Foreign Contribution Regulation Amendment Bill 2020: A Guide

Shivani Jain | Updated: Oct 01, 2020 | Category: Foreign Trade

The term “Foreign Contribution Regulation Amendment Bill 2020” denotes a bill which was presented by the Ministry of Home Affairs and was passed unanimously by the Rajya Sabha on 23.09.2020.

Further, the said bill was introduced in the Lok Sabha on 20.09.2020 and was passed to the Rajya Sabha on 21.09.2020. Furthermore, this bill amends the Foreign Contribution (Regulation) Act 2010[1] .

In this blog, we will discuss in detail about the Foreign Contribution Regulation Amendment Bill 2020 and the reason behind the amendment.

Table of Contents

Overview of Foreign Contribution (Regulation) Act 2010

The term “Foreign Contribution (Regulation) Act 2010” denotes an Act that confirms that funds or the amount received by the domestic registered, such as Trusts, Institutions, Societies, NGOs, and Associations, must be used for the objectives specified.

Further, this act was implemented by the Ministry of Home Affairs, and as per this act, an organisation needs to register themselves in every 5 years.

Furthermore, according to this act individuals are allowed to accept till Rs 25000 as foreign contributions that too without the permission of the Ministry of Home Affairs.

Purpose of Amending FCRA 2010

The reasons behind the amendment of FCRA 2010 are as follows:

- The amount of the inflow of the “Foreign Contribution” was almost doubled in the year 2019 as compared to the year 2010. However, it shall be relevant to note that many of the foreign institutions had not utilized the amount received for the objective for which they were registered under the Foreign Contribution (Regulation) Act 2010;

- Recently, the license of 6 NGOs was suspended by the Union Home Ministry, as they have used the funds received as Foreign Contribution for “Religious Conversions”;

- Many NGOs were not complying to the Statutory Compliances, such as the Maintenance of Proper Accounts and Submission of Annual Returns;

- The situations mentioned above tend to have adversely affected the Internal Security of the country.

Aim of Foreign Contribution Regulation Amendment Bill 2020

The main aims of the newly implemented FCRA Bill are as follows:

- To improve Transparency and Accountability in the receipt and utilization of “Foreign Contributions”;

- To facilitate and boost the Non-governmental Organisations and Associations, who are working for the society and public welfare;

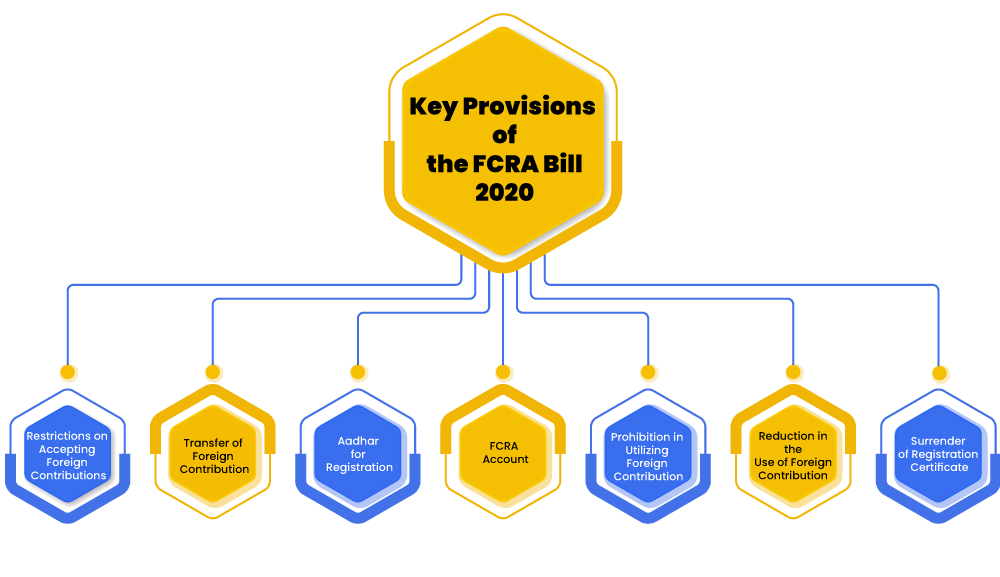

Key Provisions of the FCRA Bill 2020

The Key Provisions of the FCRA Bill 2020 are as follows:

Restrictions on Accepting Foreign Contributions

As per the FCRA Bill 2020, public servants are not allowed to accept foreign contribution. Further, the term “Public Servant” means any person who is in government service or is being remunerated by the government for performing public duty.

Moreover, this amendment was made in addition to the list of persons who are not eligible to accept foreign contribution as per FCRA 2010. The term “list of persons” includes the following:

- Election Candidate;

- Editor of a Newspaper;

- Publisher of a Newspaper;

- Judges;

- Government Servants;

- Member of any Legislature;

- Political Parties, etc.

