Web Aggregator License: All About Insurance Web Aggregation in India

Shivi Gupta | Updated: Jun 08, 2020 | Category: IRDA Advisory

Insurance plays a critical role in any country’s economy as it protects the future of individuals and businesses from any form of financial risks, allowing them to transfer such risks to a third party and manage them more efficiently. By providing security to individuals and businesses, insurance protects the overall economic development of a country. The Insurance sector in India has witnessed some significant changes over the past couple of decades. There are numerous insurance products available for insurance buyers to choose from. It has led to the need for a systematic channel for customers to get the required information on different insurance products in the market. Out of this concern, the IRDAI introduced the concept of Insurance Web Aggregators in the insurance sector, allowing buyers to find all the critical information on insurance products under one roof. This blog talks about Insurance Web Aggregators, their functions, and the eligibility, process and documents involved to obtain Insurance Web Aggregator License in India.

Table of Contents

What are Insurance Web Aggregators?

Web aggregators in the insurance sector are digital platforms that compile and provide in-depth details of various insurance products available in India. Insurance web aggregators act as comparison platforms, allowing users to compare different features of the insurance websites as per their requirements.

Insurance Web Aggregators are governed by the Insurance Regulatory and Development Authority of India and provisions of the IRDAI (Insurance Web Aggregators) Regulations, 2017[1]. These regulations were introduced to supervise and regulate the functioning of insurance web aggregators. Under the IRDAI Regulations, a web aggregator is an insurance intermediary that maintains a digital platform (website) to provide an avenue for insurance buyers to compare the features, benefits and price of the different insurance policies available in the market.

Insurance Web Aggregators have redefined the way insurance buyers make a decision regarding their insurance requirements. They offer a technology-powered platform to assess the right products from different insurance companies and choose the best insurance products as per their requirements.

Need for Insurance Web Aggregators in India

The variety of insurance products has increased significantly in recent years. It has allowed customers to make educated choices from the wide variety of options and select the most suitable policy to protect themselves from risks associated with life, health, travel and business more affordably.

In the past, the conventional insurance industry did not accept technology openly. However, the recent technological changes have made it mandatory to reimagine the insurance sector in India. Previously, a large segment of individuals and businesses was unable to find the right guidance for their financial decisions. They fell prey to the mis-selling and fraud by insurance agents who sold them over-priced or unsuitable insurance policies.

For the protection of insurance buyers in India, the Insurance Regulatory and Development Authority of India (IRDAI) increased the scope of insurance services. It led to the introduction of insurance web aggregators to establish a safer and transparent insurance sector in the country.

Insurance web aggregators were also needed to act as an information source for the rising number of internet users in India who relied on the internet for their business or financial decisions. Web aggregators in the insurance sector were also needed to allow a larger market, which was unable to access such information previously, to know about insurance products for their protection.

Functions of Insurance Web Aggregators in India

The Insurance Regulatory and Development Authority of India has laid down the framework relating to the activities and functions that insurance web aggregators in India can undertake. The key functions which can be performed by insurance web aggregator license holders are:

- Display information about various insurance products on their digital platforms.

- Provide a comparison between the different insurance products on their website in an unbiased manner.

- Transmit any leads received and converted via the digital platform to the appropriate insurance company.

- Sale of insurance products through Tele-marketing services.

- Solicit insurance products based on the leads generated from the website.

Insurance Web Aggregator License in India

To operate as an insurance web aggregator in India, a company must first obtain the Insurance Regulatory and Development Authority of India – IRDAI’s permission. This permission is granted in the form of insurance web aggregator license.

Eligibility Criteria for Insurance Web Aggregator License

To obtain the certificate of Insurance Web Aggregator registration, an applicant company must fulfil the following eligibility criteria:

- The applicant must be a person as defined under Regulation 2(k), i.e. a company registered under the Companies Act, 2013. It also includes a limited liability partnership registered under the Limited Liability Partnership Act, 2008 which has does not have a non-resident entity or a person resident outside India as a partner as per the Foreign Exchange Management Act, 1999, and is not a foreign limited liability partnership. The applicant may also be any other person recognised by the Authority to act as an Insurance Web Aggregator in India.

- The Memorandum of Association of the company must include the object clause stating the main objective of the business as web aggregation of insurance products.

