (RPF); | Section 10 (25) (ii) |

| 18. | Approved Superannuation Funds (SF); | Section 10 (25) (iii) |

| 19. | Approved Gratuity Fund; | Section 10 (25) (iv) |

| 20. | Other funds specified in the sub-clause (v) of section 10 (25); | Section 10 (25) (v) |

| 21. | Employees State Insurance Fund (ESIF) | Section 10 (25A) |

| 22. | Agricultural Produce Marketing Committee (APMC); | Section 10 (26AAB) |

| 23. | Corporation, a body of individuals, institution or association or person established for promoting the interests of members belonging to the Scheduled Castes (SC) or Scheduled Tribes (ST) or backward classes (OBC); | Section 10 (26B) |

| 24. | Corporation established for promoting the interests of the members belonging to the minority community | Section 10 (26BB) |

| 25 | Corporation established for the welfare and economic upliftment of ex-servicemen; | Section 10 (26BBB) |

| 26 | NPS (New Pension System) Trust | Section 10 (44) |

Who cannot File Form ITR 7?

Any company or entity which is not claiming exemption under section 139(4A), 139(4B), 139(4C), and 139(4D) of the Income Tax Act 1961 cannot file Form ITR 7 with the Tax Authorities.

Due Dates of Filing Form ITR 7

The due dates for filing Form ITR 7 depends upon the Audit of the Company’s Account. The tax assessee who needs to get his/her audit can file a tax return till 31.10.2020. However, the individuals who do not need to get their account audit can file ITR till 30.11.2020.

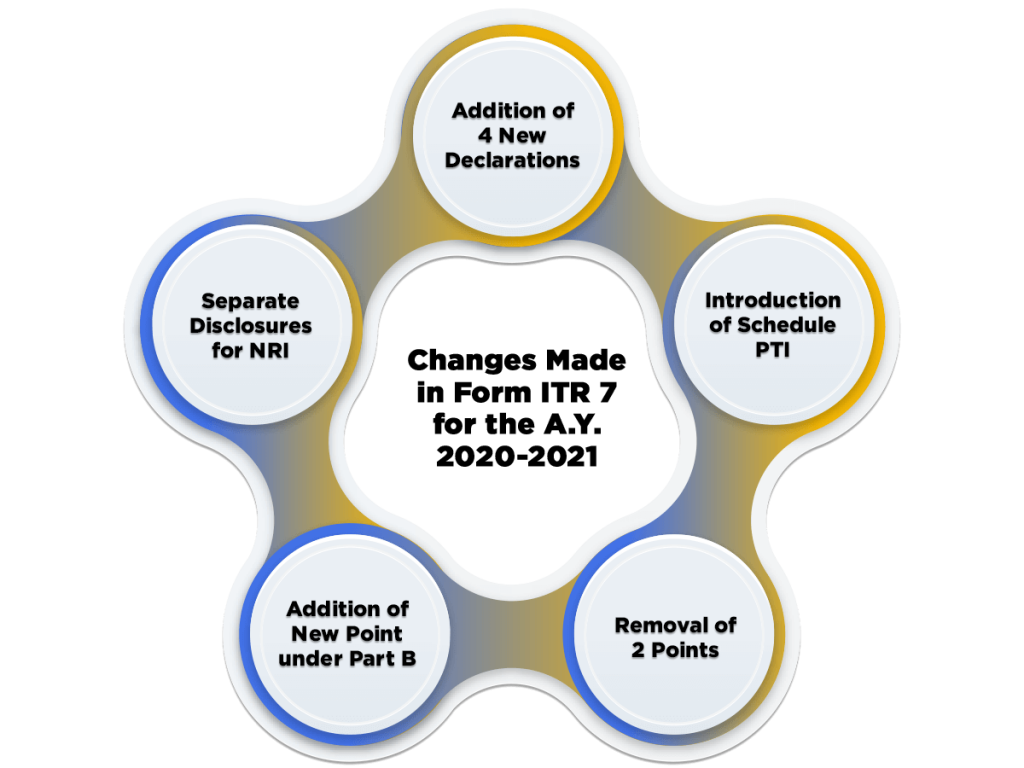

Changes Made in Form ITR 7 for the A.Y. 2020-2021

The changes made in Form ITR 7 for the A.Y. 2020-2021 are as follows:

