Will GST Registration by Start-ups Come Under Investigation?

Mudit Handa | Updated: Dec 01, 2020 | Category: GST

Table of Contents

Suspicion of violation of GST norms by registered Start-ups

These days the Union and State governments are seeking to consolidate the GST registration process for the new start-ups. The Authorities are set to reinforce the stringent legal measures on the newbie business entrants who wish to get online GST registration in India.

Such harsh measures are being proposed to taken due to the increasing number of cases related to non-compliance and fake GST invoicing by some violators. In this regard, a meeting of the GST Council law committee had taken place on 25th November 2020, Wednesday in order to propose measures to address the above issues. The finance ministry has now hinted some rigid provisions for new GST registration in India.

GST Law Committee on Non-compliance

The GST Law committee that took place on 25th November 2020 had comprised of some senior central and state GST officers. The committee discussed in detail about the following non-compliance issues:

- Fake GST invoicing scams.

- Introduction of certain rigid provisions for the GST Registration by Start-ups process.

- Working out proper legal measures to curb violation of GST norms, such as the essential GST Act amendment for restriction of the fake GST invoicing.

Current Scenario of Start-ups under the GST regime

There is no exaggeration in saying that the GST regime has given boon for overall prosperity to the start-ups and MSMEs in India. Since the beginning of GST regime in 2017, the GST law has provided basis to many budding entrepreneurs for smooth hype in profits by removing unwanted levies and taxes.

- Besides, the government in the recent years has implemented several structural reforms in the GST tax and compliance mechanism for simplifying GST registration process in India.

- For the businessmen who were once notice to this new indirect tax policy, the government has taken ample measures to tackle technical snags while tax assessment.

Despite these reforms, the problem that has caused pain in the neck of the GST department is the numerous cases of GST Frauds and fake invoicing by some scrupulous traders.

- Due to the presence of technical glitches, the problem has gained severity and is posing a serious hindrance to the healthy compliance mechanism in India.

- Hence, the GST council has now decided to strengthen the legal framework to curb fake invoicing and other violations of GST Norms.

Besides, there’s much possibility that the new start-ups getting GST registration might come under the scrutiny of GST department.

Recent Measures to curb Fake GST invoicing

Before we go into the depths of the proposed amendments in the GST laws, we must first have a glance at the recent measures against fake GST invoicing.

- At the 39th GST Council meeting, which was held on 14th of March 2020, several reforms were introduced that were aimed at strengthening of tax compliance and curbing GST frauds.

- The GST council had given firm recommendations with an aim to restrict the fake claims of GST ITC made by some traders having GST registration. Accordingly, the GST department has taken concrete steps to check fake GST ITC claims.

- The 39th GST meeting had proposed some further preventive measures against such bogus claims of GST input tax credit.

Moreover, the Government had declared fake ITC claim a non-bailable offence. For this, the Government has done amendments to 2 sections of CGST Act 2017: Section 122 & 132. Let us have a look at these 2 amendments.

Section 122: Beneficiaries of fake ITC claim liable for penal action

Both the parties involved in a fake ITC claim-the beneficiary and the defaulter having GST registration who has made such a false ITC claim shall now be subject to the severe penal action as specified under the CGST Act.

- For this, the Section 122 of the CGST Act 2017 was amended.

- As per the Section 122 of the CGST Act 2017, any individual who has indulged in the breach of GST compliance or has made a false GST ITC claim, is subject to a huge penalty of ₹10,000/- or the amount of GST tax evaded, whichsoever is more.

- The government has amended this section so as to include the beneficiaries of such transactions resulting out of the fake ITC claim, as liable for such a huge penal provision.

Fake GST ITC Claim: A non-bailable offence!

As a step ahead, the Government had also made an amendment to Section 132 of CGST Act 2017[1].

With this amendment, an act of making a false GST ITC claim, without a GST invoice, was made a non-bailable offense. Accordingly, the following parties shall be subject the imprisonment term as mentioned in section 132:

- The person having GST registration who makes a fake ITC claim.

- All those parties who are indulged in such fake ITC claim.

- All the beneficiaries of the transactions that are carried out through such fake ITC claim.

Penal Action: The penal provision for making false ITC claim, as mentioned in the section 132 of the CGST Act 2017 is- Minimum 6 months imprisonment term that may further extend to maximum 5 years.

Apart from the above, some additional measures were also proposed by 39th GST meeting to curb GST ITC frauds.