- The applicant must not be engaged in any other business other than the main object, as mentioned in the MOA.

- The applicant must not be appointed or registered as an insurance agent, company agent, micro-insurance agent, TPA, surveyor and loss assessor, insurance marketing firm or any other insurance intermediary.

- The applicant must not have a referral arrangement with an insurer.

- The applicant must have a dedicated website to perform its insurance web aggregation activities.

- The Principal Officer must be experienced and possess the qualifications as required by the IRDAI.

- The Principal Officer must have received the requisite training and passed the examination required by the IRDAI.

- The principal officer, directors, promoters, shareholders, partners or key management personnel must fulfil the fit and proper criteria.

- The authorised verifier must have received the requisite training and passed the examination required by the IRDAI.

- The Insurance Web Aggregator must not be in any form of violation of the obligations and code of conduct laid down under the IRDAI regulations.

- The IRDAI must not have previously rejected the application for grant of insurance web aggregator license.

- The applicant must not have withdrawn the application for any reason at any time during the previous financial year.

- The foreign investor or Indian promoter of the company have exited any time during the previous two financial years.

Capital Requirements to Obtain Web Aggregator License

An applicant that wishes to operate as an insurance web aggregator in India must have a minimum paid-up capital of INR 25 lakhs.

This capital must be issued and subscribed in the form of equity shares when the applicant is a company formed under Companies Act, 2013. However, in the case of a Limited Liability Partnership, the contribution of partners must be only in cash.

The aggregate holdings of equity shares or contribution of the Insurance Web Aggregator by foreign investors and portfolio investors must not be more than 49% of paid-up equity capital of the business at any given time or the FDI limit provided by the Government of India.

Insurance Web Aggregator License Registration Procedure

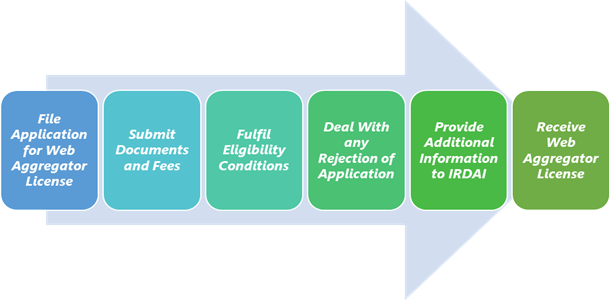

Steps to Obtain Certificate of Registration

The following steps are followed to obtain the insurance web aggregator license in India:

Application for Insurance Web Aggregator License

An applicant who wishes to obtain the insurance web aggregator license must file an application to the Insurance Regulatory and Development Authority of India in the application Form A of Schedule I of the IRDAI Regulations.

Documents and Fees

The application must be filed along with certain documents and a non-refundable fee of INR 10,000 along with applicable taxes. Such fee must be paid in the form a demand draft to the Insurance Regulatory and Development Authority of India. Any application filed without the application fee would not be processed further. The application must also be accompanied by a detailed 5-year business plan of the business, laying down its plan-of-action and financial projections.

Eligibility Conditions

The applicant must ensure that the eligibility conditions are fulfilled before such application for insurance web aggregator license is filed. If the applicant business wishes to perform outsourcing and telemarketing functions, the applicant must mention the same in the registration application.

Rejection of Application

The Authority rejects any application which does not comply with the regulations of the IRDAI. In case of any mistakes or omissions, the Authority gives the applicant a period of 30 days to rectify such errors before it can reject it.

Additional Information and Clarification

The Authority may ask the applicant to submit additional information or clarification regarding any details mentioned or documents submitted by the applicant. It is a multi-stage process and may require multiple replies to the IRDAI’s queries to be filed.

If the applicant fails to submit any such replies within 30 days from the date of communication, the application is returned, and the fresh application must be filed by the applicant business.

Grant of Insurance Web Aggregator License

Once the IRDAI is satisfied with all the details and documents and holds the opinion that the grant of such registration is in the interest of insurance policyholders, the IRDAI grants the insurance web aggregator license to the applicant to undertake its web aggregation services in India.

Documents Required for Insurance Web Aggregator Registration

There are numerous documents that must be submitted along with the insurance web aggregator license registration application. All the copies of the requisite documents must be attested by the Principal Officer of the business. These documents include:

- Copy of the Certificate of Registration issued by the ROC.