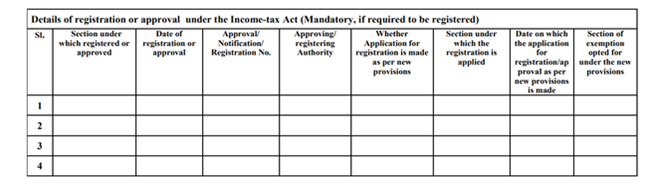

Addition of 4 New Declarations

The Central Government and the Income Tax Department have introduced 4 new declarations under the head of Basic Information for the A.Y. 2020-2021. These declarations are mentioned under “Details of Registration or Approval under the IT Act”.

Further, the declarations introduced are as follows:

- Whether Application for Registration is made according to New Provisions;

- Sections under which the Registration or Approval is applied;

- The date on which the Application for Approval or Registration is made as per new provisions; and

- Sections of Exemption opted for under the new regulations and provisions;

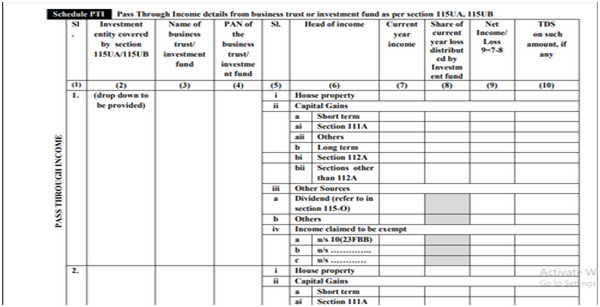

Introduction of Schedule PTI

This newly introduced schedule, named PTI, will include the details and information mentioned as follows:

- Investments made under section 115UA and 115UB;

- Classification of Income as follows:

- Current Year’s Income;

- Share and Portion in the Current Year’s Loss distributed by the Investment Fund; and

- Net Income or Loss;

Removal of 2 Points

As per the amended form ITR 7, two points have been removed from PART B (Total Income). The points removed are as follows:

- Deduction under

section 10 AA;

- Corpus donation made to other trust or institution chargeable according to Explanation 2 to section 11(1);

Addition of New Point under Part B

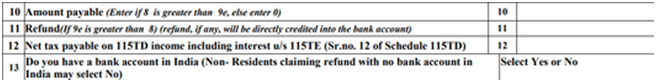

As per the amended form ITR 7, a new point has been in Part B under the tab “Computation of Tax Liability on Total Income”. The point added is as follows:

- Net tax payable on 115 TD income including interest under section 115 TE;

Separate Disclosures for NRI

As per the new ITR form 7, the applicant or taxpayer who is a Non Resident Indian or NRI and is not having any opened Bank Account in India, but wished to claim a refund of the Income Tax paid, requires to submit the details and information as follows:

- Name of the concerned Bank;

- Name of the Country;

- SWIFT Code; and

- IBAN (International Bank Account Number);

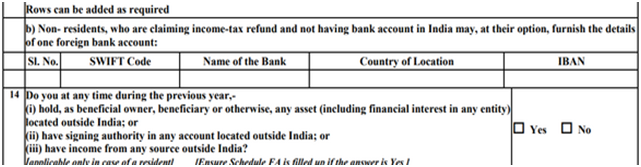

Structure of Form ITR 7

The structure of Form ITR 7 is divided into 4 parts which can be summarised as:

Part A

Part A of the tax return deals with the Basic Personal Information of the Taxpayer or Assessee. Further, the same has been made compulsory by the Income Tax Department from the A.Y. 2019-2020.

Part B

This section of the Form includes the details regarding the Total Income and Tax Computation of the Taxpayer income liable for taxation.