Also, Read: GST On Travel Agents and Tour Operators

Additional Measures to prevent fake ITC claim

The 39th Council meet had come out with some remedial steps to restrict false ITC claims. These are listed below:

- In case a new taxpayer having a new GST registration in India has made a GST ITC claim, several restrictions have been imposed before the approval of such GST ITC claim. This is to check whether any fake GST invoice has been furnished or any false ITC has been claimed by the taxpayer.

- As per the new provisions, a GST ITC claim shall be approved only after an on-site authentication of the business premises and the financial KYC of the taxpayer having new GST registration in India.

- In addition to that, the GST Council also made a recommendation to seek an annual information return (AIR) from the Commercial Banks, showing records of transactions made by their client traders.

Aadhaar Authentication of New Registrants

Most importantly, the GST council has proposed proper Aadhaar authentication of the persons, who have obtained new GST registration in India. This is to prevent chances of any fake ITC claim by them.

Despite the aforesaid provisions, the Directorate General of GST Intelligence (DGGI), has so far arrested 30 deceitful taxpayers who have created fake GST invoices. 1,282 entities have been identified and out of these, 393 cases have been booked.

To curb such deceptive practice, the GST council will now probably implement restrictive measures for allocation of ITC. The council had already proposed such restrictive measures for ITC allocation in its 39th meeting.

New rules for allocating GST ITC

The GST council had proposed to give clarification on amending the rules for the following issues related to ITC allocation:

- Allocation of ITC in case of the business reorganization u/s 18 (3) of CGST Act, read with rule 41(1) of CGST Rules. Section 18(3) allows registered person to transfer his unutilized ITC to his reorganized business firm, in case of business reorganization.

- GST refund related claims.

- A special procedure for the registered persons who have taken GST registration, but are still corporate debtors as per the provisions of the Insolvency & Bankruptcy Code, 2016, and are going through the process of corporate insolvency resolution.

All such registered persons are most likely to come under GST department scrutiny.

Amendments to the CGST Rules

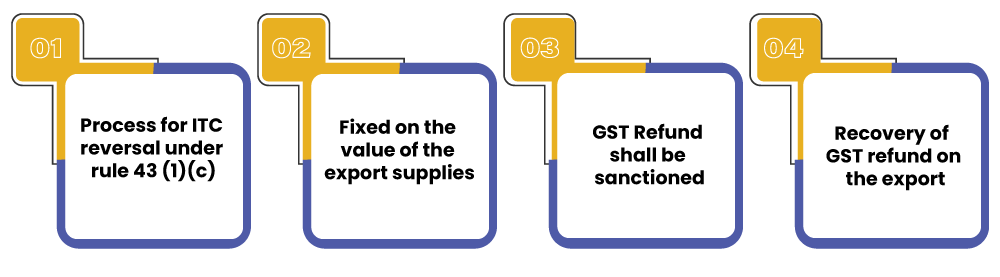

Key amendments have been made to the following CGST Rules for rigidity in ITC allocation:

- Process for ITC reversal under rule 43 (1)(c): This is with respect to the capital goods that are partly used for impacting taxable supplies and partly for the GST exempt supplies.

- An upper limit shall be fixed on the value of the export supplies, in respect of calculation of IGST refund on the zero-rated supplies.

- GST refund shall be sanctioned both in cash and credit if an excess of tax is paid.

- Recovery of those GST refund on the exports, where the export proceeds were not realized within the time-frame prescribed by FEMA.

These are some recently proposed measures for curbing the fake ITC claims by traders and exporters having GST registration.

Some strict measures against false ITC claimants

Additionally, some very strict actions might be taken in near future on all false ITC claimants.

- Advanced data analytics can be used to detect false claimants suspected to be indulged in fake ITC claims.

- Coordinated action might be taken against such persons, including:

- Immediate Suspension of their GST registration.

- This would be followed by a thorough physical and financial audit by field officials to ascertain the legitimacy of their claims.

- Only upon satisfactory results, their GST certificates would be restored.

Conclusion

Noticing the severity of the problem, the new GST registrants might come under the scrutiny, and stern actions are likely to be taken on the unscrupulous traders making bogus ITC claims.

Furthermore, the GST law committee calculate the overall impact of such fake GST invoices. Strict actions as per the CGST Act might be taken to curb such malpractices. Additional measures might also be taken to trace loopholes in the GST law that are being misused by the false claimants to defraud the exchequer.

Also, Read: Impact of GST on Start-ups