- Copies of Memorandum of Association and Articles of Association, or LLP Agreement which are certified by a practising Chartered Accountant.

- Copy of PAN Card of the company.

- Resumes of the Directors or Designated Partners along with the copies of their qualification certificates.

- Resume of the Principal Officer along with the copies of his/her qualification certificates.

- Self-Certification by two directors or designated partners notarised and laying down the competency of the principal officer, directors, promoters, shareholders, partners or key management personnel:

- The directors and the Principal Officer are major and not of unsound mind.

- They are not found guilty in any case of criminal misappropriation, criminal breach of trust, cheating, forgery or abetment to commit any such crimes in the last five years.

- The applicant or directors are not involved in any economic offences in the past three years.

- The directors or employees of the company do not hold directorships or employment in an insurance-related business.

- The net worth of the company is more than INR 25 lakhs.

- The applicant, directors or principal officers are not registered as insurance agents, company agents, micro-insurance agents, TPAs, surveyors or loss assessors, insurance brokers or other insurance intermediaries under the IRDAI regulations.

- Snapshots of the proposed website along with the proof that the company has obtained domain name registration.

- Confirmation of the place where the website would be hosted from such as registered office or operations office.

- List of individuals who would control and post the information on the website regarding the insurance products, comparisons and guides.

- Certificate by a practising Chartered Accountant stating the net worth and shareholding pattern of the company.

- Copies of the Annual Report and Audited Accounts for the past three financial years.

- Business Plan for at least the next three years.

- Details of infrastructure including IT infrastructure proposed by and available with the applicant.

- Human Resource Chart showing functions and responsibilities of each individual.

- Training and examination certificates of Principal Officer and authorised verifiers.

- Details and declarations of a principal officer, promoters, directors, partners or key management personnel confirming that they fulfil the fit and proper criteria.

- User ID and temporary password for the verification of the aggregation website, digital or LMS by IRDAI Information Technology Department.

Validity of Insurance Web Aggregator License

The certificate of registration or the insurance web aggregator license has a validity of 3 years from the date on which it was issued by the IRDAI. However, the validity period of such license may be affected or reduced in case the IRDAI suspends or cancels the license on the grounds of violation of any regulations.

Renewal of Insurance Web Aggregator License

The certificate to operate as an insurance web aggregator can be renewed for a further period of 3 years. For this, the web aggregator must file a renewal application along with the requisite documents as mentioned under the Regulations. The renewal application must be filed along with a renewal fee of INR 25,000.

However, it is to be noted that the renewal application must be filed at least 30 days before the expiry of the license, and the company can initiate its renewal process even 90 days before the expiry date.

Means of Earning of Insurance Web Aggregators

Licensed insurance web aggregators in India are only allowed to display information relating to the available insurance products and their prices. Therefore, the question of their means of revenue is often pointed out. The IRDAI (Insurance Web Aggregators) Regulations, 2017 provide the following channels of revenue for insurance web aggregator websites:

- The web aggregator can charge a flat fee of up to INR 50,000 for each insurance product of insurance company per year. This fee is the remuneration to include the insurer’s insurance products in the website’s comparison charts.

- Commission for any leads converted by the web aggregator and transmitted to the insurance company for sales of the policy. However, no fees can be charged for the leads provided through the Lead Management System.

- Fee for premium collection in case of outsourcing activities undertaken by the company.

Conclusion

With an increase in the number of internet users in India, more people rely on digital means to obtain the right information and guidance on their various requirements, including financial advice. The rise of mis-selling cases and overpricing in the insurance sector led to the advent of insurance web aggregators in India.

Insurance web aggregators act as a reliable and unbiased source of information for insurance buyers to compare and make informed decisions relating to their policy purchases. Web aggregators have also streamlined the access to insurance products for the masses by providing them with the details of products they were unaware of but eligible for.

The growing nature and welcomed entry of web aggregators in the insurance sector have led to more entities entering the sector in India. However, the process to obtain the insurance web aggregator license can be daunting since it involves multiple stages and certifications by experienced professionals.

A single error may lead to the IRDAI rejecting the application altogether. Swarit Advisors provide all-inclusive assistance to businesses that wish to operate as insurance web aggregators in India and simplify the entry of web aggregation aspirants in the insurance arena.

Read our article:What Role Does IRDA Play in the Development of Insurance Sector?