Schedules

In total, there are 23 schedules which are as follows:

- Schedule I: Details of the amount accumulated or set apart within the meaning of section 11 (2) in the last year, i.e., previous years are relevant to calculate current assessment year;

- Schedule J: Statement showcasing the investment of all funds made by the Institution or Trust as on the last day of the previous financial year;

- Schedule K: Statement showcasing the Particulars of the Author(s), Founder(s), Trustee(s), Manager(s), etc. of the Institution or Trust;

- Schedule LA: Details in the case of a Political Party;

- Schedule ET: Details in the case of an Electoral Trust;

- Schedule AI: Aggregate of the income derived during the financial year excluding the voluntary contributions;

- Schedule ER: Amount applied to the charitable or religious purposes in India in the Revenue Account;

- Schedule EC: Amount applied to the charitable or religious purposes in India in the Capital Account;

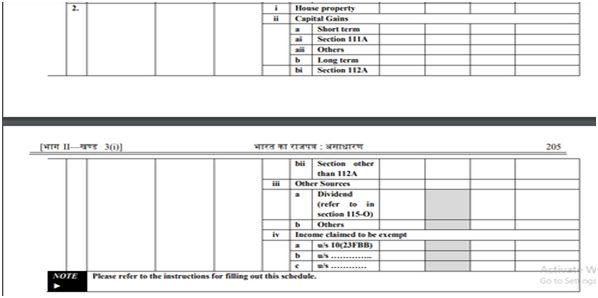

- Schedule HP: Computation of the Income earned under the head of Income from House Property;

- Schedule CG: Computation of the Income under the head of Capital gains;

- Schedule OS: Computation of the Income under the head of Income from Other Sources;

- Schedule VC: Details of the Voluntary Contributions received;

- Schedule OA: General Information about the Business and Profession;

- Schedule BP: Computation of the Income under the head of PGBP (Profit and Gains from Business or Profession);

- Schedule CYLA: Statement of the income earned after set off of the current year losses;

- Schedule MAT: Computation of the MAT (Minimum Alternate Tax) payable under section 115 JB (n);

- Schedule MATC: Computation of the Tax Credit under section 115 JAA;

- Schedule AMT: Computation of the AMT (Alternate Minimum Tax) payable under section 115 JC (p);

- Schedule AMTC: Computation of the Tax Credit under section 115 JD;

- Schedule PTI: Pass through Income information and details from the business trust or investment fund according to section 115 UA, 115;

- Schedule SI: Statement of the Income earned, which is chargeable to tax at a special rate;

- Schedule 115 TD: Accreted income under section 115 TD;

- Schedule FSI: Details and Information of the income accruing or arising from anywhere outside India;

- Schedule TR: Details of the Taxes paid outside India;

- Schedule FA: Details of the Foreign Assets;

Verification

This section of Form ITR 7 deals with the declaration that whatever the information is filed, the taxpayer or assessee is the best of his knowledge and understanding.

Modes of Filing Form ITR 7

The different modes of filing Form ITR 7 are as follows:

- By submitting it in the Physical Paper Format. However, this method is not used widely these days;

- By submitting the same under DSC (Digital Signature Certificate). This is mandatory for all the Political Parties;

- By submitting a Bar-code Return;

- By submitting the data electronically and then furnishing the E-verification of the Return in the form Return ITR V;

Process to Download Form ITR 7

A Taxpayer or assessee can easily download Form ITR 7 from the official portal of the Income Tax Department. The reason behind the same is that there are no offline tools offered by the IT Department to file Form ITR 7.

Procedure to file Form ITR 7

There are 2 different modes through which a taxpayer or assessee can file Form ITR 7, which are as follows:

- Online Procedure;

- Offline Procedure;