Transfer of Foreign Contribution

As per the Foreign Contribution Regulation Amendment Bill 2020, a registered business entity is not allowed to transfer the amount received as Foreign Contribution to any other person. Further, the term “person” includes the following:

- Individual;

- Association; or

- Registered Company;

However, it shall be pertinent to state that as per FCRA 2010, a registered business entity was allowed to transfer foreign contribution to the person eligible to accept it.

Aadhar for Registration

As per the FCRA Bill 2020, it is now mandatory for every office bearer, director, or key Functionaries of the person qualified to receive Foreign Contribution to have Aadhar Number as an Identification Document.

However, in the case of a Foreigner, a copy of either of the following is required as an Identification Document:

- Overseas Citizen of India Card; or

- Passport;

FCRA Account

As per the Foreign Contribution Regulation Amendment Bill 2020, now the registered entities can receive foreign contributions only in the account designated as “FCRA Account” by the bank. Such a bank must work as a branch of the State Bank of India, New Delhi.

Moreover, the entity is not allowed to deposit any amount other than Foreign Contribution in this account.

However, a person can open an FCRA Account in any other scheduled bank of its choice for maintaining and utilizing the amount received as a contribution.

Prohibition in Utilizing Foreign Contribution

As per the Foreign Contribution Regulation Amendment Bill 2020, the government has restricted the usage of un-utilized foreign contribution. However, the same will be done only if after the inquiry conducted by the Government, it is clear that the person has violated the provisions of the FCRA Act.

Reduction in the Use of Foreign Contribution

As per the FCRA Bill 2020, now the registered business entities cannot use more than 20% of the Total Foreign Contribution received for “Administrative Purposes”.

However, it will be noteworthy to note that such an amount was 50% in FCRA 2010.

Surrender of Registration Certificate

As per the Foreign Contribution Regulation Amendment Bill 2020, the Central Government has now allowed the registered person to surrender its “Registration Certificate”.

Further, the same will be done only in the events as follows:

- The Inquiry conducted by the Government made this clear that the person has not violated the provisions of the FCRA Act 2010; and

- The Management of the Foreign Contribution has been duly vested with the authority prescribed by the Central Government.

Impact of the Foreign Contribution Regulation Amendment Bill 2020

The impact of the Foreign Contribution Regulation Amendment Bill 2020 can be summarised as:

- The Amendment Bill will impact the “Livelihood of the Worker” associated with the small level NGOs (Non-Governmental Organisations), and may lead to the “End of the Entire Social Sector” as well, as the limits on “Administrative Expenses” will make it hard to perform even for the large NGOs;

- This Bill will adversely impact the “Collaborative Research” in significant domains in India, as the organisations receiving contribution will now be unable to transfer the same to the small NGOs operating at the grassroots level;

- Through this bill, the Central Government aims to control and regulate all the NGOs, which are engaged in “Dubious” and “Fraudulent” activities. However, it shall be relevant to note that by this bill, the government fails to recognize the diversity of NGOs, which comprise of reputed organisations, that are recognized at a global platform, will affecttheir competitiveness and creativity;

- The Foreign Contribution Regulation Amendment Bill 2020 is Incompatible with the provisions of International Law. The same can be proved by the statements as follows:

- As per the UNHRC (United Nations Human Rights Council) resolution on “Protecting Human Rights”, no law shall “Criminalize” or “Delegitimize” the activities in defense of “Human Rights” on account of the “Origin of Funding”;

- Further, this Amendment Bill fails to adhere to the India’s “International Legal Obligations” and “Constitutional Provisions” with regard to protection of the Right to Freedom of Expression, Associations, and Freedom of Assembly;

- Lastly, as per the Foreign Contribution Regulation Amendment Bill 2020, the NGOs that are receiving foreign contributions are considered guilty unless proven otherwise;

Conclusion

In a nutshell, the Foreign Contribution Regulation Amendment Bill 2020 significantly amends the earlier Foreign Contribution (Regulation) Act 2010, which imposed vague and ambiguous restrictions on civil society as well.

Further, FCRA 2020 again provides for overly broad rules and measures which would definitely restrict the access to foreign funding specifically for public servants and smaller non-governmental organisations.

Furthermore, this amendment bill adds onerous “governmental oversight”, “additional rules and regulations”, “certification processes”, and “operational requirements”, while concurrently reducing the limit of “administrative expenditure” that can be utilized to the foreign contributions to 20% from the previous 50%.

For any further details regarding FCRA Registration, visit Swarit Advisors.

Read, Also: How FDI helps Private Limited Companies.