Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Bill, 2020

Sanchita Choudhary | Updated: Oct 07, 2020 | Category: Income Tax

In midst of Covid-19 pandemic where the world is facing huge economic crisis the Finance Minister Nirmala Sitaraman introduced the Taxation and Other laws (Relaxation and Amendment of Certain Provisions) Bill,2020 in the Lok Sabha. This bill provides the compliance relief to all the taxpayers of the country. The said (Relaxation and Amendment of Certain Provisions) Bill, 2020 will replace the Taxation and Other Laws (Relaxation of Certain Provisions) Ordinance, 2020 which was promulgated on March 21st, 2020.

Table of Contents

Overview of Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Bill, 2020

The Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Bill, 2020 will extend compliance related timelines for taxpayers while offering relief to foreign investors. The bill will further amend the Income Tax Act, 1961, Central Goods and Services Tax Act, 2017, Finance Act 2019, The Direct Tax 2020 and The Finance Act, 2020. The aforesaid Bill also prescribed some changes in tax rules to boost investment. The Finance Minister Nirmala Sitaraman said “the ordinance was necessary to defer various compliance deadlines under GST and Income Tax Act during the COVID 19 times”. She further stated that the donations made by the person in PM Cares Fund will be eligible for 100 percent deduction in the taxable income.

Key Amendments

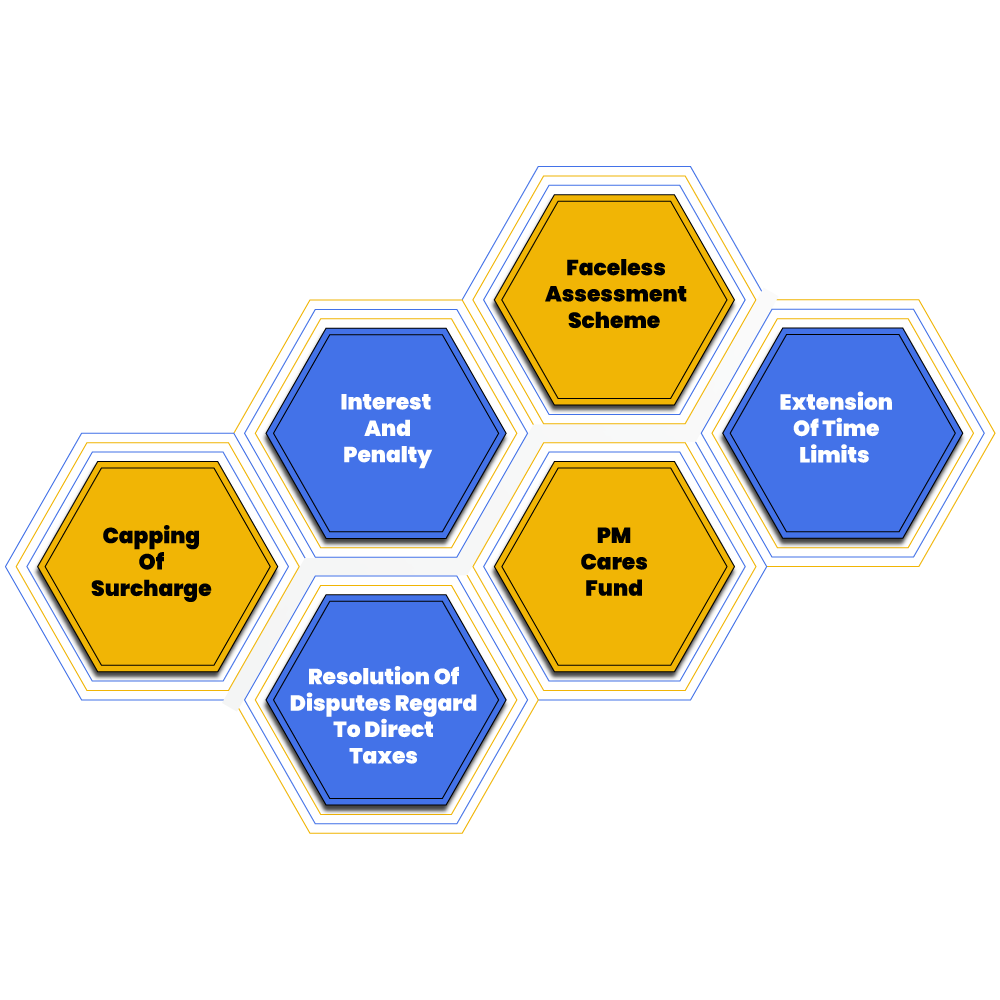

In this article, we will discuss about the key amendments proposed in the Taxation Bill, 2020. They are summarised below:

1. Faceless Assessment Scheme

The faceless assessment scheme, 2020 was issued by CBDT on August 13, 2020. As per the scheme the appeals filed before the CIT(A) shall be decided by the team of CIT’s having jurisdiction. The finance minister announced faceless appeal while presenting the Union Budget 2020. The main objective behind this appeal is to eradicate any physical interface between the tax payers and the income tax authorities. Further CBDT also issued notification to implement the faceless assessment scheme under section 143(3A). The Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Bill, 2020 proposes that the said scheme will be incorporated under the Income Tax Act effective from April 2021

2. Extension Of Time Limits

In respect of the challenges faced by the taxpayers due to the outbreak of COVID 19 the Government brought the Taxation and The Other Laws (Relaxation and Amendment of Certain Provisions) Bill, 2020 which lead to the extension of various time limits. The time of filing of Income tax return filing for the FY 2018-19 (AY 2019-20) has been extended to 31st July, 2020. The due date for the return of filing income tax return for FY 2019-20 (AY 2020-21) has been extended to 30th November 2020 which was previously required to be filed by 31st July 2020 and 31st October 2020. The date of filing of tax audit report has also been extended to 31st October, 2020. The government may further notify different dates for different actions.

3. Interest And Penalty

The Taxation and the Other Laws (Relaxation and Amendment of Certain Provisions) Bill, 2020 proposes that delay in the payment of any tax will not be held liable either for prosecution or penalty but this delay should not exceed June 30, 2020. The rate of interest payable for the delay will not exceed 0.75% per month.

4. PM Cares Fund

The Taxation And Other Laws (Relaxation and Amendment Of Certain Provisions) Bill, 2020 proposes that any donation made by the citizens to the Prime Minister’s Citizens Assistance and Relief in Emergency Situation Fund shall be eligible for 100% deduction under section 80G of the Act. Further, the limit on deduction of 10% of gross total income would not be applicable to such donations. It further explains that an amount equivalent to the donations made by a person to the Fund can be deducted from his income by calculating the total income under the IT Act.

5. Resolution Of Disputes Regard To Direct Taxes

The Taxation And Other Laws (Relaxation And Amendment Of Certain Provisions) Bill,2020 further proposes to amend the direct tax Vivad Se Vishwas Act, 2020 [1] for the due payment of additional amount to 31st December, 2020. The bill also proposes to empower the Central Government to notify dates relating to the filing of declaration and making of payment.

6. Capping Of Surcharge

The Finance Act, 2020 has also been proposed to be amended. The rate of surcharge levied on dividend income has been capped at 15% further reducing the dividend tax rate to 23.92% opposed to erstwhile tax rate of 28.5%.

Conclusion

When the world is facing such a huge economic crisis due to the pandemic the changes which are proposed by the government in the Taxation and Other Laws (Relaxation And Amendment Of Certain Provisions) Bill, 2020 must be welcomed. These amendments will help the taxpayers of our country to adhere to the compliance requirement.

Read, Also: Professional Tax Registration in India.