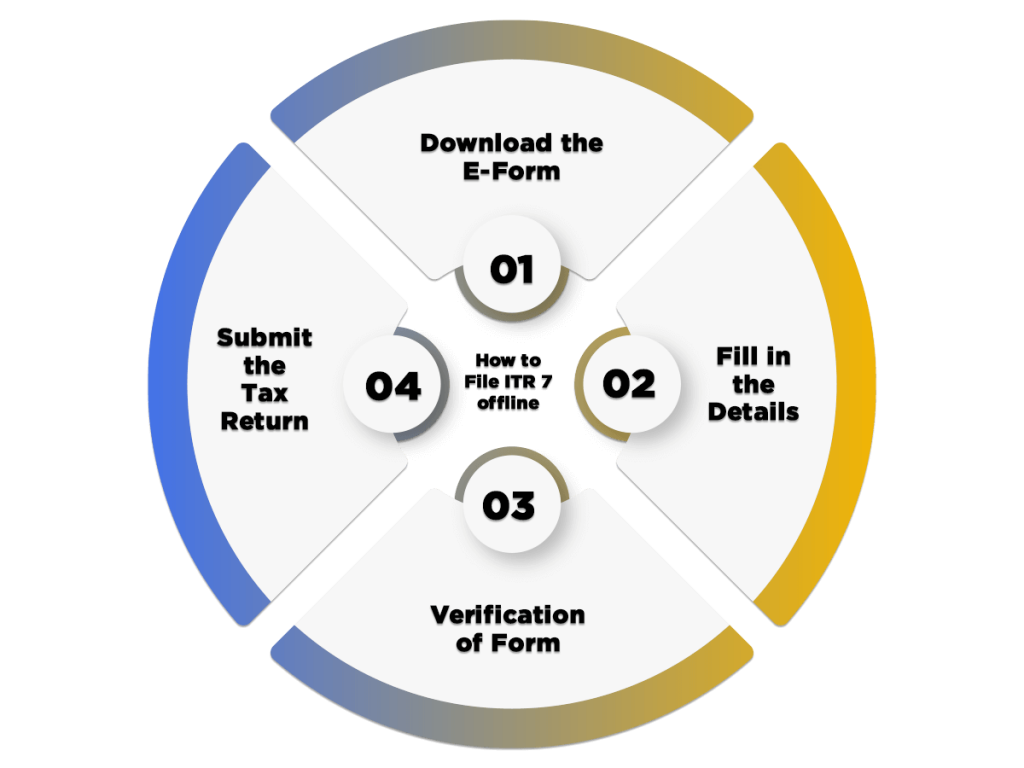

Offline Process to File Form ITR 7

The particulars of Offline Process are as follows:

What are the Modes of Filing Form ITR 7 offline?

The different offline modes for Filing Form ITR 7 with the authorities are as follows:

- By Furnishing the ITR (Income Tax Return) in a Physical Paper Format;

- By Furnishing a Bar Coded Income Tax Return;

Who can File ITR 7 offline?

The ones eligible to file ITR 7 offline are as follow:

- An Individual who is above the age of 80 years; and

- One who is not eligible to claim a refund in the Income Tax Act;

Online Procedure

The particulars and details of Online Procedure are as follows:

- Who can File ITR 4 offline?; and

- How to File ITR 4 offline?

Who can File ITR 7 online?

Every individual or business which is not included under the offline mode of filing form ITR 7 needs to file the tax return on a compulsory basis.

How to File ITR 7 online?

The steps included in the procedure to file Form ITR 7 online are as follows:

Download the E-Form

Firstly, the taxpayer or applicant should download the ITR Form 7 from the official Income Tax Website, by visiting at http://www.incometaxindiaefiling.gov.in/home;

Fill in the Details

In the next step, the assessee or taxpayer requires to furnish all the information and details asked in different sections and parts of the e-form.

Verification of Form

After that, the said applicant needs to obtain Verification and Authentication for his/ her ITR Form 7 in the modes specified as follows:

- By Getting the Form, ITR 7 signed Digitally;

- By Validating and Authenticating the Form ITR 7 through EVC (Electronic Verification Code);

Submit the Tax Return

Lastly, the concerned taxpayer, assessee, or applicant who wishes to submit his/ her tax return form online will receive an e- mail of acknowledgment from the Income Tax Department on his/ her registered email id.

However, if in case the assessee or applicant wants to send the Tax Return manually or physically by downloading the same from the official IT portal, then he/she needs to courier or speed post the same to the CPC Office of IT Department, situated at Bangalore, India, within a period of 120 days, commencing from the date of filing or submitting of the ITR Form 7.

Moreover, it shall be noteworthy to mention that ITR Form 7 is an annexure less Tax Return, which means there is no requirement for the applicant or taxpayer to annex any record or document.

Conclusion

In a nutshell, all the Companies or individuals that are claiming exemption under the provisions of section 11 of the Income Tax Act 1961 need to submit ITR Form 7 with the authorities of the Income Tax Department.

Further, the due dates for filing Form ITR 7 depends upon the Audit of the Company’s Account. The tax assessee who needs to get his/her audit can file a tax return till 31.10.2020. However, the individuals who do not need to get their account audit can file ITR till 30.11.2020.

Also, Read:GST Registration Requirement