Key Highlights and Outcomes of 43rd GST Council Meeting

Shivani Jain | Updated: Oct 19, 2020 | Category: GST, News

The 43rd GST Council Meeting was held on 13.10.2020 through Video Conferencing. The meeting was chaired by our Union Minister for Finance and Corporate Affairs, Ms. Nirmala Sitharaman[1], together with Mr. Anurag Thakur, Union Minister for Finance and Corporate Affairs and various Senior Officers from Union Government and States.

In this blog, we will discuss the Background and Outcomes of 43rd GST Council Meeting.

Table of Contents

Background of 43rd GST Council Meeting

The 43rd GST Council Meeting[2] was a one agenda meeting and was in continuation of the last GST Council Meeting, i.e., 42nd GST Council Meeting.

Further, this meeting was held to discuss the argumentative subject of compensation as the central government aimed to reach a consensus with the non-BJP ruled states.

Also, it shall be relevant to mention that this was the third time in a line that the GST Council discussed the matter of funding a deficit of tax revenue of states.

In its last meeting, the council had decided to increase the surcharge charged on taxes on Luxury Goods, such as tobacco products and cars beyond June 2022. However, it failed to reach a consensus on modes to compensate states for the deficit of tax revenue.

Moreover, it shall be relevant to note that the total projected shortfall in the current financial year stands at Rs 2.35 lakh crore. As a result, in the month of August, the Central Government gave two options to the states, i.e., either to borrow either Rs 97000 crores from a “Special Lending Window facilitated by the RBI”, or Rs 2.35 lakh crores from the Market.

Likewise, 21 states had chosen to borrow Rs 97000 crores to meet the compensation deficit. Also, on the basis of demand by some States, the amount of Rs. 97000 crores under “Option 1” was increased to Rs. 1.10 lakh crores in the last Council Meeting.

Key Highlights of 43rd GST Council Meeting

The Key Highlights of 43rd GST Council Meeting are as follows:

- The Finance Minister stated in the press conference briefing that still there is no unanimity on the cess borrowing issue and the deadlock still continues;

- The FM explained the reason to States as to why the Central Government cannot borrow more over the compensation shortfall;

- The reason explained was that the Central Government has already finalized its yearly borrowing calendar, and if it borrows now the G-Sec (Government Securities), the yields will lift up the borrowing cost for everyone including the private sector. As a result, it will have a greater impact on the Indian economy at the Macro Level. Therefore, there will be less impact if the States decide to borrow the funds;

- The Central Government will ensure that all the States are paying fairly equitable rates on the compensation borrowings made by them;

- The Finance Minister stated that Majority of States who had chosen for Option 1 wanted early funds and mentioned that they must be allowed to make the cess borrowings;

- FM also answered the questions, can members stop other States from undergoing borrowings what they want to do. The answer for the same is that the GST Council will not force any State to borrow or not to borrow;

- The question, Can States borrowings under Article 293 can be held back by Council in the absence of consensus was answered by the Finance Minister as well;

- The Finance Minister clarified that every State is welcomed to discuss the subject of borrowings;

- It was said by her that there are some states that wanted to do the meeting concerning cess borrowing at the earliest;

- The extension in cess period will confirm repayment of the cess borrowing by the State with interest;

- The resources in the Central and State Government will remain intact;

Also, Read: Real Estate to Get Relief on GST

Outcomes of 43rd GST Council Meeting

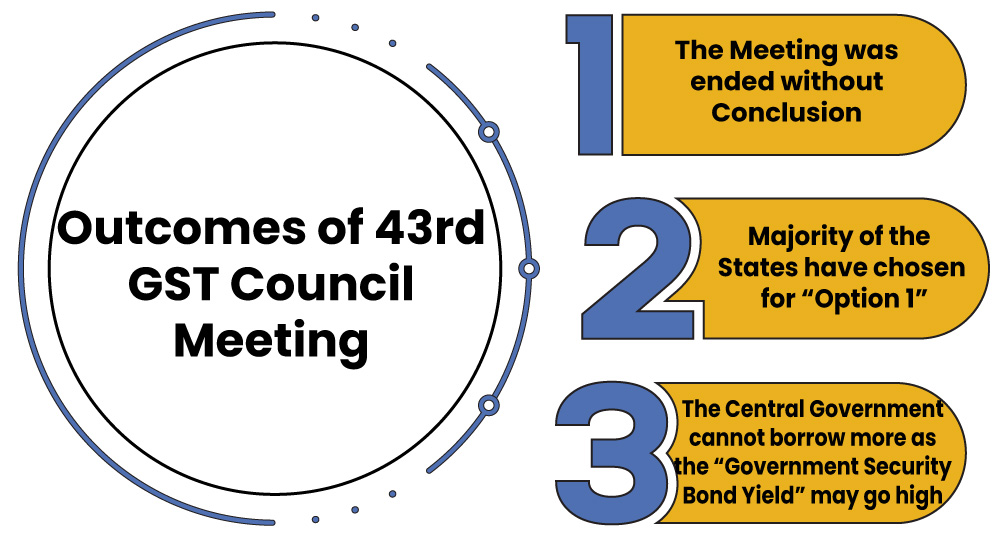

The Outcomes of the 43rd GST Council Meeting can be summarised as:

- The Meeting was ended without Conclusion;

- Majority of the States have chosen for “Option 1”. However, the states complained that the collection of cess is “insufficient” to pay the compensation;

- The Central Government cannot borrow more as the “Government Security Bond Yield” may go high;

Conclusion

In a nutshell, after the conclusion of the GST Council Meeting, the Finance Minister reiterated that the deficit in the compensation cess has to be borne by State borrowings. Further, the central government will ensure that all the States are paying fairly equitable rates on the compensation borrowings made by them.

The compensation cess has been extended beyond the period of 5 years. However, on the other hand, it shall be significant to state that no consensus has been achieved on the issue of GST Compensation Cess.

Whether you are running a small or big business, with the help of Swarit Advisors you can also apply for the GST Registration Online and get instant approval within 3 days.

Also, Read: Outcomes of the 42nd GST Council Meeting